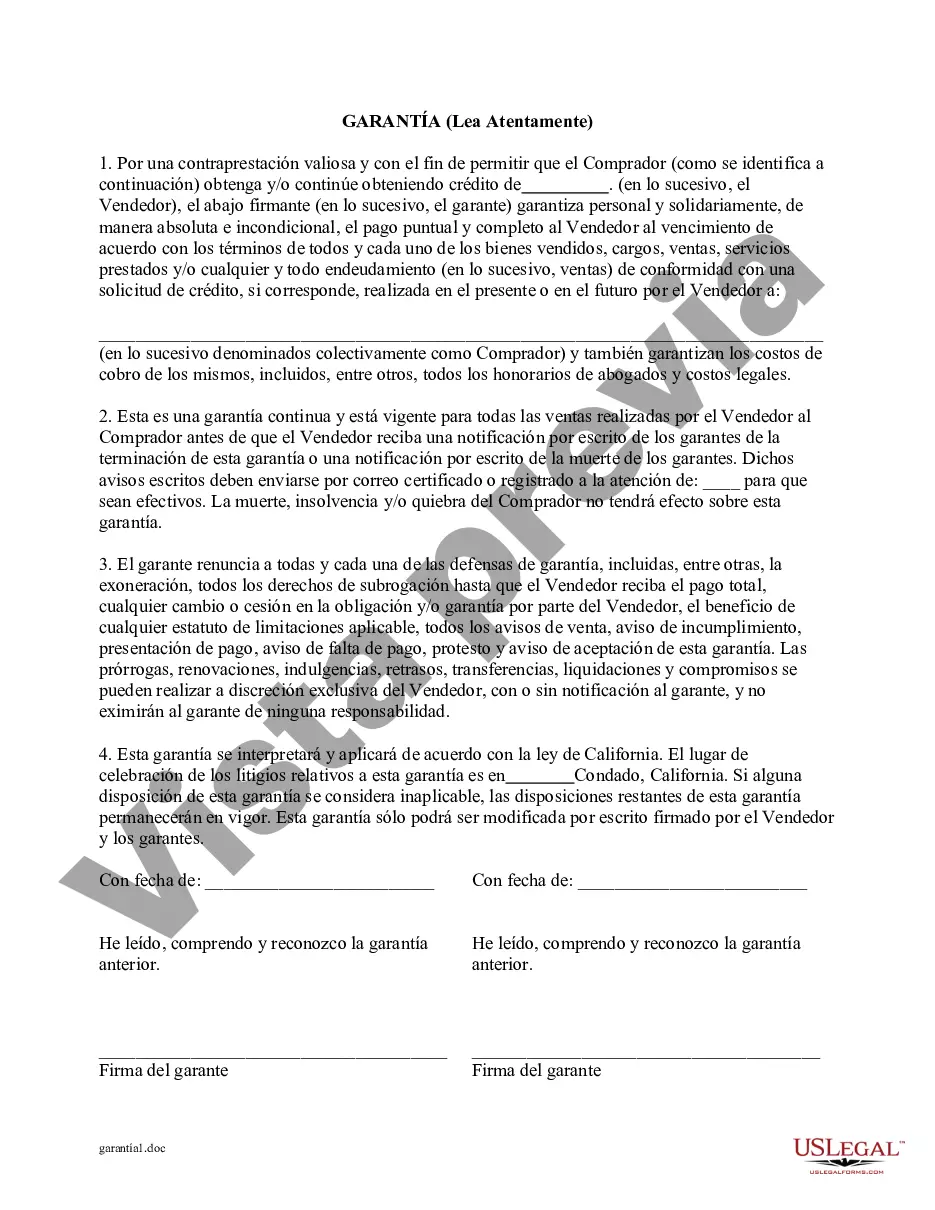

Corona California Guaranty of Payment of Open Account is a legal document that serves as a financial protection agreement between a creditor and debtor. This agreement ensures that any outstanding debts or open accounts will be guaranteed and paid by a third party known as the guarantor. Terms and conditions may vary depending on the type of guaranty being used. There are primarily two types of Corona California Guaranty of Payment of Open Account: 1. Absolute Guaranty of Payment of Open Account: This type of guaranty holds the guarantor fully responsible for the payment of the open account or debt in case the debtor fails to fulfill their financial obligations. The creditor has the right to directly pursue the guarantor for any outstanding amounts owing. 2. Conditional Guaranty of Payment of Open Account: In this type of guaranty, the liability of the guarantor is limited to certain conditions or events. The guarantor's responsibility to pay arises only when specified conditions, such as default by the debtor, are met. This conditional guaranty provides the guarantor with some protection against unwarranted liability. When entering into a Corona California Guaranty of Payment of Open Account, it is crucial to include specific provisions to safeguard the interests of all parties involved. Some important elements to consider include: 1. Clear Identification of the Parties: The guaranty agreement should clearly state the names and contact information of the creditor, debtor, and guarantor. This ensures the legal enforceability of the agreement. 2. Obligations and Responsibilities: The document should outline the debtor's obligations to make timely payments on the open account and the guarantor's responsibility to guarantee those payments if the debtor defaults. 3. Guarantee Amount and Limitations: The guaranty agreement should specify the maximum amount for which the guarantor can be held responsible. This amount might be tied to the outstanding balance of the open account or set at a fixed value. 4. Notice and Demand: The agreement should include provisions for notification requirements such as when the creditor must provide notice to the guarantor in case of debtor default. It also establishes a set period within which the guarantor must respond. 5. Governing Law and Jurisdiction: It's important to mention the governing law and jurisdiction that will apply in the event of any legal disputes arising from the guaranty agreement. Overall, a Corona California Guaranty of Payment of Open Account provides protection and assurance for creditors, ensuring that they will receive payment if the debtor fails to fulfill their obligations. It is advisable for all parties involved to seek legal counsel to draft or review the agreement to ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Corona California Garantía de Pago de Cuenta Abierta - California Guaranty of Payment of Open Account

Description

How to fill out Corona California Garantía De Pago De Cuenta Abierta?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Corona California Guaranty of Payment of Open Account becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Corona California Guaranty of Payment of Open Account takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Corona California Guaranty of Payment of Open Account. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!