Title: Understanding Visalia California Financial Account Transfer to Living Trust: A Comprehensive Guide Keywords: Visalia California, financial account transfer, living trust, types Introduction: In Visalia, California, individuals planning their estate often consider transferring their financial accounts into a living trust to streamline the transfer process and provide for the smooth management of assets. This article aims to provide a detailed description of what exactly a Visalia California Financial Account Transfer to Living Trust entails, along with different types that exist. 1. What is a Living Trust? A living trust, also known as an inter vivos trust, is a legal document that allows an individual (known as the granter or trust or) to transfer their assets, including financial accounts, into a trust while maintaining complete control over them during their lifetime. Upon the granter's passing, these assets are then smoothly distributed to the designated beneficiaries without going through the probate process. 2. Benefits of Transferring Financial Accounts to a Living Trust: — Avoidance of Probate: With a living trust, assets, including financial accounts, will not go through the probate process, helping save time and costs. — Privacy: Unlike a will, a living trust does not become public record, ensuring privacy for both the granter and beneficiaries. — Continuity and Asset Management: A living trust ensures a smooth transition of assets if the granter becomes incapacitated or passes away, as successor trustees can seamlessly manage these financial accounts. 3. Types of Visalia California Financial Account Transfer to Living Trust: While the concept of transferring financial accounts to a living trust remains consistent, there may be different types to consider based on specific needs and circumstances. Some common types include: — Savings Accounts: Savings accounts, including traditional savings accounts, money market accounts, and certificates of deposit (CDs), can be transferred to a living trust, ensuring their proper management and distribution upon the granter's passing. — Checking Accounts: Everyday checking accounts can be transferred to a living trust, facilitating the seamless access and management of funds. — Investment Accounts: Brokerage accounts, individual retirement accounts (IRA), 401(k)s, and other investment accounts can be titled in the name of a living trust, allowing for efficient management and estate planning. — Business Accounts: If you own a business, transferring business accounts into a living trust can ensure smooth continuity even after your passing. Conclusion: A Visalia California Financial Account Transfer to Living Trust involves the transfer of financial accounts into a living trust, providing a range of benefits such as probate avoidance, privacy, and effective asset management. It is crucial to consult with a qualified estate planning attorney to ensure that the transfer process is executed correctly and in alignment with your specific needs and goals.

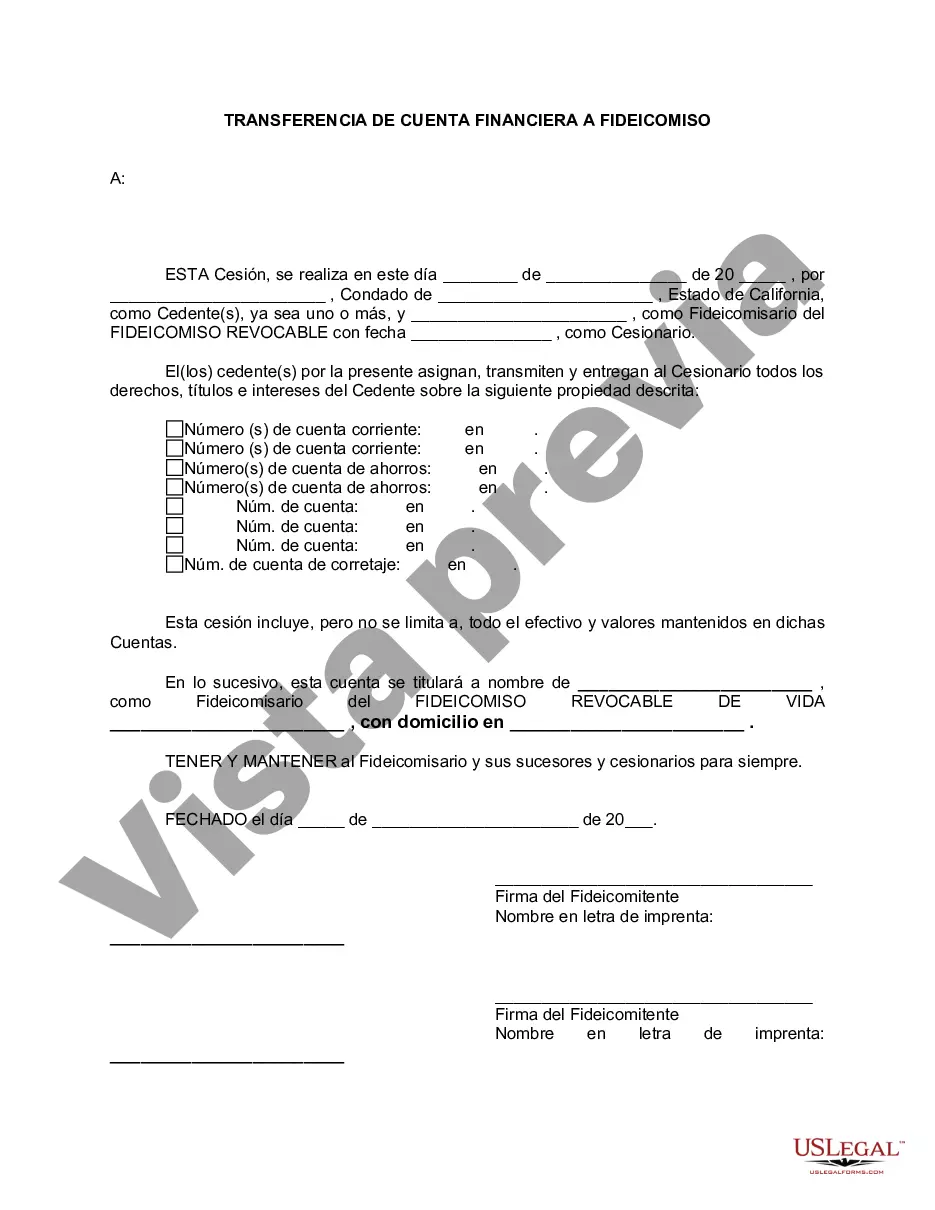

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Visalia California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out Visalia California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Make use of the US Legal Forms and get instant access to any form sample you require. Our useful platform with a huge number of templates allows you to find and get virtually any document sample you will need. You can save, fill, and certify the Visalia California Financial Account Transfer to Living Trust in just a couple of minutes instead of browsing the web for hours searching for a proper template.

Utilizing our library is a wonderful strategy to raise the safety of your record filing. Our experienced legal professionals regularly review all the documents to ensure that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you get the Visalia California Financial Account Transfer to Living Trust? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction below:

- Open the page with the form you require. Make certain that it is the template you were seeking: verify its title and description, and take take advantage of the Preview option if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Pick the format to get the Visalia California Financial Account Transfer to Living Trust and change and fill, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy form libraries on the web. We are always ready to help you in any legal process, even if it is just downloading the Visalia California Financial Account Transfer to Living Trust.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!