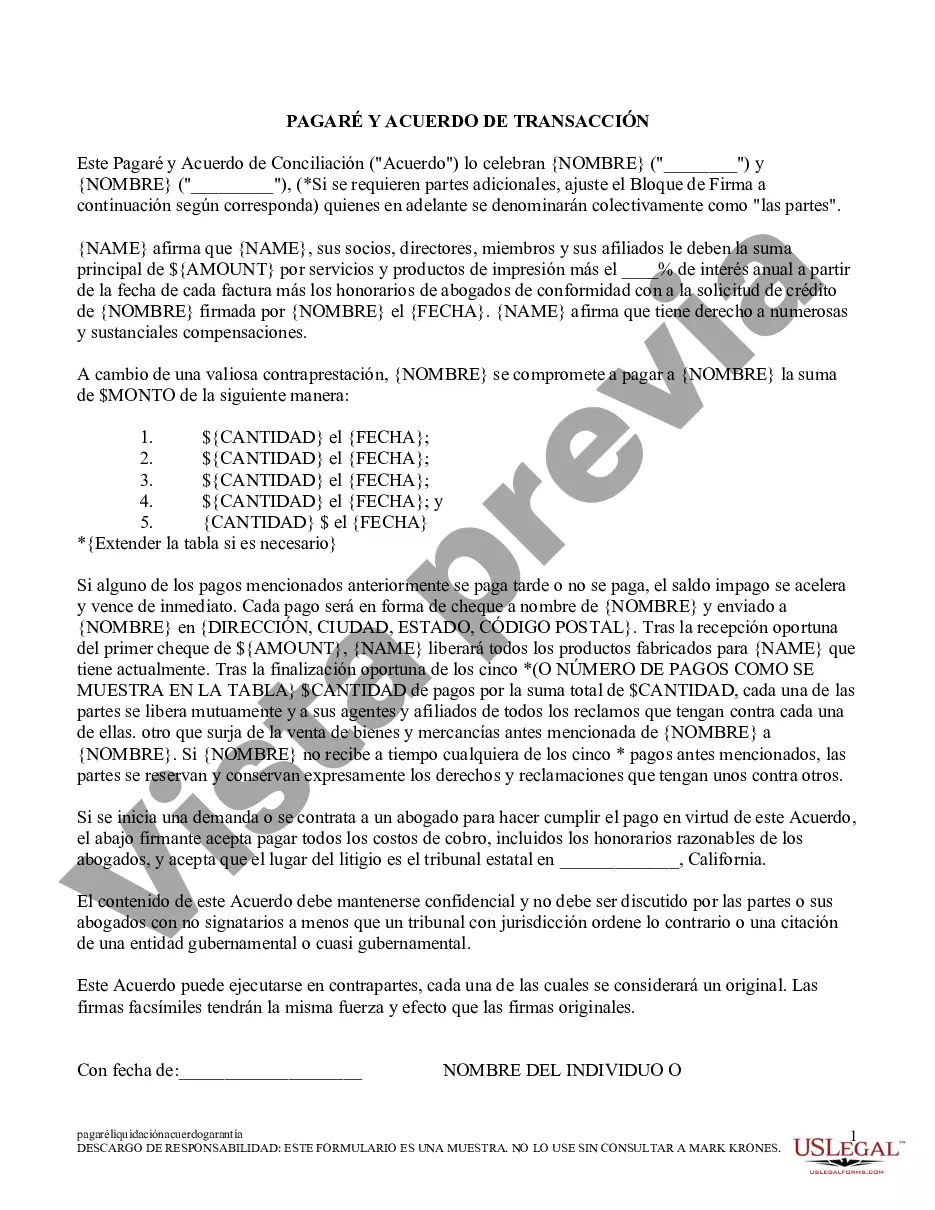

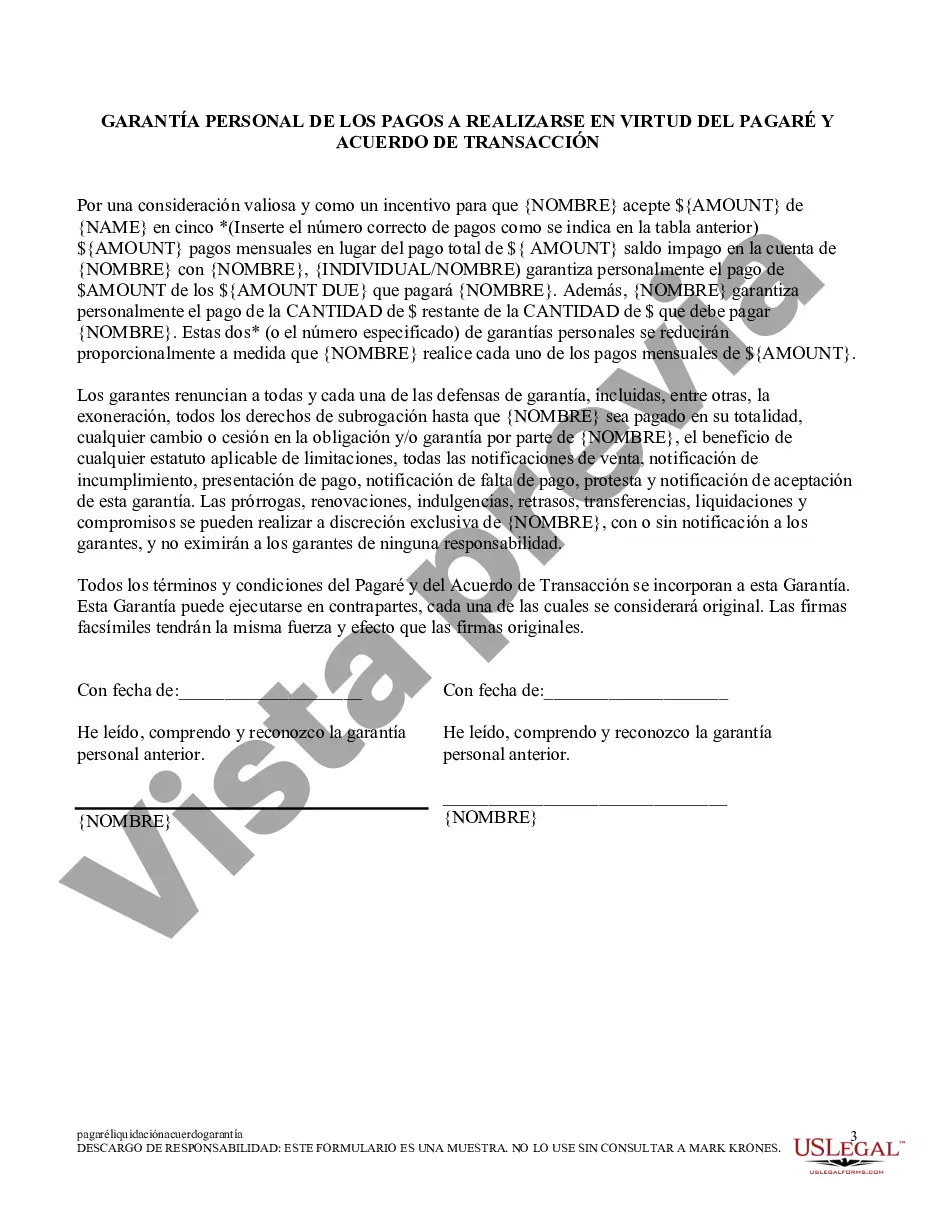

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

El Monte California Promissory Note and Settlement Agreement: A Detailed Description In El Monte, California, a Promissory Note and Settlement Agreement is a legally binding document that outlines the terms and conditions of a loan or debt settlement. This agreement is commonly used when there is a dispute or disagreement between two parties regarding a financial obligation, and both parties agree to reach a mutually acceptable resolution. Keywords: El Monte, California, Promissory Note, Settlement Agreement, loan, debt settlement, dispute, agreement, financial obligation, resolution. The El Monte California Promissory Note and Settlement Agreement serves as a written contract, ensuring that both parties involved understand and comply with the agreed-upon terms. This document provides vital protection for the lender and borrower as it clearly outlines the loan conditions and ensures proper repayment. There can be different types of Promissory Note and Settlement Agreements in El Monte, California, depending on the nature of the financial dispute. Some common variations include: 1. Personal Loan Promissory Note and Settlement Agreement: This type of agreement is typically used when an individual lends money to a family member, friend, or colleague. It outlines the loan amount, interest rate (if applicable), repayment terms, and any collateral provided. The settlement agreement section of this document would establish repayment schedules, terms of any forgiven debt, and the consequences for defaulting on the loan. 2. Business Loan Promissory Note and Settlement Agreement: When businesses are involved in financial disputes, a Promissory Note and Settlement Agreement can be used to outline the terms of a loan or settlement. This document specifies the loan amount, repayment schedule, interest rate, and any collateral put up by the borrowing party. Additionally, the agreement section covers agreed-upon compromises or concessions made to settle the dispute. 