Simi Valley, California, Letter to Lien holder to Notify of Trust — Comprehensive Guide If you are a resident of Simi Valley, California, and are looking to notify your lien holder about establishing a trust, it is crucial to understand the process and the documentation required. In this comprehensive guide, we will explore everything you need to know about the Simi Valley letter to lien holder to notify them of a trust, including its purpose, contents, and any possible variations based on different scenarios. A Simi Valley letter to a lien holder to notify them of a trust is a formal communication that informs the lien holder of the creation of a trust agreement related to a specific property. The purpose of this letter is to establish the trust as owner of the property and to ensure that all future notifications, communication, and interactions regarding the property are carried out with the trust as the primary entity. Typically, the letter includes relevant details such as the property owner's name, contact information, information about the lien holder (such as the lender or company holding the lien), and specific details about the trust being created. It is essential to provide accurate and precise information to avoid any confusion or potential legal complications. Simi Valley, California, Letter to Lien holder to Notify of Trust — Types While there may not be different "types" of Simi Valley letters to lien holders for notifying a trust, the content and format may vary based on specific circumstances. Here are a few scenarios that may require unique variations or additional information: 1. Property refinancing: In the case of refinancing a property under the trust's ownership, additional documentation or explanations may be required. This includes relevant details about the refinancing process, the new loan information, and any changes in lien holder contact information. 2. Trust modification or termination: If the trust undergoes modification or termination, it is crucial to notify the lien holder promptly. In such cases, the letter should clearly state the reason for modification or termination and any new or revised ownership details. 3. Multiple co-owners: If the trust is co-owned by multiple individuals or entities, it is essential to provide detailed information about each co-owner, including their respective ownership percentage and contact information. This ensures that all parties involved are appropriately notified and informed. 4. Trustee changes: If there are changes in the trustee appointed for the trust, the letter should include details about the new trustee, including their name, contact information, and any legal documentation supporting the trustee transition. In all scenarios, it is crucial to consult with legal professionals or experts in trust and property matters to ensure that all requirements are met and that the letter is effective in notifying the lien holder of the trust's establishment, modification, or termination. Accurate and thorough documentation can prevent potential miscommunication, legal issues, or delays in future interactions regarding the property. In conclusion, a Simi Valley letter to a lien holder to notify of a trust is a vital document to establish the trust as the primary entity owning a property. While variations may exist based on specific situations, providing detailed and accurate information is essential. It is advisable to seek legal guidance to ensure compliance with all legal requirements and to maximize the effectiveness of the letter.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Simi Valley California Carta al acreedor prendario para notificar el fideicomiso - California Letter to Lienholder to Notify of Trust

State:

California

City:

Simi Valley

Control #:

CA-E0178H

Format:

