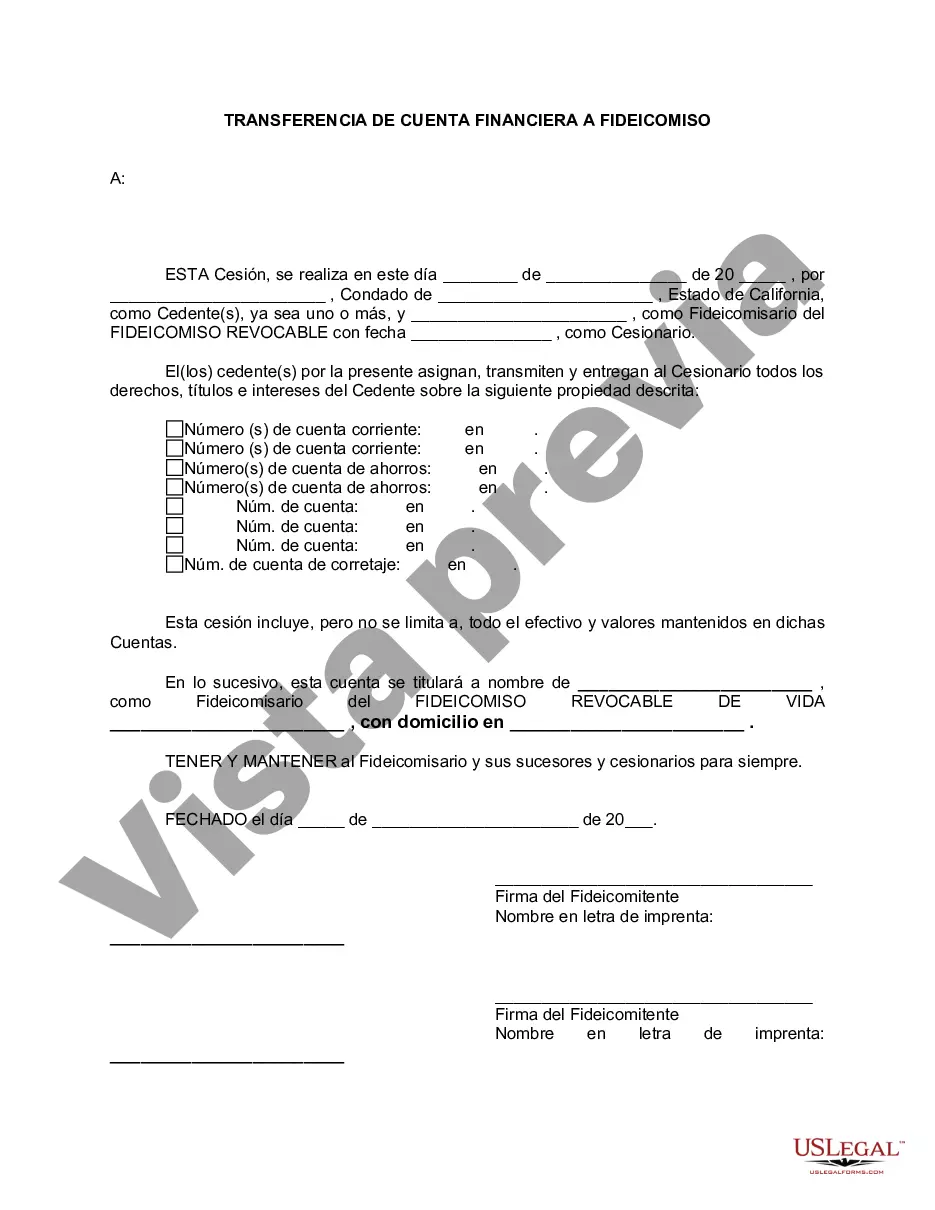

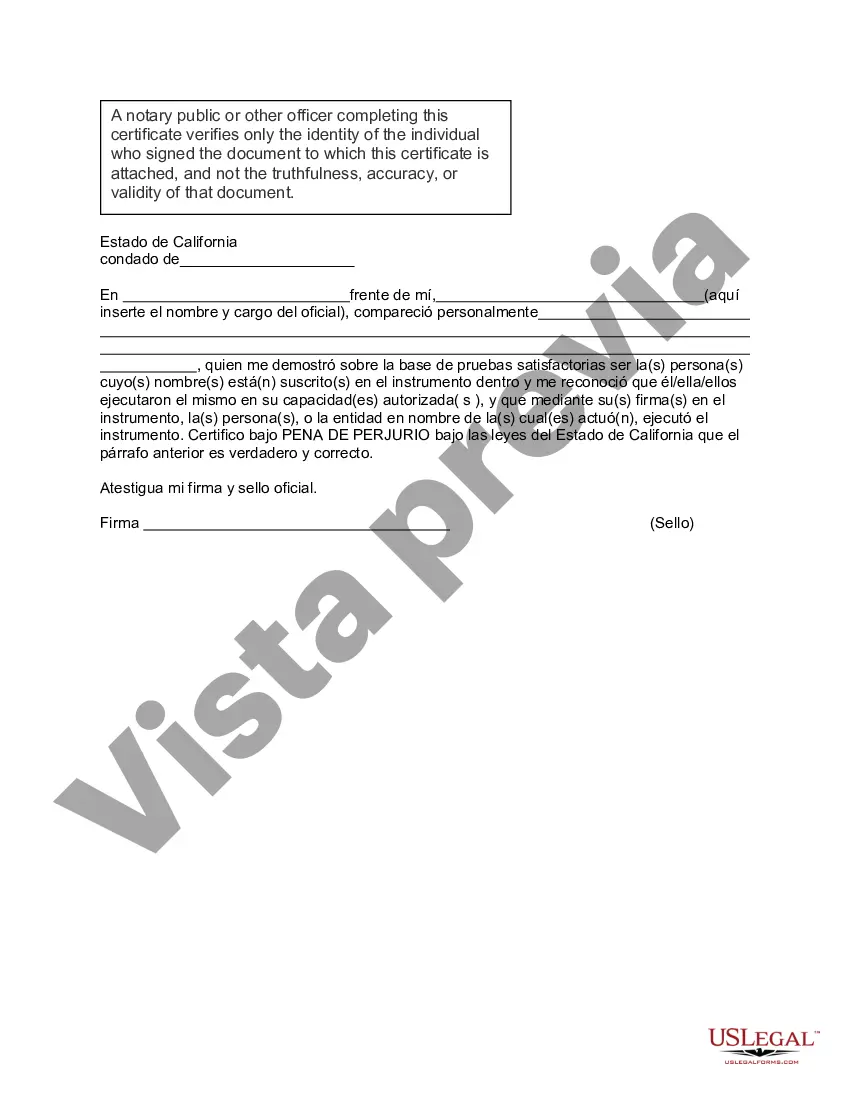

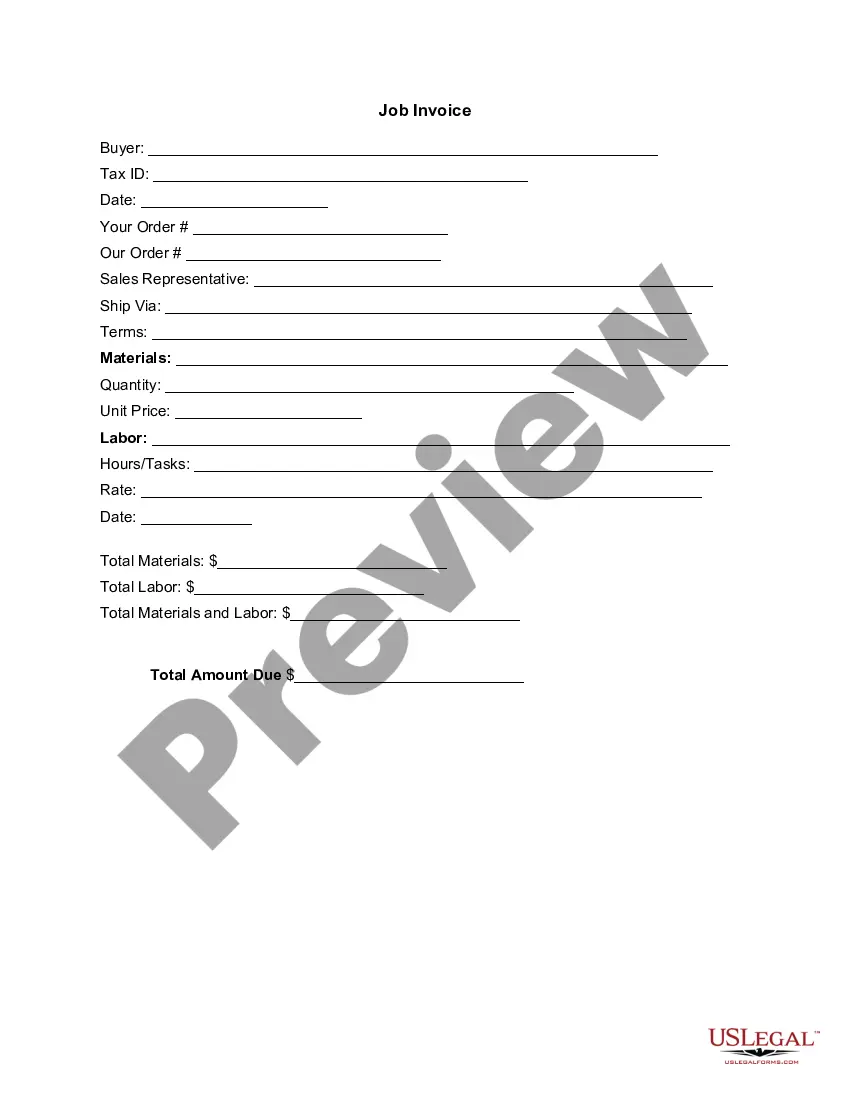

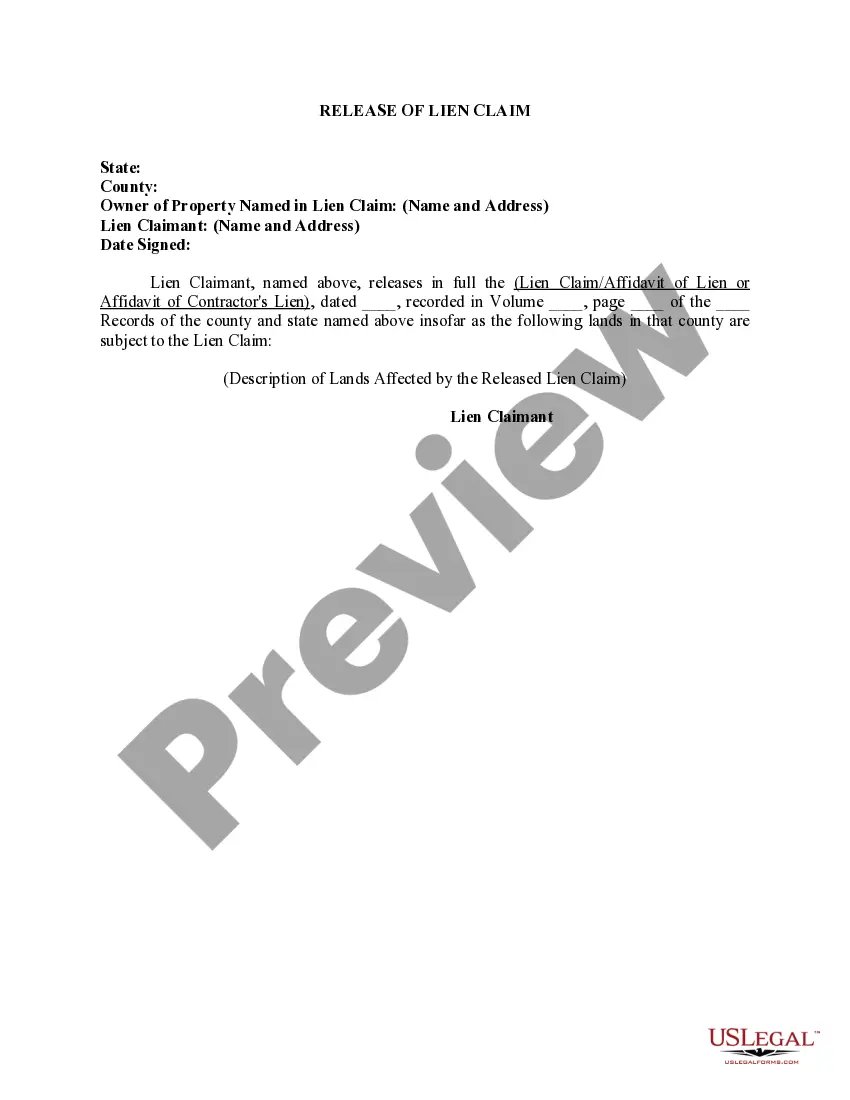

Roseville California Financial Account Transfer to Living Trust refers to the process of transferring financial accounts and assets from an individual's name into a living trust established in Roseville, California. This legal procedure allows for the seamless management and distribution of financial assets upon the granter's incapacity or death. There are various types of financial accounts that can be transferred to a living trust in Roseville, California. These include: 1. Bank Accounts: This includes checking, savings, money market, and certificates of deposit (CDs) held in the granter's name. By transferring these accounts into a living trust, the designated trustee gains the authority to manage and access the funds for the benefit of the beneficiaries. 