Burbank California Assignment to Living Trust: Exploring the Benefits and Types A Burbank California Assignment to Living Trust is a legal document that helps individuals in Burbank, California, manage their assets and properties during their lifetime and distribute them to beneficiaries upon their death. This comprehensive estate planning tool offers numerous advantages, such as avoiding probate, maintaining privacy, and ensuring a smooth transition of assets. One type of Burbank California Assignment to Living Trust is the Revocable Living Trust. This trust allows individuals to maintain control over their assets and make changes or revoke it at any time during their lifetime. By creating a revocable living trust, individuals can transfer their assets, including real estate, bank accounts, investments, and personal property, into the trust's ownership. As the primary beneficiary, individuals can continue to use and manage their assets while avoiding probate upon their passing. Another type is the Irrevocable Living Trust, which provides individuals with more asset protection and tax benefits. Unlike a revocable living trust, an irrevocable living trust cannot be changed or terminated once it's established. By transferring assets into this trust, individuals relinquish ownership, which can offer creditor protection and potentially reduce estate taxes. Burbank California Assignment to Living Trusts also come in the form of Special Needs Trusts, which are designed to help individuals with disabilities maintain their eligibility for government benefits while receiving supplemental resources from the trust. This type of trust ensures that beneficiaries with special needs have financial security and access to specific services without jeopardizing their eligibility for programs like Medicaid or Social Security Disability Income. A Qualified Personnel Residence Trust (PRT) is another type of Burbank California Assignment to Living Trust. With this trust, individuals can transfer their primary residence or vacation home into the trust with the intention of gifting it to beneficiaries while still enjoying the property for a certain period. This strategy allows for substantial estate tax savings, as the value of the home is frozen at the time of the transfer. Moreover, individuals can establish a Charitable Remainder Trust (CRT) as a Burbank California Assignment to Living Trust, ensuring financial benefits for both beneficiaries and charitable organizations. This trust allows individuals to donate assets while retaining an annual income stream either for themselves or loved ones. Upon the trust's termination, the remaining assets are distributed to the designated charity or charities. In conclusion, a Burbank California Assignment to Living Trust is a versatile estate planning tool that provides individuals with various options to manage their assets and properties during their lifetime and beyond. By utilizing the different types of trusts available, individuals can tailor their estate plans to suit their specific needs, ultimately ensuring a secure and efficient distribution of assets.

