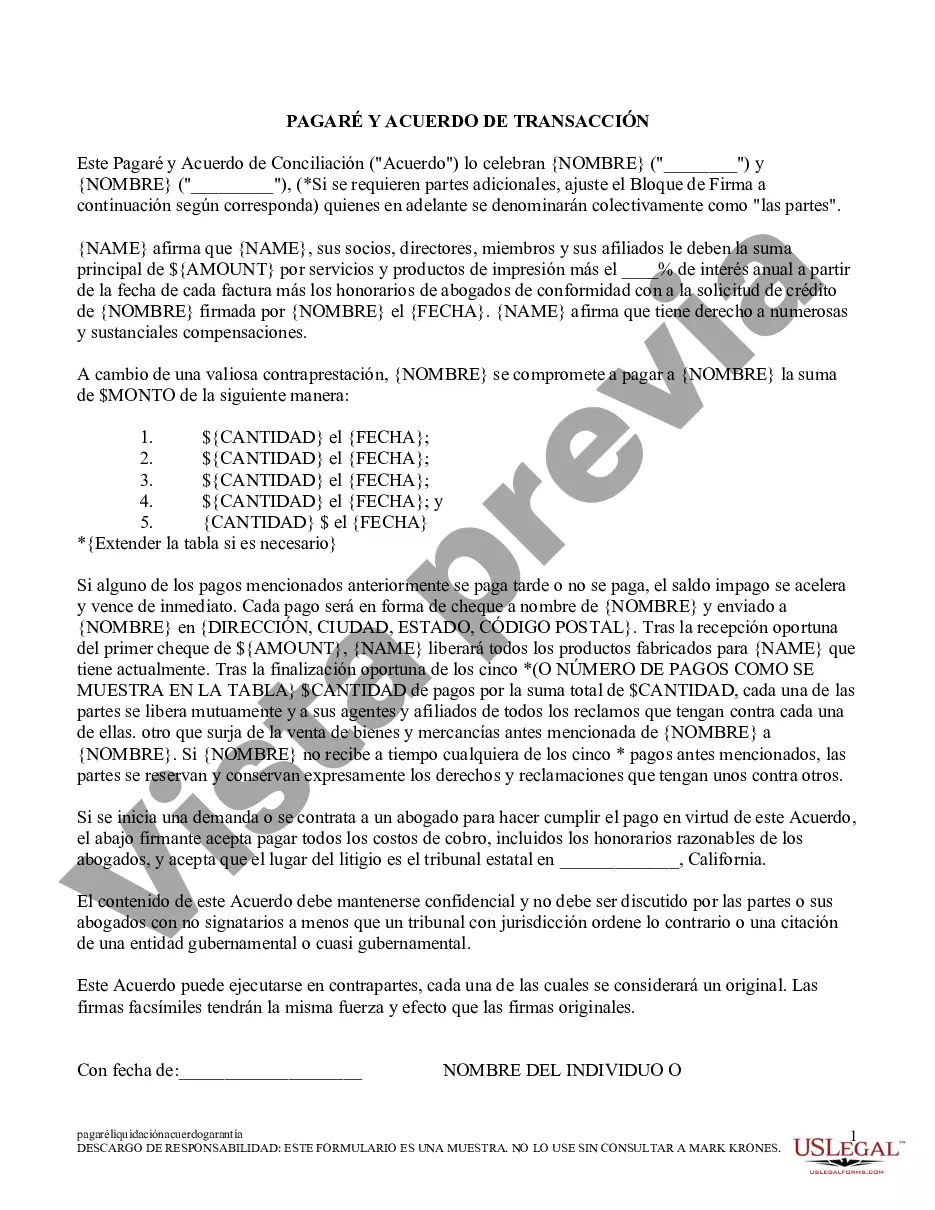

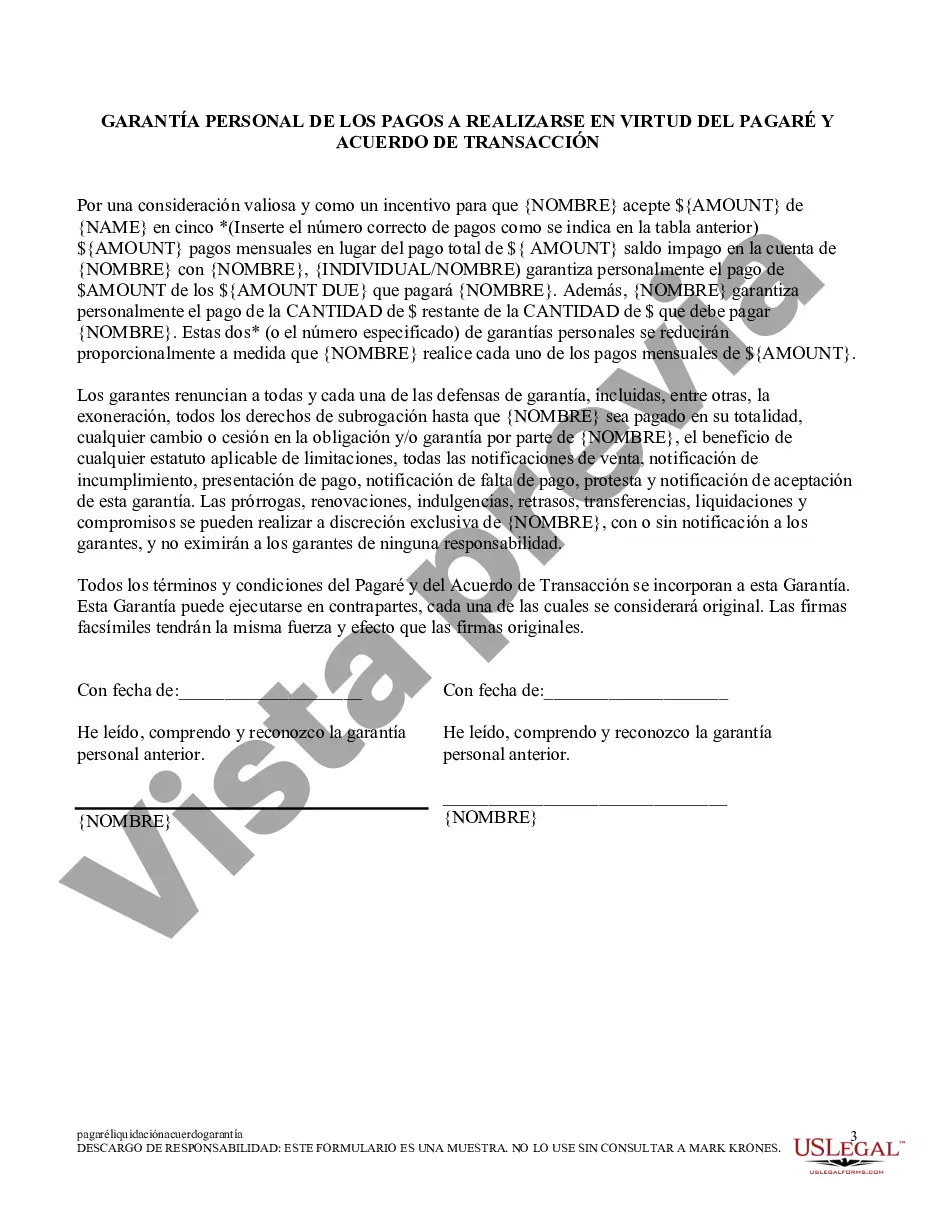

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

Palmdale, California Promissory Note and Settlement Agreement: Explained In Palmdale, California, a Promissory Note and Settlement Agreement carries significant importance in various legal and financial transactions. Let's delve into the intricacies of this document and understand its purpose, types, and critical components. A Promissory Note is a legally binding agreement that outlines the terms and conditions of a loan or debt between two parties. It acts as an IOU, where the borrower promises to repay a specific amount to the lender within a predetermined timeframe and at a stated interest rate. This document serves as evidence of the debt owed, providing legal protection to both parties involved. A Settlement Agreement, on the other hand, is a crucial legal contract that outlines the terms of an agreement reached between parties who have been involved in a dispute or lawsuit. It serves as a means to resolve conflicts outside the courtroom, promoting a mutually acceptable settlement. This agreement helps to avoid prolonged litigation, confidentiality breaches, and related expenses. In Palmdale, California, specific variations of Promissory Notes and Settlement Agreements exist to cater to different scenarios and requirements: 1. Palmdale California Promissory Note for Personal Loans: This type involves loans between individuals, friends, or family members. It encompasses terms related to loan amount, interest rate, repayment period, and consequences of default. 2. Palmdale California Promissory Note for Business Loans: Specifically designed for commercial purposes, this Promissory Note incorporates variables tailored to business partnerships, loans, and financial agreements. It focuses on factors such as loan amount, repayment schedule, collateral, and any applicable penalties. 3. Palmdale California Promissory Note with Balloon Payment: This variation includes a lump sum payment due at the end of the loan term. It allows borrowers to make smaller monthly payments initially, with a larger payment required upon maturity. 