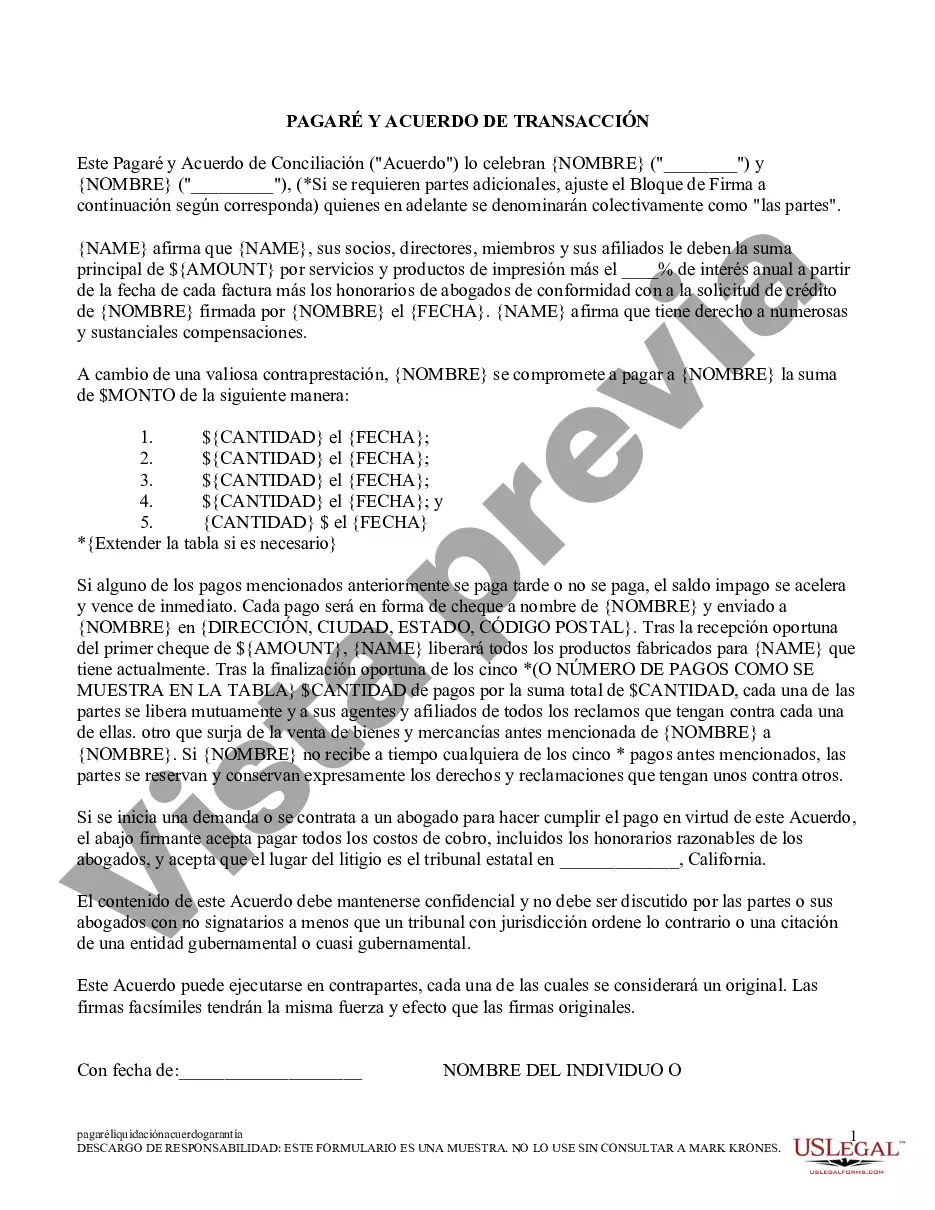

Promissory Note; Settlement Agreement: This is an Agreement and Promissory Note, stating that an individual is owed a certain sum from a corporation. The Agreement lists the payment schedule and amount to be paid by the corporation. Both the individual and a representative of the corporation must sign the contract. This form is available in both Word and Rich Text formats.