Word

Instant download

Description

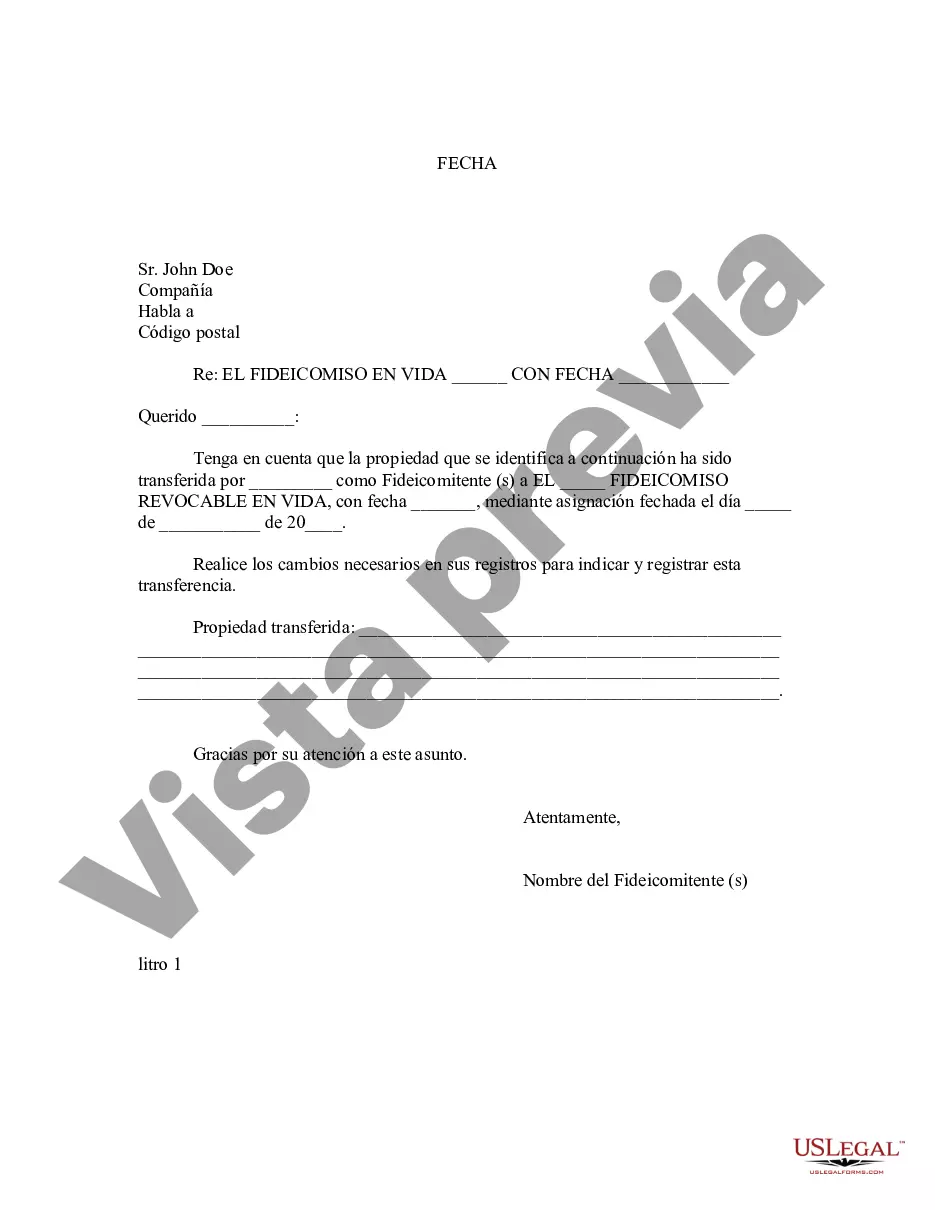

Carta al acreedor prendario notificando que la propiedad ha sido transferida a un fideicomiso en vida. (Utilice con US-E0178F, si es necesario).

Simi Valley, California, Letter to Lien holder to Notify of Trust — Comprehensive Guide If you are a resident of Simi Valley, California, and are looking to notify your lien holder about establishing a trust, it is crucial to understand the process and the documentation required. In this comprehensive guide, we will explore everything you need to know about the Simi Valley letter to lien holder to notify them of a trust, including its purpose, contents, and any possible variations based on different scenarios. A Simi Valley letter to a lien holder to notify them of a trust is a formal communication that informs the lien holder of the creation of a trust agreement related to a specific property. The purpose of this letter is to establish the trust as owner of the property and to ensure that all future notifications, communication, and interactions regarding the property are carried out with the trust as the primary entity. Typically, the letter includes relevant details such as the property owner's name, contact information, information about the lien holder (such as the lender or company holding the lien), and specific details about the trust being created. It is essential to provide accurate and precise information to avoid any confusion or potential legal complications. Simi Valley, California, Letter to Lien holder to Notify of Trust — Types While there may not be different "types" of Simi Valley letters to lien holders for notifying a trust, the content and format may vary based on specific circumstances. Here are a few scenarios that may require unique variations or additional information: 1. Property refinancing: In the case of refinancing a property under the trust's ownership, additional documentation or explanations may be required. This includes relevant details about the refinancing process, the new loan information, and any changes in lien holder contact information. 2. Trust modification or termination: If the trust undergoes modification or termination, it is crucial to notify the lien holder promptly. In such cases, the letter should clearly state the reason for modification or termination and any new or revised ownership details. 3. Multiple co-owners: If the trust is co-owned by multiple individuals or entities, it is essential to provide detailed information about each co-owner, including their respective ownership percentage and contact information. This ensures that all parties involved are appropriately notified and informed. 4. Trustee changes: If there are changes in the trustee appointed for the trust, the letter should include details about the new trustee, including their name, contact information, and any legal documentation supporting the trustee transition. In all scenarios, it is crucial to consult with legal professionals or experts in trust and property matters to ensure that all requirements are met and that the letter is effective in notifying the lien holder of the trust's establishment, modification, or termination. Accurate and thorough documentation can prevent potential miscommunication, legal issues, or delays in future interactions regarding the property. In conclusion, a Simi Valley letter to a lien holder to notify of a trust is a vital document to establish the trust as the primary entity owning a property. While variations may exist based on specific situations, providing detailed and accurate information is essential. It is advisable to seek legal guidance to ensure compliance with all legal requirements and to maximize the effectiveness of the letter.

Free preview

How to fill out Simi Valley California Carta Al Acreedor Prendario Para Notificar El Fideicomiso?

If you’ve already used our service before, log in to your account and save the Simi Valley California Letter to Lienholder to Notify of Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Simi Valley California Letter to Lienholder to Notify of Trust. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!