Title: Riverside California Financial Account Transfer to Living Trust — Comprehensive Guide Introduction: In Riverside, California, one of the essential estate planning strategies is transferring financial accounts to a living trust. This process ensures seamless management and distribution of assets while minimizing probate. In this detailed description, we will explore the steps involved in a Riverside financial account transfer to a living trust, its benefits, and the different types of accounts that can be transferred. 1. What is a Living Trust? A living trust, also known as a revocable trust, is a legal document enabling individuals to transfer their assets into a trust during their lifetime to be managed and distributed to beneficiaries. It allows the creator (trust or) to retain control over their assets while avoiding probate. 2. Process of Riverside Financial Account Transfer to Living Trust: a. Determine eligibility: Not all financial accounts can be transferred to a living trust. Research which types of accounts can be included. b. Create a living trust: Consult with an estate planning attorney in Riverside to establish a valid living trust. c. Funding the trust: Transfer ownership of assets, including financial accounts, into the trust's name. This typically involves notifying financial institutions and completing appropriate paperwork. d. Update beneficiary designations: Ensure that all beneficiary designations on the financial accounts align with the provisions in the living trust. e. Ongoing management: After the transfer, continue to oversee and manage the accounts within the trust. 3. Benefits of Financial Account Transfer to Living Trust in Riverside: a. Avoidance of probate: By placing assets in a living trust, individuals can bypass the lengthy and costly probate process. b. Privacy: Probate records are public, whereas living trusts maintain privacy for both the trust or and beneficiaries. c. Efficient asset distribution: Living trusts enable quicker transfer of assets to beneficiaries, eliminating potential delays in accessing funds. d. Incapacity planning: A living trust can provide instructions on managing assets in the event of the trust or's incapacity, ensuring seamless continuity. e. Flexibility: Living trusts can be modified or revoked during the trust or's lifetime, allowing for flexibility in changing circumstances. 4. Types of Financial Accounts Transferable to Living Trust: a. Bank accounts: Checking accounts, savings accounts, money market accounts. b. Investment accounts: Individual brokerage accounts, investment portfolios, stocks, bonds, mutual funds. c. Retirement accounts: Traditional and Roth IRAs, 401(k)s, pension plans. d. Life insurance policies: Accounts with cash value or policies with death benefit proceeds can be transferred to a living trust. e. Real estate: Properties owned individually can be transferred to the trust, ensuring seamless management and distribution. Conclusion: Riverside California's financial account transfer to a living trust simplifies asset management, minimizes probate, ensures efficient distribution, and provides greater privacy. Consult an experienced estate planning attorney in Riverside to achieve a smooth and effective transfer of financial accounts to a living trust, tailored to your specific financial situation and goals.

