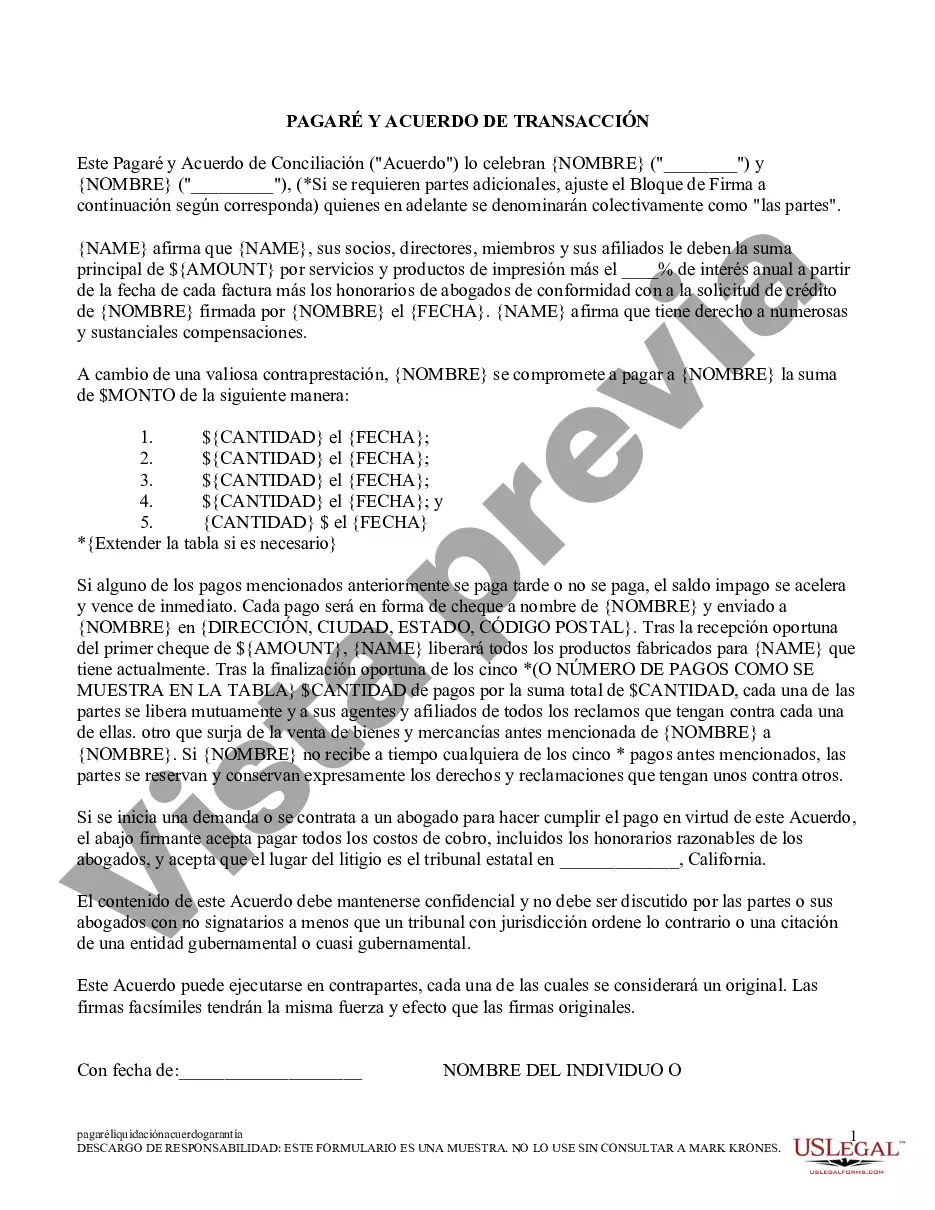

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

Los Angeles California Promissory Note and Settlement Agreement are legal documents commonly used in financial transactions and legal disputes in Los Angeles, California. They play a crucial role in outlining the terms and conditions of a loan agreement or resolving disagreements. A promissory note is a written promise from one party, known as the borrower or debtor, to repay a specified amount of money to another party, known as the lender or creditor, within a set timeframe and with agreed-upon interest rates. It serves as a legally binding contract ensuring the repayment of a loan and includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payment. In Los Angeles, there are different types of promissory notes, including secured promissory notes, unsecured promissory notes, demand promissory notes, installment promissory notes, and balloon promissory notes. A settlement agreement, also known as a settlement agreement and mutual release, is a legally binding document used to resolve legal disputes between parties without going to court. This agreement defines the terms and conditions under which the parties agree to put an end to their dispute and avoid further litigation. It covers matters like financial compensation, the release of claims, confidentiality, and any future actions that the parties must take. The settlement agreement is tailored to the specific circumstances of the case and can be used in various legal matters, such as contract disputes, employment disputes, personal injury claims, or divorce settlements. In Los Angeles, California, there might be specific types of promissory notes and settlement agreements that cater to various industries or circumstances. For instance, commercial promissory notes are used for business-related loans, while residential promissory notes are designed for real estate transactions. Settlement agreements can also vary, such as medical malpractice settlement agreements, employment settlement agreements, or construction defect settlement agreements, depending on the nature of the legal dispute being resolved. It is crucial to seek legal advice when drafting or entering into a Los Angeles California Promissory Note and Settlement Agreement to ensure compliance with state laws and to protect the interests of all parties involved. Legal professionals experienced in California contract and settlement law can provide guidance and ensure the documents are comprehensive, enforceable, and meet the specific requirements of the case.Los Angeles California Promissory Note and Settlement Agreement are legal documents commonly used in financial transactions and legal disputes in Los Angeles, California. They play a crucial role in outlining the terms and conditions of a loan agreement or resolving disagreements. A promissory note is a written promise from one party, known as the borrower or debtor, to repay a specified amount of money to another party, known as the lender or creditor, within a set timeframe and with agreed-upon interest rates. It serves as a legally binding contract ensuring the repayment of a loan and includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payment. In Los Angeles, there are different types of promissory notes, including secured promissory notes, unsecured promissory notes, demand promissory notes, installment promissory notes, and balloon promissory notes. A settlement agreement, also known as a settlement agreement and mutual release, is a legally binding document used to resolve legal disputes between parties without going to court. This agreement defines the terms and conditions under which the parties agree to put an end to their dispute and avoid further litigation. It covers matters like financial compensation, the release of claims, confidentiality, and any future actions that the parties must take. The settlement agreement is tailored to the specific circumstances of the case and can be used in various legal matters, such as contract disputes, employment disputes, personal injury claims, or divorce settlements. In Los Angeles, California, there might be specific types of promissory notes and settlement agreements that cater to various industries or circumstances. For instance, commercial promissory notes are used for business-related loans, while residential promissory notes are designed for real estate transactions. Settlement agreements can also vary, such as medical malpractice settlement agreements, employment settlement agreements, or construction defect settlement agreements, depending on the nature of the legal dispute being resolved. It is crucial to seek legal advice when drafting or entering into a Los Angeles California Promissory Note and Settlement Agreement to ensure compliance with state laws and to protect the interests of all parties involved. Legal professionals experienced in California contract and settlement law can provide guidance and ensure the documents are comprehensive, enforceable, and meet the specific requirements of the case.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.