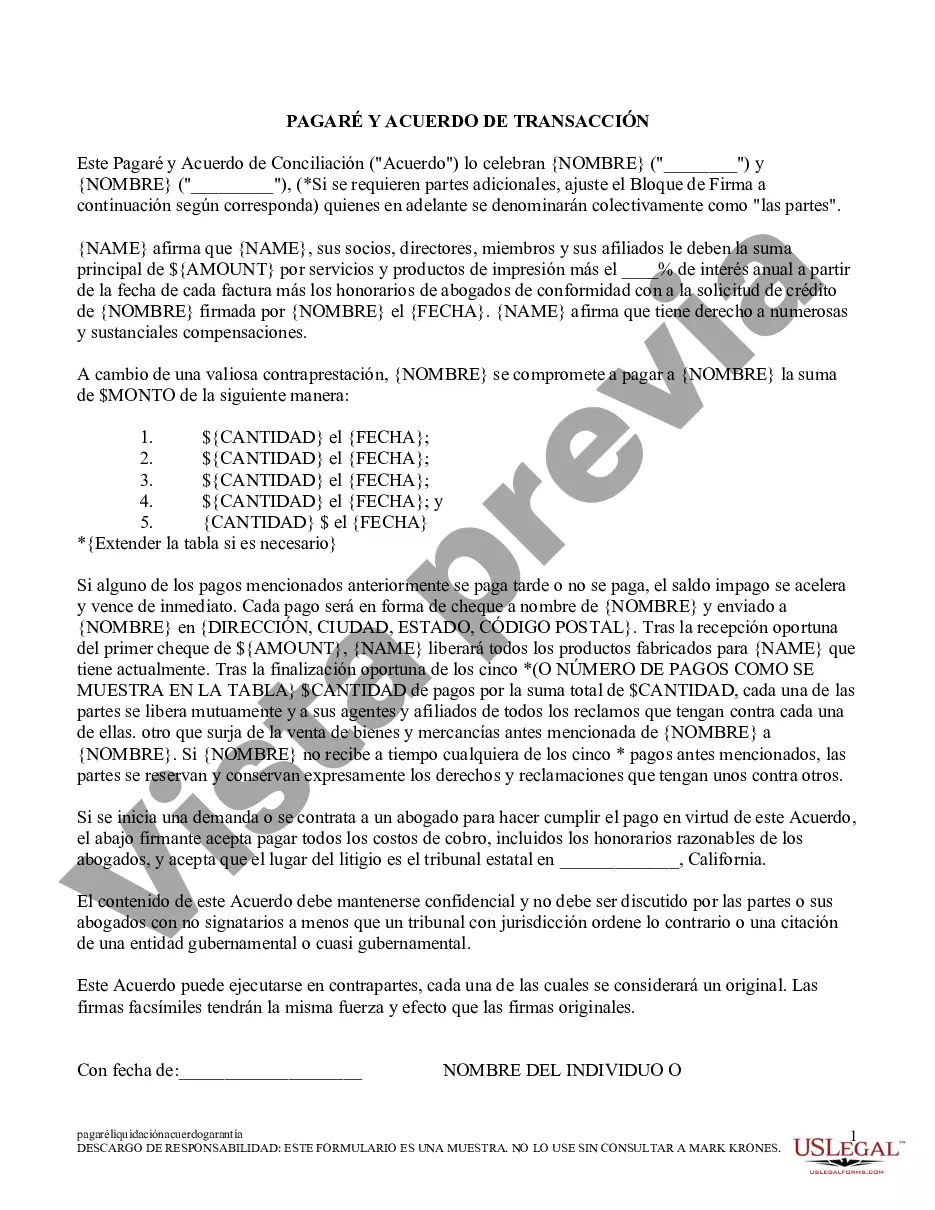

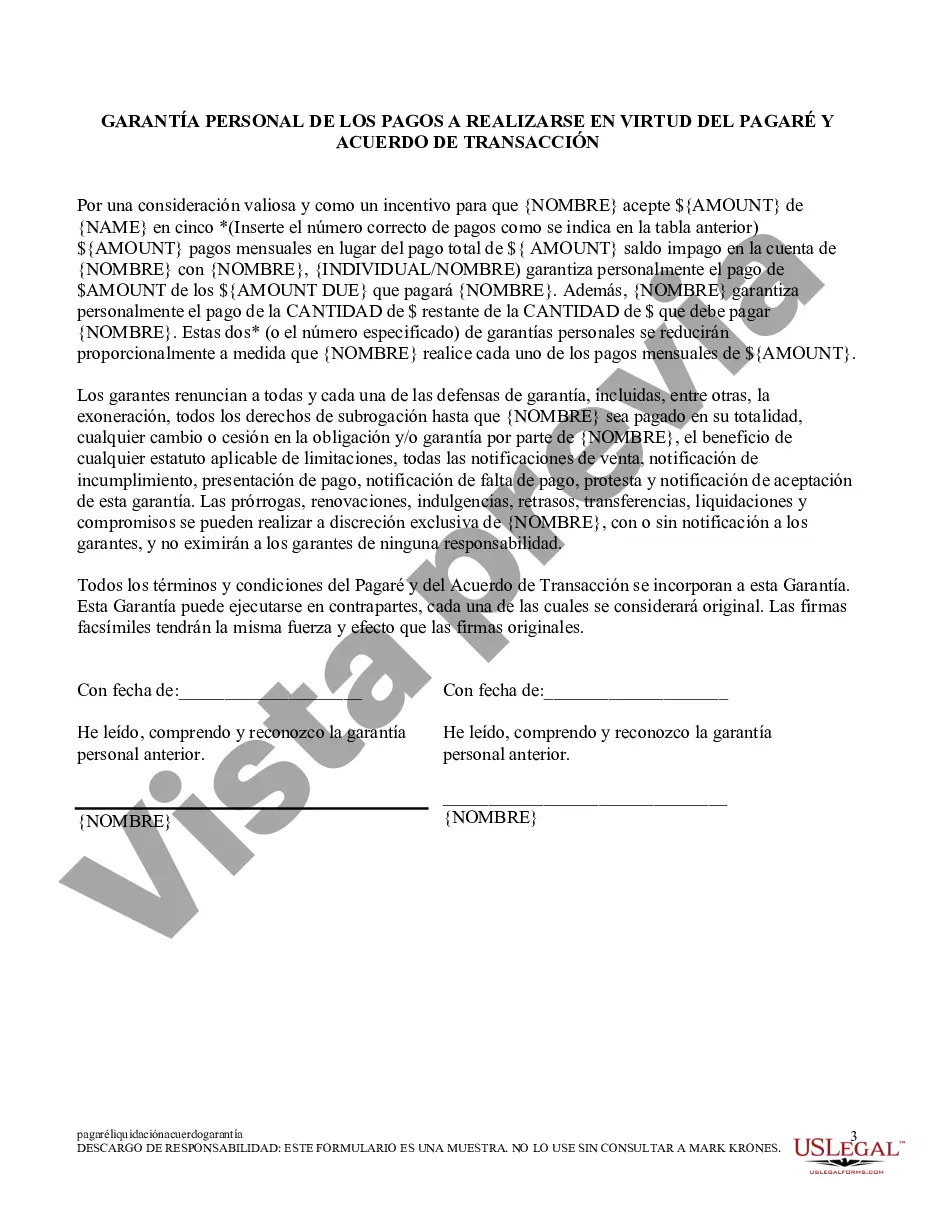

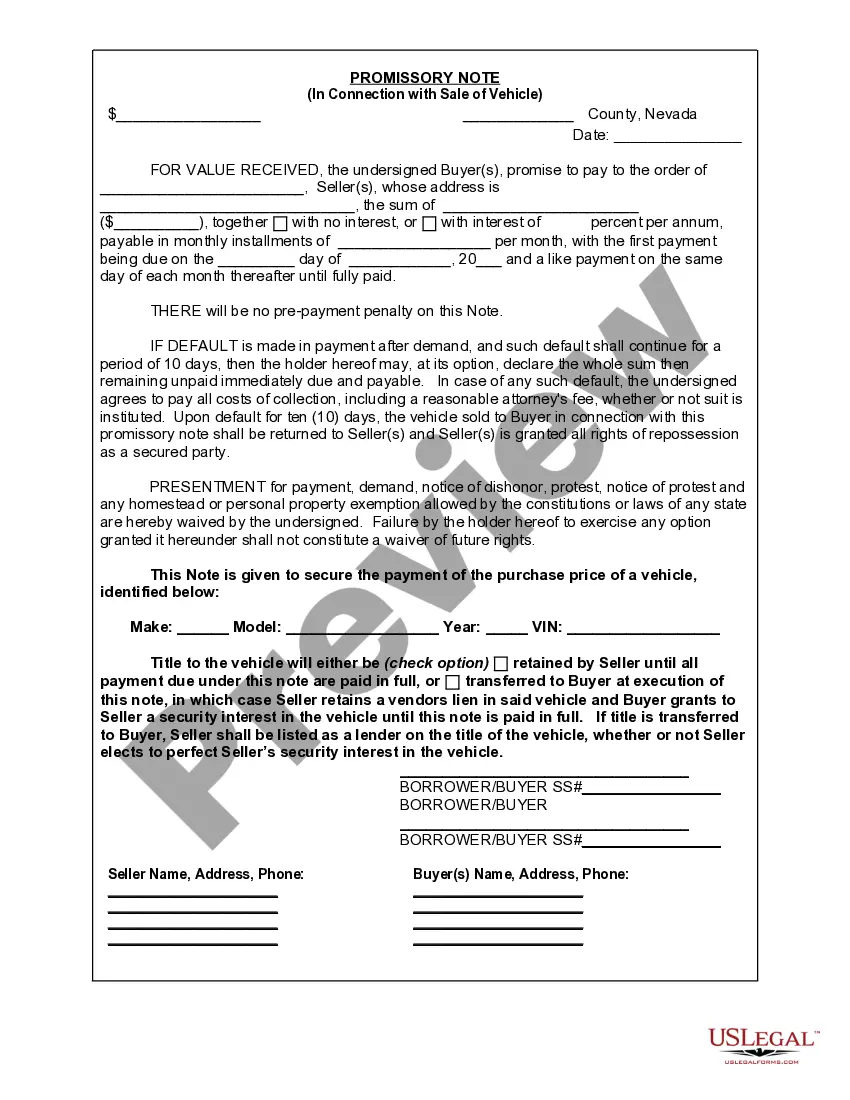

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

The Jurupa Valley California Promissory Note and Settlement Agreement is a legally binding document that outlines the terms and conditions of a financial agreement between parties in Jurupa Valley, California. This agreement is frequently utilized in various legal and financial matters to ensure clarity and enforceability between individuals or entities involved in a financial transaction or dispute resolution. A Promissory Note is a type of legally enforceable contract that establishes a promise to pay a specified amount of money to a designated party. It serves as evidence of a debt owed by one party (known as the borrower or debtor) to another (known as the lender or creditor). This note typically includes details such as the principal amount, interest rate, repayment schedule, and any additional terms or clauses set forth by the parties. A Settlement Agreement, on the other hand, is a legally binding agreement between parties who are involved in a legal dispute or potential litigation. This agreement serves as a resolution to their dispute, ensuring that all parties involved are satisfied with the terms. It outlines the terms of settlement, including the agreed-upon actions that each party must take, usually including financial compensation or other considerations to resolve the matter amicably. In Jurupa Valley, California, there may be different types of Promissory Note and Settlement Agreement, depending on the specific circumstances of the agreement. Some common variations include: 1. Secured Promissory Note: A promissory note that includes collateral to secure the repayment of the debt. This type of note provides the lender with a legal claim to the specified collateral, should the borrower fail to fulfill their repayment obligations. 