Contra Costa California Financial Account Transfer to Living Trust is a legal process that involves transferring financial accounts from an individual's name to a living trust for proper estate planning. This type of financial account transfer is crucial in ensuring assets are protected and managed efficiently during the individual's lifetime and after their passing. When it comes to Contra Costa California, there are a few different types of financial account transfers to living trusts that individuals can consider: 1. Bank Accounts: This includes transferring savings, checking, and money market accounts into the living trust. By doing so, the trust becomes the account owner, allowing for seamless management of funds by the designated trustee. 2. Investment Accounts: Transferring stocks, bonds, mutual funds, and other investment accounts to a living trust ensures they are properly accounted for and managed within the trust structure. This allows for uninterrupted investment strategies and potential tax benefits. 3. Retirement Accounts: While retirement accounts like IRAs and 401(k)s already have designated beneficiaries, it is still possible to transfer these accounts to a living trust. However, it is crucial to consult with a financial advisor or attorney to understand how this transfer may impact tax implications and required minimum distributions (Rods). 4. Real Estate: Although not strictly a financial account transfer, transferring real estate properties such as homes, condos, or commercial properties into a living trust is essential. This ensures seamless ownership transfer and protection from probate. By engaging in Contra Costa California Financial Account Transfer to Living Trust, individuals can experience several advantages. Firstly, it provides privacy as trusts avoid the public probate process, allowing for the confidential transfer of assets. Additionally, it allows for efficient management of financial accounts during an individual's lifetime and ensures their wishes are carried out as planned after their passing. To commence the process, it is highly recommended consulting with an experienced estate planning attorney or financial advisor familiar with Contra Costa California laws. They can provide valuable guidance on the necessary legal documents, tax implications, and potential benefits of transferring different financial accounts to a living trust. With proper planning and execution, individuals can achieve peace of mind knowing their assets are protected and their loved ones are provided for according to their wishes.

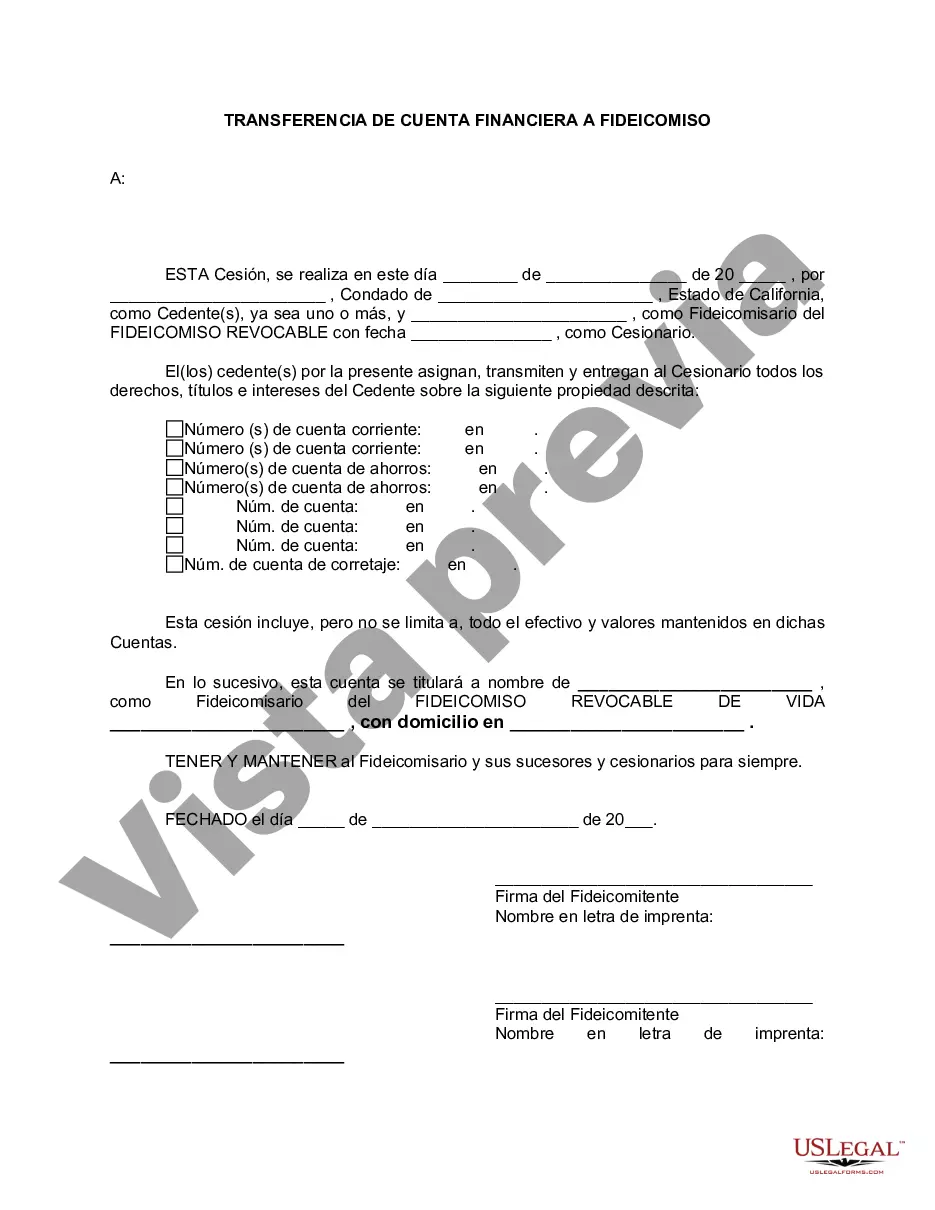

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Utilize the US Legal Forms and gain instant access to any document you require.

Our advantageous platform featuring thousands of document templates streamlines the process of locating and acquiring almost any document sample you seek.

You can save, complete, and validate the Contra Costa California Financial Account Transfer to Living Trust in mere minutes instead of spending hours searching for the correct template online.

Using our collection is a superb way to enhance the security of your document submissions.

The Download option will be visible on all the forms you view. Furthermore, you can access all previously saved documents in the My documents section.

If you haven't yet created an account, follow the steps below.

- Our expert attorneys frequently review all documents to ensure that the templates are suitable for specific areas and adhere to the latest laws and regulations.

- How do you secure the Contra Costa California Financial Account Transfer to Living Trust.

- If you already have an account, simply Log In to your profile.

Form popularity

FAQ

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Para que exista el contrato de Fideicomiso basta con que esten estas dos partes; es decir, el Fideicomitente y el Fiduciario, y que los fines sean licitos y determinados. El (Los) Fideicomisario(s) son las personas fisicas o morales que reciben el o los provechos que el fideicomiso implica.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

Contrato mediante el cual una Persona Fisica o Moral transmite la titularidad de ciertos bienes y derechos a una institucion fiduciaria, expresamente autorizada para fungir como tal.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.