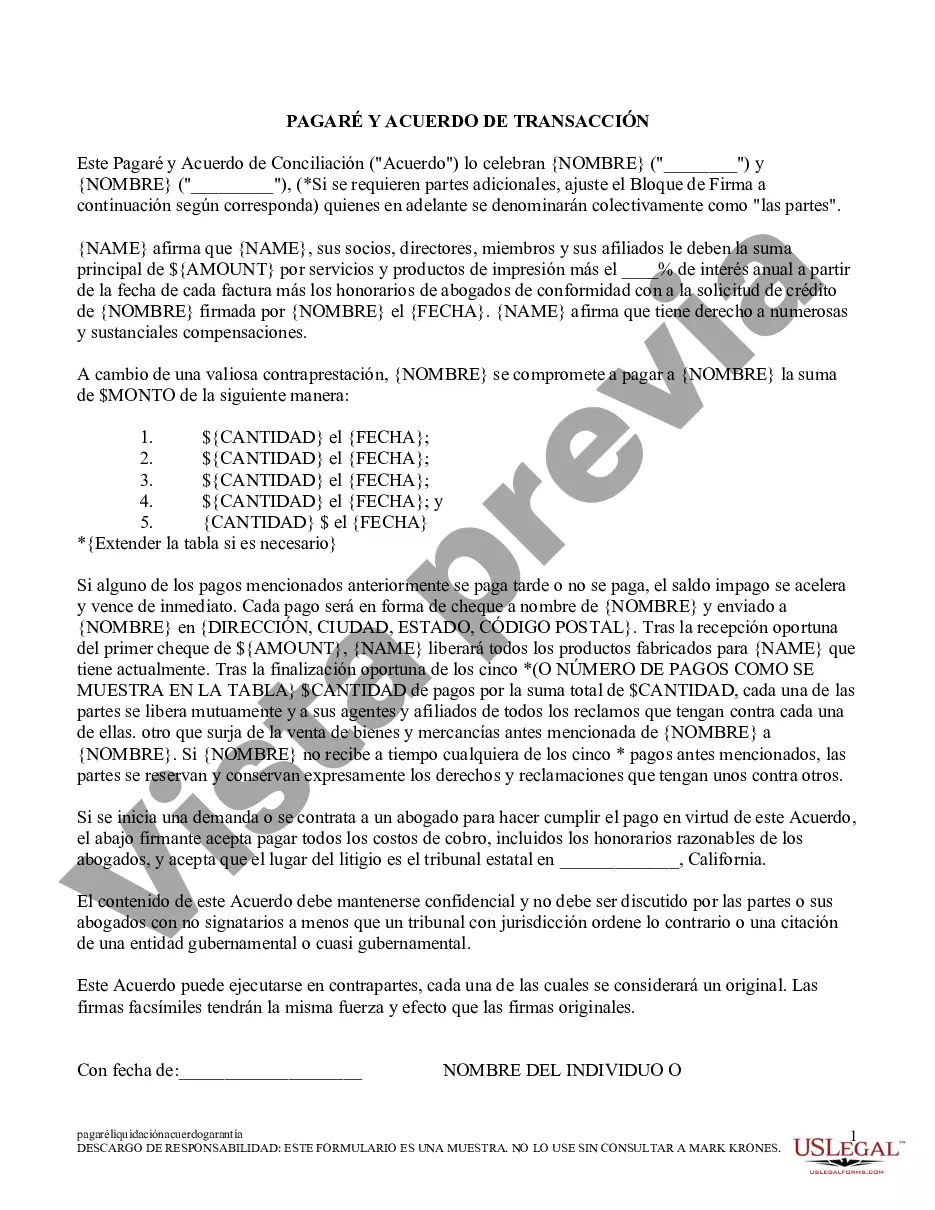

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

The Santa Clara California Promissory Note and Settlement Agreement is a legally binding document utilized in various financial scenarios. It serves as an agreement between two parties involved in a loan or debt settlement, outlining the terms and conditions of repayment or resolution. This promissory note and settlement agreement is specific to Santa Clara, California and adheres to the legal regulations and requirements of the state. One type of Santa Clara California Promissory Note and Settlement Agreement is the Personal Loan Promissory Note and Settlement Agreement. This type of agreement typically occurs between individuals, where one party lends a sum of money to another party. It details the repayment terms, including the amount borrowed, interest rate, due dates, and any repayment schedules. The agreement provides legal protection for both parties involved, preventing any potential disputes or misunderstandings in the future. Another type of Santa Clara California Promissory Note and Settlement Agreement is the Business Loan Promissory Note and Settlement Agreement. This agreement is commonly used when a business requires financing from another entity, such as a bank or investor. It outlines the specifics of the loan, including loan amount, interest rate, repayment schedule, and any collateral offered by the business. By signing this agreement, both parties are legally bound to adhere to the terms mentioned, ensuring a smooth loan repayment process. Additionally, the Santa Clara California Promissory Note and Settlement Agreement also includes the Debt Settlement Promissory Note and Settlement Agreement. This type of agreement is typically used when a debtor is unable to repay the full amount owed and seeks a negotiated settlement with the creditor. It outlines the terms of the settlement, such as a reduced total amount owed, payment plan, and release of any further obligations. This agreement provides a formal framework for resolving outstanding debts and avoids litigation or further financial complications. To create a valid Santa Clara California Promissory Note and Settlement Agreement, it is recommended to seek legal advice to ensure compliance with the specific laws and regulations applicable in Santa Clara County. It is important to include all relevant and accurate information regarding the parties involved, loan details, repayment terms, and any other pertinent clauses to protect all parties' interests and enforceability.The Santa Clara California Promissory Note and Settlement Agreement is a legally binding document utilized in various financial scenarios. It serves as an agreement between two parties involved in a loan or debt settlement, outlining the terms and conditions of repayment or resolution. This promissory note and settlement agreement is specific to Santa Clara, California and adheres to the legal regulations and requirements of the state. One type of Santa Clara California Promissory Note and Settlement Agreement is the Personal Loan Promissory Note and Settlement Agreement. This type of agreement typically occurs between individuals, where one party lends a sum of money to another party. It details the repayment terms, including the amount borrowed, interest rate, due dates, and any repayment schedules. The agreement provides legal protection for both parties involved, preventing any potential disputes or misunderstandings in the future. Another type of Santa Clara California Promissory Note and Settlement Agreement is the Business Loan Promissory Note and Settlement Agreement. This agreement is commonly used when a business requires financing from another entity, such as a bank or investor. It outlines the specifics of the loan, including loan amount, interest rate, repayment schedule, and any collateral offered by the business. By signing this agreement, both parties are legally bound to adhere to the terms mentioned, ensuring a smooth loan repayment process. Additionally, the Santa Clara California Promissory Note and Settlement Agreement also includes the Debt Settlement Promissory Note and Settlement Agreement. This type of agreement is typically used when a debtor is unable to repay the full amount owed and seeks a negotiated settlement with the creditor. It outlines the terms of the settlement, such as a reduced total amount owed, payment plan, and release of any further obligations. This agreement provides a formal framework for resolving outstanding debts and avoids litigation or further financial complications. To create a valid Santa Clara California Promissory Note and Settlement Agreement, it is recommended to seek legal advice to ensure compliance with the specific laws and regulations applicable in Santa Clara County. It is important to include all relevant and accurate information regarding the parties involved, loan details, repayment terms, and any other pertinent clauses to protect all parties' interests and enforceability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.