2. Unsecured Promissory Note: A promissory note that does not involve any collateral. In this case, the borrower's promise to repay the debt is based solely on their creditworthiness and reputation. 3. Lump Sum Settlement Agreement: A settlement agreement that involves a one-time payment or compensation to resolve a dispute or potential litigation. This type of agreement often encompasses a financial settlement to prevent further legal action. 4. Structured Settlement Agreement: A settlement agreement that outlines the terms of payment of a financial obligation over an extended period. In this type of agreement, payments are typically made in installments at agreed-upon intervals. It is crucial to consult with legal professionals experienced in contract law and dispute resolution to draft and negotiate Promissory Note and Settlement Agreements in Jurupa Valley, California. The specific terms and conditions of these agreements can vary based on individual circumstances and the nature of the financial transaction or dispute.The Jurupa Valley California Promissory Note and Settlement Agreement is a legally binding document that outlines the terms and conditions of a financial agreement between parties in Jurupa Valley, California. This agreement is frequently utilized in various legal and financial matters to ensure clarity and enforceability between individuals or entities involved in a financial transaction or dispute resolution. A Promissory Note is a type of legally enforceable contract that establishes a promise to pay a specified amount of money to a designated party. It serves as evidence of a debt owed by one party (known as the borrower or debtor) to another (known as the lender or creditor). This note typically includes details such as the principal amount, interest rate, repayment schedule, and any additional terms or clauses set forth by the parties. A Settlement Agreement, on the other hand, is a legally