Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

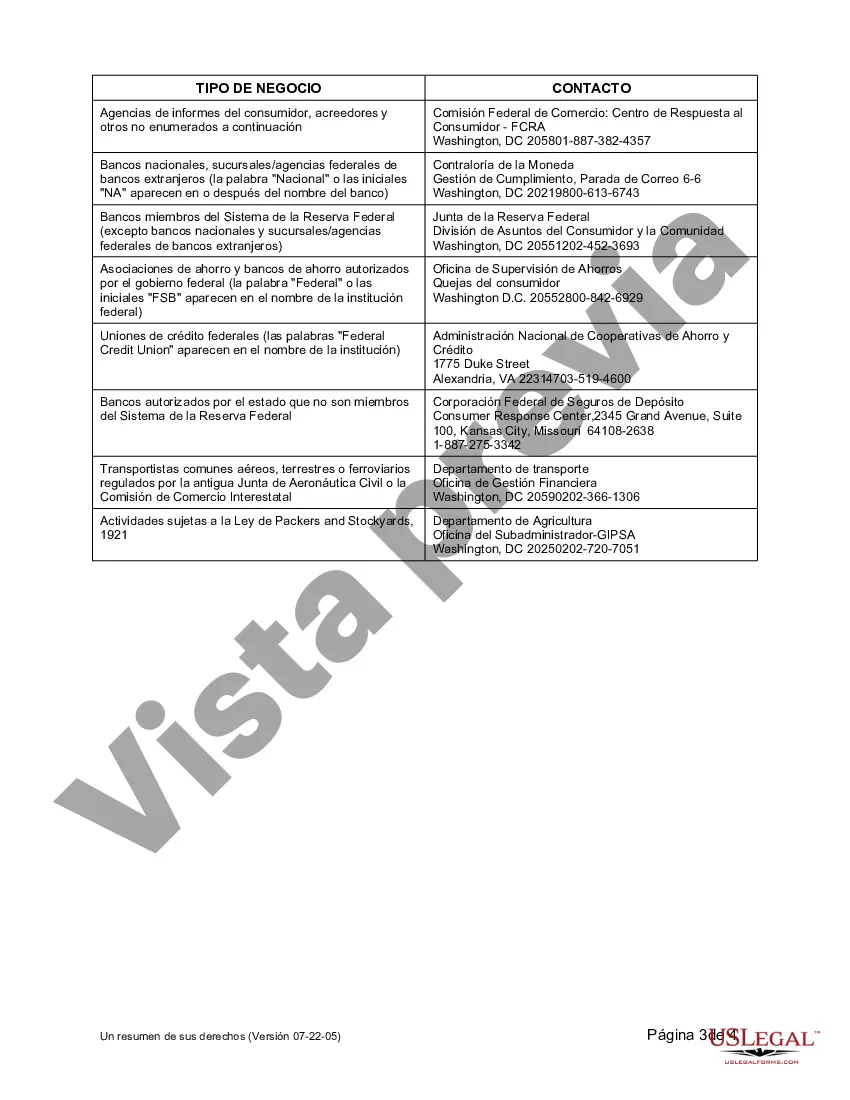

Concord California Summary of Fair Credit Reporting Act Rights is an important document that outlines the rights and protections granted to individuals in relation to their credit information under the federal Fair Credit Reporting Act (FCRA). It is crucial to understand these rights to ensure fair and accurate reporting of credit information by the consumer reporting agencies (Crash). The FCRA aims to promote accuracy, privacy, and fairness in the collection and use of consumer information by Crash. It applies to credit reporting agencies, banks, credit unions, mortgage lenders, and other entities involved in providing credit or collecting debt. The Concord California Summary of Fair Credit Reporting Act Rights provides individuals with the knowledge of their rights in various credit-related situations. Some key rights and protections covered by the summary include: 1. Access to Credit Reports: Individuals have the right to obtain a copy of their credit report from all major Crash once every 12 months. This allows consumers to review their credit history and ensure its accuracy. 2. Dispute Process: If individuals identify inaccuracies or incomplete information in their credit reports, they have the right to dispute those errors with the Crash. The FCRA mandates that the Crash must investigate the disputed information within 30 days, and if it is found to be incorrect, they must promptly update the credit report. 3. Identity Theft Protection: The summary also educates individuals about the steps to take if they suspect they have become victims of identity theft. It highlights the need to place a fraud alert on their credit file, obtain an extended fraud alert, or even freeze their credit file. 4. Adverse Actions: Individuals must be informed if their credit report was used to deny them credit, employment, insurance, or rental applications. The summary explains the right to receive notice and contact information of the CRA that provided the credit report. 5. Prescreened Offers: The FCRA gives individuals the right to "opt-out" of receiving unsolicited prescreened offers of credit and insurance by mail. This helps protect privacy and reduce the risk of identity theft. It is important to note that the Concord California Summary of Fair Credit Reporting Act Rights serves as a simplified overview of the FCRA provisions applicable in California. It also informs individuals of their rights under the California Consumer Credit Reporting Agencies Act (CC RAA), which provides additional protections specific to California residents. In conclusion, the Concord California Summary of Fair Credit Reporting Act Rights is a comprehensive resource that empowers consumers with knowledge about their rights regarding credit reporting. Understanding these rights is vital for individuals to proactively monitor and manage their credit information, ensuring accurate and fair reporting by Crash.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.