3. Debt Settlement Promissory Note and Settlement Agreement: In cases where a debtor is unable to repay a debt in full, a Promissory Note and Settlement Agreement can be enacted to outline a mutually agreed-upon settlement. This agreement allows both parties to renegotiate the terms of the debt, such as reducing the principal amount or interest rate, extending the repayment period, or accepting a lump-sum settlement amount. The settlement agreement section details the revised terms and conditions, including any provisions for creditor forgiveness of a portion of the debt. Regardless of the specific type, an El Monte California Promissory Note and Settlement Agreement is a crucial legal tool that ensures clear communication, protects the rights of both parties, and serves as a reference point in the event of any future disputes. It is always advisable to seek legal counsel or professional guidance to draft a comprehensive and enforceable promissory note and settlement agreement.El Monte California Promissory Note and Settlement Agreement: A Detailed Description In El Monte, California, a Promissory Note and Settlement Agreement is a legally binding document that outlines the terms and conditions of a loan or debt settlement. This agreement is commonly used when there is a dispute or disagreement between two parties regarding a financial obligation, and both parties agree to reach a mutually acceptable resolution. Keywords: El Monte, California, Promissory Note, Settlement Agreement, loan, debt settlement, dispute, agreement, financial obligation, resolution. The El Monte California Promissory Note and Settlement Agreement serves as a written contract, ensuring that both parties involved understand and comply with the agreed-upon terms. This document provides vital protection for the lender and borrower as it clearly outlines the loan conditions and ensures proper repayment. There can be different types of Promissory Note and Settlement