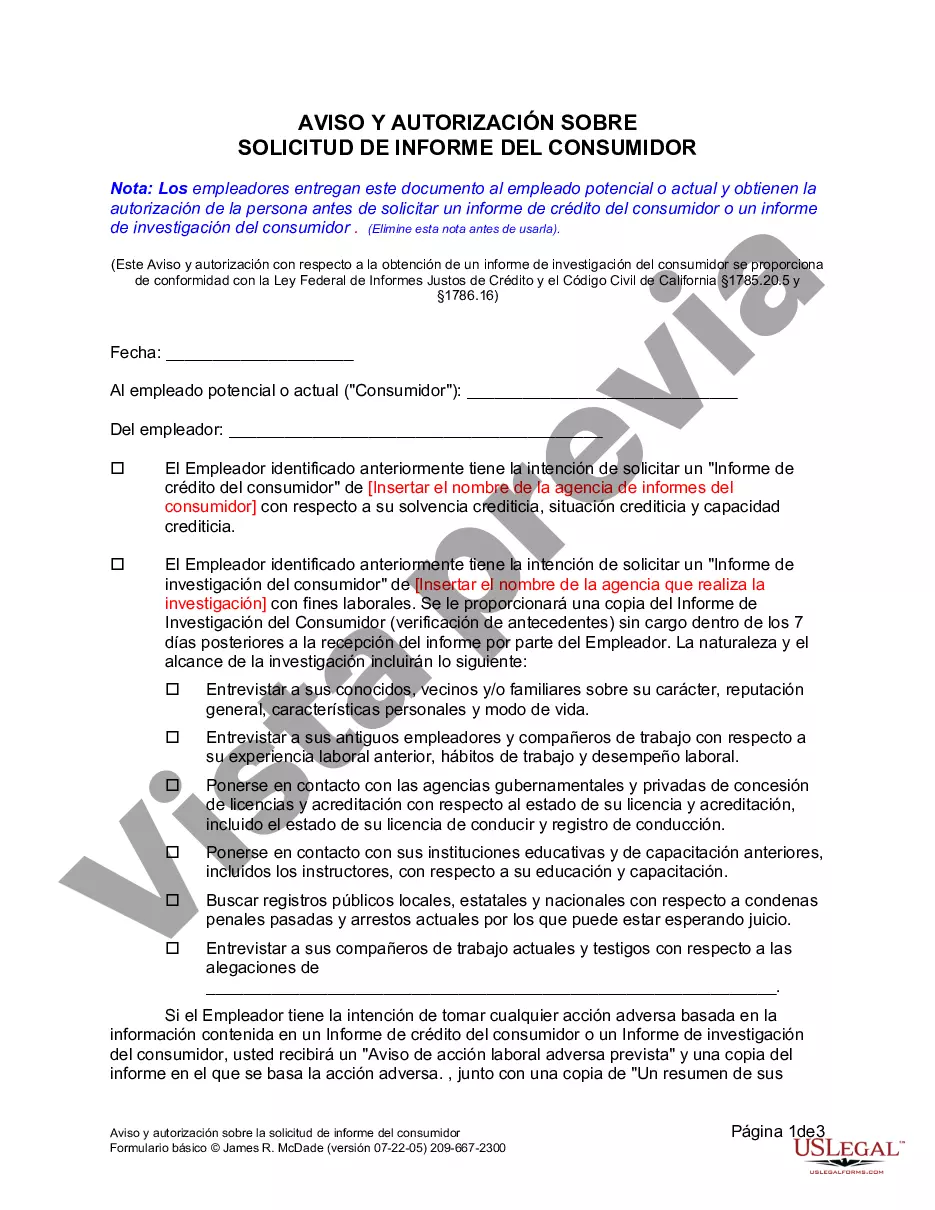

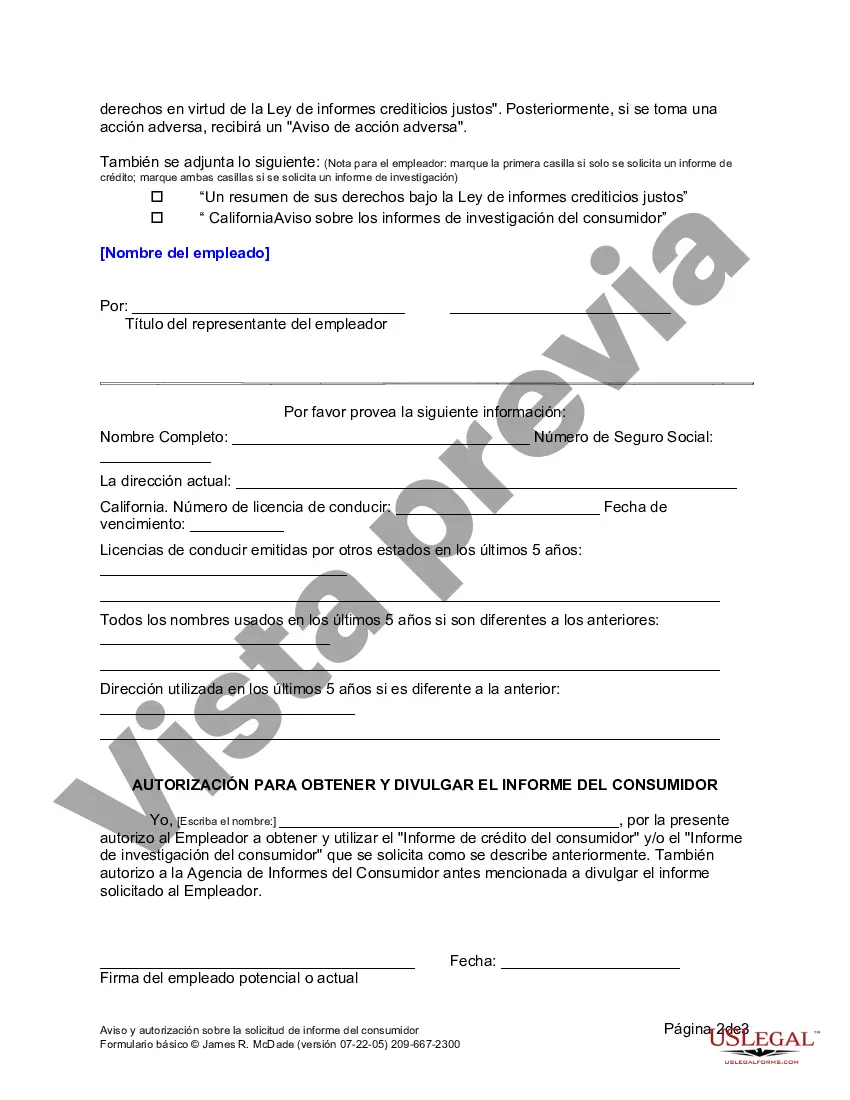

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

Murrieta California Notice and Authorization Regarding Consumer Report is a legal document designed to obtain consent from individuals residing in Murrieta, California, for conducting consumer reports in compliance with the Fair Credit Reporting Act (FCRA) and California State laws. It aims to inform individuals about their rights and obtain their authorization before conducting any background checks or credit reports. This notice and authorization typically consist of the following key elements: 1. Notice: The document starts with a clear and concise notice section, providing individuals with an overview of their rights under FCRA, such as the right to know if an employer is using consumer reports for employment decisions, the right to dispute any inaccurate information, and the right to obtain a copy of the report. 2. Authorization: A section in the document explicitly requests the individual's consent to obtain consumer reports, including but not limited to credit reports, criminal records, employment verification, education verification, and reference checks. The authorization section must be signed and dated by the individual giving their approval voluntarily. 3. Purpose: The Murrieta California Notice and Authorization Regarding Consumer Report include a purpose statement, explaining the exact reasons for which the consumer report will be used. This can include evaluating eligibility for employment, tenancy, credit, insurance, or any other specific purpose allowed under FCRA and California State laws. 4. Information Disclosure: This section outlines the specific information that may be disclosed to the consumer reporting agency, such as personal identification information (e.g., name, address, social security number), employment history, educational background, credit history, criminal records, and other relevant data necessary for conducting the consumer report. 5. Release of Liability: The document may include a release of liability clause, indemnifying the employer or entity requesting the consumer report from any legal claims arising from the authorized use of the information obtained. Other types or variations of the Murrieta California Notice and Authorization Regarding Consumer Report may include: 1. Tenant Background Check Authorization: Specifically designed for landlords or property management companies intending to conduct consumer reports on prospective tenants for residential rental purposes. 