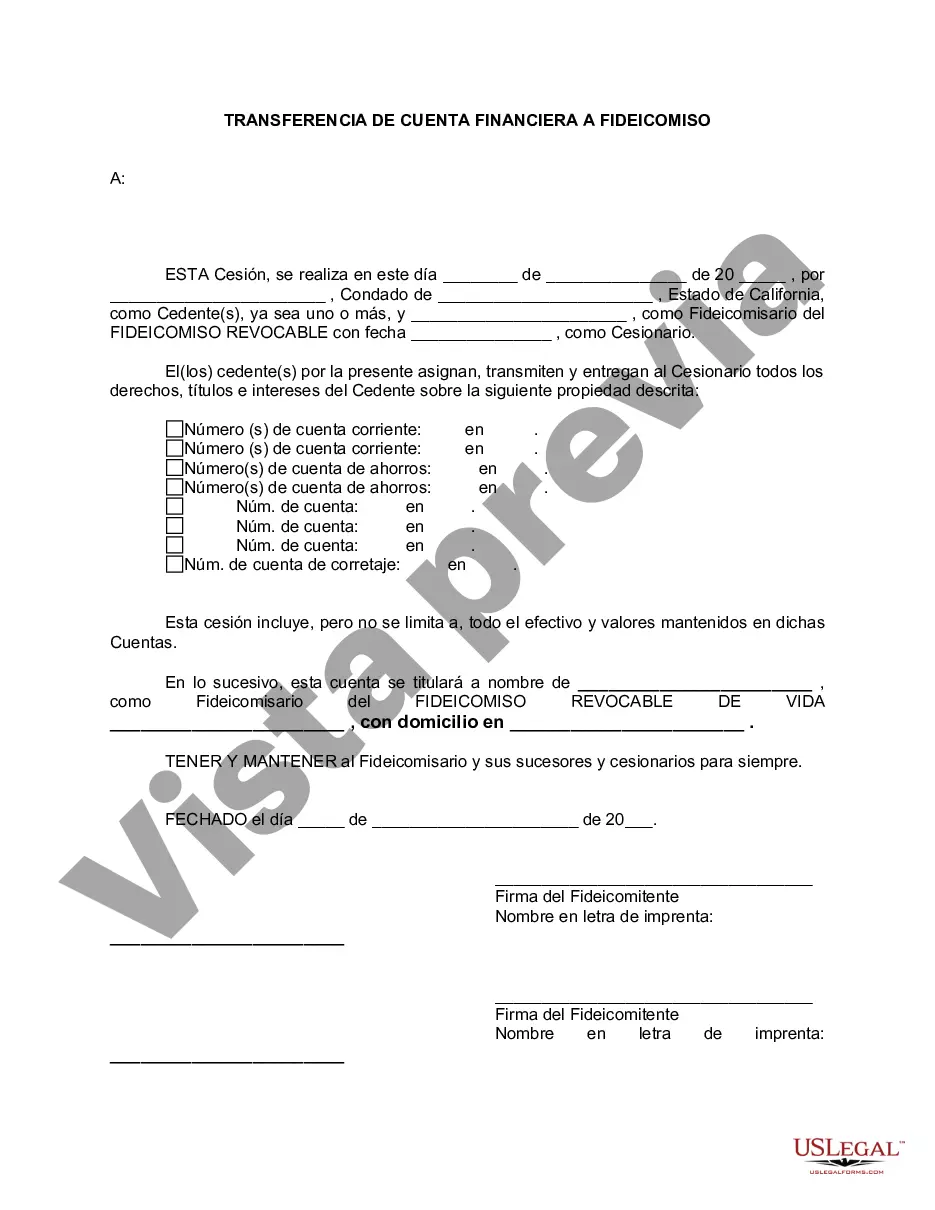

Costa Mesa California Financial Account Transfer to Living Trust refers to the process of transferring financial accounts from an individual's name to their living trust in Costa Mesa, California. This type of transfer allows individuals to manage and control their assets while minimizing probate and ensuring a smooth transition of wealth to their beneficiaries upon their passing. There are several types of financial accounts that can be transferred to a living trust in Costa Mesa, California including: 1. Bank accounts: This includes checking, savings, and money market accounts held at various financial institutions in Costa Mesa. By transferring these accounts to a living trust, individuals can secure their funds while maintaining control during their lifetime. 2. Investment accounts: Individuals can transfer their investment accounts such as brokerage accounts, stocks, bonds, and mutual funds to their living trust. This ensures that their investment decisions and portfolio management remain within the parameters set forth by the trust. 3. Retirement accounts: Certain retirement accounts like IRAs and 401(k)s may also be transferred to a living trust. However, it is essential to consult with a financial advisor or tax professional to understand the potential tax implications and eligibility criteria. 4. Life insurance policies: In some cases, individuals may choose to transfer ownership of their life insurance policies to a living trust. This allows the trust to become the policyholder, ensuring that the proceeds pass directly to the trust beneficiaries, bypassing probate. 5. Real estate assets: While not a financial account per se, real estate properties can also be transferred to a living trust in Costa Mesa, California. This includes residential and commercial properties, ensuring efficient and controlled management of these assets during the granter's lifetime and simplified transfer upon their passing. By undertaking a Costa Mesa California Financial Account Transfer to Living Trust, individuals can create an organized and efficient estate plan, ensuring their assets are protected, managed, and distributed according to their wishes. To initiate this process, it is advisable to consult with an estate planning attorney or financial advisor familiar with California laws and regulations regarding living trusts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Costa Mesa California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Category:

