The Thousand Oaks California Assignment to Living Trust is a legal document that transfers ownership of assets or property to a revocable living trust, which is created during the granter's lifetime and benefited from by the chosen beneficiaries after their passing. This assignment ensures that the granter's assets are protected, managed, and distributed accordingly, in line with their wishes. The Assignment to Living Trust process in Thousand Oaks, California involves several crucial steps. Firstly, the granter identifies the assets they wish to assign to the living trust, such as real estate, investments, bank accounts, personal belongings, and more. It is important to note that the granter retains control over the assets and can modify or revoke the trust during their lifetime as desired. Once the assets are identified, the granter appoints a trustee, who will oversee and manage the trust. This trustee can be an individual or a professional entity, such as a trust company. The granter may also name successor trustees to take over in case the initial trustee becomes unable or unwilling to fulfill their duties. Thousand Oaks California offers various types of Assignments to Living Trusts to meet different needs and circumstances. Some of these include: 1. Revocable Trust: This is the most common type of living trust in which the granter retains the ability to modify or revoke the trust during their lifetime. Assets assigned to this trust avoid probate upon the granter's passing and can be managed by the designated trustee seamlessly. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be easily modified or revoked once created. Assigning assets to an irrevocable trust provides additional asset protection, reduces estate taxes, and allows for greater control over how the assets are distributed after the granter's passing. 3. Special Needs Trust: This type of living trust is designed specifically for individuals with special needs or disabilities. The trust ensures that the beneficiary can receive financial support while maintaining eligibility for government benefits. 4. Charitable Remainder Trust: This trust allows granters to support charitable organizations while retaining an income stream during their lifetime. After the granter's passing, the remaining assets are transferred to the designated charities. 5. Testamentary Trust: Unlike other living trusts, a testamentary trust is created through a will and only goes into effect after the granter's passing. Assets assigned to this trust are subject to probate but can be managed and distributed according to the granter's preferences. When planning to create a Thousand Oaks California Assignment to Living Trust, it is advisable to consult with an experienced estate planning attorney who can guide you through the process and ensure that your assets are protected and distributed according to your wishes.

