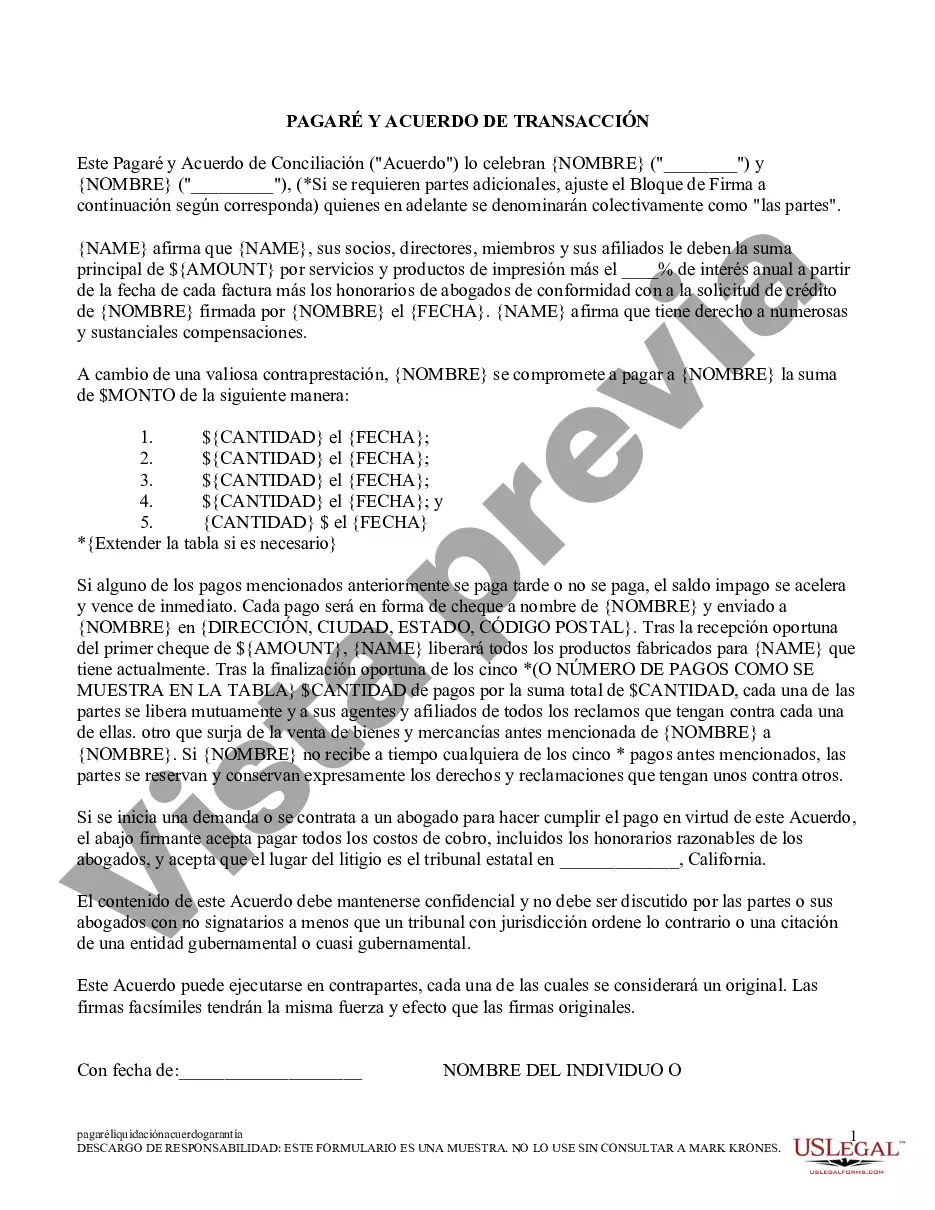

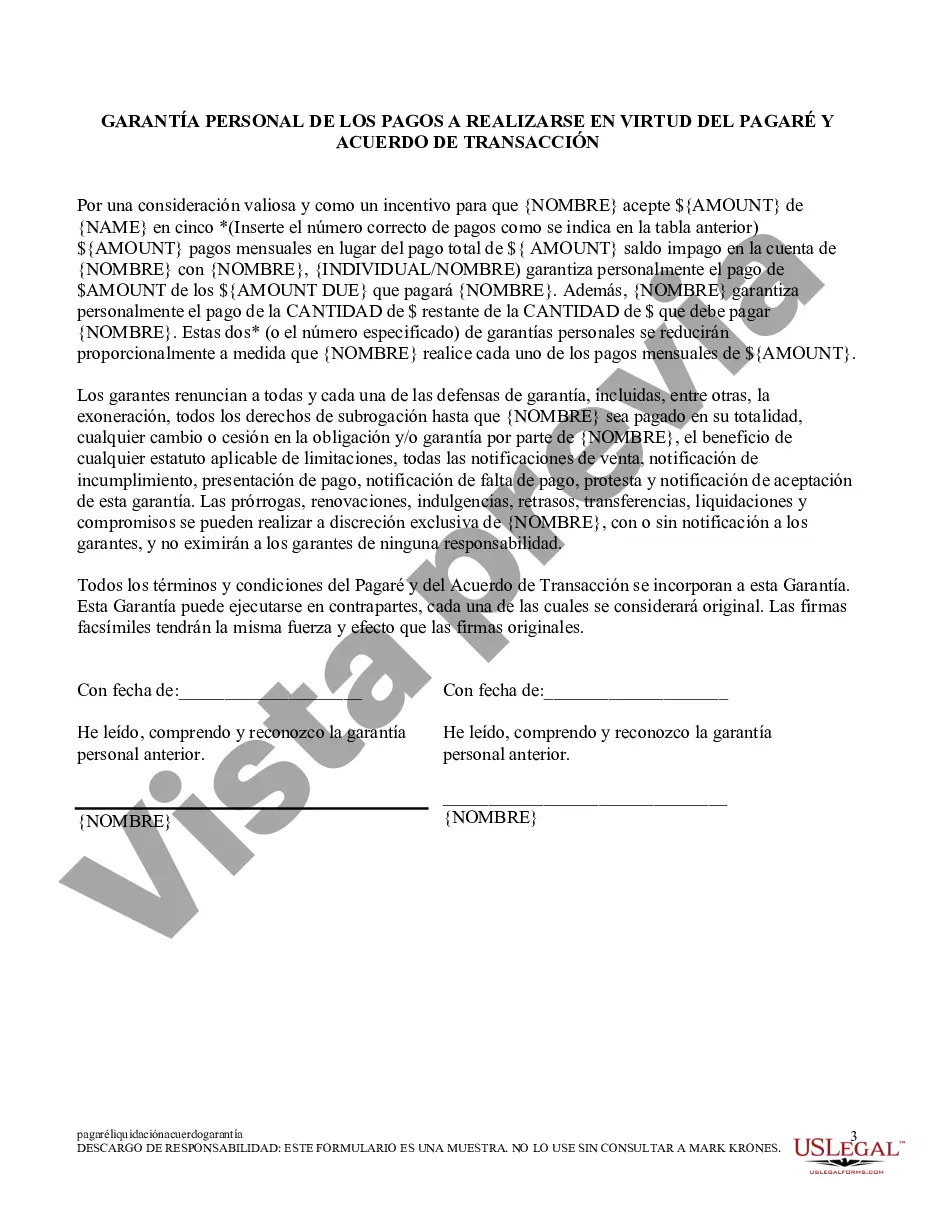

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

El Cajon California Promissory Note and Settlement Agreement refer to legal documents used in financial transactions and legal settlements within the city of El Cajon, California. These agreements are essential for establishing and enforcing the terms and conditions of a loan or a settlement between two parties. Below are some key aspects and types of El Cajon California Promissory Note and Settlement Agreement: 1. Promissory Note: An El Cajon Promissory Note is a written promise to repay a specific amount of money borrowed from one party (the lender) to another (the borrower). It outlines the terms of repayment, including the principal amount, interest rate, payment frequency, late payment penalties, and any other relevant terms. Promissory notes are commonly used in various financial transactions, such as personal loans, business loans, or real estate deals. 2. Settlement Agreement: An El Cajon Settlement Agreement is a legally binding contract between disputing parties that aims to resolve their differences and avoid litigation. It typically involves a negotiation process to reach a mutually satisfactory resolution. Settlement Agreements are frequently used in civil cases, such as personal injury claims, contract disputes, or divorce settlements. The document outlines the terms of the settlement, including any financial compensation, release of claims, confidentiality clauses, and other relevant conditions. 3. Debt Settlement Agreement: This type of El Cajon Settlement Agreement specifically pertains to settling outstanding debts between a debtor and a creditor. It helps to resolve disputes regarding repayment, interest rates, or other conditions of the debt. Debt settlement agreements often involve negotiation where the debtor agrees to pay a portion of the debt in exchange for the creditor releasing them from the remaining balance. 4. Mortgage Settlement Agreement: An El Cajon Mortgage Settlement Agreement is a specialized type of settlement agreement used in real estate transactions. It typically occurs when a borrower is facing foreclosure or default on their mortgage payments. The agreement is designed to restructure the mortgage, establish new repayment terms, or resolve any disputes between the lender and the borrower. 