4. Palmdale California Settlement Agreement in Personal Injury Cases: A Settlement Agreement commonly arises in personal injury cases, ensuring that the parties involved agree to a fair resolution for damages, medical expenses, and any other compensatory measures after an accident or injury. 5. Palmdale California Settlement Agreement in Divorce Cases: This settlement caters to the terms of divorce, covering alimony, child custody, division of assets, spousal support, and other related matters. It provides an alternative to prolonged courtroom battles, offering an expedited and amicable resolution. Understanding these variations is crucial to determine the appropriate Palmdale, California Promissory Note and Settlement Agreement for specific circumstances. In conclusion, the Palmdale, California Promissory Note and Settlement Agreement entail legally binding contracts created to establish clear terms and conditions in financial and legal matters. Whether for personal or business loans, personal injury or divorce cases, these documents play a vital role in safeguarding the interests of all involved parties while promoting a mutually agreed resolution. It is advisable to seek legal counsel to ensure compliance with local laws and regulations when drafting or signing such agreements.Palmdale, California Promissory Note and Settlement Agreement: Explained In Palmdale, California, a Promissory Note and Settlement Agreement carries significant importance in various legal and financial transactions. Let's delve into the intricacies of this document and understand its purpose, types, and critical components. A Promissory Note is a legally binding agreement that outlines the terms and conditions of a loan or debt between two parties. It acts as an IOU, where the borrower promises to repay a specific amount to the lender within a predetermined timeframe and at a stated interest rate. This document serves as evidence of the debt owed, providing legal protection to both parties involved. A Settlement Agreement, on the other hand, is a crucial legal contract that outlines the terms of an agreement reached between parties who have been involved in a dispute or lawsuit. It serves as a means to resolve conflicts outside the courtroom, promoting a mutually acceptable settlement. This agreement helps to avoid prolonged litigation, confidentiality breaches, and related expenses. In