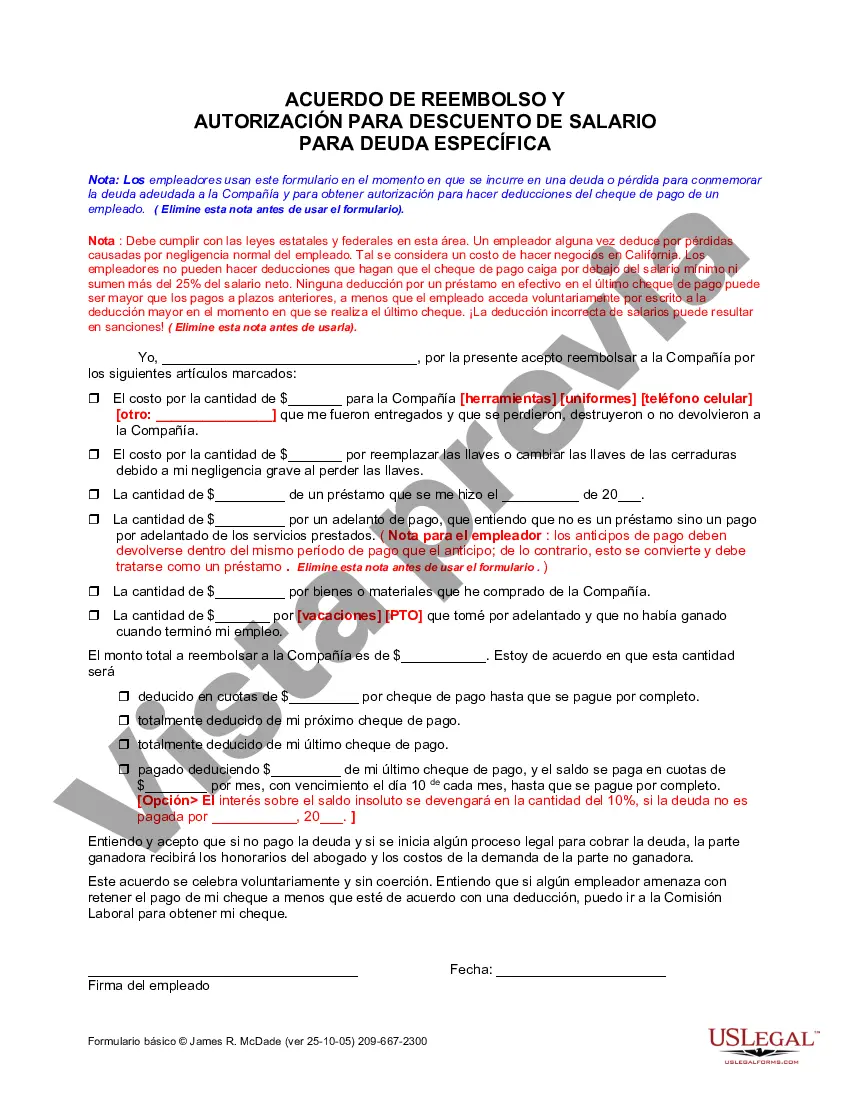

Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

Riverside California Authorization for Deduction from Pay for a Specific Debt is a legal form that allows a creditor to collect outstanding debts directly from an individual's wages or salary. This arrangement, also known as a wage garnishment, is a last resort for creditors who have been unable to collect payment through other means. The Riverside California Authorization for Deduction from Pay for a Specific Debt form outlines the terms and conditions under which the garnishment will occur. It includes details such as the amount owed, the percentage of wages that can be garnished, and the duration of the garnishment. This form is typically used for various types of debts, including unpaid loans, judgments, child support, and taxes. Different types of Riverside California Authorization for Deduction from Pay for a Specific Debt forms may exist depending on the type of debt being pursued. However, the fundamental purpose remains the same — to allow creditors to recover the outstanding amount directly from an individual's wages. 1. Student Loan Garnishment Authorization: This particular form is used when individuals in Riverside, California fail to make payments on their student loans. It enables lenders or loan services to deduct a specific amount from the debtor's wages until the outstanding debt is repaid in full. 2. Judgment Garnishment Authorization: When a debtor loses a lawsuit or fails to satisfy a court-ordered judgment in Riverside, California, a judgment garnishment authorization form may be utilized. This document allows the prevailing party to collect the owed amount directly from the debtor's wages until the judgment is satisfied. 3. Child Support Garnishment Authorization: In cases where an individual in Riverside, California is delinquent in child support payments, a child support garnishment authorization form can be employed. This form enables child support enforcement agencies or custodial parents to deduct a predetermined amount from the noncustodial parent's wages until the arrears are cleared. 4. Tax Garnishment Authorization: The Internal Revenue Service (IRS) or the State of California Franchise Tax Board may require taxpayers residing in Riverside, California to complete a tax garnishment authorization form. This form grants the tax authorities the authority to garnish a portion of the taxpayer's wages, ensuring collection of overdue taxes. It is crucial for individuals in Riverside, California facing garnishments to carefully review and understand the specific Riverside California Authorization for Deduction from Pay for a Specific Debt form relevant to their situation. Seeking legal advice or assistance from a financial professional is recommended to navigate the complexities and potential consequences associated with wage garnishments.Riverside California Authorization for Deduction from Pay for a Specific Debt is a legal form that allows a creditor to collect outstanding debts directly from an individual's wages or salary. This arrangement, also known as a wage garnishment, is a last resort for creditors who have been unable to collect payment through other means. The Riverside California Authorization for Deduction from Pay for a Specific Debt form outlines the terms and conditions under which the garnishment will occur. It includes details such as the amount owed, the percentage of wages that can be garnished, and the duration of the garnishment. This form is typically used for various types of debts, including unpaid loans, judgments, child support, and taxes. Different types of Riverside California Authorization for Deduction from Pay for a Specific Debt forms may exist depending on the type of debt being pursued. However, the fundamental purpose remains the same — to allow creditors to recover the outstanding amount directly from an individual's wages. 1. Student Loan Garnishment Authorization: This particular form is used when individuals in Riverside, California fail to make payments on their student loans. It enables lenders or loan services to deduct a specific amount from the debtor's wages until the outstanding debt is repaid in full. 2. Judgment Garnishment Authorization: When a debtor loses a lawsuit or fails to satisfy a court-ordered judgment in Riverside, California, a judgment garnishment authorization form may be utilized. This document allows the prevailing party to collect the owed amount directly from the debtor's wages until the judgment is satisfied. 3. Child Support Garnishment Authorization: In cases where an individual in Riverside, California is delinquent in child support payments, a child support garnishment authorization form can be employed. This form enables child support enforcement agencies or custodial parents to deduct a predetermined amount from the noncustodial parent's wages until the arrears are cleared. 4. Tax Garnishment Authorization: The Internal Revenue Service (IRS) or the State of California Franchise Tax Board may require taxpayers residing in Riverside, California to complete a tax garnishment authorization form. This form grants the tax authorities the authority to garnish a portion of the taxpayer's wages, ensuring collection of overdue taxes. It is crucial for individuals in Riverside, California facing garnishments to carefully review and understand the specific Riverside California Authorization for Deduction from Pay for a Specific Debt form relevant to their situation. Seeking legal advice or assistance from a financial professional is recommended to navigate the complexities and potential consequences associated with wage garnishments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.