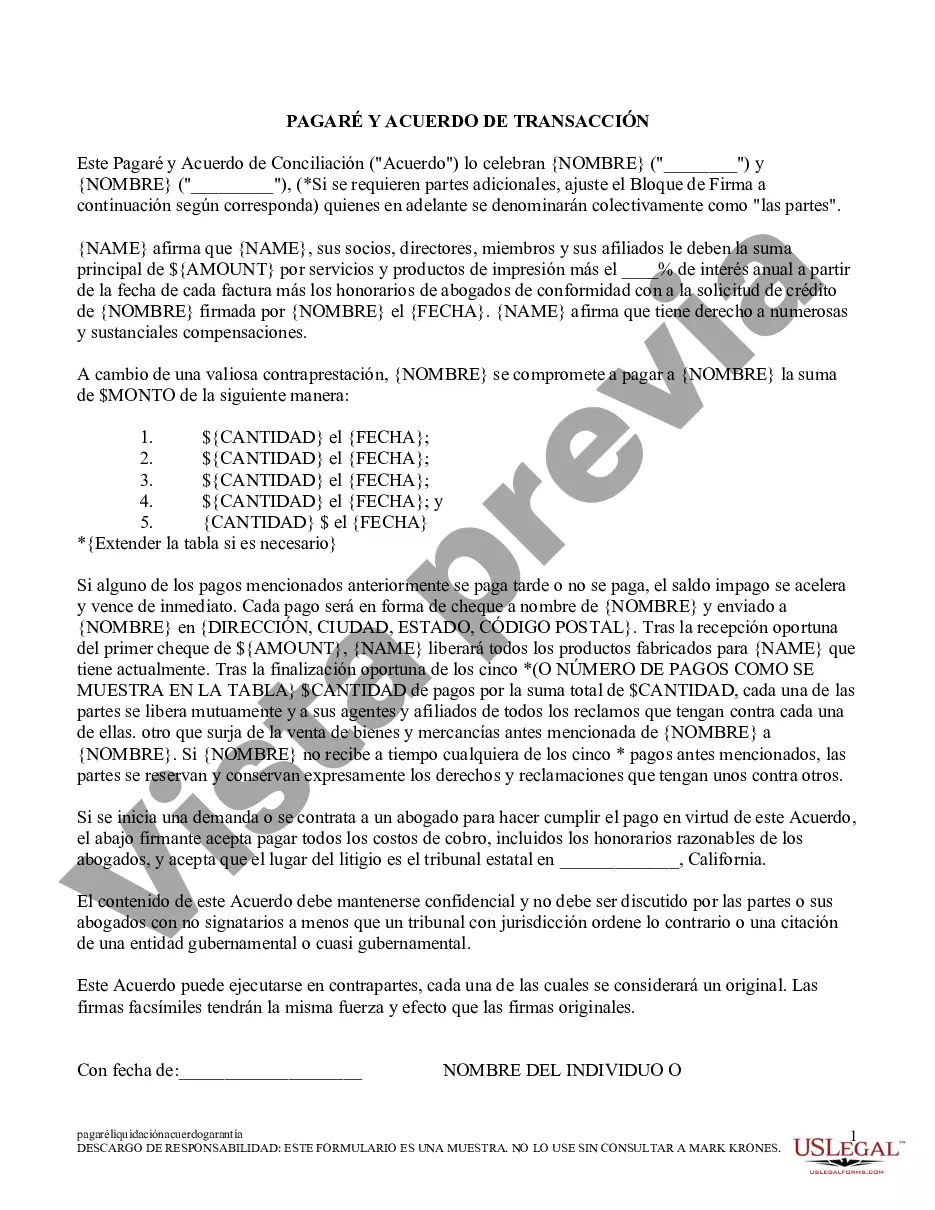

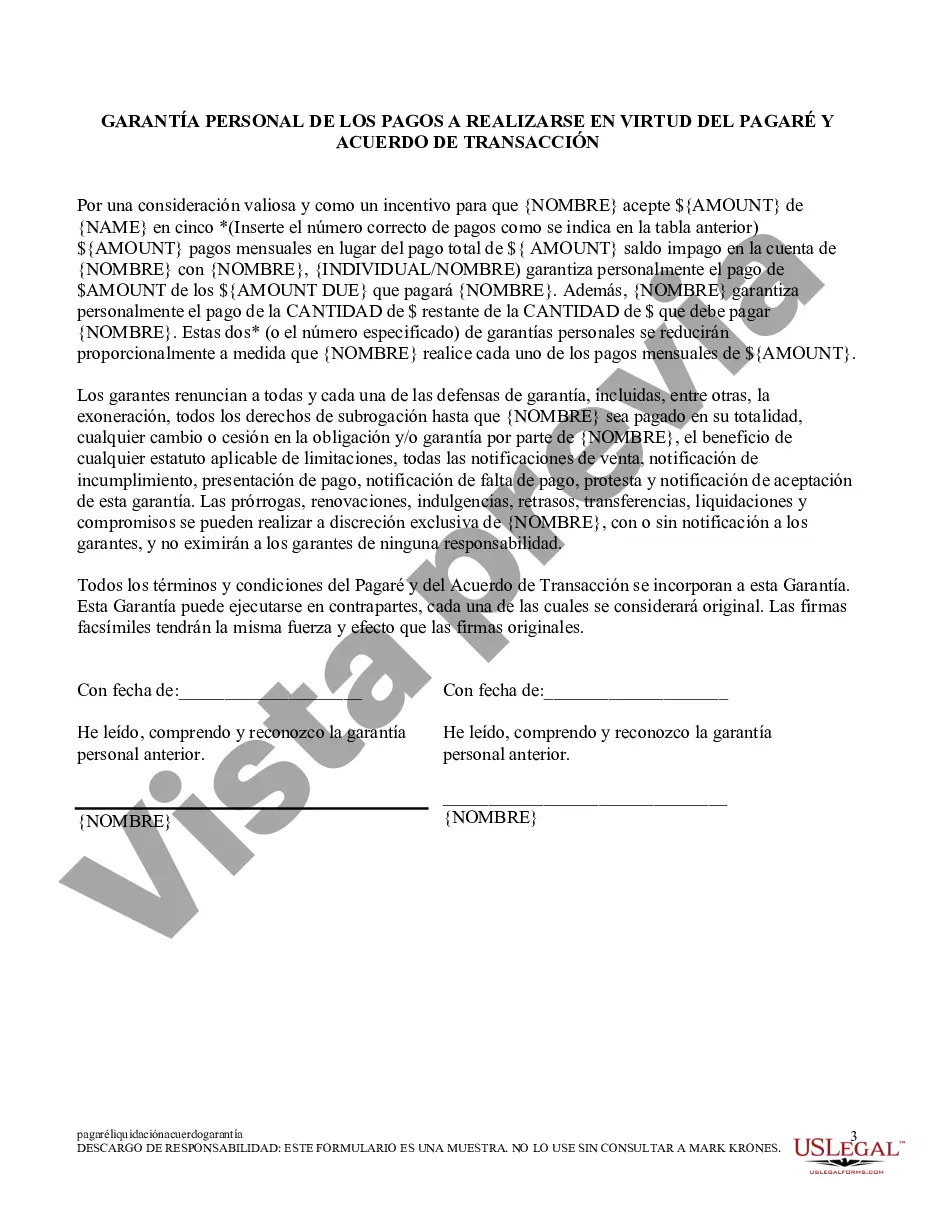

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Pagaré y Acuerdo de Liquidación - California Promissory Note and Settlement Agreement

Category:

State:

California

County:

Alameda

Control #:

CA-FS-874

Format:

Word

Instant download

Description

Free preview

How to fill out California Pagaré Y Acuerdo De Liquidación?

Irrespective of societal or occupational rank, completing legal-related documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unfeasible for an individual lacking any legal training to generate this kind of documentation from the ground up, primarily due to the intricate terminology and legal nuances they encompass.

This is where US Legal Forms can come to the rescue.

Ensure the template you have located is appropriate for your area considering that the laws of one region do not apply to another.

Preview the document and review a brief summary (if available) of scenarios the form can be utilized for.

- Our platform offers an extensive array with more than 85,000 pre-prepared state-specific templates that are suitable for nearly any legal matter.

- US Legal Forms additionally acts as a valuable tool for associates or legal advisors who wish to conserve time using our DIY documents.

- Whether you need the Alameda California Promissory Note and Settlement Agreement or any other form that will be applicable in your state or region, with US Legal Forms, everything is accessible at your fingertips.

- Here’s how to obtain the Alameda California Promissory Note and Settlement Agreement in minutes using our reliable platform.

- If you are already a customer, you can proceed to Log In to your account to download the correct document.

- However, if you are unfamiliar with our library, make sure you follow these guidelines before downloading the Alameda California Promissory Note and Settlement Agreement.