5. Business Settlement Agreement: This type of El Cajon Settlement Agreement applies to resolving disputes related to business operations or contracts. It may involve partnerships, shareholders, or commercial transactions. A business settlement agreement aims to find a compromise, resolve conflicts, and ensure the business relationship continues or concludes in a fair and acceptable manner. 6. Employment Settlement Agreement: An El Cajon Employment Settlement Agreement is used to settle employment-related disputes, such as wrongful termination, harassment claims, discrimination, or other workplace grievances. It outlines the terms of the agreement, including any financial compensation, confidentiality clauses, and other relevant conditions. In summary, El Cajon California Promissory Note and Settlement Agreements are legal documents crucial for governing financial transactions, resolving disputes, and ensuring compliance with the law. They come in various types, including promissory notes, settlement agreements, debt settlement agreements, mortgage settlement agreements, business settlement agreements, and employment settlement agreements. These agreements play a vital role in maintaining transparency, fairness, and legal compliance within El Cajon's legal framework.El Cajon California Promissory Note and Settlement Agreement refer to legal documents used in financial transactions and legal settlements within the city of El Cajon, California. These agreements are essential for establishing and enforcing the terms and conditions of a loan or a settlement between two parties. Below are some key aspects and types of El Cajon California Promissory Note and Settlement Agreement: 1. Promissory Note: An El Cajon Promissory Note is a written promise to repay a specific amount of money borrowed from one party (the lender) to another (the borrower). It outlines the terms of repayment, including the principal amount, interest rate, payment frequency, late payment penalties, and any other relevant terms. Promissory notes are commonly used in various financial transactions, such as personal loans, business loans, or real estate deals. 2. Settlement Agreement: An El Cajon Settlement Agreement is a legally binding contract between disputing parties that aims to resolve their differences and avoid litigation. It typically involves a negotiation process to reach a mutually satisfactory resolution. Settlement Agreements are frequently used in civil cases, such as personal injury claims, contract disputes, or divorce settlements. The document outlines the terms of the settlement, including any financial compensation, release of claims, confidentiality clauses, and other relevant conditions. 