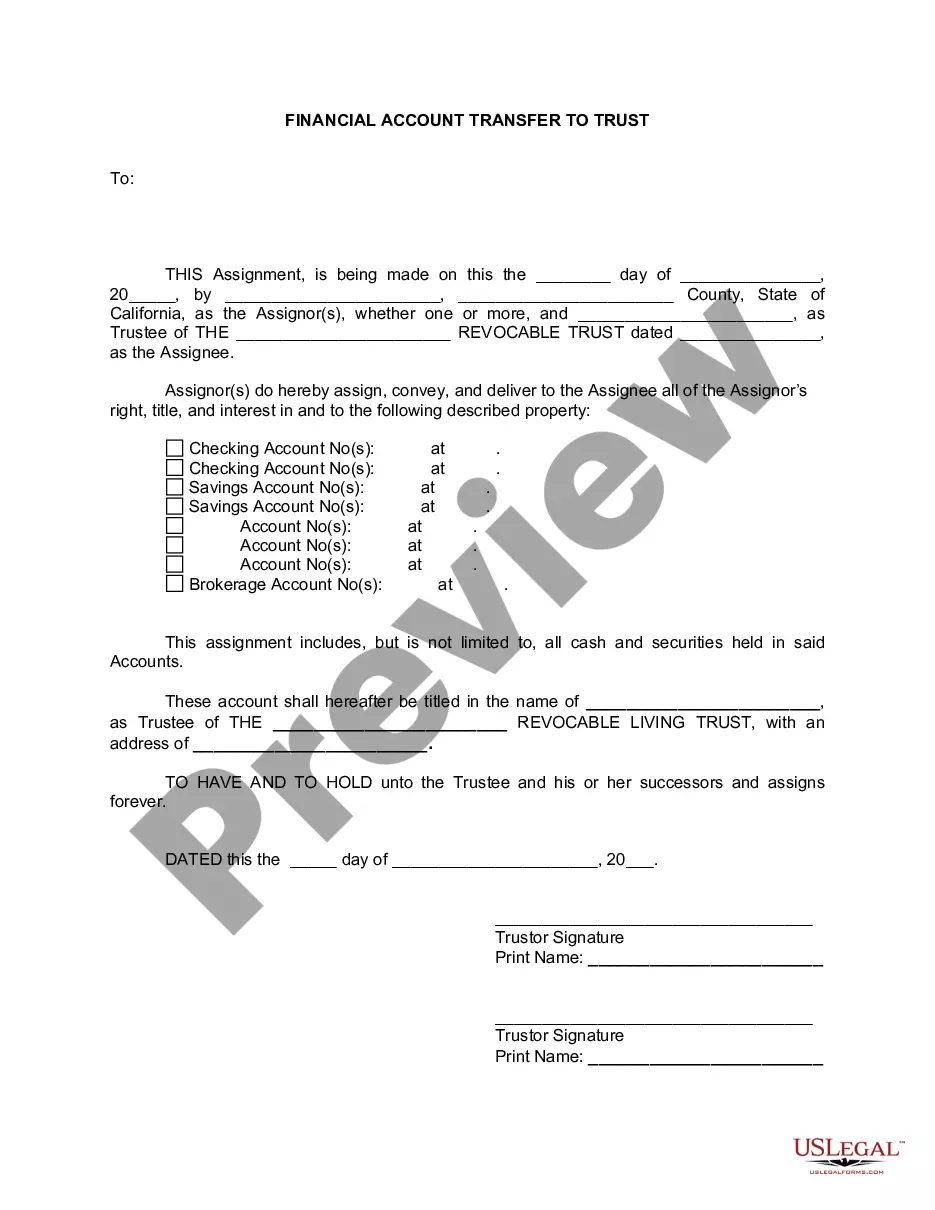

San Jose California Financial Account Transfer to Living Trust

Description

How to fill out California Financial Account Transfer To Living Trust?

Are you searching for a trustworthy and cost-effective provider of legal forms to purchase the San Jose California Financial Account Transfer to Living Trust? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use.

