Sacramento California Revocación del fideicomiso en vida - California Revocation of Living Trust

Description

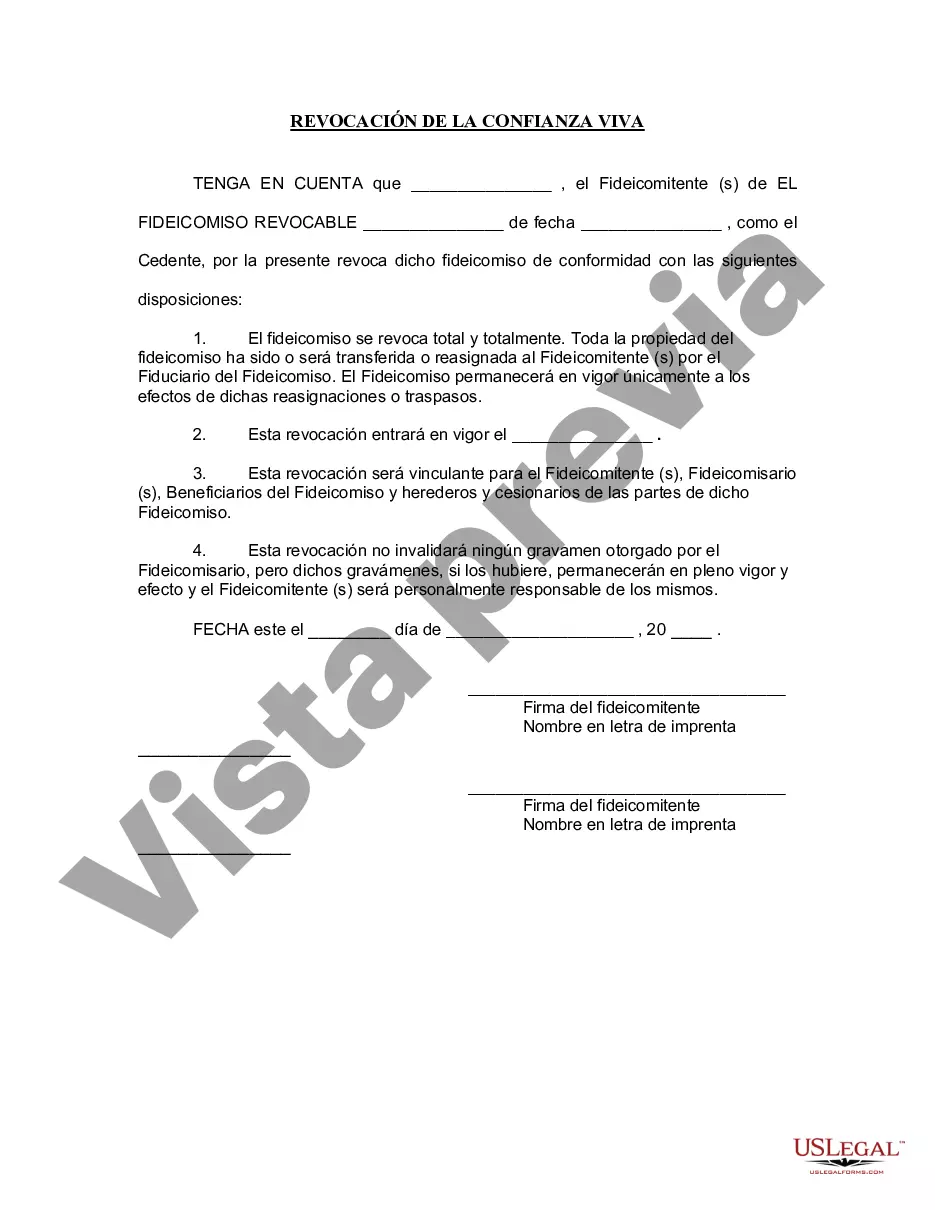

How to fill out California Revocación Del Fideicomiso En Vida?

We consistently aim to reduce or evade legal harm when addressing intricate legal or financial issues.

To achieve this, we seek attorney services that are typically quite costly.

However, not all legal challenges are equally complicated. Most can be handled independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and power of attorney to incorporation articles and dissolution petitions. Our repository empowers you to manage your issues without needing legal assistance.

