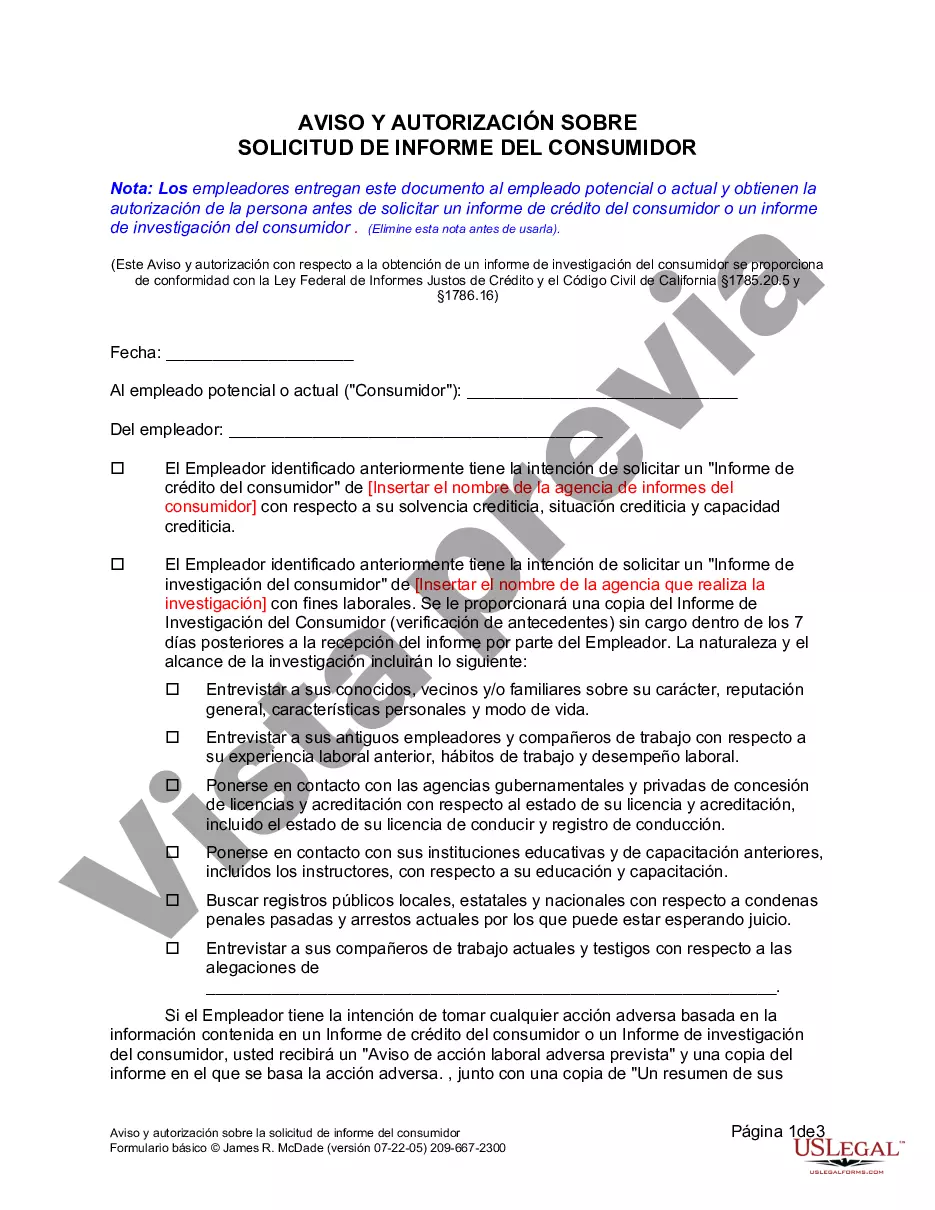

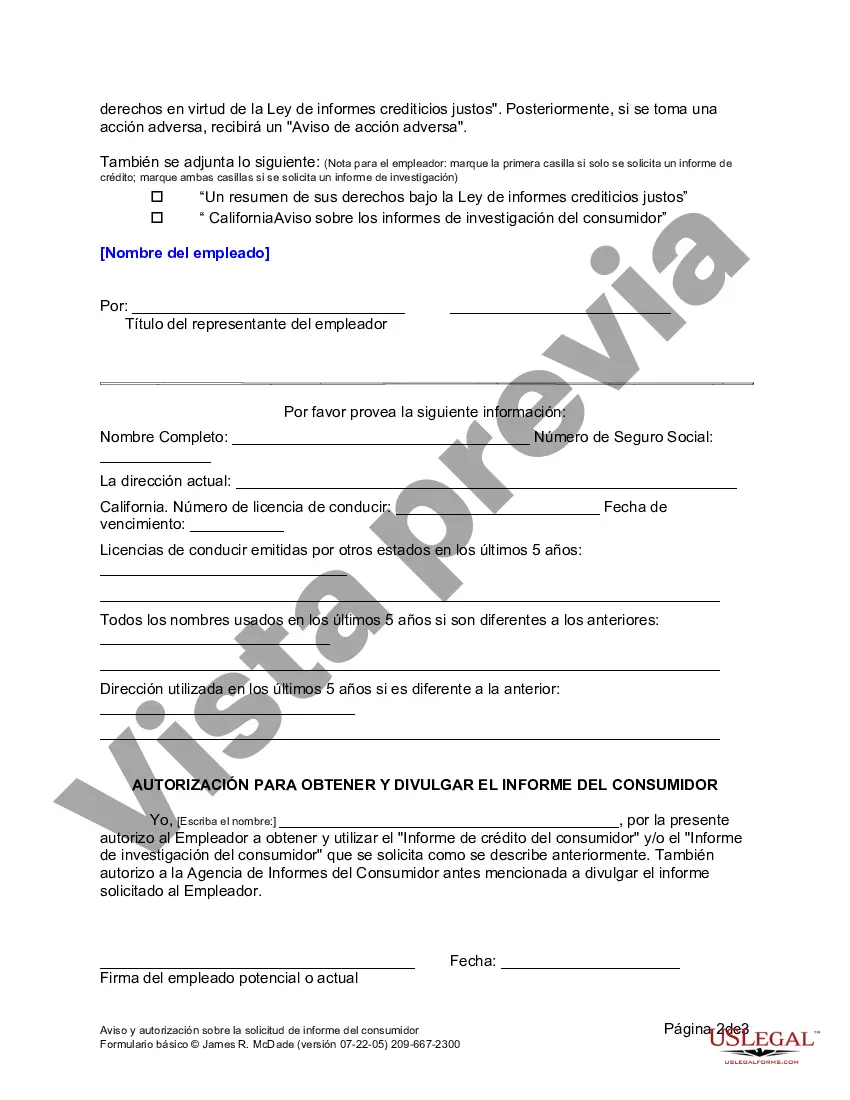

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

Hayward California Notice and Authorization Regarding Consumer Report is a legal document that outlines the rights and responsibilities of individuals and companies involved in the process of obtaining and using consumer reports. This document is essential for businesses operating in Hayward, California as it ensures compliance with state and federal laws regarding consumer data protection. The primary purpose of the Hayward California Notice and Authorization Regarding Consumer Report is to inform the consumer of their rights and obtain their written consent before obtaining and using their consumer report for employment, housing, credit, insurance, or any other permissible purpose. It is crucial for businesses to stay informed about these regulations to avoid legal implications and ensure transparency with their consumers. The different types of Hayward California Notice and Authorization Regarding Consumer Report may include: 1. Employment-related Consumer Reports: This type of consumer report is obtained when a business is considering hiring or promoting an individual. Employers seek information such as employment history, creditworthiness, and criminal records to make informed decisions. 2. Tenant Screening Consumer Reports: Property owners or managers often request tenant screening consumer reports to assess the eligibility and credibility of potential tenants. Information such as rental history, creditworthiness, and eviction records help determine if an applicant is suitable for a property. 3. Insurance Consumer Reports: Insurance companies require consumer reports to evaluate the risk profile of individuals applying for insurance coverage. These reports help in assessing the applicant's claims history, creditworthiness, and other relevant factors to determine insurability and premium rates. 4. Credit Consumer Reports: Creditors and financial institutions use credit consumer reports assessing creditworthiness, repayment capabilities, and financial history before extending credit to individuals. These reports play a significant role in determining loan eligibility, interest rates, and credit limits. It is essential for businesses to provide clear and concise information within the Hayward California Notice and Authorization Regarding Consumer Report to ensure understanding and informed consent from individuals. This document protects the privacy rights of consumers and maintains ethical practices in obtaining and utilizing consumer reports