3. Debt Settlement Agreement: This type of El Cajon Settlement Agreement specifically pertains to settling outstanding debts between a debtor and a creditor. It helps to resolve disputes regarding repayment, interest rates, or other conditions of the debt. Debt settlement agreements often involve negotiation where the debtor agrees to pay a portion of the debt in exchange for the creditor releasing them from the remaining balance. 4. Mortgage Settlement Agreement: An El Cajon Mortgage Settlement Agreement is a specialized type of settlement agreement used in real estate transactions. It typically occurs when a borrower is facing foreclosure or default on their mortgage payments. The agreement is designed to restructure the mortgage, establish new repayment terms, or resolve any disputes between the lender and the borrower. 5. Business Settlement Agreement: This type of El Cajon Settlement Agreement applies to resolving disputes related to business operations or contracts. It may involve partnerships, shareholders, or commercial transactions. A business settlement agreement aims to find a compromise, resolve conflicts, and ensure the business relationship continues or concludes in a fair and acceptable manner. 6. Employment Settlement Agreement: An El Cajon Employment Settlement Agreement is used to settle employment-related disputes, such as wrongful termination, harassment claims, discrimination, or other workplace grievances. It outlines the terms of the agreement, including any financial compensation, confidentiality clauses, and other relevant conditions. In summary, El Cajon California Promissory Note and Settlement Agreements are legal documents crucial for governing financial transactions, resolving disputes, and ensuring compliance with the law. They come in various types, including promissory notes, settlement agreements, debt settlement agreements, mortgage settlement agreements, business settlement agreements, and employment settlement agreements. These agreements play a vital role in maintaining transparency, fairness, and legal compliance within El Cajon's legal framework.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.