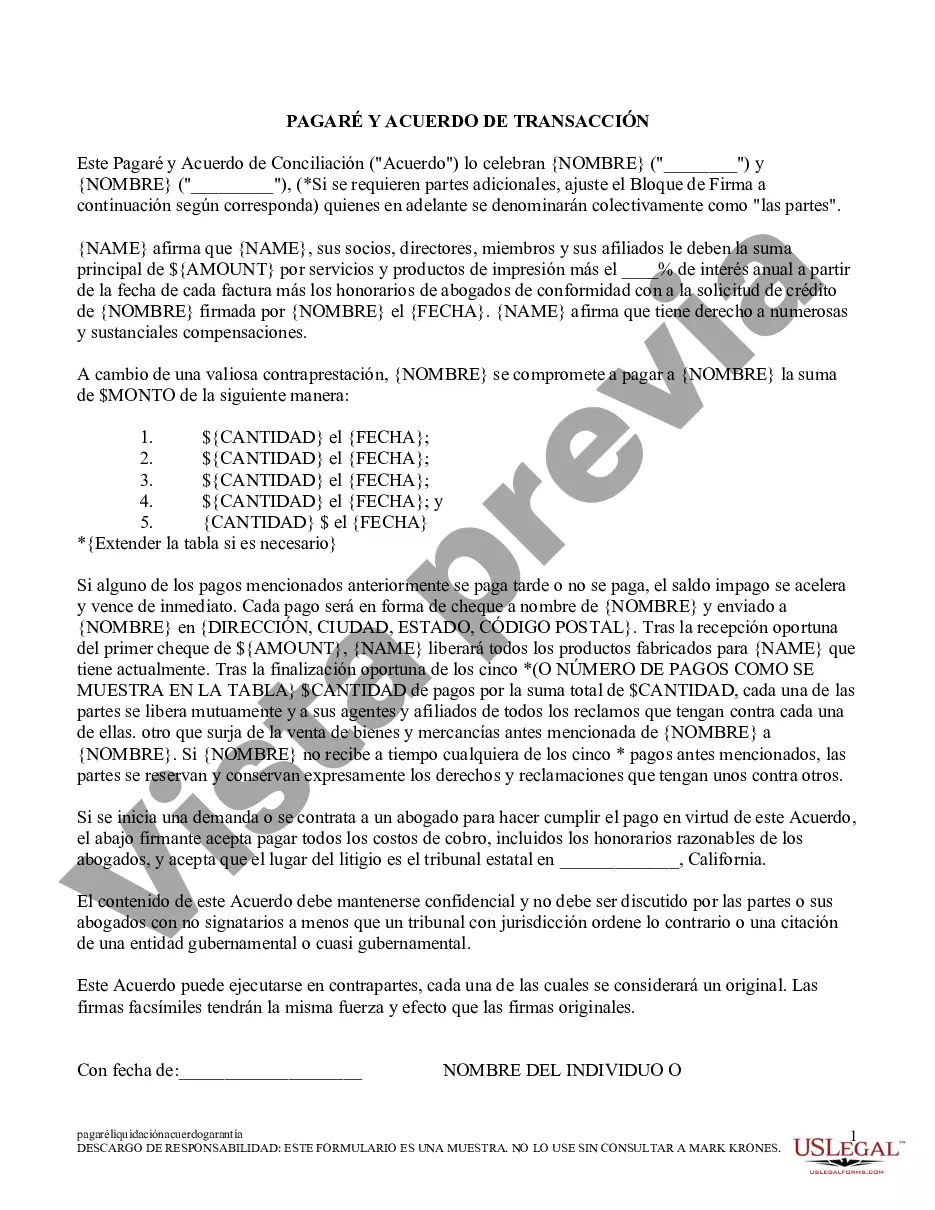

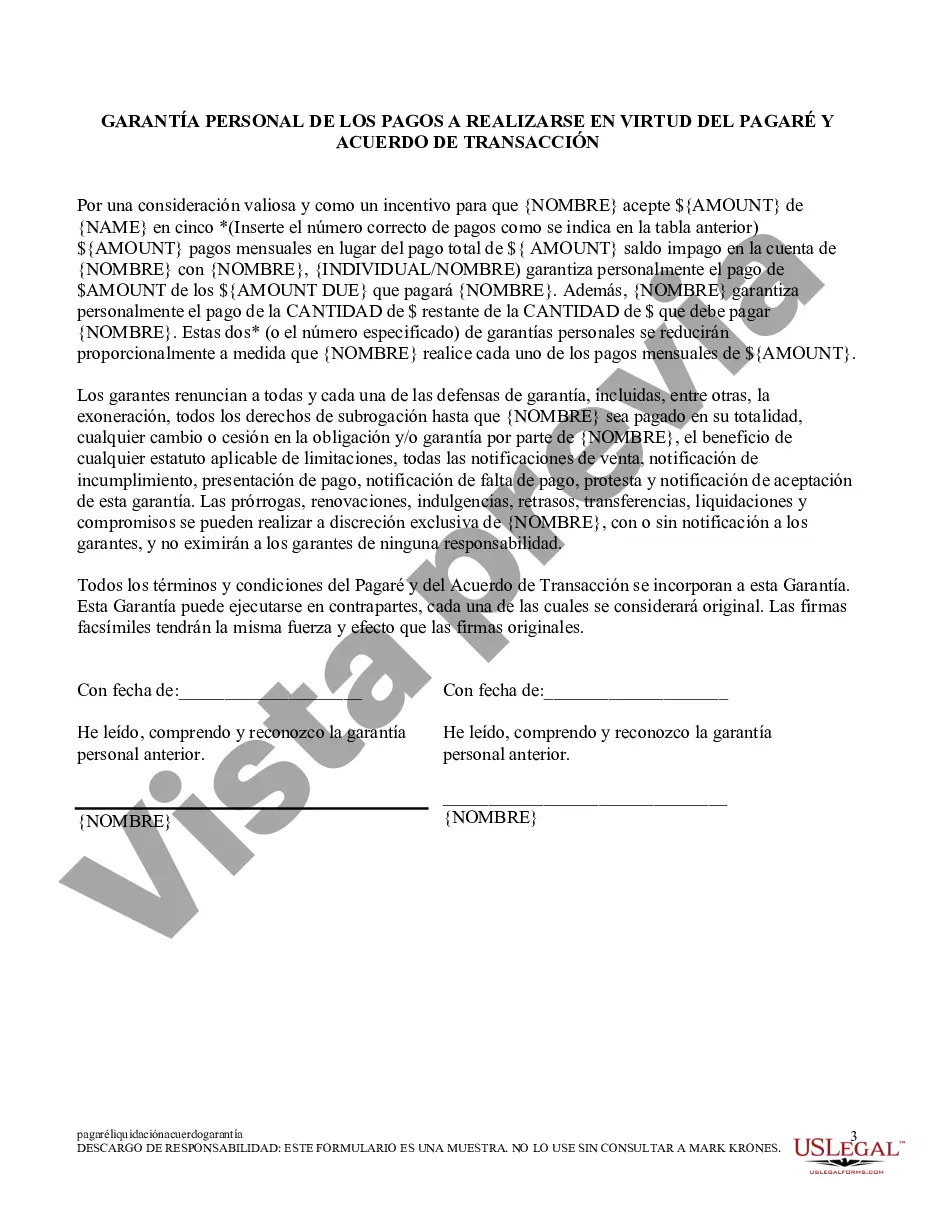

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

A Contra Costa California Promissory Note and Settlement Agreement is a legally binding document that establishes the terms and conditions of a loan repayment and dispute resolution. This agreement is typically used in Contra Costa County, located in the state of California, to outline the obligations of the borrower and lender, providing clarity and protection for both parties involved in a financial transaction. The Contra Costa California Promissory Note portion of the agreement defines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late or missed payments. It outlines the responsibilities of the borrower, such as making timely repayments, while also specifying the lender's rights, regarding potential legal actions or reporting to credit agencies in cases of default. Simultaneously, the Settlement Agreement section focuses on resolving disputes or outstanding issues between the involved parties. This portion typically includes negotiated terms to settle disagreements, outlining the steps to be taken to resolve them amicably, thus avoiding lengthy and costly court proceedings. Settlement agreements can encompass various topics like loan modifications, debt restructuring, or even repayment plans. Different types of Contra Costa California Promissory Note and Settlement Agreements may include: 1. Commercial Promissory Note and Settlement Agreement: These agreements are utilized for business-related loans, ensuring repayment terms and resolution of potential disputes are clearly outlined, protecting the interests of both the borrower and lender in commercial contexts. 2. Real Estate Promissory Note and Settlement Agreement: When a loan is secured by real estate, this type of agreement is employed to establish terms and conditions specific to property-related transactions. It deals with matters such as mortgage or lien placement, foreclosure procedures, and settlement processes for disputes arising within the real estate sphere. 3. Personal Promissory Note and Settlement Agreement: This form of agreement is often used for loans between individuals, addressing issues related to personal loans, such as repayment terms, interest rates, and dispute resolution mechanisms. These are just a few examples of the Contra Costa California Promissory Note and Settlement Agreement variations that exist to cater to various scenarios and legal contexts, providing peace of mind and clarity to all parties involved in financial transactions within the