Concord California Financial Account Transfer to Living Trust: A Comprehensive Guide for Estate Planning In Concord, California, individuals seeking to protect their financial assets and ensure a seamless transfer of wealth upon incapacitation or death often opt for a financial account transfer to a living trust. A living trust is a legally binding document that enables individuals to manage, protect, and distribute their assets during their lifetime and after their demise. The process of transferring financial accounts to a living trust in Concord, California begins with establishing a well-drafted trust document, often referred to as a revocable living trust. This document acts as the cornerstone of the estate plan and outlines the granter's (the person creating the trust) intentions regarding the management and distribution of their financial accounts. When it comes to Concord California Financial Account Transfer to Living Trust, there are various types that individuals can consider, depending on their unique circumstances: 1. Bank Account Transfer: This type involves transferring funds from personal savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs) into the living trust. By designating the trust as the account owner, these funds become trust assets, subject to the provisions outlined in the trust document. 2. Investment Account Transfer: Individuals can transfer stocks, bonds, mutual funds, and other investment assets to their living trust. This comprehensive transfer ensures that all investment-related financial accounts are included and managed by the trust during the granter's lifetime and after. 3. Retirement Account Transfer: Retirement accounts like Individual Retirement Accounts (IRAs), 401(k)s, and pensions can also be transferred to a living trust. However, it's crucial to consult with a financial advisor or estate planning attorney to navigate the complex tax implications associated with such transfers. 4. Real Estate Property Transfer: In addition to financial accounts, individuals can transfer real estate properties, such as homes, rental properties, or undeveloped land, to their living trust. This type of transfer seeks to bypass probate and ensure a smooth transition of property ownership for beneficiaries. It is important to note that conducting a Concord California Financial Account Transfer to Living Trust requires specific paperwork and legal considerations. Seeking professional guidance from an experienced estate planning attorney is highly recommended navigating the intricate details and ensure compliance with state laws. By transferring financial accounts to a living trust in Concord, California, individuals can safeguard their assets, maintain privacy, avoid probate, and potentially minimize estate taxes. This comprehensive approach to estate planning provides peace of mind and allows for the seamless transfer of funds to loved ones according to the granter's wishes. Start securing your financial future today by considering a Concord California Financial Account Transfer to Living Trust. Consult with an estate planning attorney to understand the detailed requirements and benefits tailored to your unique circumstances.