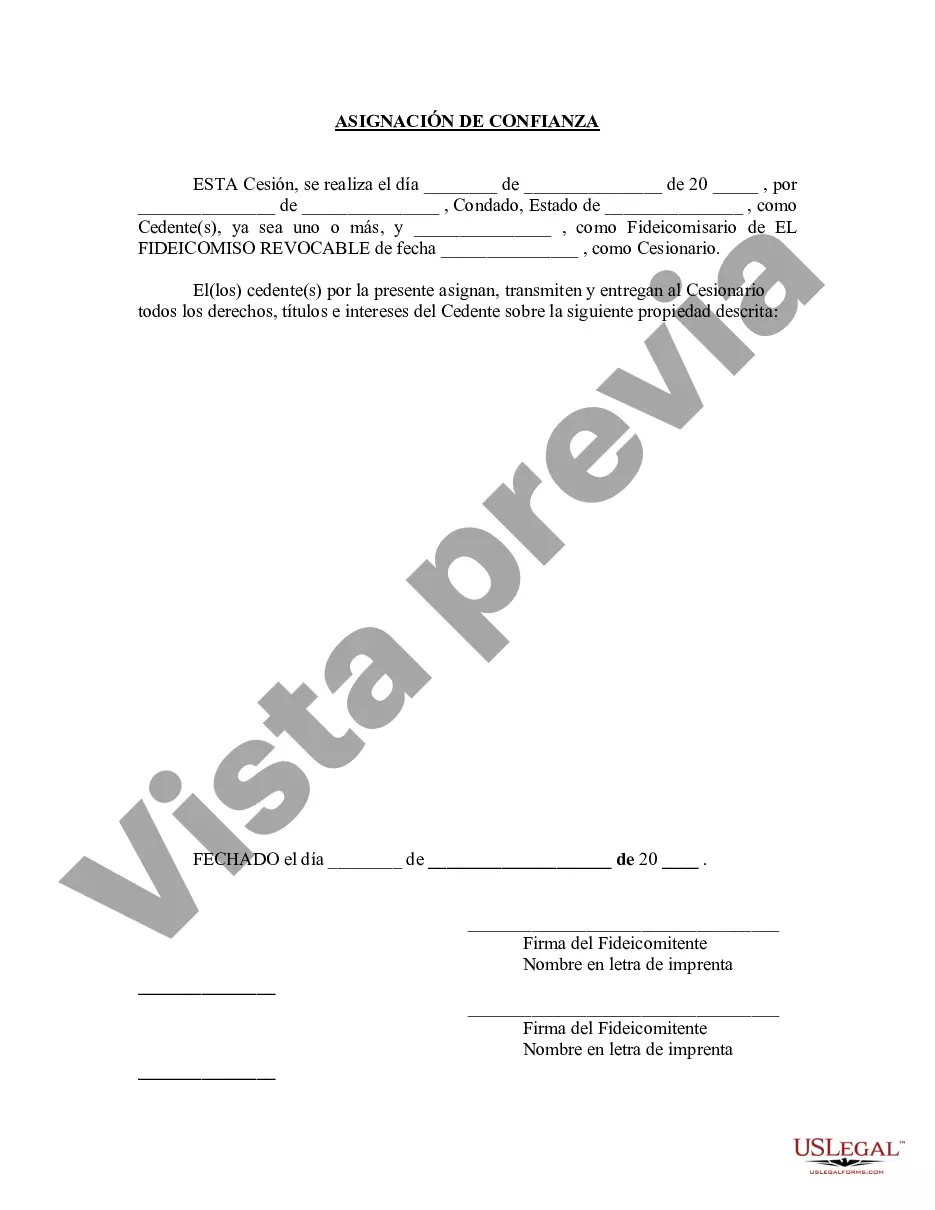

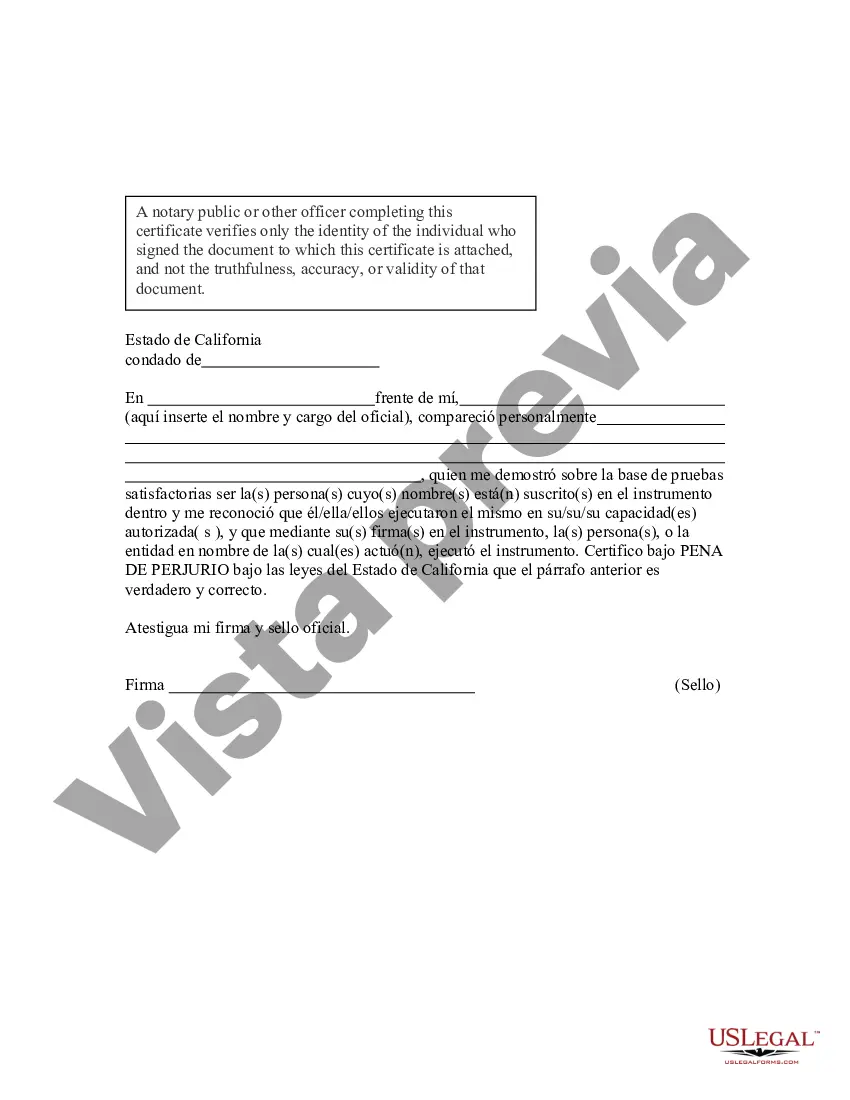

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Burbank California Asignación a un fideicomiso en vida - California Assignment to Living Trust

Description

How to fill out Burbank California Asignación A Un Fideicomiso En Vida?

If you are searching for a relevant form, it’s difficult to choose a more convenient platform than the US Legal Forms site – one of the most considerable online libraries. Here you can find a huge number of document samples for business and personal purposes by types and regions, or keywords. Using our advanced search feature, getting the most up-to-date Burbank California Assignment to Living Trust is as easy as 1-2-3. In addition, the relevance of each document is proved by a group of professional attorneys that on a regular basis review the templates on our website and revise them according to the most recent state and county regulations.

If you already know about our platform and have an account, all you should do to receive the Burbank California Assignment to Living Trust is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the form you need. Check its information and utilize the Preview function (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to get the proper document.

- Affirm your choice. Click the Buy now button. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Select the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Burbank California Assignment to Living Trust.

Every single form you save in your account has no expiry date and is yours forever. It is possible to access them via the My Forms menu, so if you need to have an additional duplicate for modifying or printing, feel free to return and export it once again anytime.

Take advantage of the US Legal Forms professional library to get access to the Burbank California Assignment to Living Trust you were looking for and a huge number of other professional and state-specific templates on a single platform!