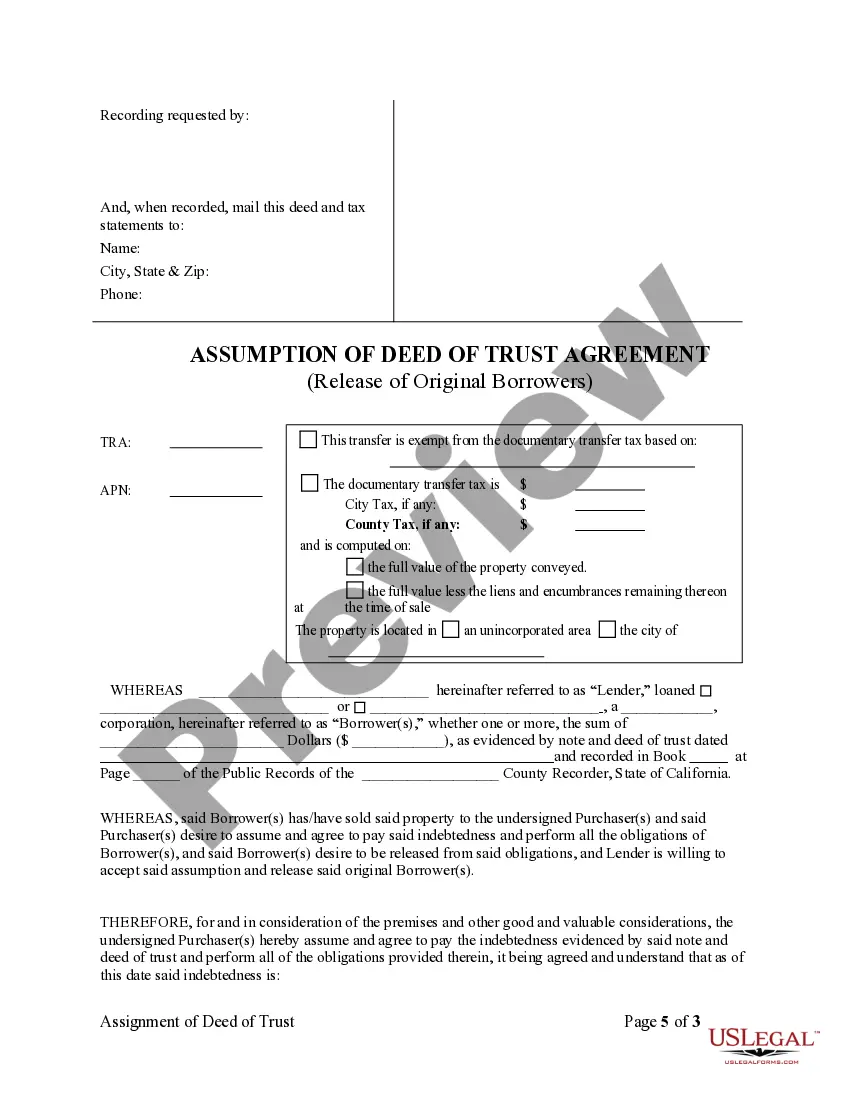

The Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that describes the process and terms associated with transferring the ownership and responsibility of a property to a new buyer while releasing the original mortgagors from their obligations. This agreement plays a crucial role in real estate transactions in Thousand Oaks, California, ensuring a smooth transfer of ownership and management of a property. Keywords: Thousand Oaks California, Assumption Agreement, Deed of Trust, Release of Original Mortgagors, legal document, property transfer, real estate transactions, ownership, responsibility, mortgage obligations, smooth transfer, management of property. There are different types of Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors, which include: 1. Traditional Assumption Agreement: This type of agreement is used when the buyer assumes the existing mortgage debt from the original mortgagors, taking responsibility for the monthly mortgage payments and any associated costs or fees. The original mortgagors are released from their obligations and no longer hold the liability for the property. 2. Subject To Assumption Agreement: In this scenario, the buyer takes over the property without assuming the existing mortgage debt formally. The buyer agrees to make monthly payments to the original mortgagors directly, while the original mortgagors retain their mortgage obligation. This type of agreement requires a high level of trust between the parties involved. 3. Novation Assumption Agreement: This agreement involves the substitution of the original mortgagor with a new borrower. The new borrower, representing the buyer, assumes the original terms of the mortgage and becomes solely responsible for the debt. The original mortgagor is released from any liability related to the property. 4. Wraparound Assumption Agreement: This type of agreement is used when the new buyer assumes the existing mortgage and also offers a secondary loan to the original mortgagors. The wraparound loan combines both loans into a single payment made to the buyer, who, in turn, is responsible for paying the original mortgage and receiving the secondary loan payments from the original mortgagors. These different types of Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors provide flexibility and options for buyers and original mortgagors in real estate transactions within the Thousand Oaks area. It is vital to consult with legal professionals or real estate experts to ensure compliance with local laws and regulations when entering into these agreements.

Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Thousand Oaks California Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for legal solutions that, usually, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Thousand Oaks California Assumption Agreement of Deed of Trust and Release of Original Mortgagors would work for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!