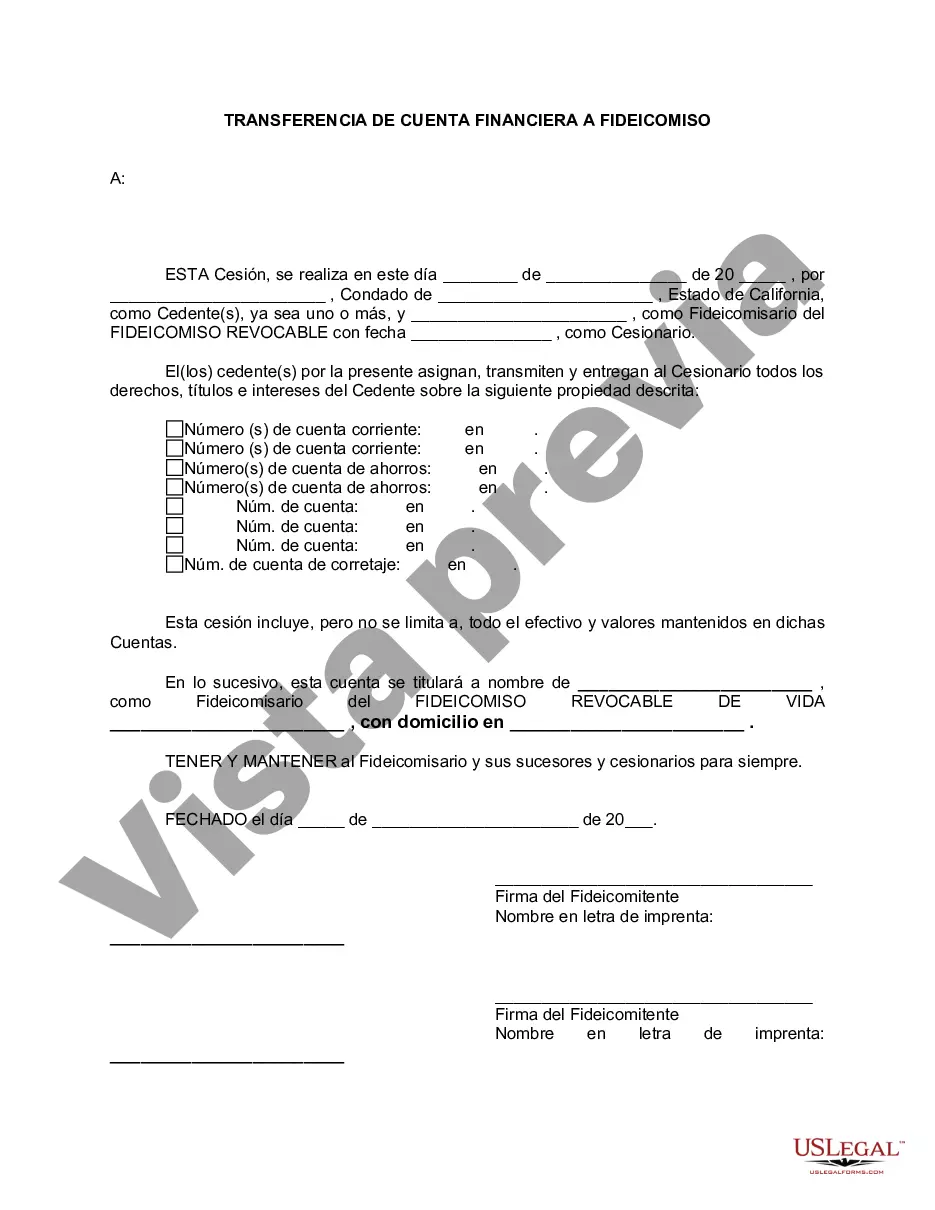

Rancho Cucamonga California Financial Account Transfer to Living Trust: A Comprehensive Guide In Rancho Cucamonga, California, financial account transfer to a living trust has become an essential estate planning strategy for many individuals and families. The process involves transferring ownership of financial accounts to a revocable living trust during one's lifetime, ensuring seamless management and distribution of assets upon incapacitation or death. This detailed description explores the benefits, types, and key considerations when executing a financial account transfer to a living trust in Rancho Cucamonga. Benefits of Financial Account Transfer to Living Trust: 1. Avoidance of Probate: By transferring financial accounts to a living trust, individuals can effectively bypass the probate process, saving their beneficiaries time, money, and potential complications. 2. Privacy Protection: Unlike probate proceedings, a properly executed living trust remains private, shielding sensitive financial information from public disclosure. 3. Incapacity Planning: Establishing a living trust allows for the seamless management of financial accounts if the account owner becomes incapacitated, ensuring continuity in financial affairs. 4. Flexibility and Control: With a living trust, account owners retain full control over their assets during their lifetime, including the ability to modify or revoke the trust at any time. Types of Financial Account Transfer to Living Trust: 1. Bank Accounts: Individuals can transfer various bank accounts, such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), to their living trust. 2. Investment Accounts: Investment portfolios, including brokerage accounts, stocks, bonds, mutual funds, and retirement accounts like IRAs and 401(k)s, may be transferred to a living trust. 3. Real Estate: Rancho Cucamonga residents can transfer real estate properties they own, such as homes, condos, or land, into their living trust for easier management and transfer to beneficiaries. 4. Business Interests: Individuals with a business can transfer their ownership interests, shares, or membership interests to their living trust, ensuring a smooth transition for their successors. Key Considerations for Financial Account Transfer to Living Trust: 1. Seek Professional Guidance: It is crucial to consult an experienced estate planning attorney or financial advisor specializing in living trusts to ensure proper execution of the transfer and compliance with legal requirements. 2. Updated Beneficiary Designations: While transferring financial accounts to a living trust, individuals should review and update beneficiary designations on retirement accounts or insurance policies to align with their overall estate plan. 3. Funding the Living Trust: Merely creating a living trust is insufficient; individuals must ensure it is sufficiently funded by transferring ownership of the desired financial accounts into the trust. Failure to properly fund the trust might render it ineffective. 4. Regular Review and Updates: Over time, financial circumstances and estate planning goals may change. Regularly reviewing and updating the living trust to reflect such changes is vital to ensure its continued effectiveness. In conclusion, a Rancho Cucamonga California Financial Account Transfer to Living Trust involves the careful process of transferring ownership of various financial accounts into a revocable living trust. This approach offers numerous benefits, including probate avoidance, asset management during incapacitation, and enhanced control over distribution. However, obtaining professional advice, properly funding the trust, and regularly reviewing and updating the living trust as needed are key considerations for a successful financial account transfer to a living trust.

