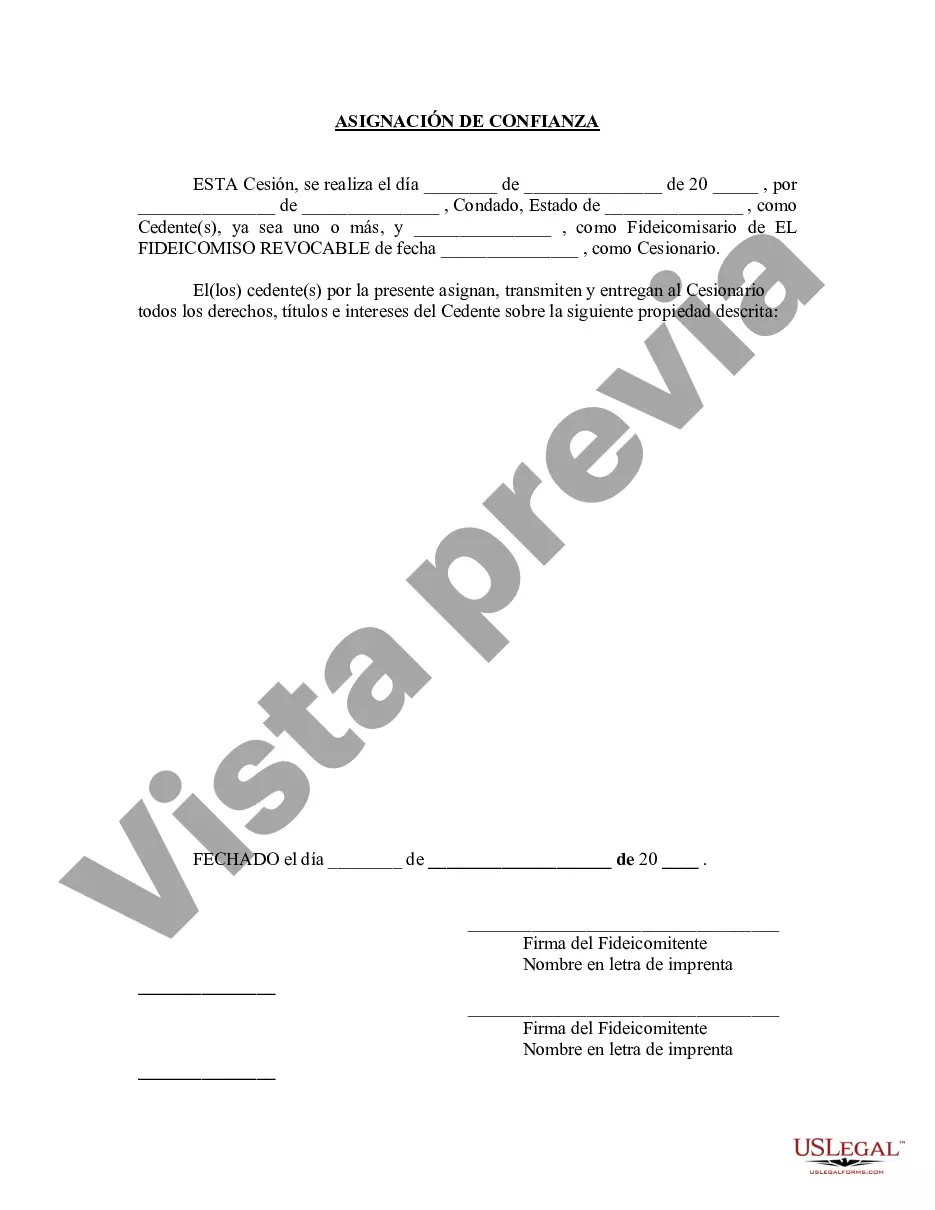

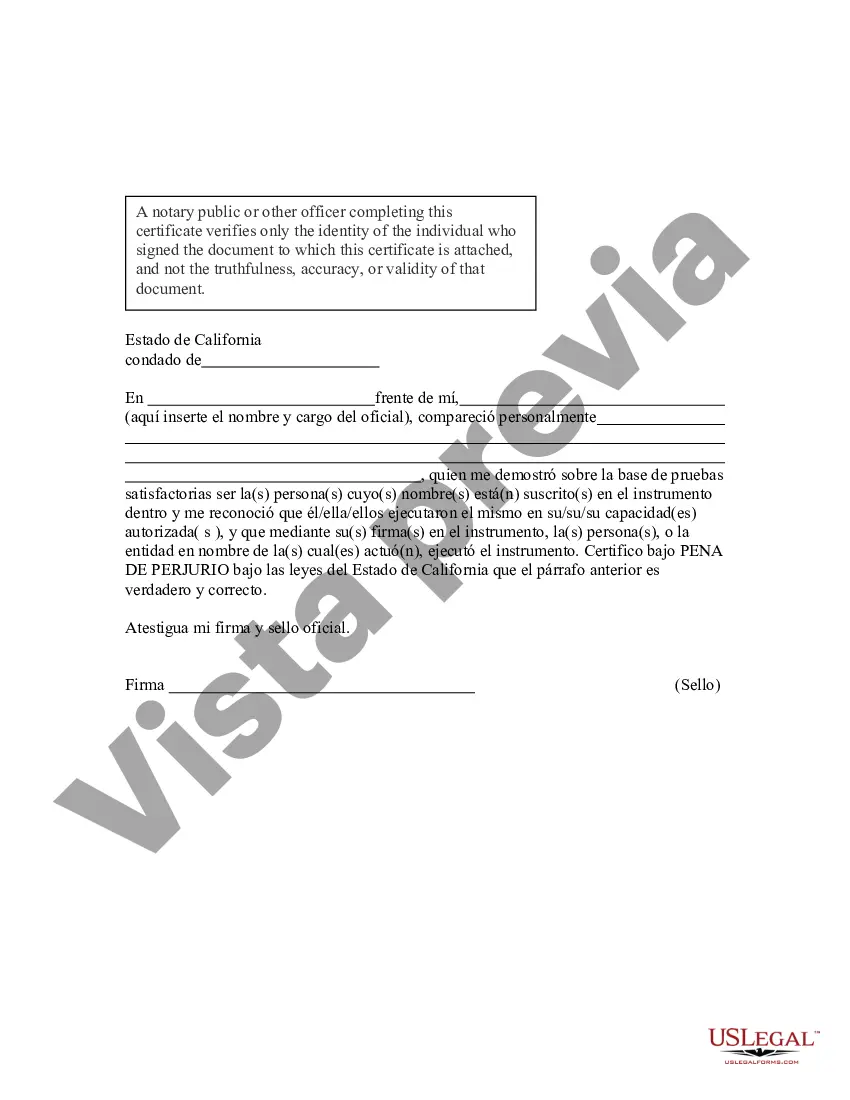

Inglewood, California Assignment to Living Trust: A Comprehensive Guide to Protecting Your Assets When it comes to estate planning, assigning your assets to a living trust is a vital step to ensure their protection and seamless transfer to your beneficiaries. Inglewood, California residents can benefit immensely from establishing an Assignment to Living Trust, which offers many advantages over traditional wills or outright ownership. This detailed description will delve into what an Inglewood California Assignment to Living Trust entails, its benefits, and the various types available. What is an Inglewood California Assignment to Living Trust? An Inglewood California Assignment to Living Trust is a legal document that allows individuals, referred to as Granters or Settlers, to transfer ownership of their assets to a trust during their lifetime. The trust is managed by a trustee, who can be the Granter or someone else appointed to fulfill this role. The Assignment to Living Trust outlines how the assets should be managed, distributed, and protected during the Granter's lifetime, as well as after their passing. Benefits of an Inglewood California Assignment to Living Trust: 1. Probate Avoidance: One significant advantage of an Assignment to Living Trust is the ability to bypass probate, a time-consuming and costly legal process. By assigning assets to a trust, they are no longer subject to probate court proceedings, allowing for a faster and more efficient distribution of your estate. 2. Privacy Protection: Unlike a will, which becomes public record upon probate, an Assignment to Living Trust maintains the privacy of your financial affairs. This confidentiality ensures that sensitive details about your assets, beneficiaries, and their inheritance remain confidential. 3. Incapacity Planning: An Assignment to Living Trust also serves as an effective tool for incapacity planning. If the Granter becomes incapacitated or unable to manage their affairs, the trustee can step in and manage the trust according to the instructions outlined in the document, alleviating the need for court-appointed conservatorship. Types of Inglewood California Assignment to Living Trust: 1. Revocable Living Trust: A revocable trust provides flexibility and allows modifications or revocation by the Granter during their lifetime. This type of trust remains within the Granter's control, and they can change beneficiaries, assets, or trustees as needed. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be modified or revoked without the consent of all named beneficiaries. Assets assigned to an irrevocable trust are effectively removed from the Granter's estate, offering potential tax benefits and creditor protection. 