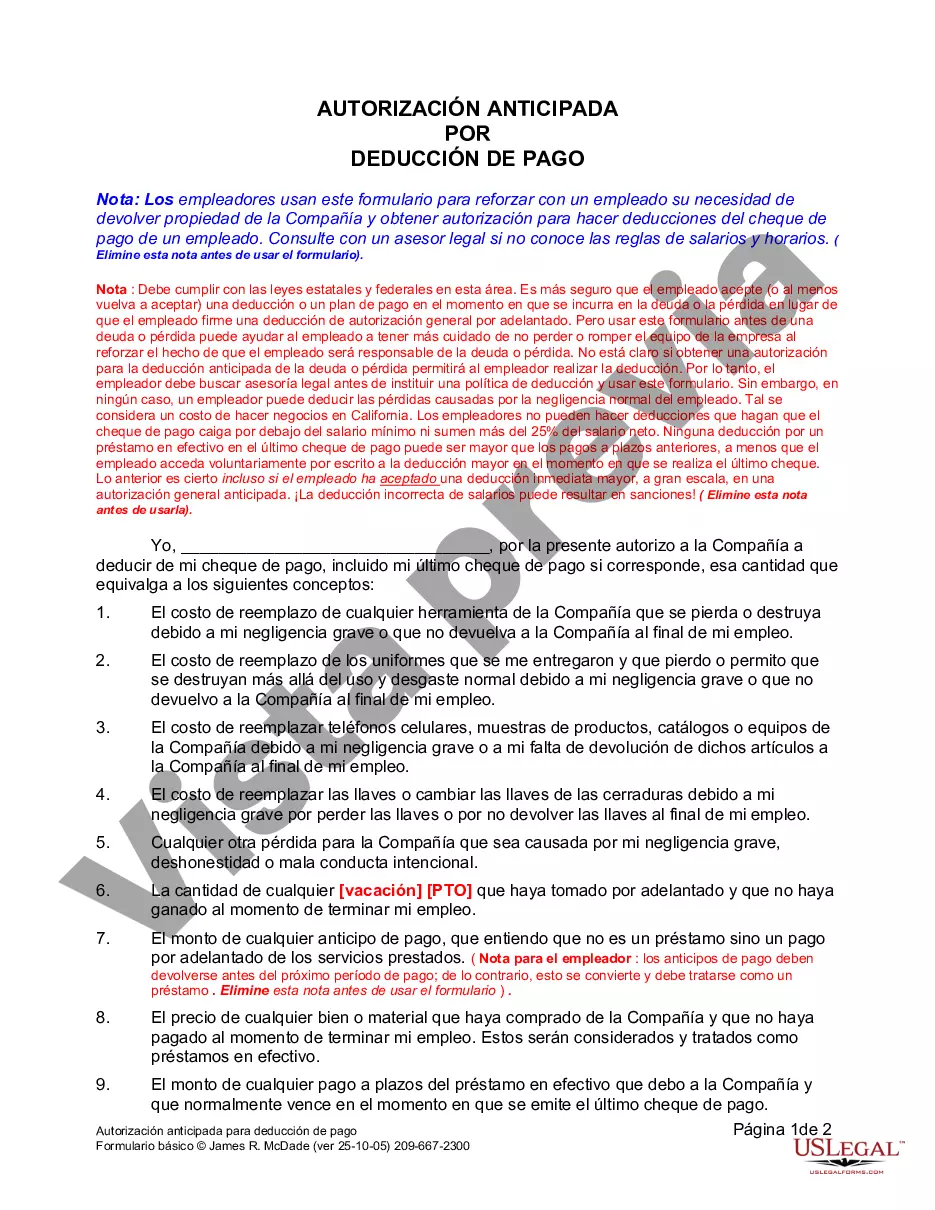

Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

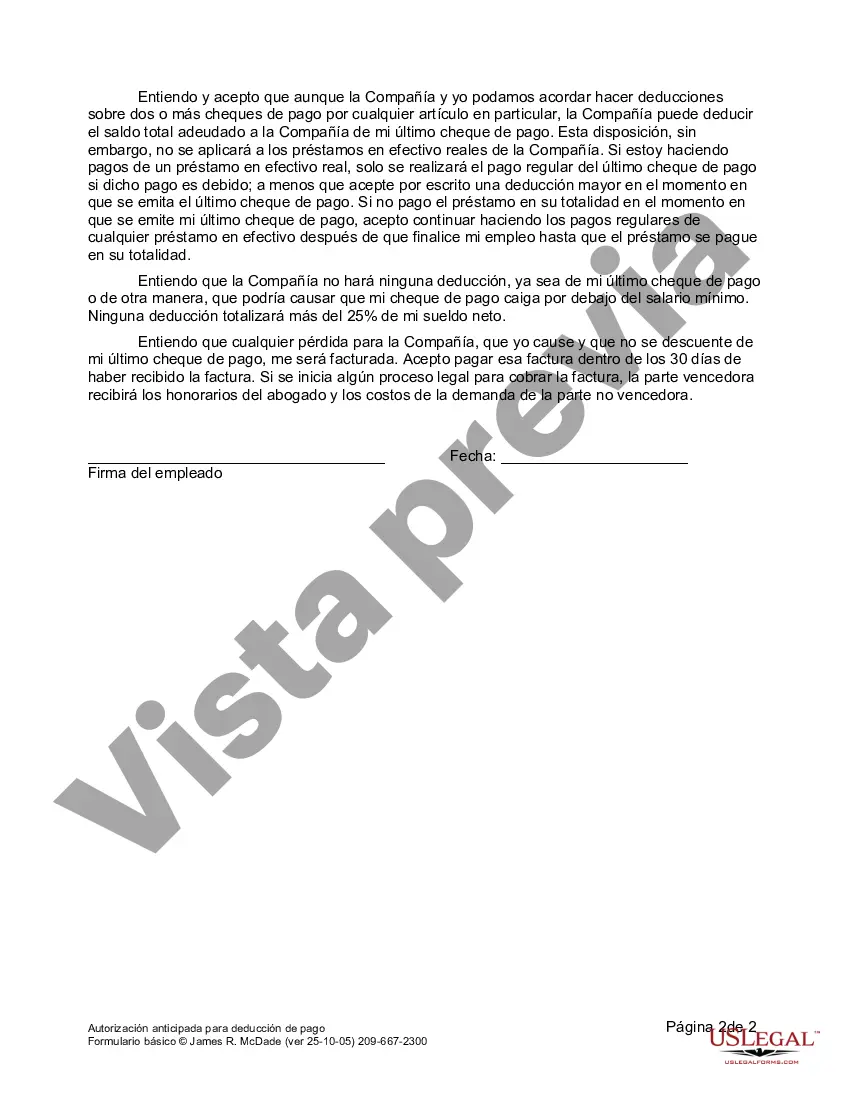

Los Angeles California Advance Authorization for Pay Deduction: A Comprehensive Overview In the bustling city of Los Angeles, California, employers have the option to implement an Advance Authorization for Pay Deduction program. This initiative allows employers to deduct a portion of their employees' wages as repayment for advanced funds issued to them. This arrangement can provide financial assistance to employees in need while ensuring their obligations are met through a structured repayment plan. The Los Angeles California Advance Authorization for Pay Deduction program serves as a legally binding agreement between employers and employees, empowering employers to deduct specific amounts from future paychecks. This arrangement is mutually agreed upon, typically documented in writing, and ensures transparency and fairness in deducting the advanced funds while considering the employees' rights and interests. Customarily, there are several types of Los Angeles California Advance Authorization for Pay Deduction programs designed to cater to different scenarios and needs, including: 1. Emergency Expense Deduction: This type of deduction allows employees to request advances for unforeseen emergencies, such as medical bills, sudden repairs, or urgent travel expenses. Employers can authorize specific deductions to repay these emergency funds. 2. Education or Training Deduction: This type of deduction is useful for employees seeking self-improvement through educational programs or professional development courses. Employers can offer advancements to cover tuition fees, textbooks, or training costs, with defined deductions to repay the advanced amount. 3. Housing Assistance Deduction: Aimed at supporting employees with housing-related matters, this deduction type covers expenses like rental deposits, home repairs, or relocation costs. Employers may approve deductions to recoup the advanced funds provided for these purposes. 4. Repayment Schedule Deduction: Under this type of authorization, employees can request advanced funds to manage existing debts or financial obligations. Employers can then design a repayment schedule with specific deductions from an employee's paycheck until the advanced amount is fully repaid. It's important to note that these types of Los Angeles California Advance Authorization for Pay Deduction programs are subject to compliance with federal and