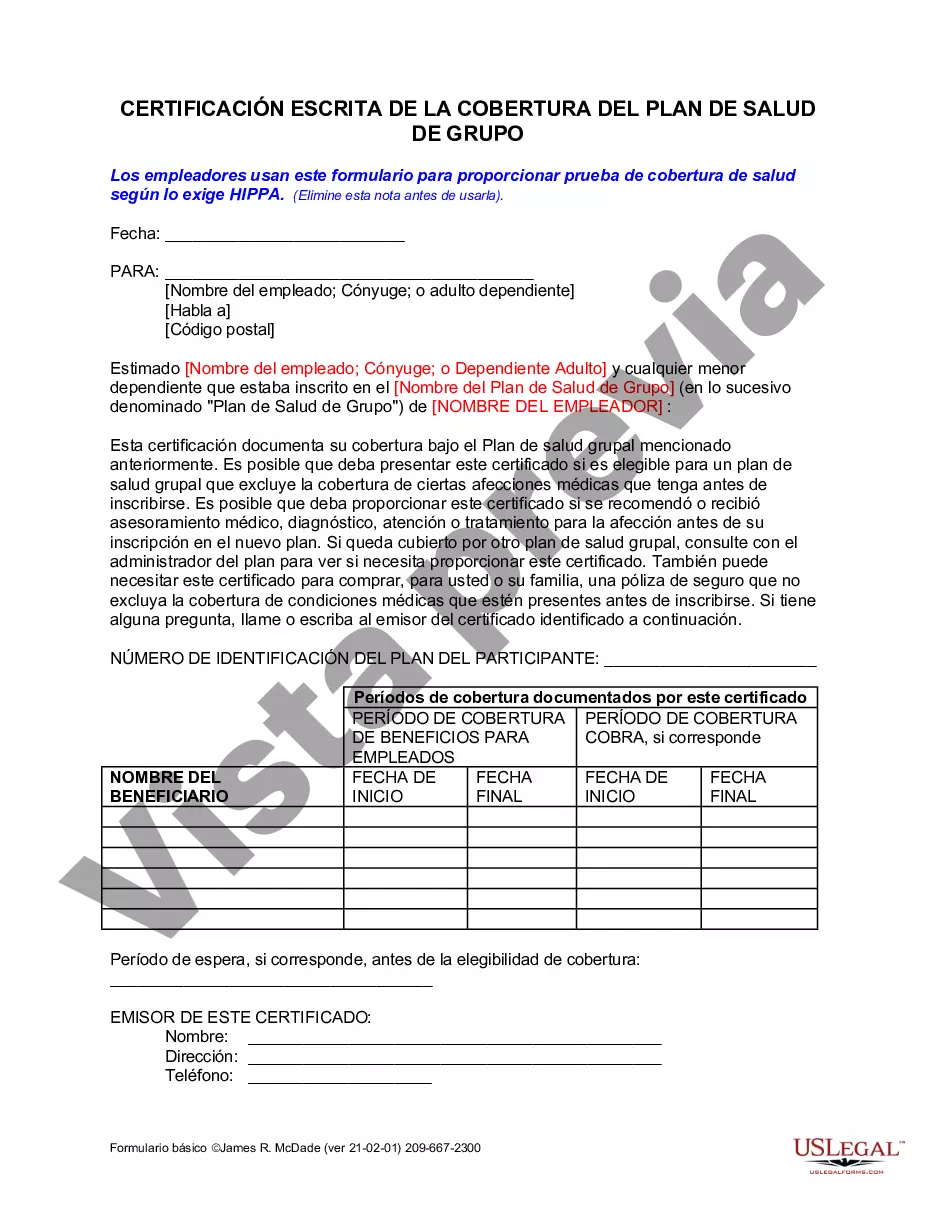

Employers use this form to provide proof to the employee of health coverage as required by HIPPA.