binding agreement between parties who are involved in a legal dispute or potential litigation. This agreement serves as a resolution to their dispute, ensuring that all parties involved are satisfied with the terms. It outlines the terms of settlement, including the agreed-upon actions that each party must take, usually including financial compensation or other considerations to resolve the matter amicably. In Jurupa Valley, California, there may be different types of Promissory Note and Settlement Agreement, depending on the specific circumstances of the agreement. Some common variations include: 1. Secured Promissory Note: A promissory note that includes collateral to secure the repayment of the debt. This type of note provides the lender with a legal claim to the specified collateral, should the borrower fail to fulfill their repayment obligations. 2. Unsecured Promissory Note: A promissory note that does not involve any collateral. In this case, the borrower's promise to repay the debt is based solely on their creditworthiness and reputation. 3. Lump Sum Settlement Agreement: A settlement agreement that involves a one-time payment or compensation to resolve a dispute or potential litigation. This type of agreement often encompasses a financial settlement to prevent further legal action. 4. Structured Settlement Agreement: A settlement agreement that outlines the terms of payment of a financial obligation over an extended period. In this type of agreement, payments are typically made in installments at agreed-upon intervals. It is crucial to consult with legal professionals experienced in contract law and dispute resolution to draft and negotiate Promissory Note and Settlement Agreements in Jurupa Valley, California. The specific terms and conditions of these agreements can vary based on individual circumstances and the nature of the financial transaction or dispute.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.