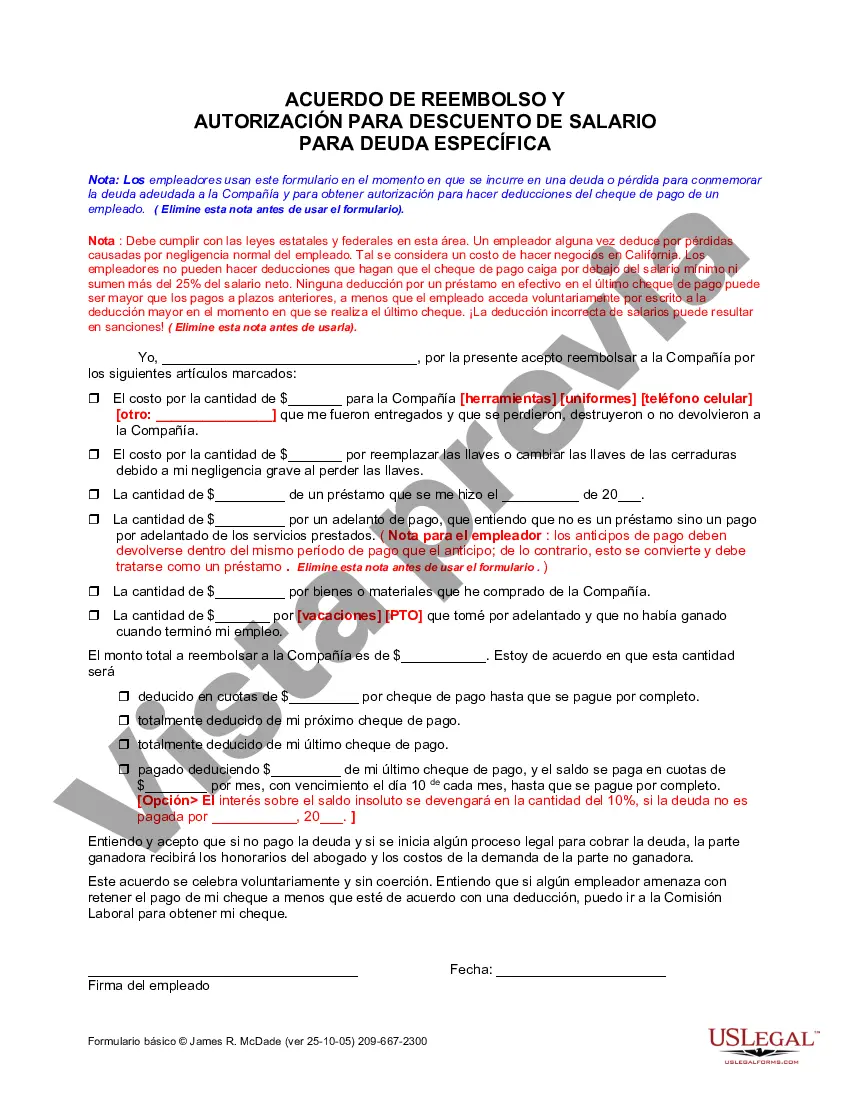

Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

Garden Grove California Authorization for Deduction from Pay for a Specific Debt is a legal document that allows a creditor to collect a debt directly from the wages or salary of an individual who owes money. This powerful tool helps creditors enforce their rights and ensures timely repayment. It is essential to understand the specific requirements and provisions associated with such authorization to protect the rights of both creditors and debtors in Garden Grove, California. One type of Garden Grove California Authorization for Deduction from Pay for a Specific Debt is the Wage Garnishment Authorization. This document allows a creditor to collect a portion of the debtor's wages until the debt is fully satisfied. Wage garnishment provides a systematic approach to debt collection, preventing further accumulation of debt and ensuring timely repayment. Another type is the Salary Deduction Authorization, which authorizes a creditor to deduct a specific amount from the debtor's salary or wages. This type of authorization is suitable for long-term repayment plans, enabling steady and manageable debt reduction without causing significant financial strain on the debtor. To initiate the process, the creditor must first obtain a court order or judgment against the debtor. Once the court order is secured, the creditor can present the Garden Grove California Authorization for Deduction from Pay for a Specific Debt to the debtor's employer. This document outlines the terms and conditions of the wage garnishment or salary deduction, including the amount to be deducted, the frequency of deductions, and the duration of the authorization. It is important to note that there are legal limitations on the amount that can be deducted from a debtor's pay. In Garden Grove, California, federal laws such as the Consumer Credit Protection Act (CCPA) place restrictions on the maximum percentage of wages that can be garnished. The specific limitations depend on the debtor's disposable income and the type of debt being collected. Furthermore, Garden Grove California Authorization for Deduction from Pay for a Specific Debt also provides provisions for protecting the debtor's rights. Debtors have the right to receive written notice of the wage garnishment or salary deduction, including details about the debt being collected and the action being taken. Additionally, debtors have the right to challenge the garnishment or deduction if they believe it is incorrect or unfair. In conclusion, Garden Grove California Authorization for Deduction from Pay for a Specific Debt is a crucial legal document that enables creditors to collect debts directly from a debtor's wages or salary. There are different types of authorizations, including wage garnishment and salary deduction, each suitable for specific debt repayment scenarios. It is vital for both creditors and debtors to understand the rights, provisions, and limitations associated with these authorizations to ensure fair and lawful debt collection practices