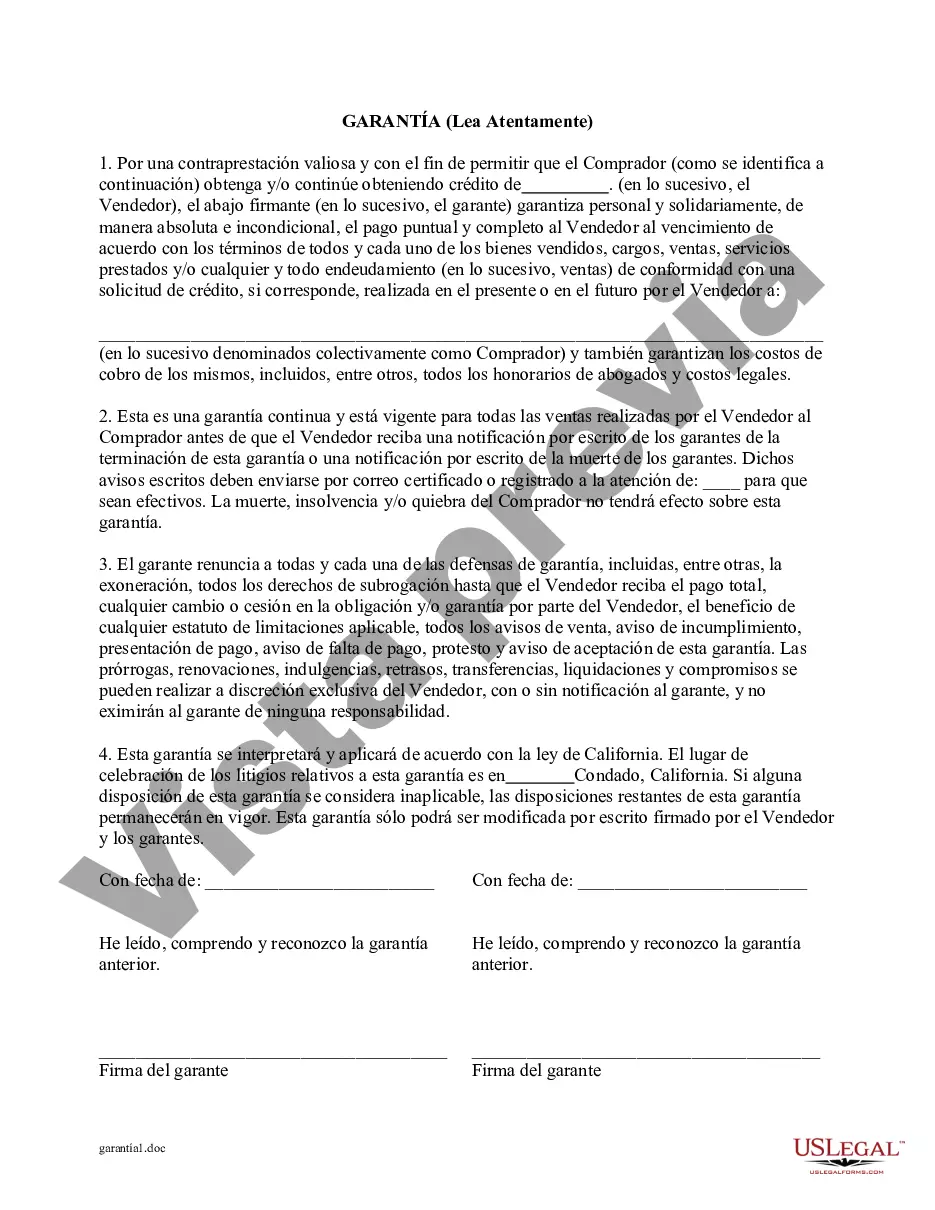

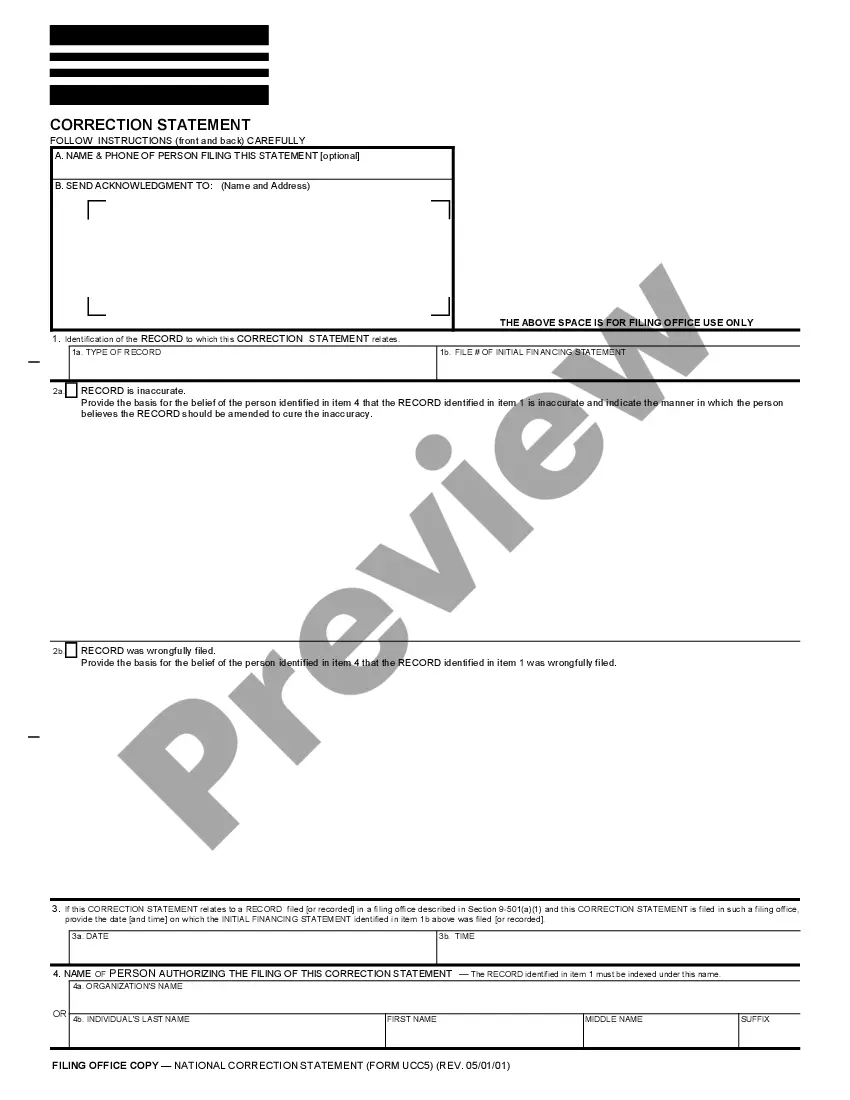

A Jurupa Valley California Guaranty of Payment of Open Account is a legal document that serves as a binding agreement between a creditor and a guarantor stating that the guarantor will be responsible for the payment of an open account if the debtor defaults. The purpose of this guaranty is to provide the creditor with an additional layer of security by having a third party co-sign and guarantee the payment of any outstanding debts. This ensures that the creditor can seek payment from both the debtor and the guarantor in case of non-payment. In Jurupa Valley California, there are two main types of Guaranty of Payment of Open Account: 1. Limited Guaranty of Payment of Open Account: This type of guaranty limits the liability of the guarantor to a specific amount or duration. The guarantor's obligation is limited to the agreed-upon terms mentioned in the document, providing them with some protection in case the debtor defaults. 2. Unlimited Guaranty of Payment of Open Account: Unlike the limited guaranty, the unlimited guaranty holds the guarantor fully responsible for the payment of the open account without any limitations on liability. The guarantor is obligated to pay the full amount owed by the debtor if they fail to do so. When drafting a Jurupa Valley California Guaranty of Payment of Open Account, certain keywords or terms should be included: 1. Debtor: The individual or entity that owes the debt or has an open account with the creditor. 2. Creditor: The individual or company that is owed the money or has extended credit to the debtor. 3. Guarantor: The party who co-signs the guaranty and agrees to be liable for the payment of the open account if the debtor defaults. 4. Open Account: Refers to an account where a debtor has the ability to make purchases or receive goods/services on credit, meeting specific payment terms established by the creditor. 5. Default: The failure of the debtor to make the required payments or fulfill their obligations as stated by the creditor, triggering the guarantor's responsibility for payment. 