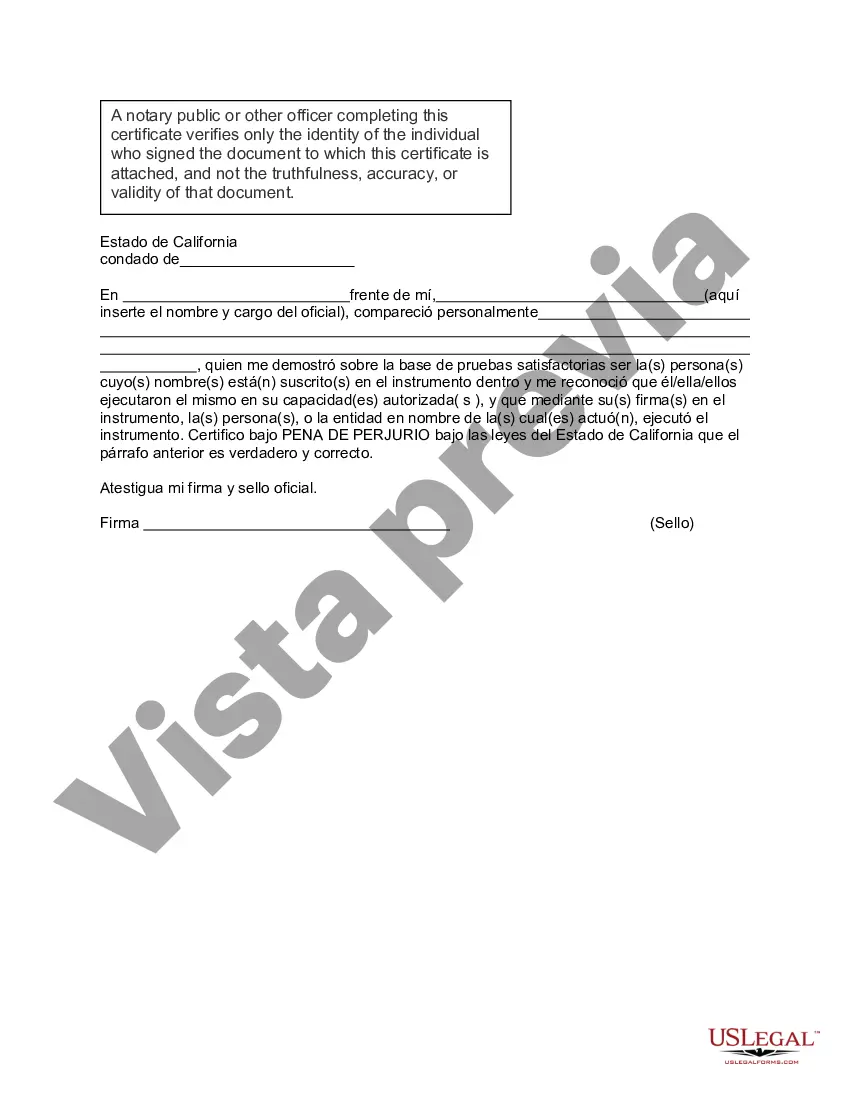

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rancho Cucamonga California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out Rancho Cucamonga California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any law background to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a huge catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you want the Rancho Cucamonga California Financial Account Transfer to Living Trust or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Rancho Cucamonga California Financial Account Transfer to Living Trust in minutes employing our trusted service. In case you are presently an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps before downloading the Rancho Cucamonga California Financial Account Transfer to Living Trust:

- Ensure the template you have chosen is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the document and go through a quick description (if provided) of cases the document can be used for.

- If the one you selected doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and choose the subscription option that suits you the best.

- with your login information or register for one from scratch.

- Select the payment method and proceed to download the Rancho Cucamonga California Financial Account Transfer to Living Trust once the payment is through.

You’re all set! Now you can go ahead and print the document or fill it out online. If you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.