Vista California Financial Account Transfer to Living Trust A financial account transfer to a living trust in Vista, California is an essential step in estate planning. By transferring financial accounts into a trust, individuals can ensure their assets are properly managed and distributed to their beneficiaries after their passing. This process offers numerous advantages, including avoiding probate, minimizing estate taxes, protecting privacy, and maintaining control over assets. There are different types of financial accounts that can be transferred to a living trust in Vista, California. These include: 1. Bank Accounts: This category encompasses checking, savings, money market, and certificate of deposit (CD) accounts held at banks or credit unions. By placing these accounts into a living trust, the trustee can seamlessly manage the funds in accordance with the granter's instructions. 2. Investment Accounts: Investment accounts such as individual brokerage accounts, stocks, bonds, mutual funds, and exchange-traded funds (ETFs) can be transferred to a living trust. Doing so allows the granter's chosen trustee to oversee and make investment decisions on behalf of the trust. 3. Retirement Accounts: While it is generally not recommended to transfer retirement accounts (such as IRAs or 401(k)s) directly into a living trust, it is possible to designate the trust as the beneficiary. This strategy ensures that the retirement account assets are distributed according to the trust's provisions after the granter's passing. 4. Real Estate: While not a financial account per se, real estate properties located in Vista, California can be transferred to a living trust. This type of transfer is commonly known as a "real estate deed transfer" and ensures seamless ownership transition while bypassing probate. 5. Business Accounts: If the granter owns business accounts either as a sole proprietor or part of a partnership, those accounts can also be transferred to the living trust. This enables the trustee to continue managing the business's financial affairs in line with the granter's wishes. To initiate a Vista California financial account transfer to a living trust, individuals should consult with an estate planning attorney or financial advisor well-versed in trust establishment and administration. A professional can guide them through the process, ensuring all legal requirements are met and helping create a comprehensive estate plan tailored to their specific needs. In summary, a Vista California financial account transfer to a living trust allows individuals to protect their assets and efficiently manage their finances both during their lifetime and after their passing. By transferring various types of financial accounts, individuals can ensure their wishes are carried out and their loved ones are provided for in the most effective and tax-efficient manner possible.