Palmdale, California, specific variations of Promissory Notes and Settlement Agreements exist to cater to different scenarios and requirements: 1. Palmdale California Promissory Note for Personal Loans: This type involves loans between individuals, friends, or family members. It encompasses terms related to loan amount, interest rate, repayment period, and consequences of default. 2. Palmdale California Promissory Note for Business Loans: Specifically designed for commercial purposes, this Promissory Note incorporates variables tailored to business partnerships, loans, and financial agreements. It focuses on factors such as loan amount, repayment schedule, collateral, and any applicable penalties. 3. Palmdale California Promissory Note with Balloon Payment: This variation includes a lump sum payment due at the end of the loan term. It allows borrowers to make smaller monthly payments initially, with a larger payment required upon maturity. 4. Palmdale California Settlement Agreement in Personal Injury Cases: A Settlement Agreement commonly arises in personal injury cases, ensuring that the parties involved agree to a fair resolution for damages, medical expenses, and any other compensatory measures after an accident or injury. 5. Palmdale California Settlement Agreement in Divorce Cases: This settlement caters to the terms of divorce, covering alimony, child custody, division of assets, spousal support, and other related matters. It provides an alternative to prolonged courtroom battles, offering an expedited and amicable resolution. Understanding these variations is crucial to determine the appropriate Palmdale, California Promissory Note and Settlement Agreement for specific circumstances. In conclusion, the Palmdale, California Promissory Note and Settlement Agreement entail legally binding contracts created to establish clear terms and conditions in financial and legal matters. Whether for personal or business loans, personal injury or divorce cases, these documents play a vital role in safeguarding the interests of all involved parties while promoting a mutually agreed resolution. It is advisable to seek legal counsel to ensure compliance with local laws and regulations when drafting or signing such agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.