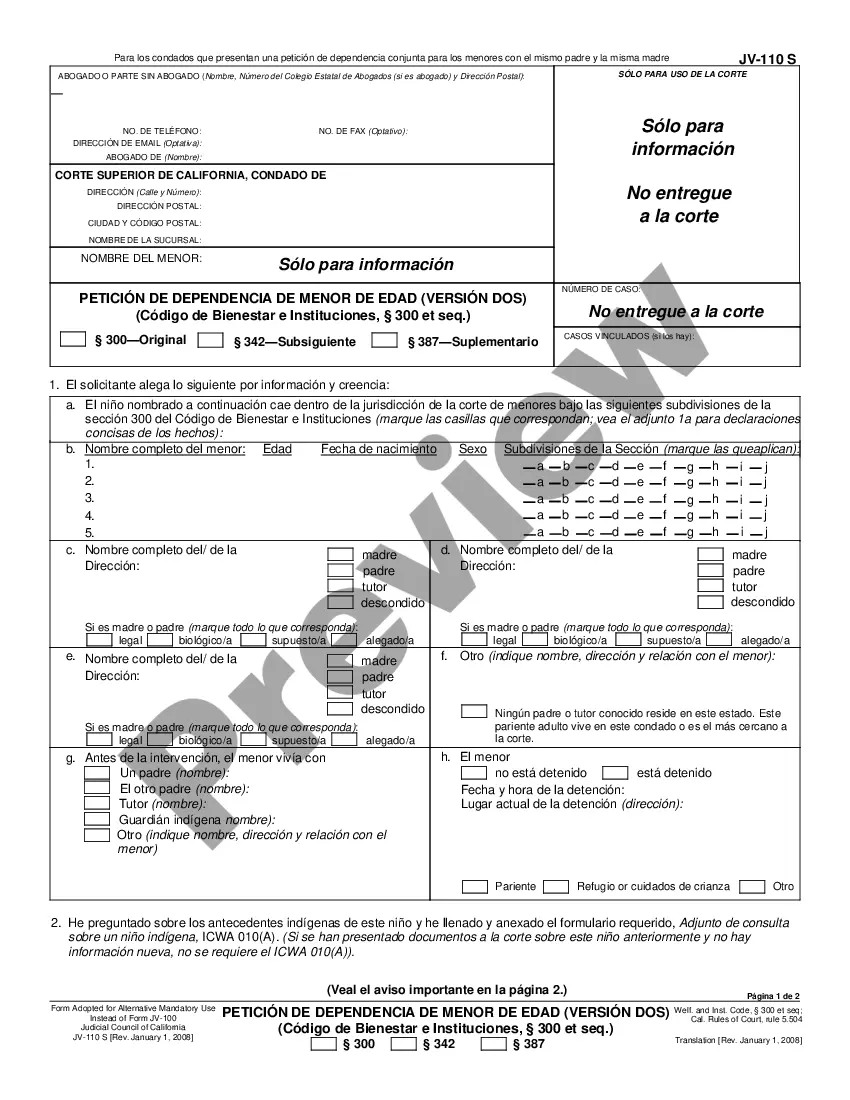

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Downey California Non-Cash Assets on Hand at End of Account Period In standard and simplified account statements, non-cash assets refer to those valuable possessions or resources that an individual or business entity in Downey, California owns and can utilize to generate income but are not in the form of cash. These assets are typically tangible or intangible in nature and can be classified into various categories, including but not limited to: 1. Property and Real Estate: — Commercial buildings and office— - Rental properties and apartments — Land holdings and vacant lot— - Industrial facilities and warehouses 2. Equipment and Machinery: — Manufacturinmachineer— - Computer hardware and software — Vehicles and transportatioequipmenten— - Farming and agricultural machinery 3. Investments: — Stocks, bonds, and mutual fund— - Securities and derivatives — Ownership stakes in othecompaniesie— - Intellectual property rights (patents, copyrights, trademarks) 4. Financial Assets: — Accounts receivable (outstanding payments from customers) — Prepaid expenses (advance payments for services or goods) — Loans and mortgages receivable 5. Inventories and Raw Materials: — FinishegoodDSds inventor— - Raw materials and supplies — Work-in-progress item— - Merchandise available for resale 6. Non-Current Assets: — Long-term investment— - Long-term receivables — Deferred tax asset— - Intangible assets (goodwill, brand reputation) 7. Other Non-Cash Assets: — Non-cash charitable donation— - Non-cash employee benefits or compensations — Non-cash government grants or subsidies It is essential for individuals, businesses, and accounting professionals in Downey, California to accurately document and assess their non-cash assets at the end of an accounting period to ensure comprehensive financial reporting. Proper valuation and management of these assets facilitate informed decision-making, tax planning, and overall financial health. Note: The content generated by AI is solely for the purpose of providing information and should not be considered as professional advice.Downey California Non-Cash Assets on Hand at End of Account Period In standard and simplified account statements, non-cash assets refer to those valuable possessions or resources that an individual or business entity in Downey, California owns and can utilize to generate income but are not in the form of cash. These assets are typically tangible or intangible in nature and can be classified into various categories, including but not limited to: 1. Property and Real Estate: — Commercial buildings and office— - Rental properties and apartments — Land holdings and vacant lot— - Industrial facilities and warehouses 2. Equipment and Machinery: — Manufacturinmachineer— - Computer hardware and software — Vehicles and transportatioequipmenten— - Farming and agricultural machinery 3. Investments: — Stocks, bonds, and mutual fund— - Securities and derivatives — Ownership stakes in othecompaniesie— - Intellectual property rights (patents, copyrights, trademarks) 4. Financial Assets: — Accounts receivable (outstanding payments from customers) — Prepaid expenses (advance payments for services or goods) — Loans and mortgages receivable 5. Inventories and Raw Materials: — FinishegoodDSds inventor— - Raw materials and supplies — Work-in-progress item— - Merchandise available for resale 6. Non-Current Assets: — Long-term investment— - Long-term receivables — Deferred tax asset— - Intangible assets (goodwill, brand reputation) 7. Other Non-Cash Assets: — Non-cash charitable donation— - Non-cash employee benefits or compensations — Non-cash government grants or subsidies It is essential for individuals, businesses, and accounting professionals in Downey, California to accurately document and assess their non-cash assets at the end of an accounting period to ensure comprehensive financial reporting. Proper valuation and management of these assets facilitate informed decision-making, tax planning, and overall financial health. Note: The content generated by AI is solely for the purpose of providing information and should not be considered as professional advice.