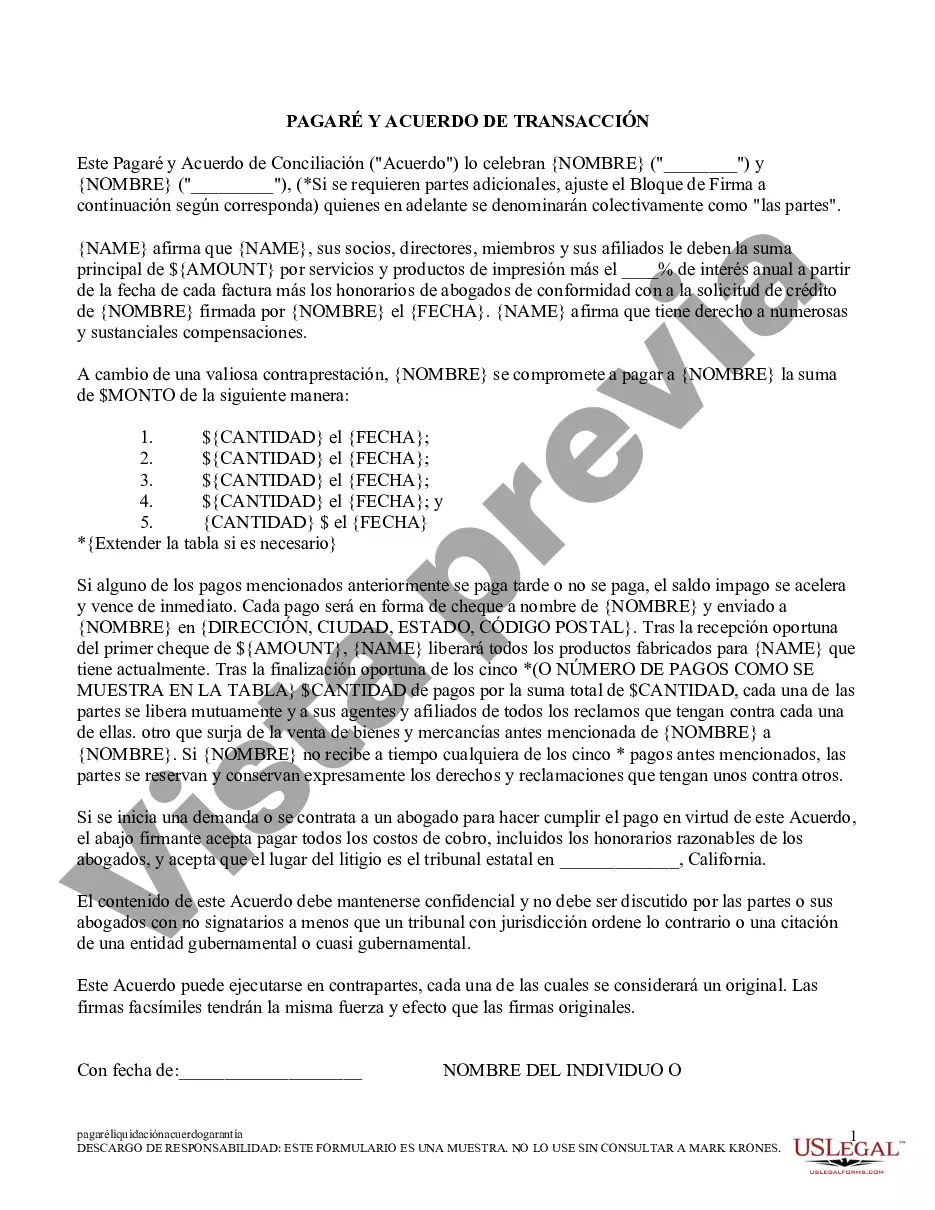

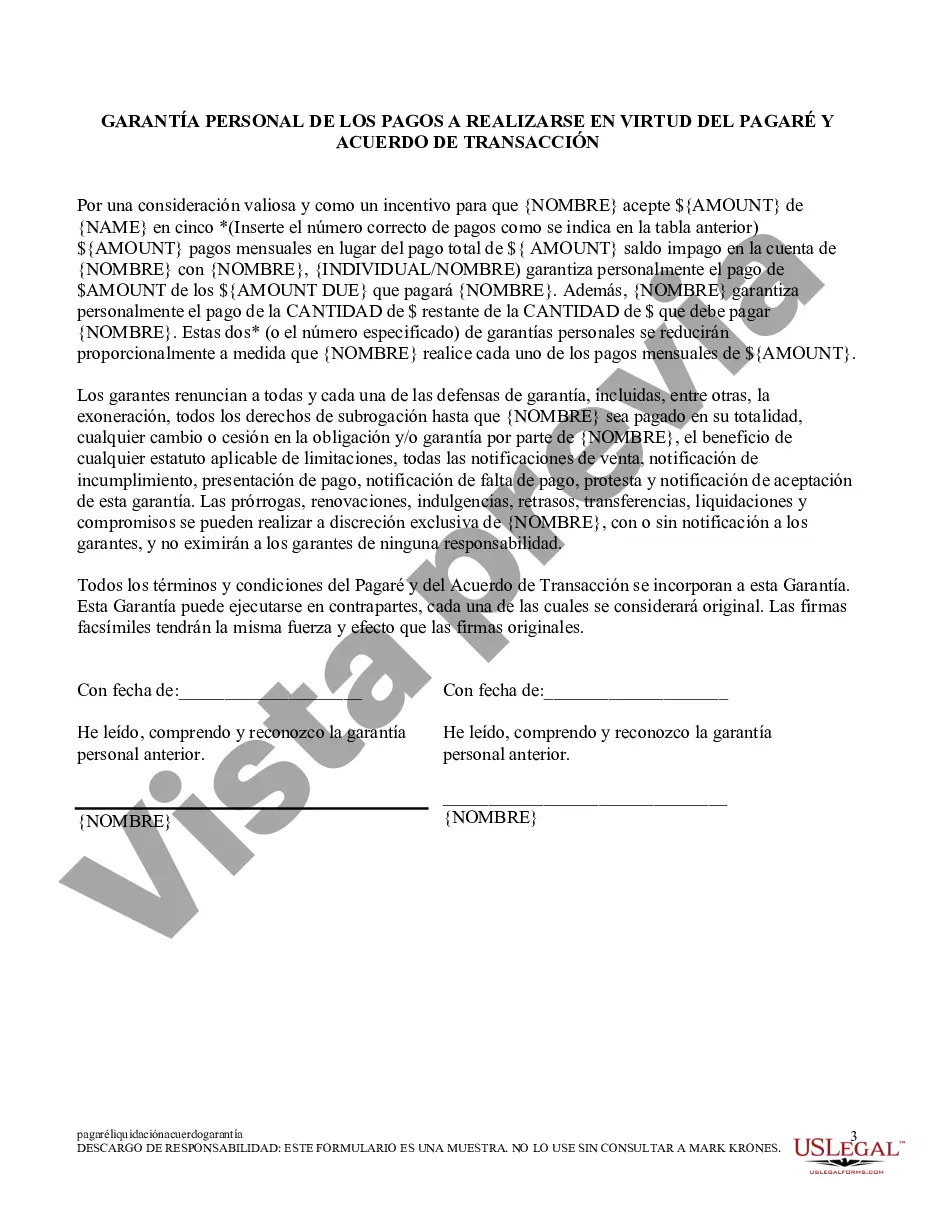

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

A Salinas California Promissory Note and Settlement Agreement is a legally binding document that outlines the terms and conditions of a financial agreement between two parties in the Salinas, California region. This agreement serves as a written agreement that solidifies the repayment of a debt or the settlement of a legal dispute. Promissory Note: In Salinas, California, a promissory note is a legal instrument that outlines a borrower's promise to repay a specific amount of money to a lender within a specified time frame. It includes vital details such as the names of both parties involved, the principal amount borrowed, the interest rate (if applicable), the repayment schedule, and any penalties for late or missed payments. Settlement Agreement: A settlement agreement refers to a legally binding contract that ends a legal dispute between two parties without going to court. It is a negotiated settlement where parties come to terms with a resolution to avoid further legal proceedings. The agreement outlines the terms of the settlement, including any financial terms, compromises, or concessions made by each party. Some key elements that may be included in a Salinas California Promissory Note and Settlement Agreement are: 1. Repayment Terms: The amount borrowed, the interest rate (if agreed upon), and the repayment schedule, including the due dates and payment amounts. 2. Default and Remedies: The consequences and remedies if the borrower fails to make payments as agreed, such as late fees, penalties, or legal actions. 3. Release and Waiver: Both parties agree to release each other from any future claims or obligations related to the dispute or debt. 4. Confidentiality: Provisions to maintain the confidentiality of the settlement to protect both parties' privacy and reputations. 5. Governing Law: Specifies that the agreement is governed by California state laws and any disputes shall be resolved in Salinas, California. 6. Signatures and Notarization: Requires the signatures of both parties involved and may require notarization to ensure its legality and enforceability. While there may not be specific types of Salinas California Promissory Note and Settlement Agreements, the content and terms may vary depending on the nature of the financial agreement or dispute being resolved. It is important to consult with an attorney or legal professional to draft such agreements to ensure