2. Financial Institution Authorization: Tailored for financial institutions or lenders aiming to examine the creditworthiness and financial history of individuals applying for loans, mortgages, or credit cards. 3. Volunteer Screening Authorization: Suitable for organizations or nonprofits screening individuals volunteering for sensitive or vulnerable population-related activities, ensuring the safety and security of those they serve. 4. Insurance Application Authorization: Primarily used by insurance companies to evaluate an applicant's risk profile and determine premium rates by accessing their credit report, driving history, and other relevant data. In conclusion, the Murrieta California Notice and Authorization Regarding Consumer Report is a crucial document used to obtain consent and inform individuals about their rights regarding the use of consumer reports. This comprehensive authorization ensures compliance with applicable laws while protecting the privacy and interests of individuals and organizations involved.Murrieta California Notice and Authorization Regarding Consumer Report is a legal document designed to obtain consent from individuals residing in Murrieta, California, for conducting consumer reports in compliance with the Fair Credit Reporting Act (FCRA) and California State laws. It aims to inform individuals about their rights and obtain their authorization before conducting any background checks or credit reports. This notice and authorization typically consist of the following key elements: 1. Notice: The document starts with a clear and concise notice section, providing individuals with an overview of their rights under FCRA, such as the right to know if an employer is using consumer reports for employment decisions, the right to dispute any inaccurate information, and the right to obtain a copy of the report. 2. Authorization: A section in the document explicitly requests the individual's consent to obtain consumer reports, including but not limited to credit reports, criminal records, employment verification, education verification, and reference checks. The authorization section must be signed and dated by the individual giving their approval voluntarily. 