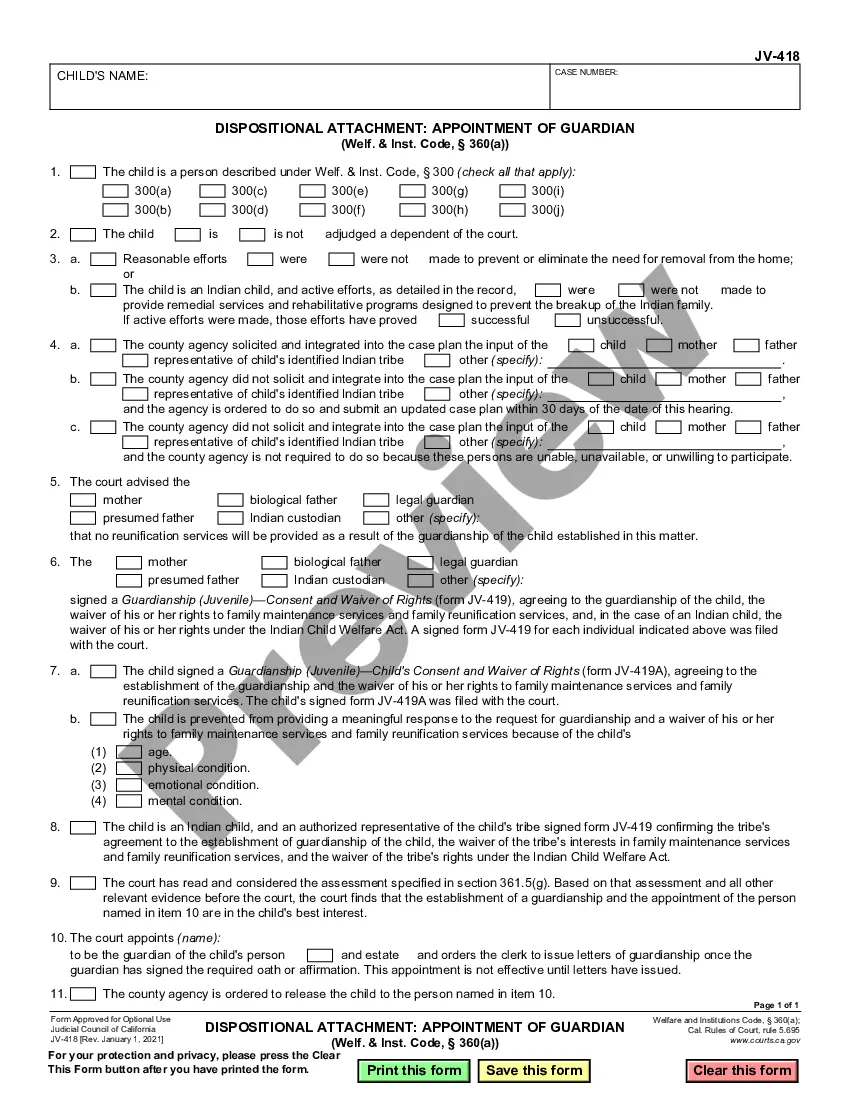

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

San Diego California Schedule A, Receipts-Simplified Account is a form used by taxpayers in the city of San Diego, California, to report their deductions for Schedule A expenses. This form is essential for individuals who want to claim itemized deductions on their state income tax return. The Schedule A, Receipts-Simplified Account form requires taxpayers to provide detailed information about their eligible expenses, such as medical and dental expenses, state and local taxes, home mortgage interest, and charitable contributions. By completing this form accurately, taxpayers can maximize their potential deductions and potentially reduce the amount of tax they owe. There are different types of San Diego California Schedule A, Receipts-Simplified Account, which are specifically designed to address various types of deductible expenses. Some common types include: 1. Medical Expenses: This category of Schedule A cover reimbursed medical and dental expenses, including doctor's visits, prescription medications, hospital stays, and certain medical equipment. 2. State and Local Taxes: Taxpayers can deduct state and local income taxes, property taxes, and sales taxes paid throughout the tax year. This category allows individuals to reduce their tax liability by claiming the taxes they have paid to state and local government entities. 3. Home Mortgage Interest: This category includes the deductible interest paid on a mortgage for a primary or secondary residence. Taxpayers can claim the interest on loans used to purchase, build, or improve their homes, subject to certain limitations. 4. Charitable Contributions: This category allows taxpayers to deduct their donations to qualified charitable organizations. Individuals can claim both cash and non-cash contributions, such as clothing or furniture, as long as they meet specific criteria outlined by the Internal Revenue Service (IRS). It is important for individuals to maintain accurate records and receipts when claiming deductions on their San Diego California Schedule A, Receipts-Simplified Account. These receipts serve as evidence to support the claims made on the form and may be subject to review by the tax authorities. By utilizing the San Diego California Schedule A, Receipts-Simplified Account effectively, taxpayers can potentially reduce their overall tax burden and increase their chances of receiving a higher tax refund or owing less in taxes. It is advisable to consult with a tax professional or refer to the official guidelines provided by the San Diego County tax authorities to ensure compliance with the latest regulations and maximize deductions.San Diego California Schedule A, Receipts-Simplified Account is a form used by taxpayers in the city of San Diego, California, to report their deductions for Schedule A expenses. This form is essential for individuals who want to claim itemized deductions on their state income tax return. The Schedule A, Receipts-Simplified Account form requires taxpayers to provide detailed information about their eligible expenses, such as medical and dental expenses, state and local taxes, home mortgage interest, and charitable contributions. By completing this form accurately, taxpayers can maximize their potential deductions and potentially reduce the amount of tax they owe. There are different types of San Diego California Schedule A, Receipts-Simplified Account, which are specifically designed to address various types of deductible expenses. Some common types include: 1. Medical Expenses: This category of Schedule A cover reimbursed medical and dental expenses, including doctor's visits, prescription medications, hospital stays, and certain medical equipment. 2. State and Local Taxes: Taxpayers can deduct state and local income taxes, property taxes, and sales taxes paid throughout the tax year. This category allows individuals to reduce their tax liability by claiming the taxes they have paid to state and local government entities. 3. Home Mortgage Interest: This category includes the deductible interest paid on a mortgage for a primary or secondary residence. Taxpayers can claim the interest on loans used to purchase, build, or improve their homes, subject to certain limitations. 4. Charitable Contributions: This category allows taxpayers to deduct their donations to qualified charitable organizations. Individuals can claim both cash and non-cash contributions, such as clothing or furniture, as long as they meet specific criteria outlined by the Internal Revenue Service (IRS). It is important for individuals to maintain accurate records and receipts when claiming deductions on their San Diego California Schedule A, Receipts-Simplified Account. These receipts serve as evidence to support the claims made on the form and may be subject to review by the tax authorities. By utilizing the San Diego California Schedule A, Receipts-Simplified Account effectively, taxpayers can potentially reduce their overall tax burden and increase their chances of receiving a higher tax refund or owing less in taxes. It is advisable to consult with a tax professional or refer to the official guidelines provided by the San Diego County tax authorities to ensure compliance with the latest regulations and maximize deductions.