All templates we provide are not generic and are designed in accordance with the regulations of individual states and counties.

To obtain the document, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please remember that you can download your previously purchased document templates at any time from the My documents section.

Now you can register for your account. After that, choose a subscription plan and proceed to payment. Once your payment is confirmed, download the San Jose California Financial Account Transfer to Living Trust in any available format. You can revisit the website anytime and redownload the document at no extra cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal papers online once and for all.

- Are you a newcomer to our website? No problem.

- You can set up an account in just a few minutes, but first, ensure that.

- The San Jose California Financial Account Transfer to Living Trust complies with your state and local laws.

- You review the details of the form (if available) to understand for whom and what the document is designed.

- You restart your search if the template does not fit your legal needs.

Form popularity

FAQ

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

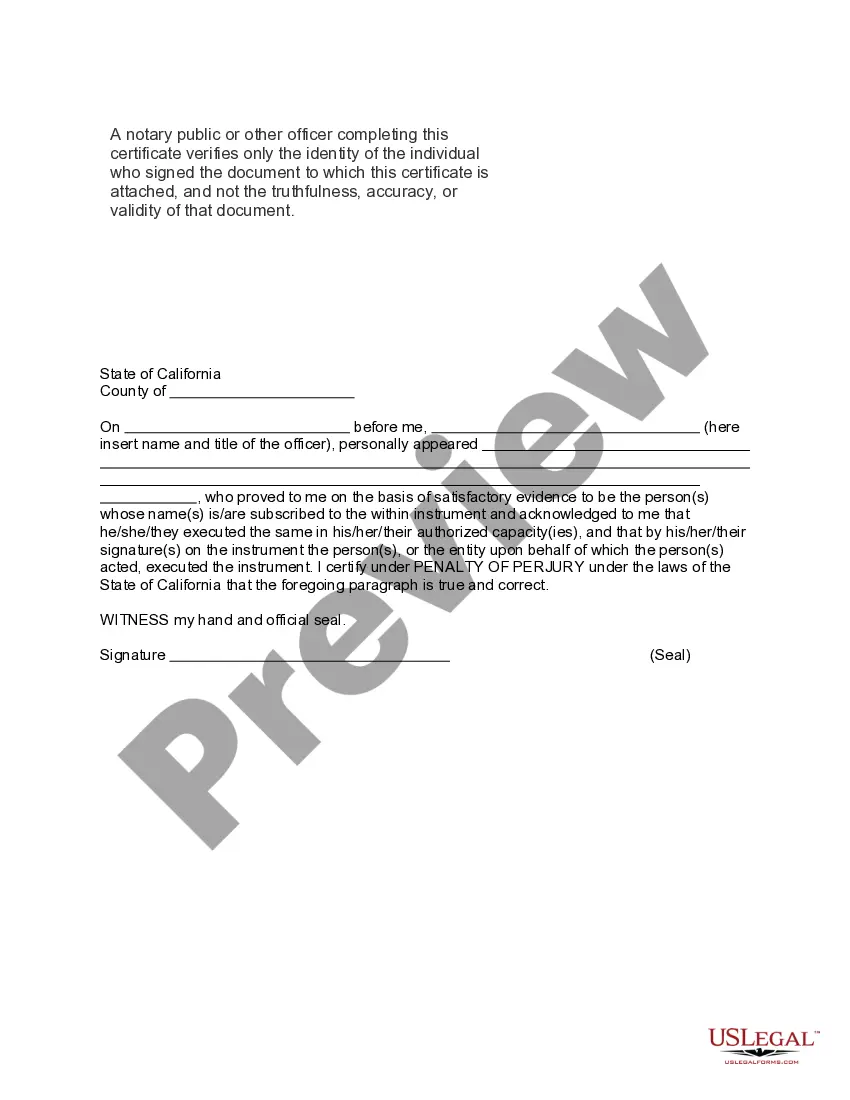

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

In most cases, the trustee who manages the funds and assets in the account acts as a fiduciary, meaning the trustee has a legal responsibility to manage the account prudently and manage assets in the best interests of the beneficiary.

