This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

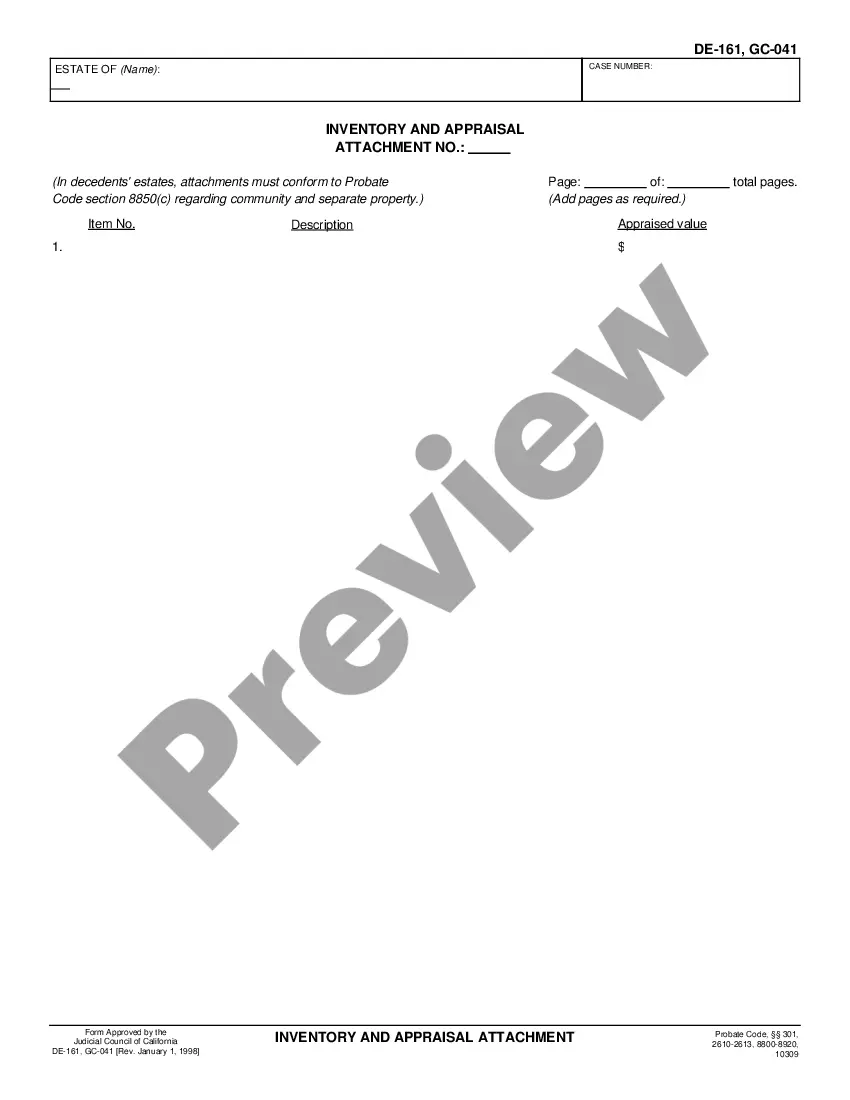

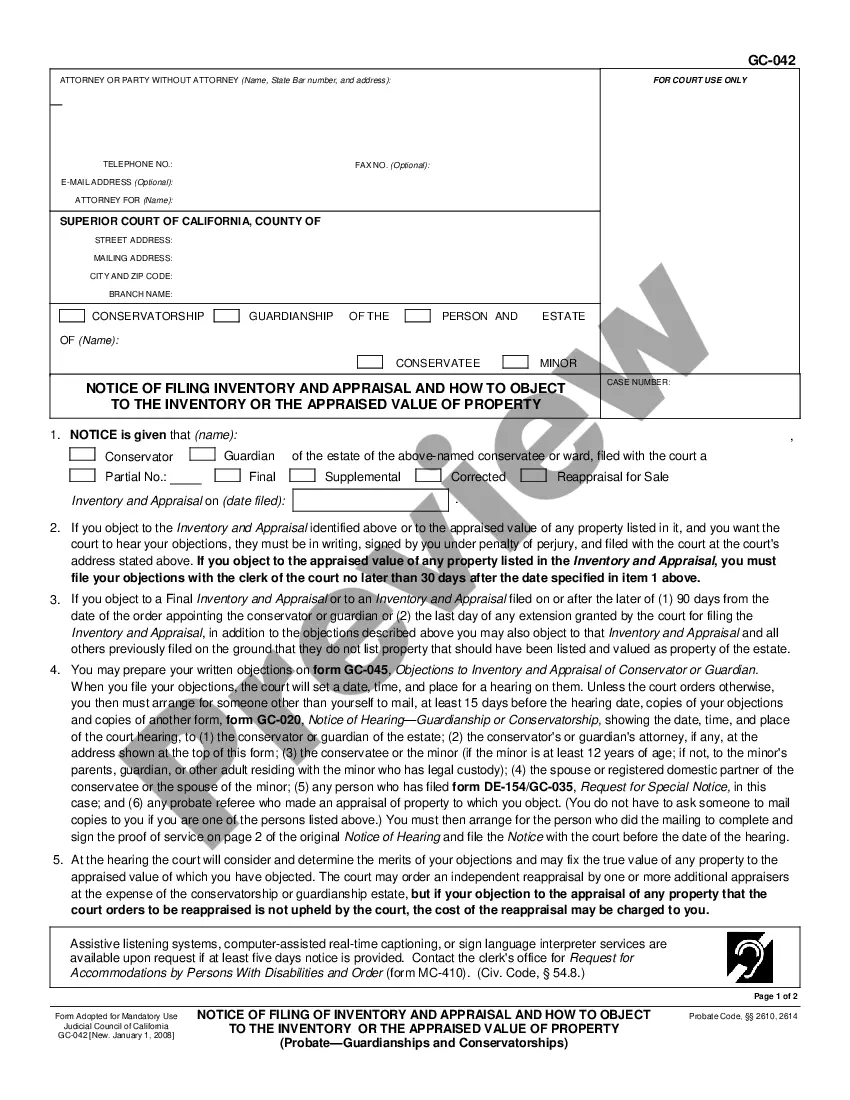

Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property

Description

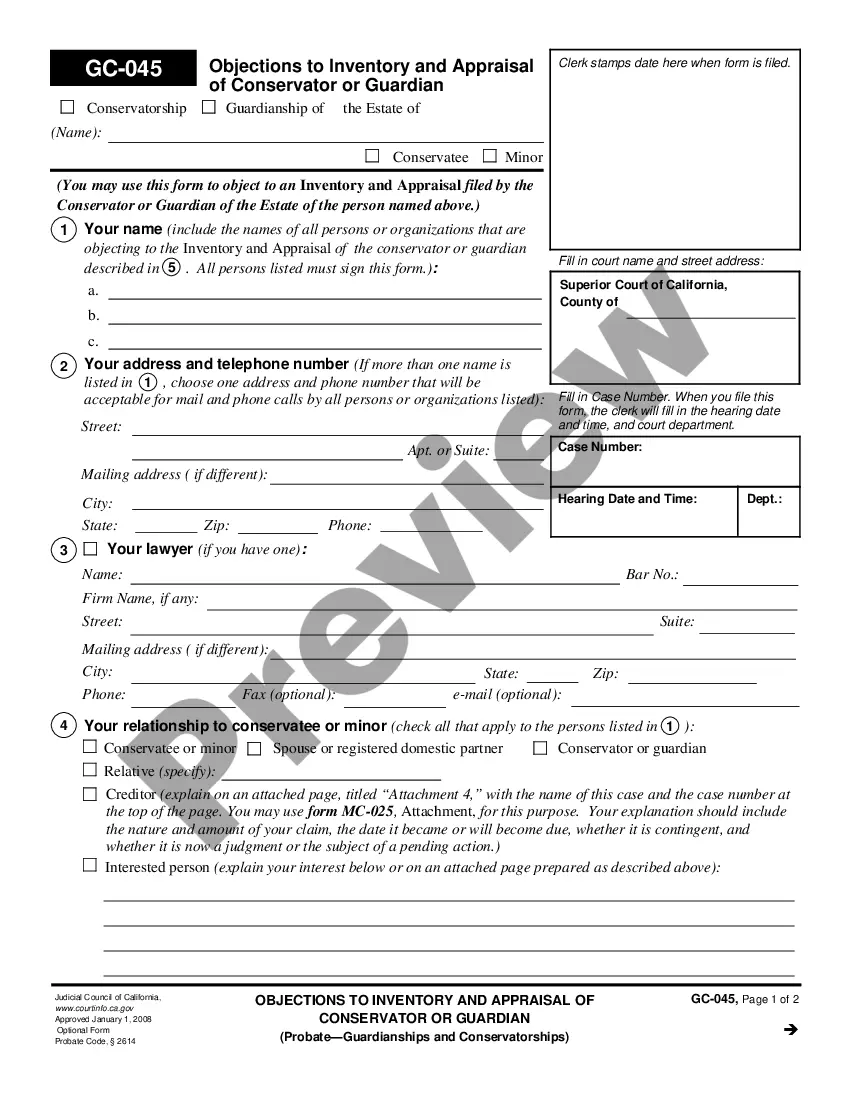

How to fill out California Attachment To Notice Of Filing Of Inventory And Appraisal And How To Object To The Inventory Or The Appraised Value Of Property?

Obtaining validated templates that comply with your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both individual and business requirements, covering various real-life situations.

All forms are appropriately categorized by area of use and jurisdiction, making it as effortless as pie to find the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property.

Maintaining documents organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to have essential document templates readily available for any needs!

- For those already familiar with our inventory and who have used it previously, acquiring the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property requires just a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- This process will demand only a few more steps for newcomers.

- Follow the instructions outlined below to begin with the most comprehensive online form library.

- Examine the Preview mode and form description. Ensure you’ve chosen the correct one that fulfills your requirements and fully aligns with your local jurisdiction stipulations.

Form popularity

FAQ

An inventory appraisal refers to the assessment of a deceased individual's assets to establish their overall value. In the context of Santa Maria, California, this process is vital when handling an estate, as it involves the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal and How to Object to the Inventory or the Appraised Value of Property. This ensures that all property is accurately documented and valued, allowing beneficiaries to understand what they may inherit. If you wish to challenge the appraisal, knowing how to navigate this process can be essential to protecting your interests.

