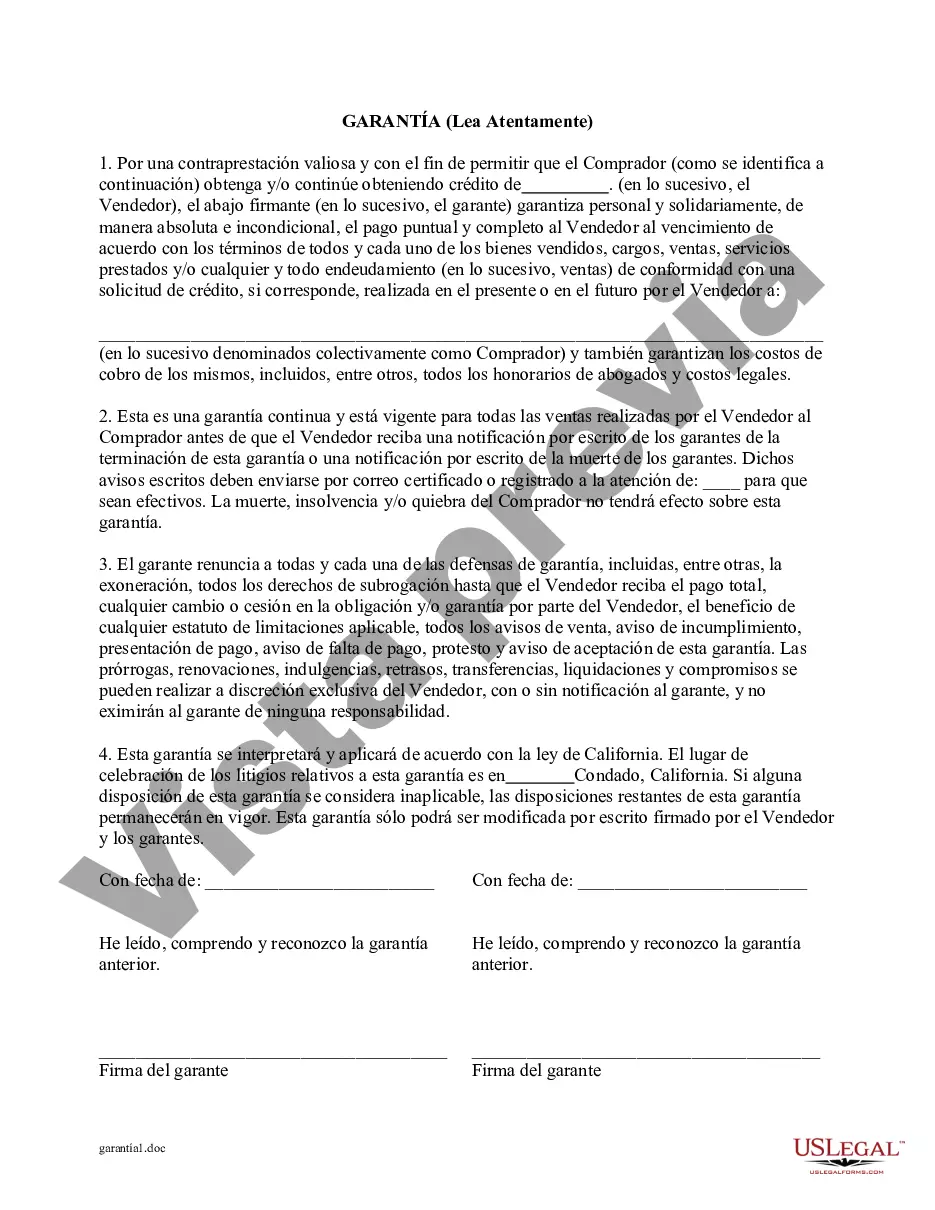

Norwalk California Guaranty of Payment of Open Account is a legal document designed to protect creditors regarding unpaid debts on open accounts in Norwalk, California. This type of guarantee ensures that the debtor's financial obligations will be met if they default on payments. It is crucial to understand the key terms and provisions associated with this guarantee to comprehend its significance fully. In Norwalk, California, there are primarily two types of Guaranty of Payment of Open Accounts: 1. Absolute Guaranty: An absolute guaranty offers a comprehensive and unconditional commitment by the guarantor to ensure the payment of the debtor's open account. This type of guarantee binds the guarantor to pay the debts, usually in case of default, irrespective of any other circumstances or defenses that the debtor might raise. 2. Conditional Guaranty: In contrast, a conditional guaranty of payment of open account includes certain specified conditions under which the guarantor becomes liable for the debtor's unpaid debts. These conditions might include the debtor's bankruptcy, insolvency, or failure to pay within a specific timeframe. The guarantor's liability is contingent on the occurrence of these predetermined events. Both types of guarantees are legally binding contracts and must be drafted with precision and attention to detail to safeguard the rights of creditors. It is advisable for creditors to consult legal professionals knowledgeable in Norwalk, California laws while drafting or enforcing the Guaranty of Payment of Open Account. Some essential provisions commonly included in Norwalk California Guaranty of Payment of Open Account may include the following: 1. Identification of Parties: The document should clearly identify the parties involved, including the creditor (the person or entity extending credit) and the debtor (the individual or business receiving credit). 2. Obligations: The guaranty should specify the nature and extent of the debtor's obligations, such as the total amount owed, interest rates, and any additional charges. 3. Personal Guarantee: The guaranty should explicitly state that the guarantor assumes personal liability for the debtor's open account, emphasizing that their personal assets may be used to satisfy the outstanding debts in case of default. 4. Default and Remedies: The document must outline the conditions under which the guarantor's liability is triggered, such as non-payment by the debtor, insolvency, or bankruptcy. It should also include the remedies available to the creditor in case of default, which may include seeking legal action or initiating collections procedures. 5. Governing Law: It is crucial to include a clause stating that the guaranty is governed by Norwalk, California laws, thus ensuring any disputes are resolved in accordance with the appropriate legal jurisdiction. Norwalk California Guaranty of Payment of Open Account plays a vital role in protecting creditors' interests by providing a legally enforceable mechanism to recover outstanding debts. As such, it is essential for both creditors and guarantors to understand the terms and conditions of this guarantee thoroughly before entering into any financial agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Norwalk California Garantía de Pago de Cuenta Abierta - California Guaranty of Payment of Open Account

Description

How to fill out Norwalk California Garantía De Pago De Cuenta Abierta?

Are you looking for a reliable and affordable legal forms supplier to get the Norwalk California Guaranty of Payment of Open Account? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Norwalk California Guaranty of Payment of Open Account conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Norwalk California Guaranty of Payment of Open Account in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online for good.