state laws, including wage and hour regulations. Employers must ensure adherence to these laws, such as maximum deduction limits, proper documentation, and employee consent. Employers may require employees to submit a formal request form detailing the purpose of the advance and the proposed repayment terms. The authorization should clearly state the deducted amount, any applicable interest or fees, as well as the start and end dates of the deduction. By implementing the Los Angeles California Advance Authorization for Pay Deduction program, employers can foster a supportive work environment that assists employees during financial difficulties while safeguarding their own interests. This program can alleviate financial burdens, enable employees to handle unexpected expenses or pursue personal growth, and ultimately enhance employee satisfaction and retention. Keywords: Los Angeles, California, advance authorization, pay deduction, program, employers, employees, repay, funds, financial assistance, repayment plan, deductions, emergency expenses, education, training, housing assistance, repayment schedule, compliance, federal laws, state laws, wage and hour regulations, consent, request form, interest, fees, work environment, financial difficulties, personal growth, employee satisfaction, retention.Los Angeles California Advance Authorization for Pay Deduction: A Comprehensive Overview In the bustling city of Los Angeles, California, employers have the option to implement an Advance Authorization for Pay Deduction program. This initiative allows employers to deduct a portion of their employees' wages as repayment for advanced funds issued to them. This arrangement can provide financial assistance to employees in need while ensuring their obligations are met through a structured repayment plan. The Los Angeles California Advance Authorization for Pay Deduction program serves as a legally binding agreement between employers and employees, empowering employers to deduct specific amounts from future paychecks. This arrangement is mutually agreed upon, typically documented in writing, and ensures transparency and fairness in deducting the advanced funds while considering the employees' rights and interests. Customarily, there are several types of Los Angeles California Advance Authorization for Pay Deduction programs designed to cater to different scenarios and needs, including: 1. Emergency Expense Deduction: This type of deduction allows employees to request advances for unforeseen emergencies, such as medical bills, sudden repairs, or urgent travel expenses. Employers can authorize specific deductions to repay these emergency funds. 