Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

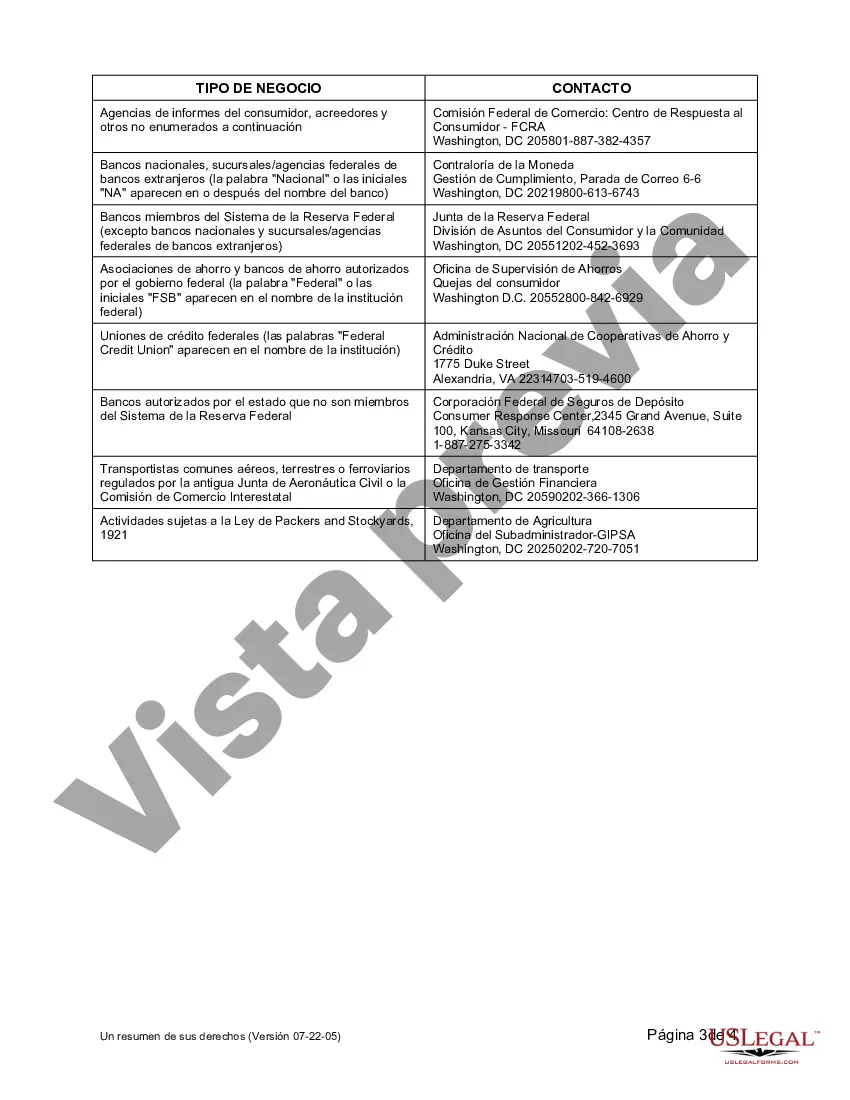

Keywords: Oceanside California, Fair Credit Reporting Act, FCRA, rights, detailed description, types Title: Understanding Your Oceanside California Summary of Fair Credit Reporting Act Rights Introduction: In Oceanside, California, individuals are protected by the Fair Credit Reporting Act (FCRA), which grants specific rights and regulations pertaining to their credit reporting. This comprehensive guide aims to provide a detailed description of the Oceanside California Summary of Fair Credit Reporting Act Rights, shedding light on the various types and provisions that individuals need to be aware of. 1. The Basic Rights: The Oceanside California Summary of Fair Credit Reporting Act Rights encompasses several fundamental rights that every individual should be aware of. These include: — Access to Free Credit Reports: Under the FCRA, consumers are entitled to a free copy of their credit report from each of the three major credit reporting agencies (CRA) — Equifax, Experian, and TransUnion, once every 12 months. — Dispute Process: If inaccuracies or discrepancies are found in your credit report, you have the right to dispute them with both the credit reporting agency and the information provider. The FCRA ensures a fair and timely investigation of your disputes. — Consent Requirement: Prior to obtaining your credit report, potential employers, lenders, and insurance agencies must obtain your written consent. — Limitation on Reporting Negative Information: The FCRA places certain limitations on how long negative information can stay on your credit report, ensuring a more accurate reflection of your creditworthiness over time. 2. The Types of Oceanside California Summary of Fair Credit Reporting Act Rights: Beyond the basic rights, there are specific types of FCRA rights that individuals in Oceanside can assert to protect their credit-related information. These include: — Adverse Action Rights: If an adverse action, such as a denial of credit, employment, or insurance, is taken against you based on information found in your credit report, you have the right to receive a notice and explanation of the adverse action. — Identity Theft Protection Rights: In cases of identity theft, the FCRA guarantees specific rights for Oceanside residents, allowing them to place fraud alerts and credit freezes on their credit reports, as well as dispute fraudulent accounts or information. — Consumer Reporting Agency Obligations: The FCRA outlines the obligations of consumer reporting agencies, ensuring they collect and maintain accurate information, handle disputes efficiently, and provide individuals with their rights as consumers. Conclusion: Being aware of your Oceanside California Summary of Fair Credit Reporting Act Rights is essential for safeguarding your credit-related information. Whether it's accessing your free credit reports, disputing inaccuracies, or understanding your rights in adverse actions or identity theft situations, the FCRA is designed to protect consumers in Oceanside and provide them with the necessary tools to maintain a fair and accurate