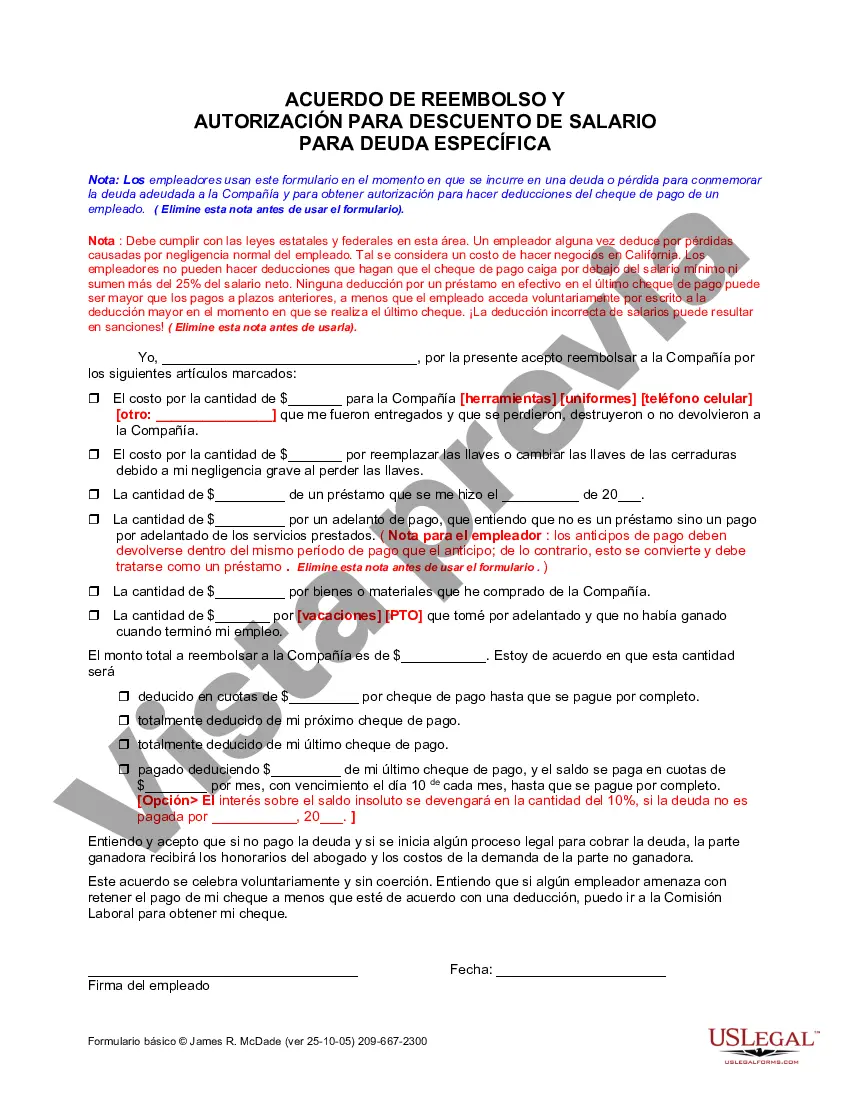

Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

Carlsbad California Authorization for Deduction from Pay for a Specific Debt is a legal document that allows a creditor to deduct a specific amount from an individual's paycheck to repay a particular debt. This authorization is typically used when an individual has failed to make regular payments towards their debt and a new repayment method needs to be established. This type of authorization is commonly used for various types of debts, including but not limited to: 1. Car Loan Debt: If an individual has outstanding payments on their car loan, the creditor may request a Carlsbad California Authorization for Deduction from Pay for a Specific Debt to ensure regular repayments. Through this authorization, a predetermined amount is deducted from the borrower's paycheck until the debt is fully repaid. 2. Student Loan Debt: In cases where individuals have defaulted on their student loans, lenders or loan services may seek an authorization to deduct a certain amount from the borrower's paycheck. Carlsbad California Authorization for Deduction from Pay for a Specific Debt can help facilitate the repayment process and ensure the borrower meets their obligations. 3. Personal Loan Debt: For individuals who have outstanding personal loan debts, creditors may opt to utilize this authorization to automatically deduct the agreed-upon repayment amount from the borrower's paycheck. This allows for a structured repayment plan and helps the borrower stay on track with their financial responsibilities. It is important to note that this authorization must comply with state laws and regulations to ensure the rights of both the debtor and creditor are protected. The specific terms and conditions of Carlsbad California Authorization for Deduction from Pay for a Specific Debt should be clearly outlined, including the amount to be deducted, the frequency of deductions, and any applicable fees or interest rates. To initiate the process, both the debtor and creditor must sign the authorization, acknowledging their understanding and agreement to the terms. This document serves as a legally binding agreement, and any changes to the deduction amount or duration may require written consent from both parties. In summary, Carlsbad California Authorization for Deduction from Pay for a Specific Debt is a valuable tool that provides a structured repayment method for various types of debts, such as car loans, student loans, and personal loans. This authorization ensures timely and consistent payments by allowing creditors to deduct a predetermined amount from the debtor's paycheck until the debt is fully satisfied.Carlsbad California Authorization for Deduction from Pay for a Specific Debt is a legal document that allows a creditor to deduct a specific amount from an individual's paycheck to repay a particular debt. This authorization is typically used when an individual has failed to make regular payments towards their debt and a new repayment method needs to be established. This type of authorization is commonly used for various types of debts, including but not limited to: 1. Car Loan Debt: If an individual has outstanding payments on their car loan, the creditor may request a Carlsbad California Authorization for Deduction from Pay for a Specific Debt to ensure regular repayments. Through this authorization, a predetermined amount is deducted from the borrower's paycheck until the debt is fully repaid. 2. Student Loan Debt: In cases where individuals have defaulted on their student loans, lenders or loan services may seek an authorization to deduct a certain amount from the borrower's paycheck. Carlsbad California Authorization for Deduction from Pay for a Specific Debt can help facilitate the repayment process and ensure the borrower meets their obligations. 3. Personal Loan Debt: For individuals who have outstanding personal loan debts, creditors may opt to utilize this authorization to automatically deduct the agreed-upon repayment amount from the borrower's paycheck. This allows for a structured repayment plan and helps the borrower stay on track with their financial responsibilities. It is important to note that this authorization must comply with state laws and regulations to ensure the rights of both the debtor and creditor are protected. The specific terms and conditions of Carlsbad California Authorization for Deduction from Pay for a Specific Debt should be clearly outlined, including the amount to be deducted, the frequency of deductions, and any applicable fees or interest rates. To initiate the process, both the debtor and creditor must sign the authorization, acknowledging their understanding and agreement to the terms. This document serves as a legally binding agreement, and any changes to the deduction amount or duration may require written consent from both parties. In summary, Carlsbad California Authorization for Deduction from Pay for a Specific Debt is a valuable tool that provides a structured repayment method for various types of debts, such as car loans, student loans, and personal loans. This authorization ensures timely and consistent payments by allowing creditors to deduct a predetermined amount from the debtor's paycheck until the debt is fully satisfied.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.