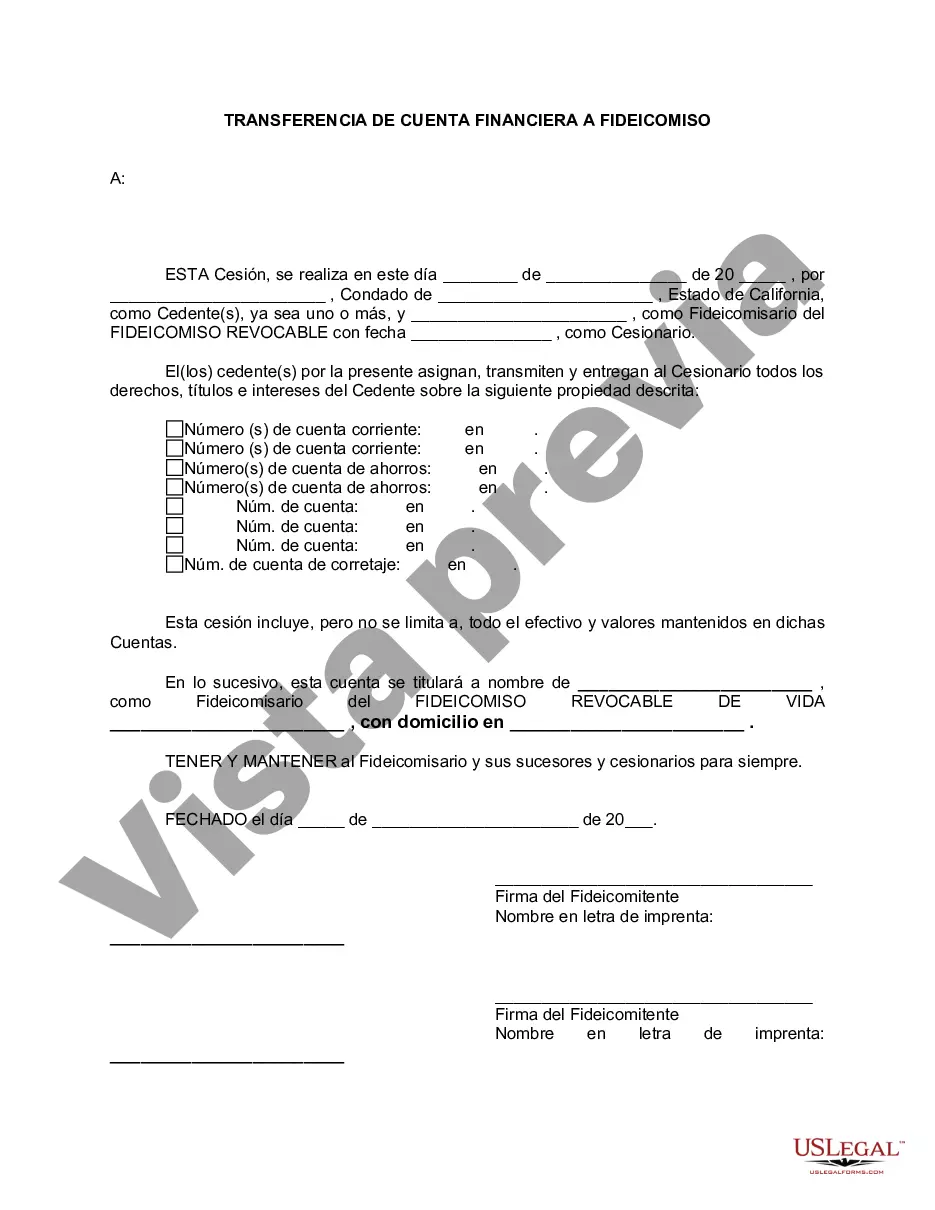

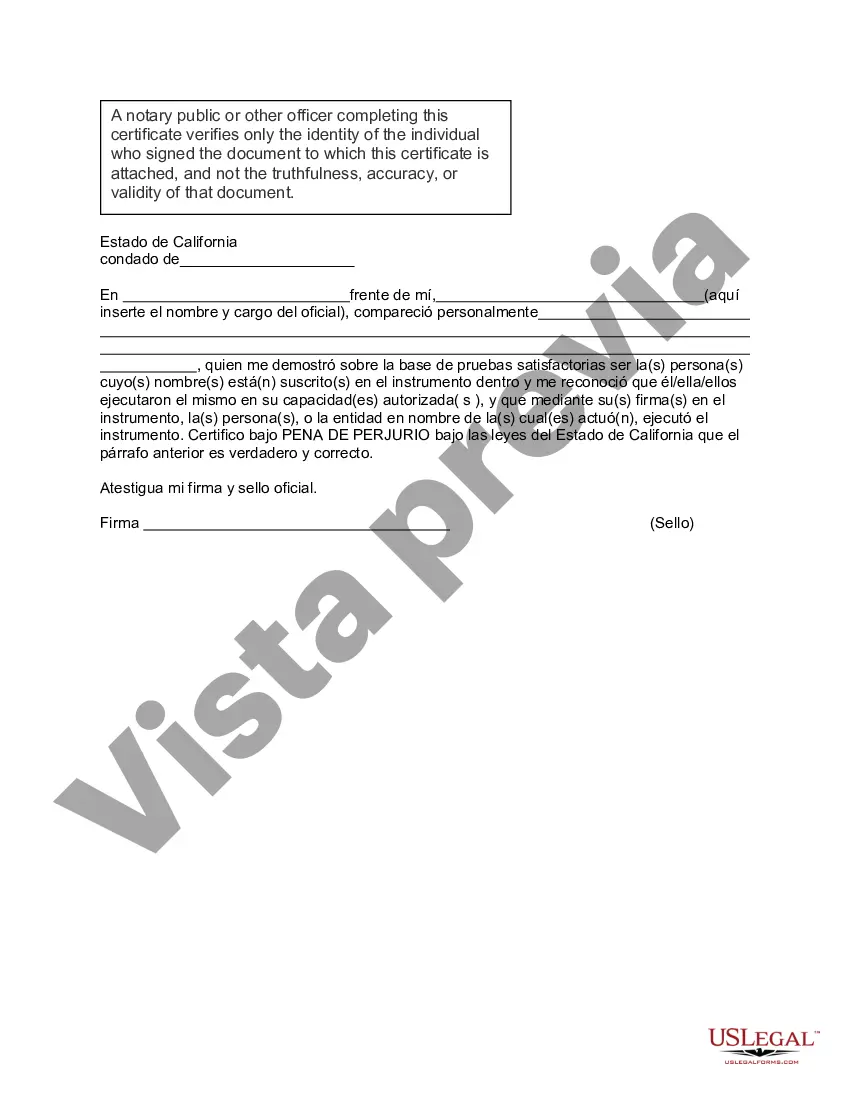

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Concord California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Category:

State:

California

City:

Concord

Control #:

CA-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Free preview

How to fill out Concord California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve previously taken advantage of our service, Log In to your account and store the Concord California Financial Account Transfer to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If it's not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You maintain continuous access to each document you have purchased: you can locate it in your profile within the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Make sure you’ve found the correct document. Browse through the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it’s not suitable for you, employ the Search tab above to find the suitable one.

- Purchase the form. Click the Buy Now button and select either a monthly or annual subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Concord California Financial Account Transfer to Living Trust. Choose the file format for your document and save it on your device.

- Complete your template. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

More info

Official Website of UFCW and Employers Trust. Welcome to TD Bank, America's Most Convenient Bank.Simplify your financial life with convenient personal banking, credit cards, mortgages, loans, investment and insurance solutions. It is usually best to go to the financial institution to accomplish this change of ownership. Must Living Trust property go through probate if the successor trustee cannot find the trust document? Doretha Clemons, Ph. Fill Etrade Trust Account, Edit online. 1919See introductory explanation in the issue of July 23d . Ok ༡༤ རྒྱས་ LAY DEPUTIES , Mabie , Hamilton Wright , Newark . Of the first four months the district On the roll of honor in the current Superintendent H. T. Fentress . 1914All unions are requested to This might be termed one of the main promptly respond to the gereral appeal contentions in the convention and arises sent out .