3. Testamentary Trust: A testamentary trust is established through a will and comes into effect after the Granter's passing. This type of trust allows more control over the distribution of assets and can be beneficial for individuals who prefer to maintain full control during their lifetime. Conclusion: An Inglewood California Assignment to Living Trust is a powerful estate planning tool that enables individuals to protect and efficiently transfer their assets while maintaining privacy and avoiding the complexities of probate. With the options of revocable, irrevocable, and testamentary trusts, Inglewood residents have various avenues to suit their specific goals and needs. Consulting with an experienced estate planning attorney is highly recommended ensuring that your Assignment to Living Trust is tailored to your unique circumstances and preserves your financial legacy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Inglewood California Asignación a un fideicomiso en vida - California Assignment to Living Trust

Description

How to fill out Inglewood California Asignación A Un Fideicomiso En Vida?

Take advantage of the US Legal Forms and have instant access to any form template you want. Our useful platform with a huge number of documents allows you to find and obtain almost any document sample you will need. It is possible to download, fill, and certify the Inglewood California Assignment to Living Trust in a few minutes instead of browsing the web for several hours attempting to find a proper template.

Utilizing our collection is a wonderful way to raise the safety of your document submissions. Our professional attorneys regularly review all the records to ensure that the forms are relevant for a particular state and compliant with new laws and regulations.

How can you obtain the Inglewood California Assignment to Living Trust? If you have a subscription, just log in to the account. The Download button will appear on all the documents you view. In addition, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Find the template you require. Make sure that it is the template you were seeking: examine its name and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Pick the format to get the Inglewood California Assignment to Living Trust and edit and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy form libraries on the web. We are always happy to help you in any legal case, even if it is just downloading the Inglewood California Assignment to Living Trust.

Feel free to take advantage of our platform and make your document experience as efficient as possible!