6. Indemnification: The process of compensating the creditor for any losses incurred due to non-payment by the debtor, which the guarantor would be responsible for. Overall, a Jurupa Valley California Guaranty of Payment of Open Account is an important legal document that protects the creditor's interests by securing an additional party to guarantee the payment of any outstanding debts. The type of guaranty chosen will depend on the creditor's preferences and the level of liability they desire to place on the guarantor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Jurupa Valley California Garantía de Pago de Cuenta Abierta - California Guaranty of Payment of Open Account

Description

How to fill out Jurupa Valley California Garantía De Pago De Cuenta Abierta?

If you are searching for a relevant form template, it’s impossible to choose a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can find a huge number of form samples for organization and individual purposes by types and regions, or key phrases. Using our high-quality search function, discovering the most up-to-date Jurupa Valley California Guaranty of Payment of Open Account is as easy as 1-2-3. Furthermore, the relevance of each and every record is proved by a group of expert lawyers that on a regular basis review the templates on our website and revise them in accordance with the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Jurupa Valley California Guaranty of Payment of Open Account is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the sample you require. Read its information and utilize the Preview feature (if available) to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the appropriate file.

- Affirm your selection. Select the Buy now option. After that, select the preferred pricing plan and provide credentials to register an account.

- Make the purchase. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the form. Pick the file format and save it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Jurupa Valley California Guaranty of Payment of Open Account.

Every single form you add to your profile does not have an expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you want to have an extra version for enhancing or printing, feel free to return and export it again anytime.

Make use of the US Legal Forms professional collection to get access to the Jurupa Valley California Guaranty of Payment of Open Account you were looking for and a huge number of other professional and state-specific samples on one platform!