2. Education or Training Deduction: This type of deduction is useful for employees seeking self-improvement through educational programs or professional development courses. Employers can offer advancements to cover tuition fees, textbooks, or training costs, with defined deductions to repay the advanced amount. 3. Housing Assistance Deduction: Aimed at supporting employees with housing-related matters, this deduction type covers expenses like rental deposits, home repairs, or relocation costs. Employers may approve deductions to recoup the advanced funds provided for these purposes. 4. Repayment Schedule Deduction: Under this type of authorization, employees can request advanced funds to manage existing debts or financial obligations. Employers can then design a repayment schedule with specific deductions from an employee's paycheck until the advanced amount is fully repaid. It's important to note that these types of Los Angeles California Advance Authorization for Pay Deduction programs are subject to compliance with federal and state laws, including wage and hour regulations. Employers must ensure adherence to these laws, such as maximum deduction limits, proper documentation, and employee consent. Employers may require employees to submit a formal request form detailing the purpose of the advance and the proposed repayment terms. The authorization should clearly state the deducted amount, any applicable interest or fees, as well as the start and end dates of the deduction. By implementing the Los Angeles California Advance Authorization for Pay Deduction program, employers can foster a supportive work environment that assists employees during financial difficulties while safeguarding their own interests. This program can alleviate financial burdens, enable employees to handle unexpected expenses or pursue personal growth, and ultimately enhance employee satisfaction and retention. Keywords: Los Angeles, California, advance authorization, pay deduction, program, employers, employees, repay, funds, financial assistance, repayment plan, deductions, emergency expenses, education, training, housing assistance, repayment schedule, compliance, federal laws, state laws, wage and hour regulations, consent, request form, interest, fees, work environment, financial difficulties, personal growth, employee satisfaction, retention.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.