2. Investment Accounts: This category encompasses brokerage accounts, stocks, bonds, mutual funds, and retirement accounts such as IRAs or 401(k)s. Transferring these accounts to a living trust ensures their proper management and distribution according to the granter's wishes. 3. Real Estate: Property holdings such as residential homes, vacation homes, rental properties, and commercial buildings can also be included in a living trust. Transferring real estate into a living trust helps avoid the hassle and costs associated with probate while facilitating a smooth transfer of ownership to the trust's beneficiaries. 4. Life Insurance Policies: While life insurance policies cannot be directly transferred into a living trust, they can be designated as trust assets. By naming the trust as the beneficiary or contingent beneficiary of the policy, the proceeds will pass directly to the trust upon the insured’s death, allowing for efficient management and distribution of the funds. 5. Retirement Accounts: Although retirement accounts such as IRAs and 401(k)s cannot be transferred directly into a living trust during the granter's lifetime, it is possible to name the trust as a primary or contingent beneficiary. This ensures that the retirement account assets will be distributed according to the trust's provisions after the granter's passing. In Roseville, California, the process of transferring financial accounts to a living trust typically involves drafting a Trust Transfer document that clearly identifies the assets being transferred and designates the living trust as the owner. This document is then submitted to the relevant financial institutions, such as banks or investment firms, along with any additional paperwork they may require. Utilizing a Roseville California living trust for financial account transfers offers several advantages, including the preservation of privacy, avoidance of probate, potential reduction of estate taxes, and centralized management of assets. However, it is essential to consult with a qualified estate planning attorney or financial advisor to ensure the process adheres to state laws and meets individual needs and objectives. Disclaimer: The information provided here is for general informational purposes only and should not be considered as legal or financial advice. It is recommended to consult a professional advisor for personalized guidance regarding specific financial account transfers to a living trust in Roseville, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Roseville California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out Roseville California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Do you need a trustworthy and inexpensive legal forms provider to get the Roseville California Financial Account Transfer to Living Trust? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Roseville California Financial Account Transfer to Living Trust conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Roseville California Financial Account Transfer to Living Trust in any provided format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online once and for all.