in Garden Grove, California.Garden Grove California Authorization for Deduction from Pay for a Specific Debt is a legal document that allows a creditor to collect a debt directly from the wages or salary of an individual who owes money. This powerful tool helps creditors enforce their rights and ensures timely repayment. It is essential to understand the specific requirements and provisions associated with such authorization to protect the rights of both creditors and debtors in Garden Grove, California. One type of Garden Grove California Authorization for Deduction from Pay for a Specific Debt is the Wage Garnishment Authorization. This document allows a creditor to collect a portion of the debtor's wages until the debt is fully satisfied. Wage garnishment provides a systematic approach to debt collection, preventing further accumulation of debt and ensuring timely repayment. Another type is the Salary Deduction Authorization, which authorizes a creditor to deduct a specific amount from the debtor's salary or wages. This type of authorization is suitable for long-term repayment plans, enabling steady and manageable debt reduction without causing significant financial strain on the debtor. To initiate the process, the creditor must first obtain a court order or judgment against the debtor. Once the court order is secured, the creditor can present the Garden Grove California Authorization for Deduction from Pay for a Specific Debt to the debtor's employer. This document outlines the terms and conditions of the wage garnishment or salary deduction, including the amount to be deducted, the frequency of deductions, and the duration of the authorization. It is important to note that there are legal limitations on the amount that can be deducted from a debtor's pay. In Garden Grove, California, federal laws such as the Consumer Credit Protection Act (CCPA) place restrictions on the maximum percentage of wages that can be garnished. The specific limitations depend on the debtor's disposable income and the type of debt being collected. Furthermore, Garden Grove California Authorization for Deduction from Pay for a Specific Debt also provides provisions for protecting the debtor's rights. Debtors have the right to receive written notice of the wage garnishment or salary deduction, including details about the debt being collected and the action being taken. Additionally, debtors have the right to challenge the garnishment or deduction if they believe it is incorrect or unfair. In conclusion, Garden Grove California Authorization for Deduction from Pay for a Specific Debt is a crucial legal document that enables creditors to collect debts directly from a debtor's wages or salary. There are different types of authorizations, including wage garnishment and salary deduction, each suitable for specific debt repayment scenarios. It is vital for both creditors and debtors to understand the rights, provisions, and limitations associated with these authorizations to ensure fair and lawful debt collection practices in Garden Grove, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.