State:

California

City:

Costa Mesa

Control #:

CA-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Free preview

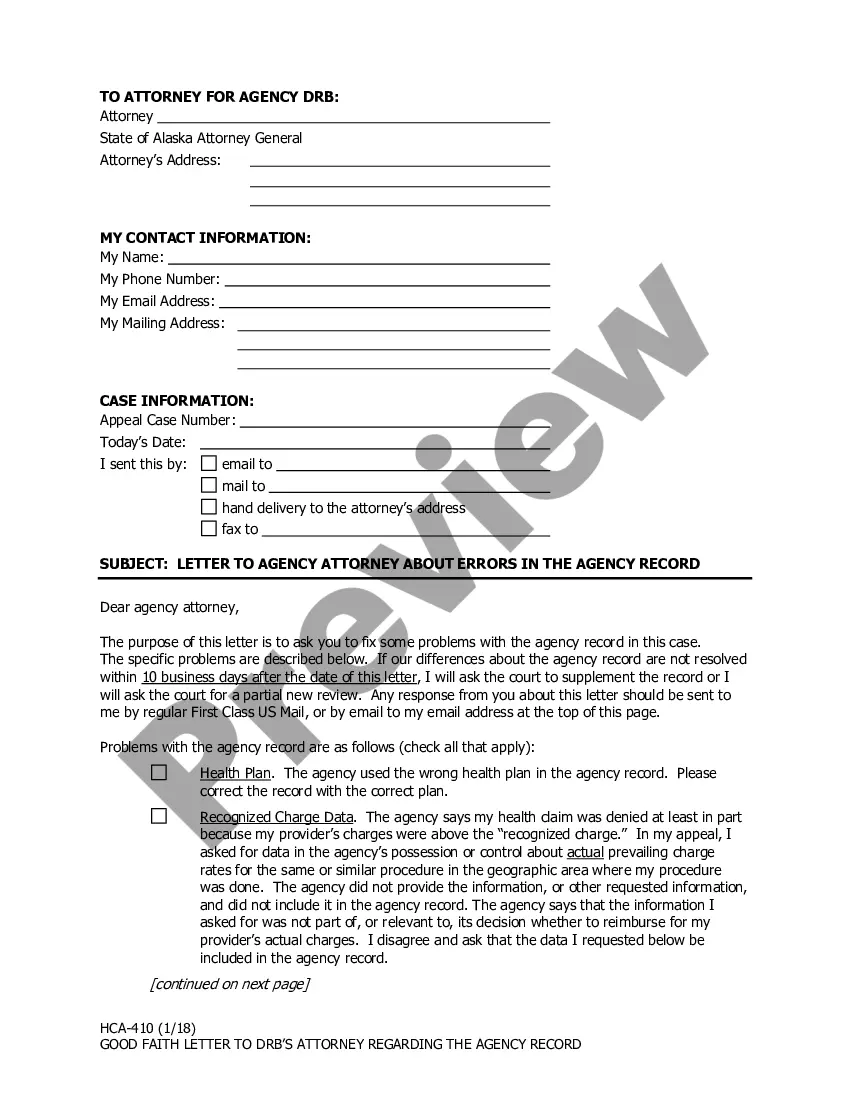

How to fill out California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you have previously employed our service, sign in to your account and store the Costa Mesa California Financial Account Transfer to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to refer to it again. Utilize the US Legal Forms service to efficiently discover and save any template for your personal or business necessities!

- Ensure you've found the correct document. Review the details and utilize the Preview feature, if available, to determine if it fulfills your requirements. If it doesn't meet your expectations, use the Search tab above to find the appropriate one.

- Purchase the document. Click the Buy Now button and select either a monthly or yearly subscription option.

- Create an account and complete a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Receive your Costa Mesa California Financial Account Transfer to Living Trust. Choose the file format for your document and download it to your device.

- Fill out your document. Print it out or use professional online editors to complete it and sign it electronically.

Form popularity

Interesting Questions

More info

The Probate Clerk's Office is in Room D110 of the Central Justice Center courthouse. If you want to revoke a revocable living trust, you'll first have to transfer all your assets out of it.Development of an estate plan with an attorney to protect beneficiaries from probate and inheritance costs. We will then work with you to develop a comprehensive plan to effectuate those goals in the most efficient and costconscious manner. A pile of newspapers in the background with the OC Social Services Agency logo and the. General Relief Services Expand. NAFS provides an excellent service, with their free and informative seminars on revocable living trust, then facilitating a law firm to draw up my trust. A revocable living trust becomes irrevocable at the death of the grantor. Seek the advice of your financial or legal advisor. Without consistent access to nutritious food children, families and seniors will not thrive.