Pertaining to the types of asset you put in a living trust: generally speaking, all of your assets should be transferred into your trust. However, there are some assets that you may not want or cannot be transferred into the trust. You cannot put a 401(k) in a living trust or other tax-deferred plans, for that matter.

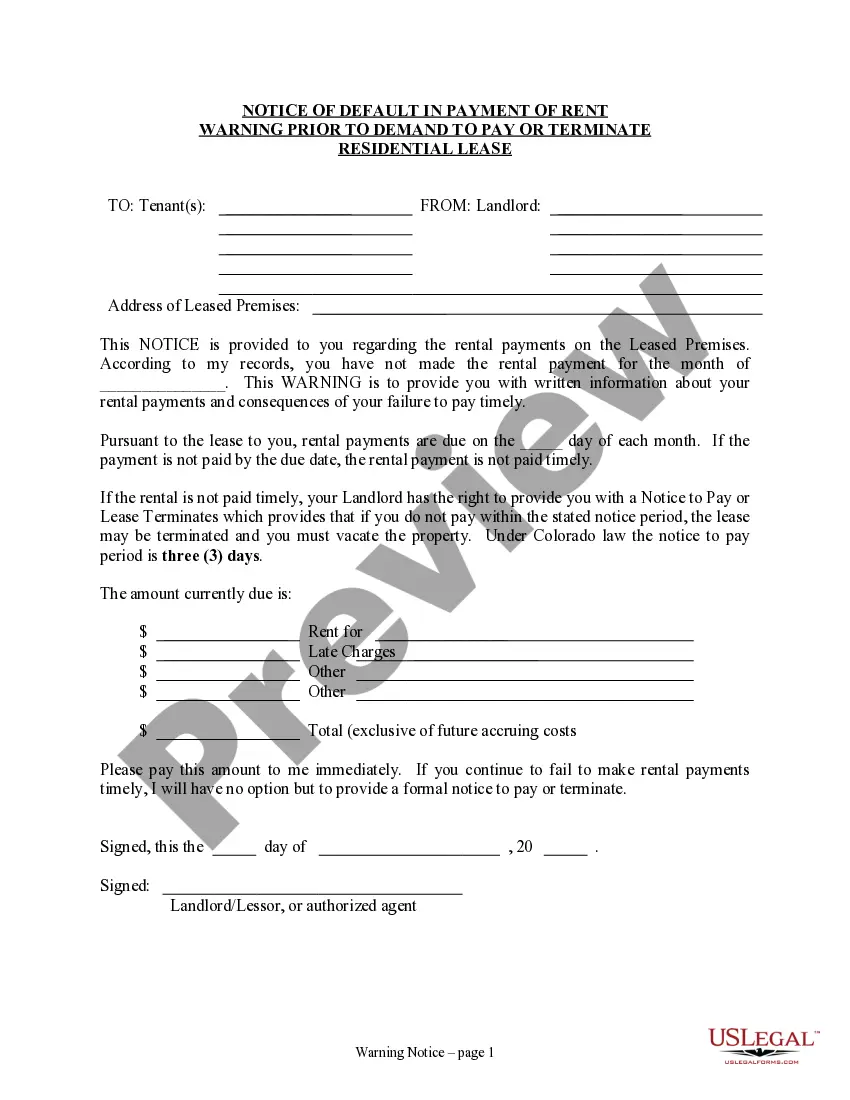

Having a separate account makes it easier to move funds into the accounts and keep track of related expenses. Being able to disperse funds quickly and easily is important, especially if the trust was created to handle immediate needs, like the death of a parent or guardian, or urgent medical expenses.

Recommended for you To make sure your Beneficiaries can easily access your accounts and receive their inheritance, protect your assets by putting them in a Trust. A Trust-Based Estate Plan is the most secure way to make your last wishes known while protecting your assets and loved ones.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

Most banks prefer that you and your spouse come to a local branch of the bank and complete their trust transfer form. Typically this is a one or two page document that will ask you to list the name of your trust, the date of the trust and who the current trustees are.