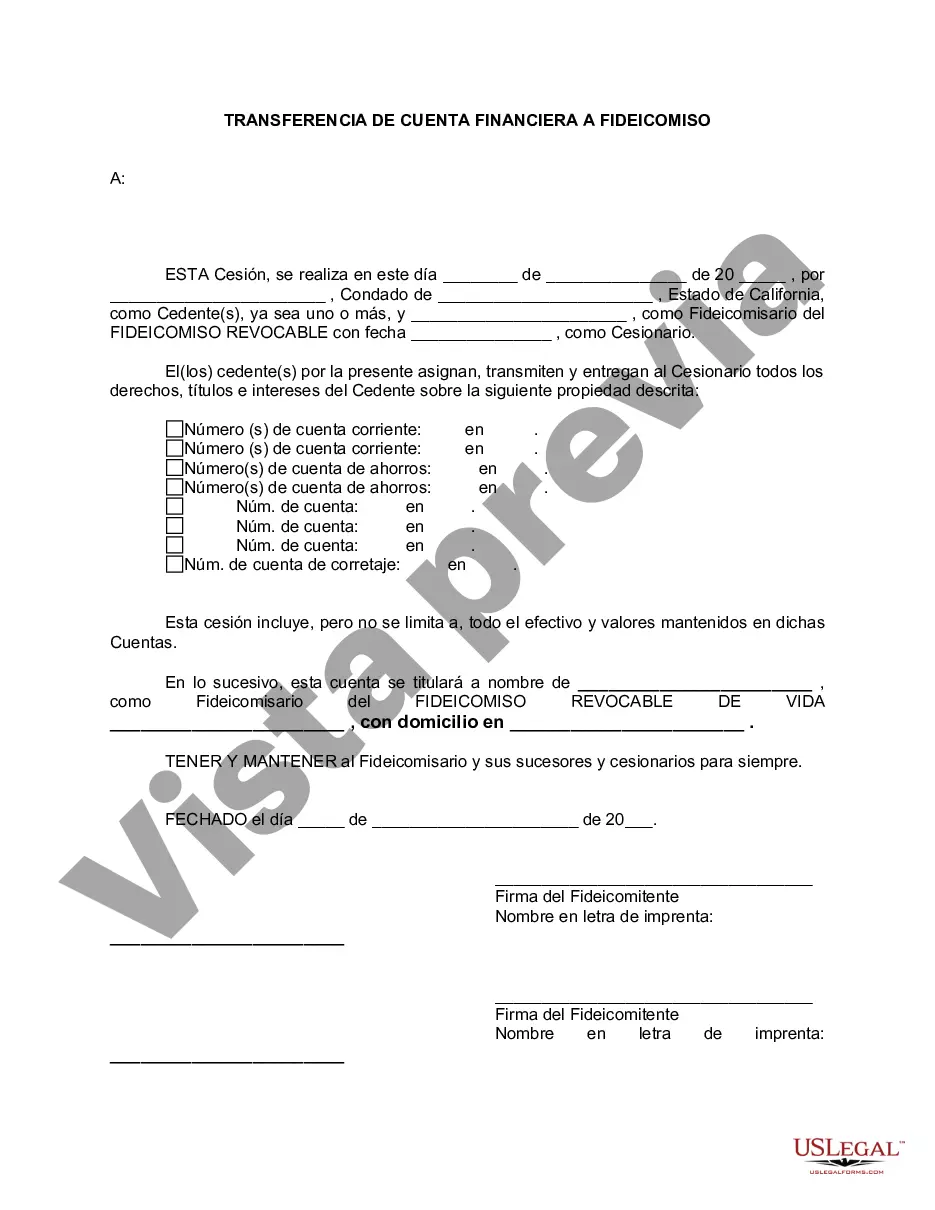

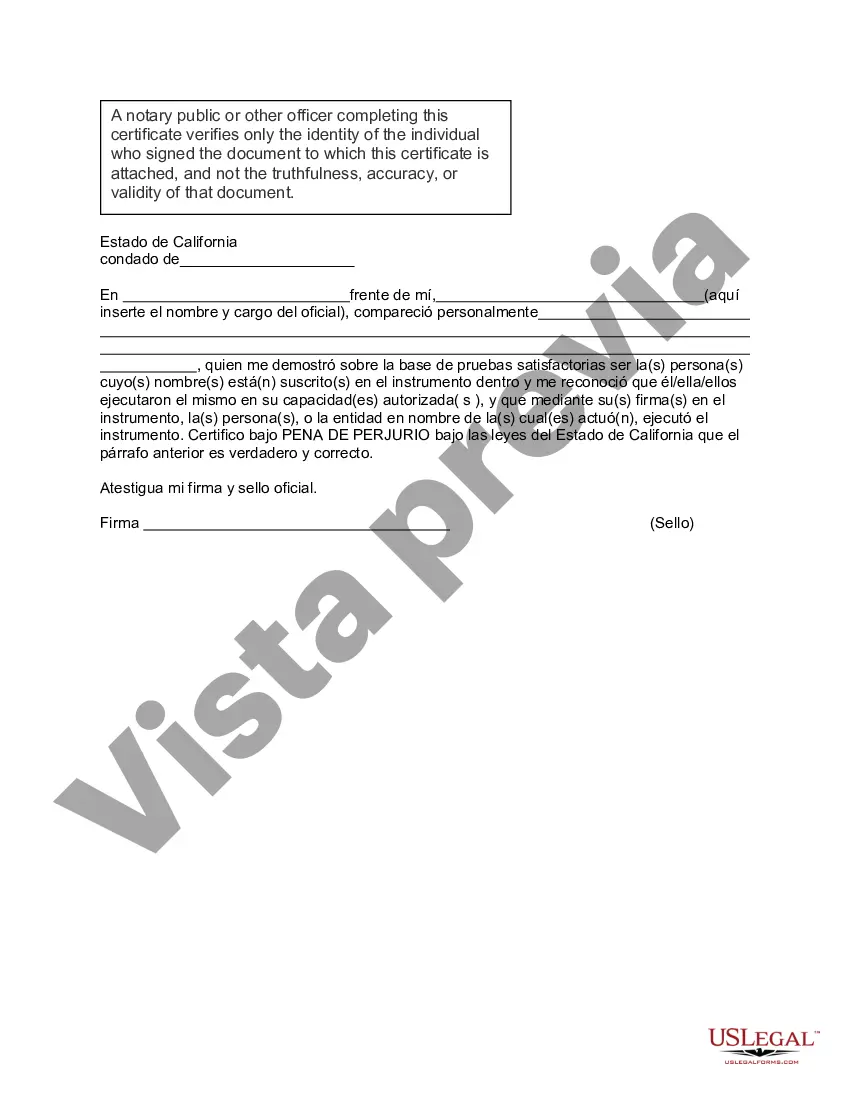

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Obtaining validated templates specific to your local regulations can be difficult unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional needs as well as various real-life scenarios.

All the forms are appropriately categorized by area of use and jurisdiction, making the search for the Riverside California Financial Account Transfer to Living Trust as simple as pie.

Input your credit card information or utilize your PayPal account to complete the payment. Download the Riverside California Financial Account Transfer to Living Trust and save the form on your device for completion, and access it anytime in the My documents section of your profile.

- Examine the Preview mode and document description.

- Ensure you've selected the correct template that fulfills your requirements and is fully compliant with your local jurisdiction stipulations.

- Search for another template, if necessary.

- If you encounter any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Contrato mediante el cual una Persona Fisica o Moral transmite la titularidad de ciertos bienes y derechos a una institucion fiduciaria, expresamente autorizada para fungir como tal.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

El fideicomiso financiero es un instrumento que le permite al inversor participar de un proyecto o de un cobro futuro determinado a traves de una colocacion de deuda o una participacion de capital.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

Para que exista el contrato de Fideicomiso basta con que esten estas dos partes; es decir, el Fideicomitente y el Fiduciario, y que los fines sean licitos y determinados. El (Los) Fideicomisario(s) son las personas fisicas o morales que reciben el o los provechos que el fideicomiso implica.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

More info

It's helpful to have one prepared at all times. California Form Interrogatory 6. 1 ana ‑interrogatory‣, b ‑interrogatories‣) is the most current interrogatory served on a party. It's an important tool, particularly when questioning witnesses, which is what matters most to a court. California Form Intimate Partner Violence Form 8500. 1 is the only document needed to file an intimate partner violence allegation or arrest. If you think your sexual partner is in danger, call the California Statewide Victim Assistance and Referral Hotline at. There's also a 24-hour, toll-free line at where you can receive immediate assistance. California Probate and Estate Law The California Probate and Estate Guide helps people who want to know the rules that govern the disposition of their assets after their death. It is also useful as a training tool for attorneys who are preparing real estate trust documents.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.