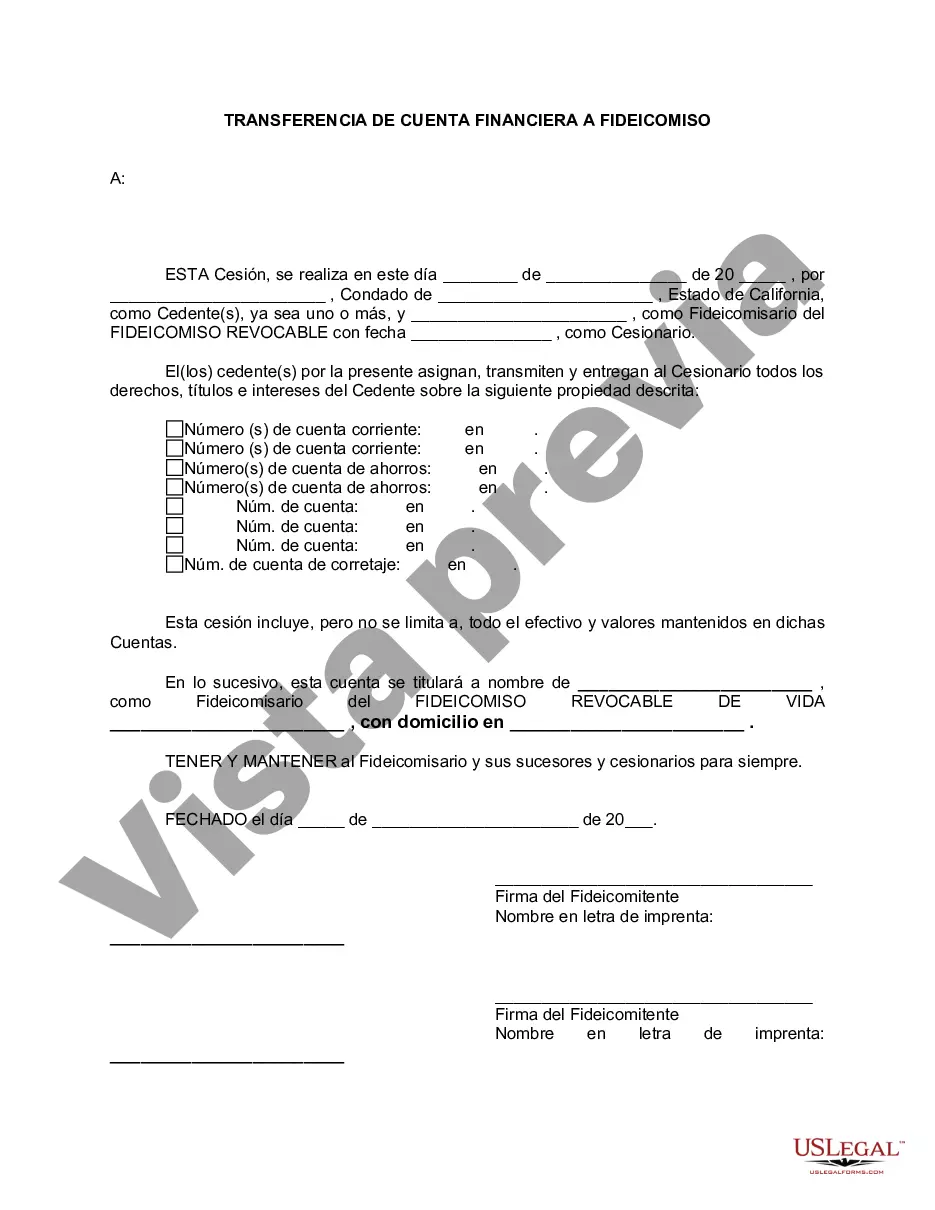

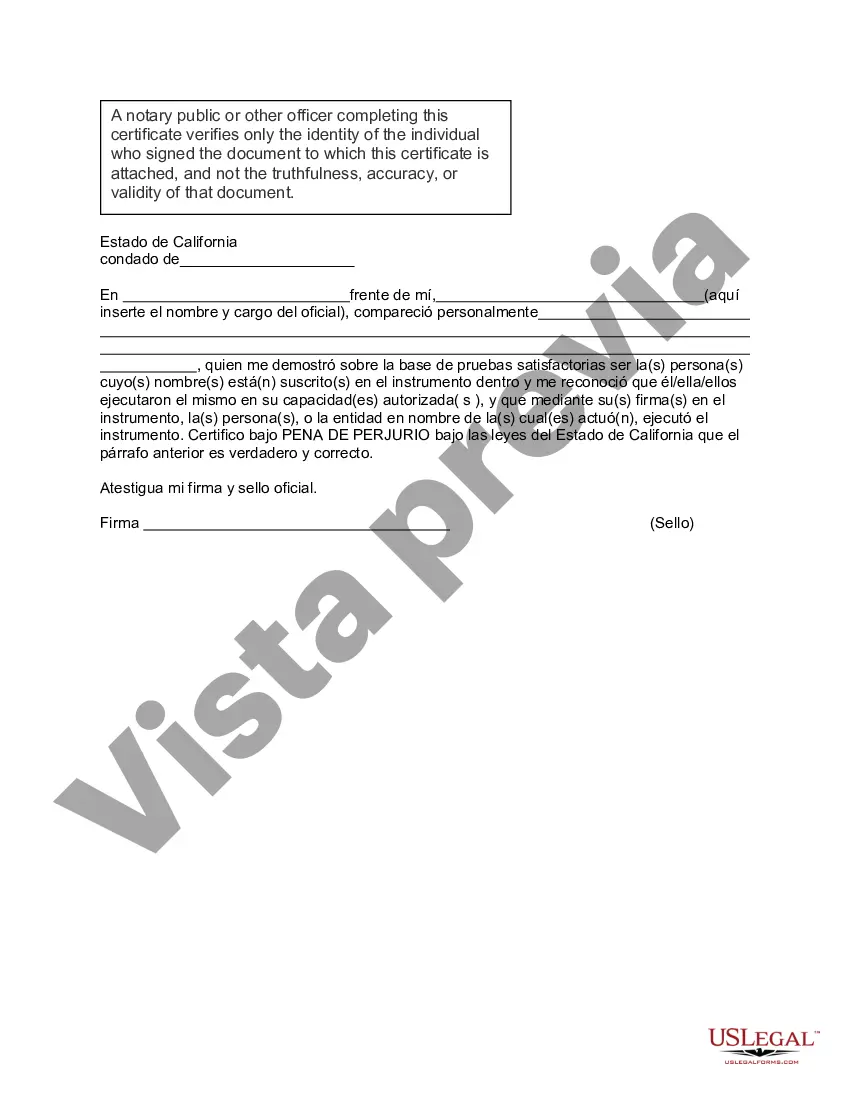

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Vista California Transferencia de cuenta financiera a fideicomiso en vida - California Financial Account Transfer to Living Trust

Description

How to fill out Vista California Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney solutions that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Vista California Financial Account Transfer to Living Trust or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Vista California Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Vista California Financial Account Transfer to Living Trust would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!