credit reporting system.Keywords: Oceanside California, Fair Credit Reporting Act, FCRA, rights, detailed description, types Title: Understanding Your Oceanside California Summary of Fair Credit Reporting Act Rights Introduction: In Oceanside, California, individuals are protected by the Fair Credit Reporting Act (FCRA), which grants specific rights and regulations pertaining to their credit reporting. This comprehensive guide aims to provide a detailed description of the Oceanside California Summary of Fair Credit Reporting Act Rights, shedding light on the various types and provisions that individuals need to be aware of. 1. The Basic Rights: The Oceanside California Summary of Fair Credit Reporting Act Rights encompasses several fundamental rights that every individual should be aware of. These include: — Access to Free Credit Reports: Under the FCRA, consumers are entitled to a free copy of their credit report from each of the three major credit reporting agencies (CRA) — Equifax, Experian, and TransUnion, once every 12 months. — Dispute Process: If inaccuracies or discrepancies are found in your credit report, you have the right to dispute them with both the credit reporting agency and the information provider. The FCRA ensures a fair and timely investigation of your disputes. — Consent Requirement: Prior to obtaining your credit report, potential employers, lenders, and insurance agencies must obtain your written consent. — Limitation on Reporting Negative Information: The FCRA places certain limitations on how long negative information can stay on your credit report, ensuring a more accurate reflection of your creditworthiness over time. 2. The Types of Oceanside California Summary of Fair Credit Reporting Act Rights: Beyond the basic rights, there are specific types of FCRA rights that individuals in Oceanside can assert to protect their credit-related information. These include: — Adverse Action Rights: If an adverse action, such as a denial of credit, employment, or insurance, is taken against you based on information found in your credit report, you have the right to receive a notice and explanation of the adverse action. — Identity Theft Protection Rights: In cases of identity theft, the FCRA guarantees specific rights for Oceanside residents, allowing them to place fraud alerts and credit freezes on their credit reports, as well as dispute fraudulent accounts or information. — Consumer Reporting Agency Obligations: The FCRA outlines the obligations of consumer reporting agencies, ensuring they collect and maintain accurate information, handle disputes efficiently, and provide individuals with their rights as consumers. Conclusion: Being aware of your Oceanside California Summary of Fair Credit Reporting Act Rights is essential for safeguarding your credit-related information. Whether it's accessing your free credit reports, disputing inaccuracies, or understanding your rights in adverse actions or identity theft situations, the FCRA is designed to protect consumers in Oceanside and provide them with the necessary tools to maintain a fair and accurate credit reporting system.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.