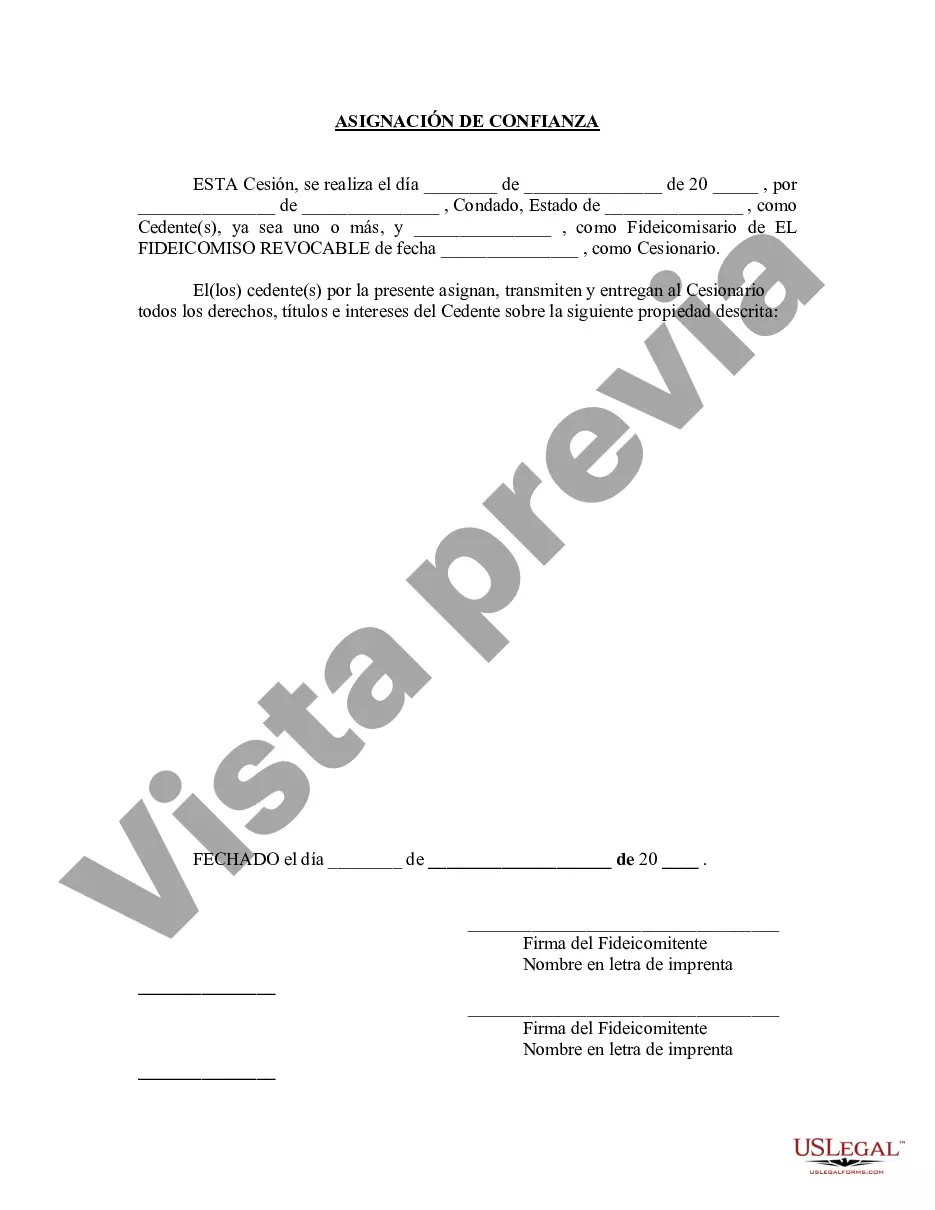

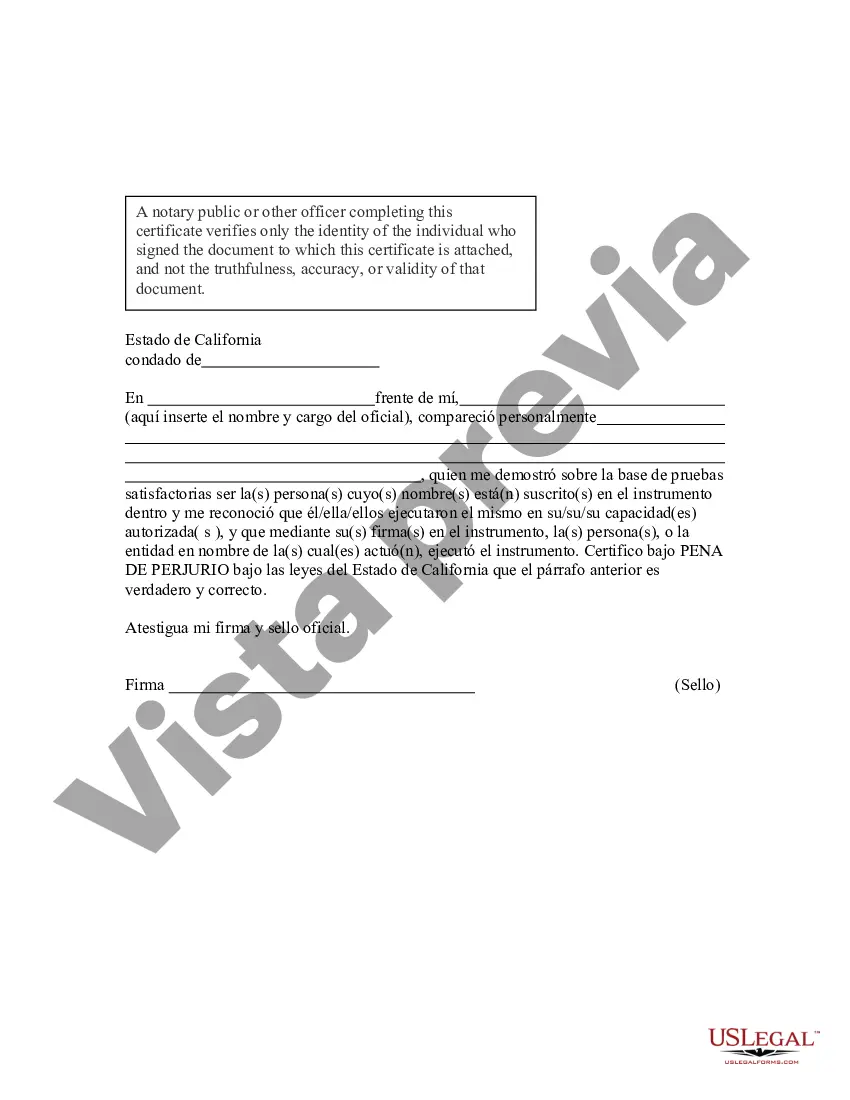

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Thousand Oaks California Asignación a un fideicomiso en vida - California Assignment to Living Trust

State:

California

City:

Thousand Oaks

Control #:

CA-E0178E

Format:

Word

Instant download

Description

Formulario para la asignación de varios bienes a un fideicomiso en vida.

The Thousand Oaks California Assignment to Living Trust is a legal document that transfers ownership of assets or property to a revocable living trust, which is created during the granter's lifetime and benefited from by the chosen beneficiaries after their passing. This assignment ensures that the granter's assets are protected, managed, and distributed accordingly, in line with their wishes. The Assignment to Living Trust process in Thousand Oaks, California involves several crucial steps. Firstly, the granter identifies the assets they wish to assign to the living trust, such as real estate, investments, bank accounts, personal belongings, and more. It is important to note that the granter retains control over the assets and can modify or revoke the trust during their lifetime as desired. Once the assets are identified, the granter appoints a trustee, who will oversee and manage the trust. This trustee can be an individual or a professional entity, such as a trust company. The granter may also name successor trustees to take over in case the initial trustee becomes unable or unwilling to fulfill their duties. Thousand Oaks California offers various types of Assignments to Living Trusts to meet different needs and circumstances. Some of these include: 1. Revocable Trust: This is the most common type of living trust in which the granter retains the ability to modify or revoke the trust during their lifetime. Assets assigned to this trust avoid probate upon the granter's passing and can be managed by the designated trustee seamlessly. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be easily modified or revoked once created. Assigning assets to an irrevocable trust provides additional asset protection, reduces estate taxes, and allows for greater control over how the assets are distributed after the granter's passing. 3. Special Needs Trust: This type of living trust is designed specifically for individuals with special needs or disabilities. The trust ensures that the beneficiary can receive financial support while maintaining eligibility for government benefits. 4. Charitable Remainder Trust: This trust allows granters to support charitable organizations while retaining an income stream during their lifetime. After the granter's passing, the remaining assets are transferred to the designated charities. 5. Testamentary Trust: Unlike other living trusts, a testamentary trust is created through a will and only goes into effect after the granter's passing. Assets assigned to this trust are subject to probate but can be managed and distributed according to the granter's preferences. When planning to create a Thousand Oaks California Assignment to Living Trust, it is advisable to consult with an experienced estate planning attorney who can guide you through the process and ensure that your assets are protected and distributed according to your wishes.

Free preview

How to fill out Thousand Oaks California Asignación A Un Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and save the Thousand Oaks California Assignment to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Thousand Oaks California Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!