Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

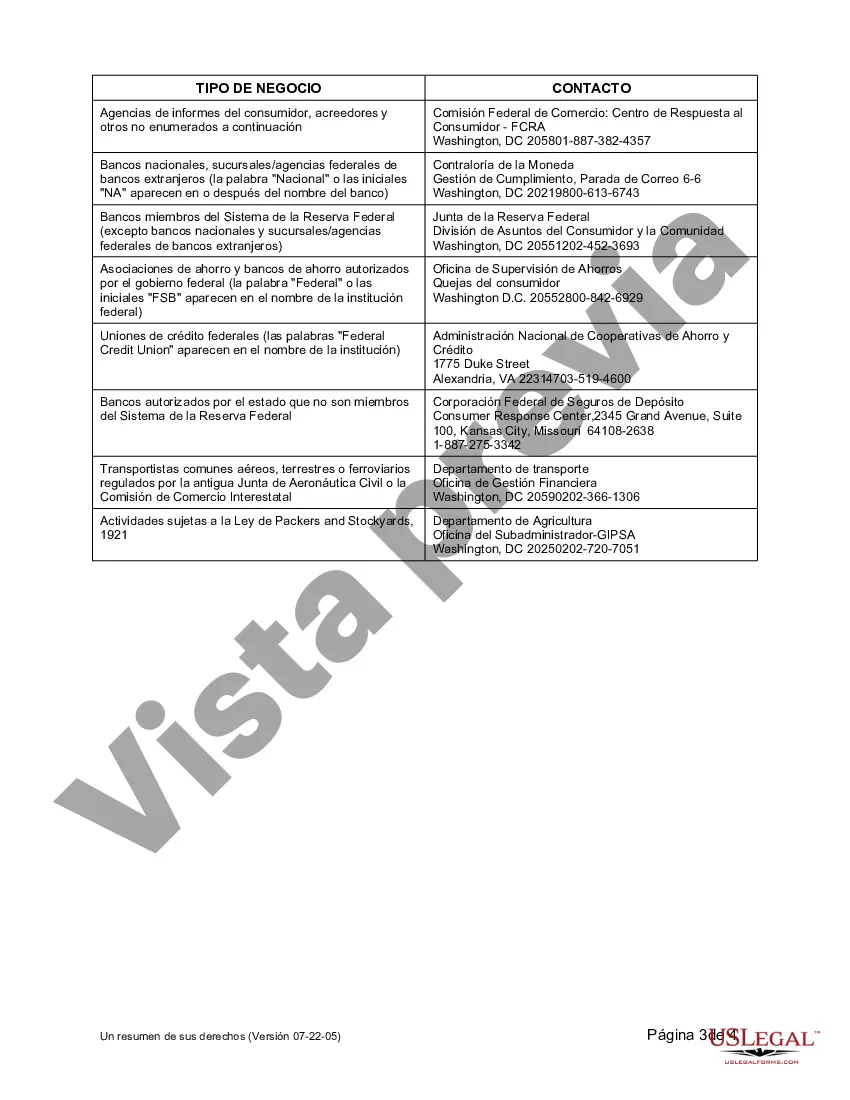

Title: Understanding Burbank California Summary of Fair Credit Reporting Act Rights Introduction: The Burbank California Summary of Fair Credit Reporting Act (FCRA) Rights outlines the rights and responsibilities of consumers in relation to their credit reports. This comprehensive guide aims to provide you with a detailed understanding of your rights under the FCRA and how they apply specifically to residents of Burbank, California. This summary ensures that you are well-informed about the various types of rights conferred to you as a consumer. 1. Access to Free Credit Reports: As a resident of Burbank, California, you have the right to a free copy of your credit report from each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) once every 12 months. This right allows you to monitor and review your credit history, ensuring accuracy and identifying any potential discrepancies. 2. Right to Dispute Inaccurate Information: Under the FCRA, you have the right to dispute any inaccurate or incomplete information on your credit report. If you discover errors, such as incorrect personal details, fraudulent accounts, or outdated information, you can request the credit reporting agencies to investigate and correct them. The Burbank California Summary reinforces this right, empowering you to maintain an accurate credit history. 3. Notification of Adverse Actions: When an adverse action is taken against you, such as denial of credit, employment, or insurance, based on information contained in your credit report, you have the right to be notified. The Burbank California Summary ensures that you are informed of these actions and provided with the reasons and sources behind them, promoting transparency and accountability. 4. Consent for Credit Report Access: Before obtaining your credit report, agencies and entities are required to seek your consent. This means that your credit report cannot be accessed without a legitimate reason, such as for loan applications, employment screenings, or tenant screenings. The Burbank California Summary emphasizes your right to grant or deny consent for credit report access, adding an extra layer of protection to your personal information. 5. Identity Theft Protection: The Burbank California Summary highlights your rights in cases of identity theft. If your identity is stolen, you have the right to place fraud alerts or security freezes on your credit reports. These measures help prevent potential fraudulent activity and unauthorized access to your credit information, thereby safeguarding your financial well-being. 6. Disclosure of Credit Scores: When your credit score is used to determine a decision, such as loan terms or insurance rates, you have the right to be informed of the score used. The Burbank California Summary ensures that you are provided with this crucial information, allowing you to understand how your creditworthiness is evaluated. Conclusion: The Burbank California Summary of Fair Credit Reporting Act Rights is a comprehensive guide that empowers you as a consumer, ensuring your rights are protected under the FCRA. By understanding and utilizing these rights, you can actively manage and maintain a healthy credit history, promoting financial well-being and security. Stay informed, exercise your rights, and safeguard your creditworthiness in