Chula Vista California Certification of Group Health Plan Coverage is a crucial document that verifies the provision of health insurance coverage to a group of individuals in the Chula Vista area of California. This certification ensures that employers and organizations comply with state and federal laws related to employee benefits. Employers and organizations offering group health plans in Chula Vista must obtain the Certification of Group Health Plan Coverage to demonstrate their commitment to providing adequate healthcare options to their employees. This certification is a testament to the employer's responsibility and duty in offering comprehensive health insurance coverage. The Chula Vista California Certification of Group Health Plan Coverage encompasses various types of health insurance plans provided by employers and organizations. These plans can include: 1. Health Maintenance Organization (HMO): This type of plan requires individuals to select a primary care physician (PCP) from a network of healthcare providers. The PCP manages all healthcare needs, including referrals to specialists if necessary. 2. Preferred Provider Organization (PPO): PPO plans allow individuals to seek medical care from both in-network and out-of-network providers. While individuals have the freedom to choose their healthcare providers, staying within the network generally results in lower out-of-pocket expenses. 3. Exclusive Provider Organization (EPO): EPO plans combine elements of both HMO and PPO plans. Individuals must choose a primary care provider and stay within the network for coverage. However, they do not require referrals to see specialists within the network. 4. Point of Service (POS): POS plans offer more flexibility than HMO's but less than PPO's. Individuals select a primary care physician but can seek care both in and out of the network. However, out-of-network care typically requires higher co-payments and deductibles. 5. High Deductible Health Plan (DHP): HDPS have higher deductibles and lower monthly premiums. These plans often accompany a Health Savings Account (HSA), allowing individuals to save pre-tax money to cover qualified medical expenses. Obtaining the Chula Vista California Certification of Group Health Plan Coverage not only ensures compliance but also provides employees with assurance that their healthcare needs will be met. Employers must regularly renew their certification, ensuring that coverage remains up to date and continuously available to employees. This certification plays a vital role in promoting the overall health and well-being of the Chula Vista community.Chula Vista California Certification of Group Health Plan Coverage is a crucial document that verifies the provision of health insurance coverage to a group of individuals in the Chula Vista area of California. This certification ensures that employers and organizations comply with state and federal laws related to employee benefits. Employers and organizations offering group health plans in Chula Vista must obtain the Certification of Group Health Plan Coverage to demonstrate their commitment to providing adequate healthcare options to their employees. This certification is a testament to the employer's responsibility and duty in offering comprehensive health insurance coverage. The Chula Vista California Certification of Group Health Plan Coverage encompasses various types of health insurance plans provided by employers and organizations. These plans can include: 1. Health Maintenance Organization (HMO): This type of plan requires individuals to select a primary care physician (PCP) from a network of healthcare providers. The PCP manages all healthcare needs, including referrals to specialists if necessary. 2. Preferred Provider Organization (PPO): PPO plans allow individuals to seek medical care from both in-network and out-of-network providers. While individuals have the freedom to choose their healthcare providers, staying within the network generally results in lower out-of-pocket expenses. 3. Exclusive Provider Organization (EPO): EPO plans combine elements of both HMO and PPO plans. Individuals must choose a primary care provider and stay within the network for coverage. However, they do not require referrals to see specialists within the network. 4. Point of Service (POS): POS plans offer more flexibility than HMO's but less than PPO's. Individuals select a primary care physician but can seek care both in and out of the network. However, out-of-network care typically requires higher co-payments and deductibles. 5. High Deductible Health Plan (DHP): HDPS have higher deductibles and lower monthly premiums. These plans often accompany a Health Savings Account (HSA), allowing individuals to save pre-tax money to cover qualified medical expenses. Obtaining the Chula Vista California Certification of Group Health Plan Coverage not only ensures compliance but also provides employees with assurance that their healthcare needs will be met. Employers must regularly renew their certification, ensuring that coverage remains up to date and continuously available to employees. This certification plays a vital role in promoting the overall health and well-being of the Chula Vista community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.