Victorville, California Promissory Note and Settlement Agreement are legal contracts that outline the terms and conditions of a financial agreement between two parties. These agreements specify the repayment of a loan or debt along with any additional terms agreed upon by the parties involved. Promissory notes are essentially legal IOUs and serve as evidence of a borrower's promise to repay a specific amount of money within a specified timeframe. They outline the amount borrowed, the interest rate (if any), the repayment schedule, and any other specific conditions agreed upon by both the lender and the borrower. Promissory notes are commonly used in various financial transactions, such as personal loans, business loans, real estate transactions, or even loans between friends and family. A settlement agreement, on the other hand, pertains to resolving a dispute or legal matter between parties involved in a lawsuit or existing conflict. It outlines the terms agreed upon to settle the dispute and avoid further litigation. Settlement agreements are typically used in cases involving personal injury claims, contractual disputes, employment matters, or divorce proceedings. In Victorville, California, these agreements may vary depending on the specific nature of the dispute being resolved. Types of Victorville, California Promissory Note and Settlement Agreement might include: 1. Personal Loan Promissory Note and Settlement Agreement: This type of agreement is used when individuals lend or borrow money for personal purposes, such as financing education, purchasing a vehicle, or covering unexpected expenses. It specifies the repayment terms and conditions. 2. Real Estate Promissory Note and Settlement Agreement: This agreement is commonly used in real estate transactions, such as seller financing or private mortgage situations. It outlines the repayment terms, interest rate, and any specific conditions related to the loan. 3. Business Loan Promissory Note and Settlement Agreement: This agreement comes into play when a business borrows money to fund its operations, expansion, or other capital needs. It defines the repayment plan, interest rate, and any other terms agreed upon to ensure both parties' rights and obligations are protected. 4. Settlement Agreement in Personal Injury Case: This agreement is reached between parties involved in a personal injury lawsuit, aiming to resolve the dispute and avoid proceeding to trial in Victorville, California. It typically includes details about the compensation paid by the responsible party to the injured party, as well as any stipulations or conditions related to the settlement. 5. Employment Settlement Agreement: This type of agreement is used to settle disputes or claims arising from employment-related matters such as wrongful termination, discrimination, or breach of contract. It lays out the terms and conditions agreed upon, including any financial compensation or other relevant provisions. In summary, Victorville, California Promissory Note and Settlement Agreements are legal documents that outline the terms, conditions, and obligations related to loans, debts, and dispute resolutions. These agreements come in various types, ranging from personal loans to business transactions, real estate, personal injury cases, and employment matters, all aiming to provide clear guidelines and protect the rights of all parties involved.Victorville, California Promissory Note and Settlement Agreement are legal contracts that outline the terms and conditions of a financial agreement between two parties. These agreements specify the repayment of a loan or debt along with any additional terms agreed upon by the parties involved. Promissory notes are essentially legal IOUs and serve as evidence of a borrower's promise to repay a specific amount of money within a specified timeframe. They outline the amount borrowed, the interest rate (if any), the repayment schedule, and any other specific conditions agreed upon by both the lender and the borrower. Promissory notes are commonly used in various financial transactions, such as personal loans, business loans, real estate transactions, or even loans between friends and family. A settlement agreement, on the other hand, pertains to resolving a dispute or legal matter between parties involved in a lawsuit or existing conflict. It outlines the terms agreed upon to settle the dispute and avoid further litigation. Settlement agreements are typically used in cases involving personal injury claims, contractual disputes, employment matters, or divorce proceedings. In Victorville, California, these agreements may vary depending on the specific nature of the dispute being resolved. Types of Victorville, California Promissory Note and Settlement Agreement might include: 1. Personal Loan Promissory Note and Settlement Agreement: This type of agreement is used when individuals lend or borrow money for personal purposes, such as financing education, purchasing a vehicle, or covering unexpected expenses. It specifies the repayment terms and conditions. 2. Real Estate Promissory Note and Settlement Agreement: This agreement is commonly used in real estate transactions, such as seller financing or private mortgage situations. It outlines the repayment terms, interest rate, and any specific conditions related to the loan. 3. Business Loan Promissory Note and Settlement Agreement: This agreement comes into play when a business borrows money to fund its operations, expansion, or other capital needs. It defines the repayment plan, interest rate, and any other terms agreed upon to ensure both parties' rights and obligations are protected. 4. Settlement Agreement in Personal Injury Case: This agreement is reached between parties involved in a personal injury lawsuit, aiming to resolve the dispute and avoid proceeding to trial in Victorville, California. It typically includes details about the compensation paid by the responsible party to the injured party, as well as any stipulations or conditions related to the settlement. 5. Employment Settlement Agreement: This type of agreement is used to settle disputes or claims arising from employment-related matters such as wrongful termination, discrimination, or breach of contract. It lays out the terms and conditions agreed upon, including any financial compensation or other relevant provisions. In summary, Victorville, California Promissory Note and Settlement Agreements are legal documents that outline the terms, conditions, and obligations related to loans, debts, and dispute resolutions. These agreements come in various types, ranging from personal loans to business transactions, real estate, personal injury cases, and employment matters, all aiming to provide clear guidelines and protect the rights of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.