Agreements in El Monte, California, depending on the nature of the financial dispute. Some common variations include: 1. Personal Loan Promissory Note and Settlement Agreement: This type of agreement is typically used when an individual lends money to a family member, friend, or colleague. It outlines the loan amount, interest rate (if applicable), repayment terms, and any collateral provided. The settlement agreement section of this document would establish repayment schedules, terms of any forgiven debt, and the consequences for defaulting on the loan. 2. Business Loan Promissory Note and Settlement Agreement: When businesses are involved in financial disputes, a Promissory Note and Settlement Agreement can be used to outline the terms of a loan or settlement. This document specifies the loan amount, repayment schedule, interest rate, and any collateral put up by the borrowing party. Additionally, the agreement section covers agreed-upon compromises or concessions made to settle the dispute. 3. Debt Settlement Promissory Note and Settlement Agreement: In cases where a debtor is unable to repay a debt in full, a Promissory Note and Settlement Agreement can be enacted to outline a mutually agreed-upon settlement. This agreement allows both parties to renegotiate the terms of the debt, such as reducing the principal amount or interest rate, extending the repayment period, or accepting a lump-sum settlement amount. The settlement agreement section details the revised terms and conditions, including any provisions for creditor forgiveness of a portion of the debt. Regardless of the specific type, an El Monte California Promissory Note and Settlement Agreement is a crucial legal tool that ensures clear communication, protects the rights of both parties, and serves as a reference point in the event of any future disputes. It is always advisable to seek legal counsel or professional guidance to draft a comprehensive and enforceable promissory note and settlement agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.