Filling out a probate inventory may seem daunting, but it is straightforward with the right guidance. Start by gathering all assets, including real estate, personal property, and any financial accounts. The Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal will provide clear instructions on documenting the values accurately. Using resources like USLegalForms can simplify this process and ensure you comply with all legal requirements.

After the inventory and appraisal process, the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal becomes essential for all interested parties. This document outlines the officially recognized assets and their values within the probate case. If you wish to challenge the inventory or appraised value, you can use the established procedures to object. Understanding this process is crucial for protecting your rights in California’s probate proceedings.

In probate, inventory refers to the detailed listing of all assets and property belonging to the deceased individual. This document is key in evaluating the estate's total worth and is critical for the subsequent distribution to beneficiaries. If you find that the inventory does not reflect accurate values, the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal offers guidelines on how to raise your objections effectively.

In California, estates valued at $166,250 or less may not need to go through formal probate procedures. However, this threshold can change, so staying informed is essential. For estates that require inventory and appraisal, use the resources available from USLegalForms to understand your options if you wish to challenge any valuations.

To inventory an estate in California, gather all documents related to assets and liabilities and enlist the help of professionals for accurate valuation. The inventory process helps create a clear outline of the estate's worth, which is important for distribution among heirs. If discrepancies arise, the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal serves as a critical element for lodging an objection.

An inventory notice is a formal communication indicating that an inventory statement has been filed with the probate court. This notice ensures that beneficiaries and interested parties are informed of the estate's assets. If you receive an inventory notice in Santa Maria and have concerns about the appraised values or want to raise objections, understanding the filing process is crucial.

Yes, a probate inventory is generally considered public record, making it accessible to interested parties. This transparency helps maintain accountability during the probate process. However, if you feel that the provided inventory values are incorrect, knowing your rights under the Santa Maria California Attachment to Notice of Filing of Inventory and Appraisal can guide you on how to object.

To take inventory in a deceased estate, you start by compiling a list of all assets, including real estate, bank accounts, personal belongings, and investments. Documenting their values is essential, often requiring professional appraisals. Familiarizing yourself with the Attachment to Notice of Filing of Inventory and Appraisal can streamline this process and provide protection if you later need to dispute any values.

Yes, in California, an inventory and appraisal must be served to interested parties, which may include heirs and beneficiaries. This service ensures that everyone stays informed about the estate's assets and values. If you receive such a notice in Santa Maria, understanding how to object to the inventory or appraised value helps you protect your interests.