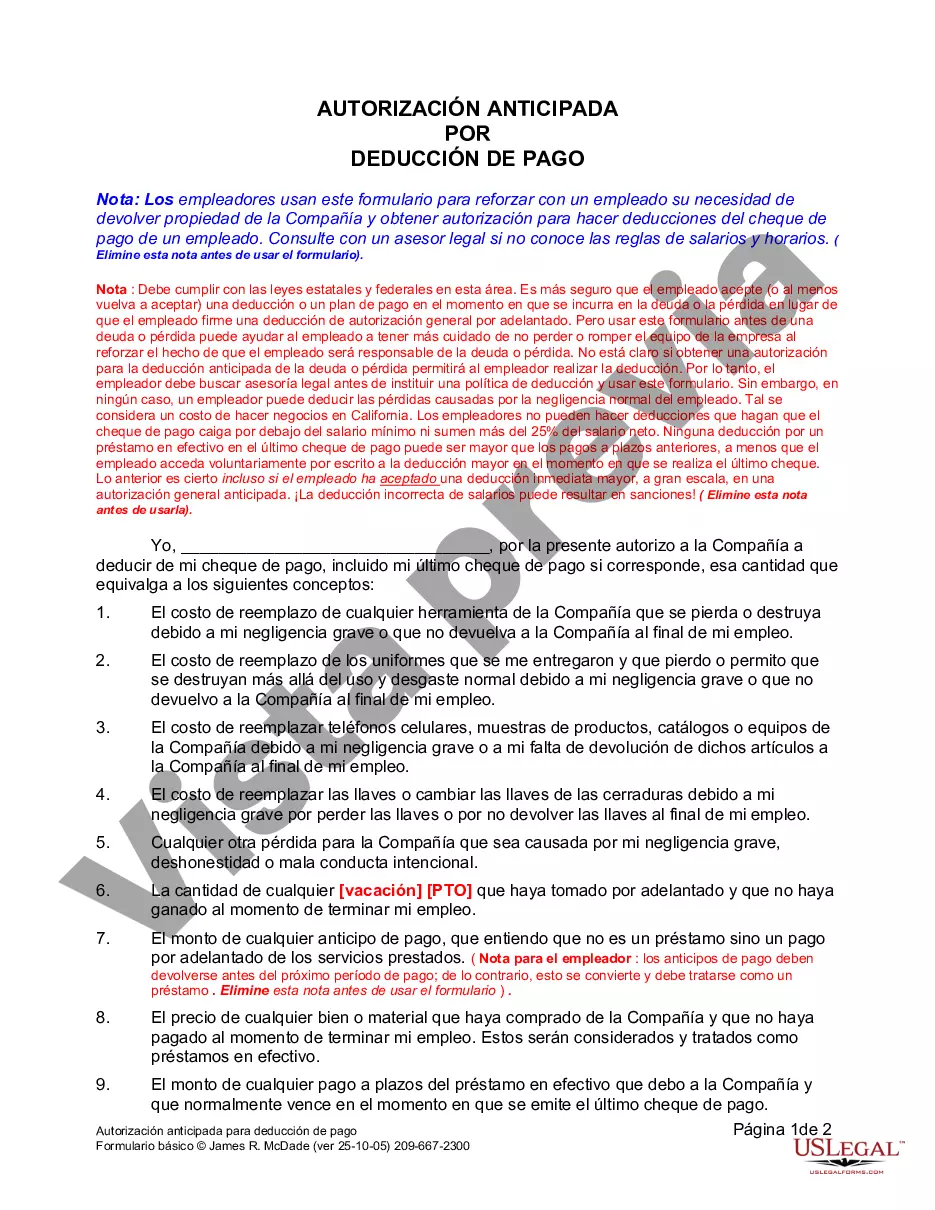

Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

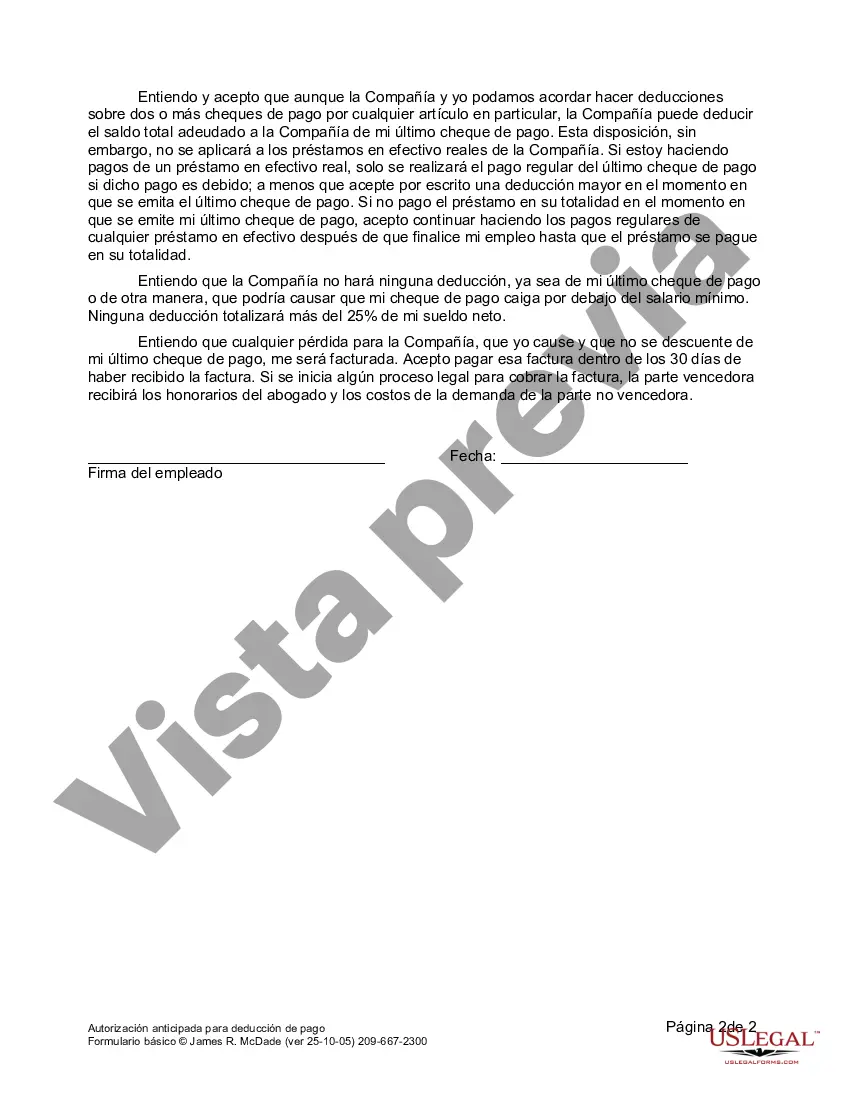

Vacaville California Advance Authorization for Pay Deduction is a legal agreement that enables employers in Vacaville, California, to deduct funds from an employee's paycheck for various purposes. This authorization is typically given voluntarily by the employee and can cover a range of situations such as loans, advances, taxes, garnishments, and benefit plans. It is an essential tool for both employers and employees to manage financial obligations effectively. One common type of Vacaville California Advance Authorization for Pay Deduction is for employee loans. This agreement allows employers to deduct a portion of an employee's wages to repay a loan provided by the company. This type of deduction ensures a structured repayment plan, protecting both the employee and the employer's interests. Another type of authorization is for payroll advances. In situations where an employee needs immediate financial assistance, they can request an advance on their salary. By signing the Vacaville California Advance Authorization for Pay Deduction, the employee agrees to have the advance deducted from future paychecks, ensuring timely repayment. Additionally, this authorization can cover deductions for taxes. The agreement allows employers to deduct the appropriate amounts for state, federal, and local taxes from an employee's wages, ensuring compliance with tax regulations. Vacaville California Advance Authorization for Pay Deduction can also include deductions for garnishments. In cases where an employee has court-ordered debt obligations, such as child support or alimony, this authorization allows employers to deduct the specified amount from the employee's paycheck and transfer it to the appropriate recipient. Moreover, many employers offer various benefit plans, such as health insurance, retirement savings, or flexible spending accounts. The Vacaville California Advance Authorization for Pay Deduction can incorporate deductions for these benefits, ensuring employees' participation and timely contributions to such plans. Overall, Vacaville California Advance Authorization for Pay Deduction is a comprehensive legal agreement that allows employers to deduct funds from an employee's paycheck for various purposes. Whether it be loan repayments, payroll advances, tax deductions, garnishments, or benefit plan contributions, this agreement helps employers and employees manage financial