jurisdiction of Contra Costa County, California.A Contra Costa California Promissory Note and Settlement Agreement is a legally binding document that establishes the terms and conditions of a loan repayment and dispute resolution. This agreement is typically used in Contra Costa County, located in the state of California, to outline the obligations of the borrower and lender, providing clarity and protection for both parties involved in a financial transaction. The Contra Costa California Promissory Note portion of the agreement defines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late or missed payments. It outlines the responsibilities of the borrower, such as making timely repayments, while also specifying the lender's rights, regarding potential legal actions or reporting to credit agencies in cases of default. Simultaneously, the Settlement Agreement section focuses on resolving disputes or outstanding issues between the involved parties. This portion typically includes negotiated terms to settle disagreements, outlining the steps to be taken to resolve them amicably, thus avoiding lengthy and costly court proceedings. Settlement agreements can encompass various topics like loan modifications, debt restructuring, or even repayment plans. Different types of Contra Costa California Promissory Note and Settlement Agreements may include: 1. Commercial Promissory Note and Settlement Agreement: These agreements are utilized for business-related loans, ensuring repayment terms and resolution of potential disputes are clearly outlined, protecting the interests of both the borrower and lender in commercial contexts. 2. Real Estate Promissory Note and Settlement Agreement: When a loan is secured by real estate, this type of agreement is employed to establish terms and conditions specific to property-related transactions. It deals with matters such as mortgage or lien placement, foreclosure procedures, and settlement processes for disputes arising within the real estate sphere. 3. Personal Promissory Note and Settlement Agreement: This form of agreement is often used for loans between individuals, addressing issues related to personal loans, such as repayment terms, interest rates, and dispute resolution mechanisms. These are just a few examples of the Contra Costa California Promissory Note and Settlement Agreement variations that exist to cater to various scenarios and legal contexts, providing peace of mind and clarity to all parties involved in financial transactions within the jurisdiction of Contra Costa County, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.