Burbank, California.Title: Understanding Burbank California Summary of Fair Credit Reporting Act Rights Introduction: The Burbank California Summary of Fair Credit Reporting Act (FCRA) Rights outlines the rights and responsibilities of consumers in relation to their credit reports. This comprehensive guide aims to provide you with a detailed understanding of your rights under the FCRA and how they apply specifically to residents of Burbank, California. This summary ensures that you are well-informed about the various types of rights conferred to you as a consumer. 1. Access to Free Credit Reports: As a resident of Burbank, California, you have the right to a free copy of your credit report from each of the three major credit reporting agencies (Experian, Equifax, and TransUnion) once every 12 months. This right allows you to monitor and review your credit history, ensuring accuracy and identifying any potential discrepancies. 2. Right to Dispute Inaccurate Information: Under the FCRA, you have the right to dispute any inaccurate or incomplete information on your credit report. If you discover errors, such as incorrect personal details, fraudulent accounts, or outdated information, you can request the credit reporting agencies to investigate and correct them. The Burbank California Summary reinforces this right, empowering you to maintain an accurate credit history. 3. Notification of Adverse Actions: When an adverse action is taken against you, such as denial of credit, employment, or insurance, based on information contained in your credit report, you have the right to be notified. The Burbank California Summary ensures that you are informed of these actions and provided with the reasons and sources behind them, promoting transparency and accountability. 4. Consent for Credit Report Access: Before obtaining your credit report, agencies and entities are required to seek your consent. This means that your credit report cannot be accessed without a legitimate reason, such as for loan applications, employment screenings, or tenant screenings. The Burbank California Summary emphasizes your right to grant or deny consent for credit report access, adding an extra layer of protection to your personal information. 5. Identity Theft Protection: The Burbank California Summary highlights your rights in cases of identity theft. If your identity is stolen, you have the right to place fraud alerts or security freezes on your credit reports. These measures help prevent potential fraudulent activity and unauthorized access to your credit information, thereby safeguarding your financial well-being. 6. Disclosure of Credit Scores: When your credit score is used to determine a decision, such as loan terms or insurance rates, you have the right to be informed of the score used. The Burbank California Summary ensures that you are provided with this crucial information, allowing you to understand how your creditworthiness is evaluated. Conclusion: The Burbank California Summary of Fair Credit Reporting Act Rights is a comprehensive guide that empowers you as a consumer, ensuring your rights are protected under the FCRA. By understanding and utilizing these rights, you can actively manage and maintain a healthy credit history, promoting financial well-being and security. Stay informed, exercise your rights, and safeguard your creditworthiness in Burbank, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.