adherence to local laws and individual circumstances.A Salinas California Promissory Note and Settlement Agreement is a legally binding document that outlines the terms and conditions of a financial agreement between two parties in the Salinas, California region. This agreement serves as a written agreement that solidifies the repayment of a debt or the settlement of a legal dispute. Promissory Note: In Salinas, California, a promissory note is a legal instrument that outlines a borrower's promise to repay a specific amount of money to a lender within a specified time frame. It includes vital details such as the names of both parties involved, the principal amount borrowed, the interest rate (if applicable), the repayment schedule, and any penalties for late or missed payments. Settlement Agreement: A settlement agreement refers to a legally binding contract that ends a legal dispute between two parties without going to court. It is a negotiated settlement where parties come to terms with a resolution to avoid further legal proceedings. The agreement outlines the terms of the settlement, including any financial terms, compromises, or concessions made by each party. Some key elements that may be included in a Salinas California Promissory Note and Settlement Agreement are: 1. Repayment Terms: The amount borrowed, the interest rate (if agreed upon), and the repayment schedule, including the due dates and payment amounts. 2. Default and Remedies: The consequences and remedies if the borrower fails to make payments as agreed, such as late fees, penalties, or legal actions. 3. Release and Waiver: Both parties agree to release each other from any future claims or obligations related to the dispute or debt. 4. Confidentiality: Provisions to maintain the confidentiality of the settlement to protect both parties' privacy and reputations. 5. Governing Law: Specifies that the agreement is governed by California state laws and any disputes shall be resolved in Salinas, California. 6. Signatures and Notarization: Requires the signatures of both parties involved and may require notarization to ensure its legality and enforceability. While there may not be specific types of Salinas California Promissory Note and Settlement Agreements, the content and terms may vary depending on the nature of the financial agreement or dispute being resolved. It is important to consult with an attorney or legal professional to draft such agreements to ensure adherence to local laws and individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.