in compliance with local and federal laws.Hayward California Notice and Authorization Regarding Consumer Report is a legal document that outlines the rights and responsibilities of individuals and companies involved in the process of obtaining and using consumer reports. This document is essential for businesses operating in Hayward, California as it ensures compliance with state and federal laws regarding consumer data protection. The primary purpose of the Hayward California Notice and Authorization Regarding Consumer Report is to inform the consumer of their rights and obtain their written consent before obtaining and using their consumer report for employment, housing, credit, insurance, or any other permissible purpose. It is crucial for businesses to stay informed about these regulations to avoid legal implications and ensure transparency with their consumers. The different types of Hayward California Notice and Authorization Regarding Consumer Report may include: 1. Employment-related Consumer Reports: This type of consumer report is obtained when a business is considering hiring or promoting an individual. Employers seek information such as employment history, creditworthiness, and criminal records to make informed decisions. 2. Tenant Screening Consumer Reports: Property owners or managers often request tenant screening consumer reports to assess the eligibility and credibility of potential tenants. Information such as rental history, creditworthiness, and eviction records help determine if an applicant is suitable for a property. 3. Insurance Consumer Reports: Insurance companies require consumer reports to evaluate the risk profile of individuals applying for insurance coverage. These reports help in assessing the applicant's claims history, creditworthiness, and other relevant factors to determine insurability and premium rates. 4. Credit Consumer Reports: Creditors and financial institutions use credit consumer reports assessing creditworthiness, repayment capabilities, and financial history before extending credit to individuals. These reports play a significant role in determining loan eligibility, interest rates, and credit limits. It is essential for businesses to provide clear and concise information within the Hayward California Notice and Authorization Regarding Consumer Report to ensure understanding and informed consent from individuals. This document protects the privacy rights of consumers and maintains ethical practices in obtaining and utilizing consumer reports in compliance with local and federal laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.