3. Purpose: The Murrieta California Notice and Authorization Regarding Consumer Report include a purpose statement, explaining the exact reasons for which the consumer report will be used. This can include evaluating eligibility for employment, tenancy, credit, insurance, or any other specific purpose allowed under FCRA and California State laws. 4. Information Disclosure: This section outlines the specific information that may be disclosed to the consumer reporting agency, such as personal identification information (e.g., name, address, social security number), employment history, educational background, credit history, criminal records, and other relevant data necessary for conducting the consumer report. 5. Release of Liability: The document may include a release of liability clause, indemnifying the employer or entity requesting the consumer report from any legal claims arising from the authorized use of the information obtained. Other types or variations of the Murrieta California Notice and Authorization Regarding Consumer Report may include: 1. Tenant Background Check Authorization: Specifically designed for landlords or property management companies intending to conduct consumer reports on prospective tenants for residential rental purposes. 2. Financial Institution Authorization: Tailored for financial institutions or lenders aiming to examine the creditworthiness and financial history of individuals applying for loans, mortgages, or credit cards. 3. Volunteer Screening Authorization: Suitable for organizations or nonprofits screening individuals volunteering for sensitive or vulnerable population-related activities, ensuring the safety and security of those they serve. 4. Insurance Application Authorization: Primarily used by insurance companies to evaluate an applicant's risk profile and determine premium rates by accessing their credit report, driving history, and other relevant data. In conclusion, the Murrieta California Notice and Authorization Regarding Consumer Report is a crucial document used to obtain consent and inform individuals about their rights regarding the use of consumer reports. This comprehensive authorization ensures compliance with applicable laws while protecting the privacy and interests of individuals and organizations involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.