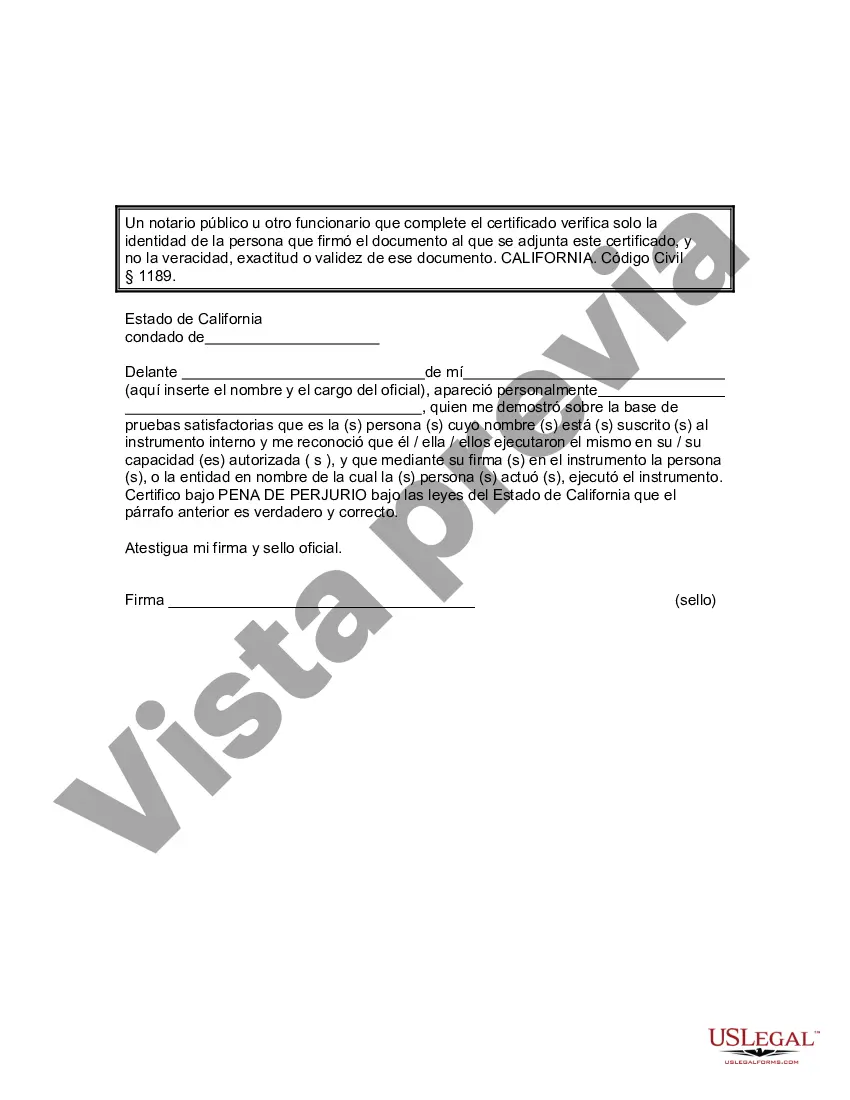

In case you lose the document, you can always re-download it from within the My documents tab. The process is just as simple if you’re new to the platform! You can create your account in just a few minutes. Ensure to verify if the Sacramento California Revocation of Living Trust aligns with the laws and regulations of your state and area. Additionally, it’s crucial to review the form’s outline (if available) and if you find any inconsistencies with your initial expectations, look for an alternative form. Once you have confirmed that the Sacramento California Revocation of Living Trust is appropriate for your situation, you can select the subscription option and proceed to payment. Then, you can download the document in any preferred file format. For over 24 years in the market, we’ve assisted millions of individuals by providing readily customizable and up-to-date legal documents. Utilize US Legal Forms now to conserve time and resources!

- Gain access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, which greatly eases the search procedure.

- Benefit from US Legal Forms whenever you need to locate and download the Sacramento California Revocation of Living Trust or any other form swiftly and securely.

- Simply Log In to your account and click the Get button beside it.

Form popularity

FAQ

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El fideicomisario es el beneficiario que fue nombrado en el contrato de fideicomiso. Puede ser una persona fisica o moral, que recibira bienes, valores o recursos cuando se cumplan las condiciones establecidas.

Es un contrato basado principalmente en la confianza, en el cual una persona transfiere bienes o derechos a favor de un patrimonio autonomo, el cual es administrado por Interbank y dirigido a cumplir determinados objetivos.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

Fideicomiso Revocable Un Fideicomiso que puede ser cambiado. Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.