obligations in an organized and structured manner.Vacaville California Advance Authorization for Pay Deduction is a legal agreement that enables employers in Vacaville, California, to deduct funds from an employee's paycheck for various purposes. This authorization is typically given voluntarily by the employee and can cover a range of situations such as loans, advances, taxes, garnishments, and benefit plans. It is an essential tool for both employers and employees to manage financial obligations effectively. One common type of Vacaville California Advance Authorization for Pay Deduction is for employee loans. This agreement allows employers to deduct a portion of an employee's wages to repay a loan provided by the company. This type of deduction ensures a structured repayment plan, protecting both the employee and the employer's interests. Another type of authorization is for payroll advances. In situations where an employee needs immediate financial assistance, they can request an advance on their salary. By signing the Vacaville California Advance Authorization for Pay Deduction, the employee agrees to have the advance deducted from future paychecks, ensuring timely repayment. Additionally, this authorization can cover deductions for taxes. The agreement allows employers to deduct the appropriate amounts for state, federal, and local taxes from an employee's wages, ensuring compliance with tax regulations. Vacaville California Advance Authorization for Pay Deduction can also include deductions for garnishments. In cases where an employee has court-ordered debt obligations, such as child support or alimony, this authorization allows employers to deduct the specified amount from the employee's paycheck and transfer it to the appropriate recipient. Moreover, many employers offer various benefit plans, such as health insurance, retirement savings, or flexible spending accounts. The Vacaville California Advance Authorization for Pay Deduction can incorporate deductions for these benefits, ensuring employees' participation and timely contributions to such plans. Overall, Vacaville California Advance Authorization for Pay Deduction is a comprehensive legal agreement that allows employers to deduct funds from an employee's paycheck for various purposes. Whether it be loan repayments, payroll advances, tax deductions, garnishments, or benefit plan contributions, this agreement helps employers and employees manage financial obligations in an organized and structured manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.