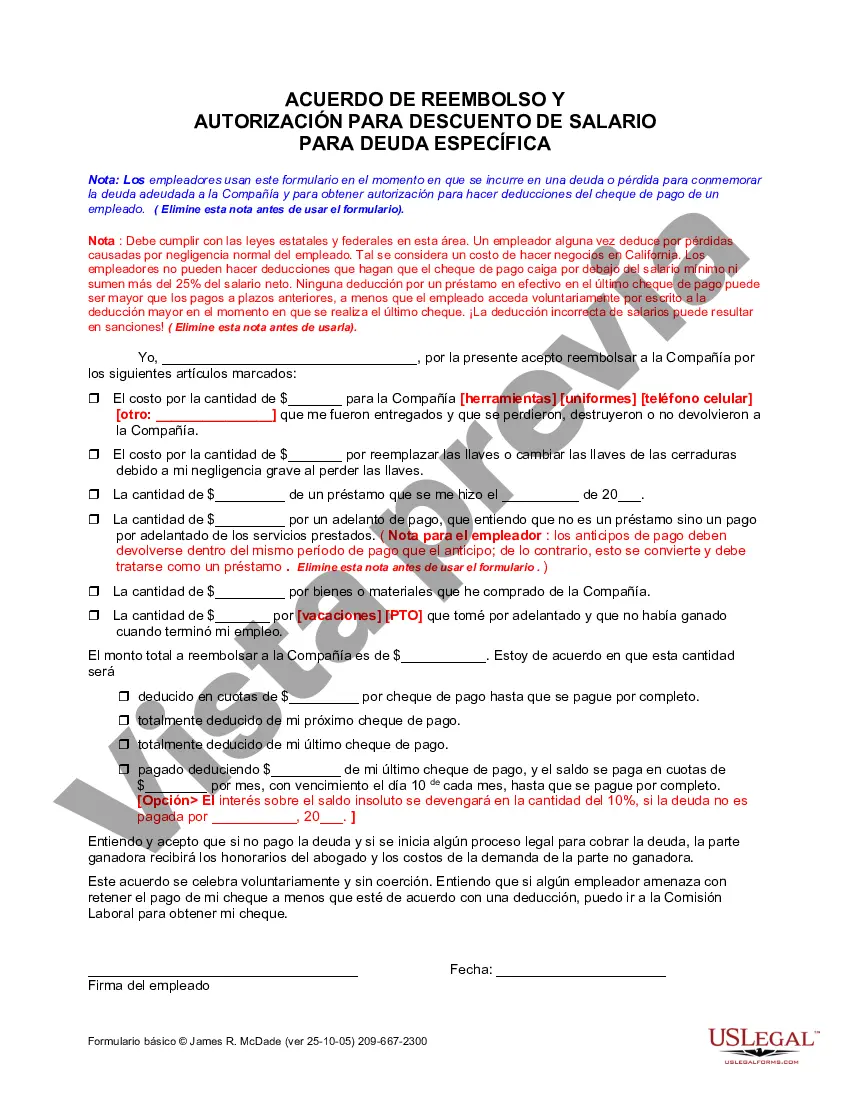

Employers use this form at the time a debt or loss is incurred to memorialize the debt owed to the Company and to obtain authorization for making deductions from an employee’s paycheck.

San Bernardino California Authorization for Deduction from Pay for a Specific Debt is a legal document that allows a creditor to deduct a specific amount of money from an individual's wages or salary to repay a debt owed to the creditor. This authorization is commonly utilized by creditors who are seeking to collect outstanding debts from individuals residing in San Bernardino, California. The Authorization for Deduction from Pay for a Specific Debt is a formal agreement between the debtor and the creditor, outlining the terms and conditions of the wage garnishment. By signing this document, the debtor gives explicit permission for their employer to withhold a specific amount from their wages or salary and remit it directly to the creditor until the debt is fully repaid. In San Bernardino, there are various types of Authorization for Deduction from Pay for a Specific Debt, which include: 1. Unsecured Debts: This type of authorization is used for debts that are not backed by collateral, such as credit card debts, medical bills, personal loans, or utility bills. Creditors can obtain a court order to garnish wages if the debtor fails to repay these debts voluntarily. 2. Secured Debts: Unlike unsecured debts, secured debts are backed by collateral, such as a mortgage or a car loan. If a debtor in San Bernardino defaults on their secured debt payments, the creditor may obtain a court order to garnish wages as a means of recovering the outstanding balance. 3. Court-Ordered Debts: This type of authorization is typically issued by a judge in San Bernardino County when an individual fails to comply with a court-ordered financial obligation, such as unpaid fines, child support, or spousal support. The court can order wage garnishment, allowing the creditor to deduct a specified amount from the debtor's wages until the debt is satisfied. It's important to note that a San Bernardino California Authorization for Deduction from Pay for a Specific Debt must comply with state and federal laws governing wage garnishment. The maximum amount that can be garnished from an individual's wages is limited by law, and certain types of income, such as certain federal benefits, are exempt from garnishment. In conclusion, the San Bernardino California Authorization for Deduction from Pay for a Specific Debt serves as a legal tool for creditors to recover outstanding debts from individuals residing in the San Bernardino area. This agreement enables the creditor to receive regular payments directly from the debtor's wages until the debt is fully repaid, helping to satisfy financial obligations and resolve outstanding debts.San Bernardino California Authorization for Deduction from Pay for a Specific Debt is a legal document that allows a creditor to deduct a specific amount of money from an individual's wages or salary to repay a debt owed to the creditor. This authorization is commonly utilized by creditors who are seeking to collect outstanding debts from individuals residing in San Bernardino, California. The Authorization for Deduction from Pay for a Specific Debt is a formal agreement between the debtor and the creditor, outlining the terms and conditions of the wage garnishment. By signing this document, the debtor gives explicit permission for their employer to withhold a specific amount from their wages or salary and remit it directly to the creditor until the debt is fully repaid. In San Bernardino, there are various types of Authorization for Deduction from Pay for a Specific Debt, which include: 1. Unsecured Debts: This type of authorization is used for debts that are not backed by collateral, such as credit card debts, medical bills, personal loans, or utility bills. Creditors can obtain a court order to garnish wages if the debtor fails to repay these debts voluntarily. 2. Secured Debts: Unlike unsecured debts, secured debts are backed by collateral, such as a mortgage or a car loan. If a debtor in San Bernardino defaults on their secured debt payments, the creditor may obtain a court order to garnish wages as a means of recovering the outstanding balance. 3. Court-Ordered Debts: This type of authorization is typically issued by a judge in San Bernardino County when an individual fails to comply with a court-ordered financial obligation, such as unpaid fines, child support, or spousal support. The court can order wage garnishment, allowing the creditor to deduct a specified amount from the debtor's wages until the debt is satisfied. It's important to note that a San Bernardino California Authorization for Deduction from Pay for a Specific Debt must comply with state and federal laws governing wage garnishment. The maximum amount that can be garnished from an individual's wages is limited by law, and certain types of income, such as certain federal benefits, are exempt from garnishment. In conclusion, the San Bernardino California Authorization for Deduction from Pay for a Specific Debt serves as a legal tool for creditors to recover outstanding debts from individuals residing in the San Bernardino area. This agreement enables the creditor to receive regular payments directly from the debtor's wages until the debt is fully repaid, helping to satisfy financial obligations and resolve outstanding debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.