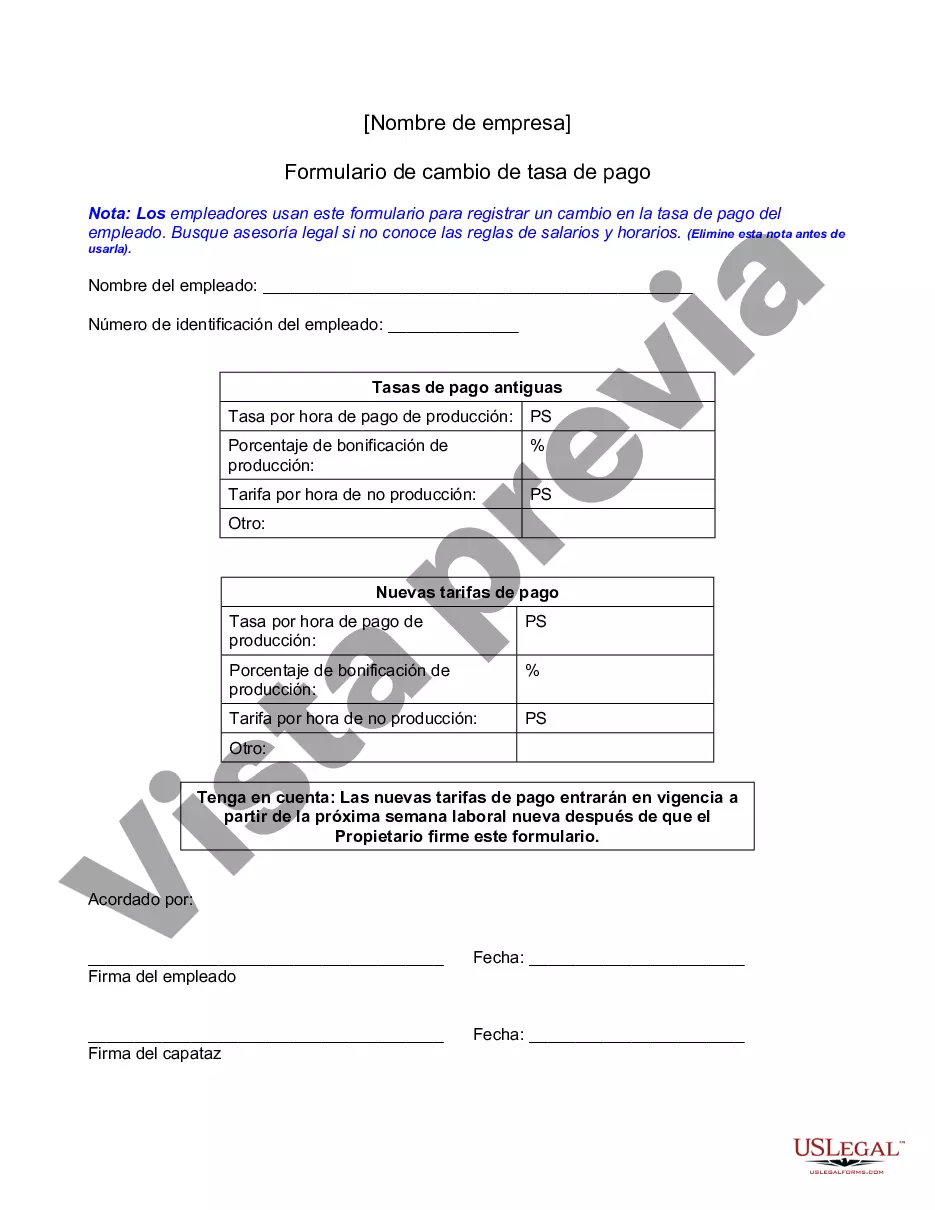

Employers use this form to record a change in the employee’s rate of pay.

San Diego California Pay Rate Change Form is a crucial document used by employers in San Diego, California, to facilitate changes in employees' pay rates. The form is designed to ensure accurate and transparent record-keeping while complying with state labor laws. It allows employers to document and process pay rate adjustments efficiently, ensuring proper compensation for their workforce. Keywords: San Diego California, pay rate change form, employers, employees, pay rate adjustments, accurate, transparent, record-keeping, state labor laws, document, process, compensation, workforce. Different types of San Diego California Pay Rate Change Forms include: 1. Regular Pay Rate Change Form: This form is used to record routine pay rate adjustments for employees in accordance with company policies or changes in the job market. It captures details such as the employee's name, employment ID, current pay rate, effective date, new pay rate, reason for the change, and any additional remarks. 2. Promotional Pay Rate Change Form: When an employee receives a promotion or new job position with an associated pay increase, employers utilize this form to document the change in pay rate. It includes information such as the employee's name, employee ID, previous pay rate, effective date, new pay rate, job title, and reason for the promotion. 3. Performance-based Pay Rate Change Form: This form is utilized when an employee's pay rate is adjusted based on performance evaluations. Employers use this form to assess and reward outstanding performance or provide constructive feedback leading to pay rate changes. It typically includes the employee's name, employee ID, current pay rate, effective date, new pay rate, evaluation criteria, supervisor's comments, and signatures. 4. Merit-based Pay Rate Change Form: In cases where pay rate adjustments are determined by merit or seniority, employers utilize this form to document the change. It involves capturing information such as employee name, employee ID, current pay rate, effective date, new pay rate, criteria for merit assessment, supervisor's recommendation, and management's approval. Overall, San Diego California Pay Rate Change Forms are indispensable for maintaining accurate and transparent payroll records while ensuring that employees are compensated fairly and in compliance with relevant labor laws. By utilizing different types of forms, employers can systematically manage various scenarios that lead to changes in pay rates.San Diego California Pay Rate Change Form is a crucial document used by employers in San Diego, California, to facilitate changes in employees' pay rates. The form is designed to ensure accurate and transparent record-keeping while complying with state labor laws. It allows employers to document and process pay rate adjustments efficiently, ensuring proper compensation for their workforce. Keywords: San Diego California, pay rate change form, employers, employees, pay rate adjustments, accurate, transparent, record-keeping, state labor laws, document, process, compensation, workforce. Different types of San Diego California Pay Rate Change Forms include: 1. Regular Pay Rate Change Form: This form is used to record routine pay rate adjustments for employees in accordance with company policies or changes in the job market. It captures details such as the employee's name, employment ID, current pay rate, effective date, new pay rate, reason for the change, and any additional remarks. 2. Promotional Pay Rate Change Form: When an employee receives a promotion or new job position with an associated pay increase, employers utilize this form to document the change in pay rate. It includes information such as the employee's name, employee ID, previous pay rate, effective date, new pay rate, job title, and reason for the promotion. 3. Performance-based Pay Rate Change Form: This form is utilized when an employee's pay rate is adjusted based on performance evaluations. Employers use this form to assess and reward outstanding performance or provide constructive feedback leading to pay rate changes. It typically includes the employee's name, employee ID, current pay rate, effective date, new pay rate, evaluation criteria, supervisor's comments, and signatures. 4. Merit-based Pay Rate Change Form: In cases where pay rate adjustments are determined by merit or seniority, employers utilize this form to document the change. It involves capturing information such as employee name, employee ID, current pay rate, effective date, new pay rate, criteria for merit assessment, supervisor's recommendation, and management's approval. Overall, San Diego California Pay Rate Change Forms are indispensable for maintaining accurate and transparent payroll records while ensuring that employees are compensated fairly and in compliance with relevant labor laws. By utilizing different types of forms, employers can systematically manage various scenarios that lead to changes in pay rates.

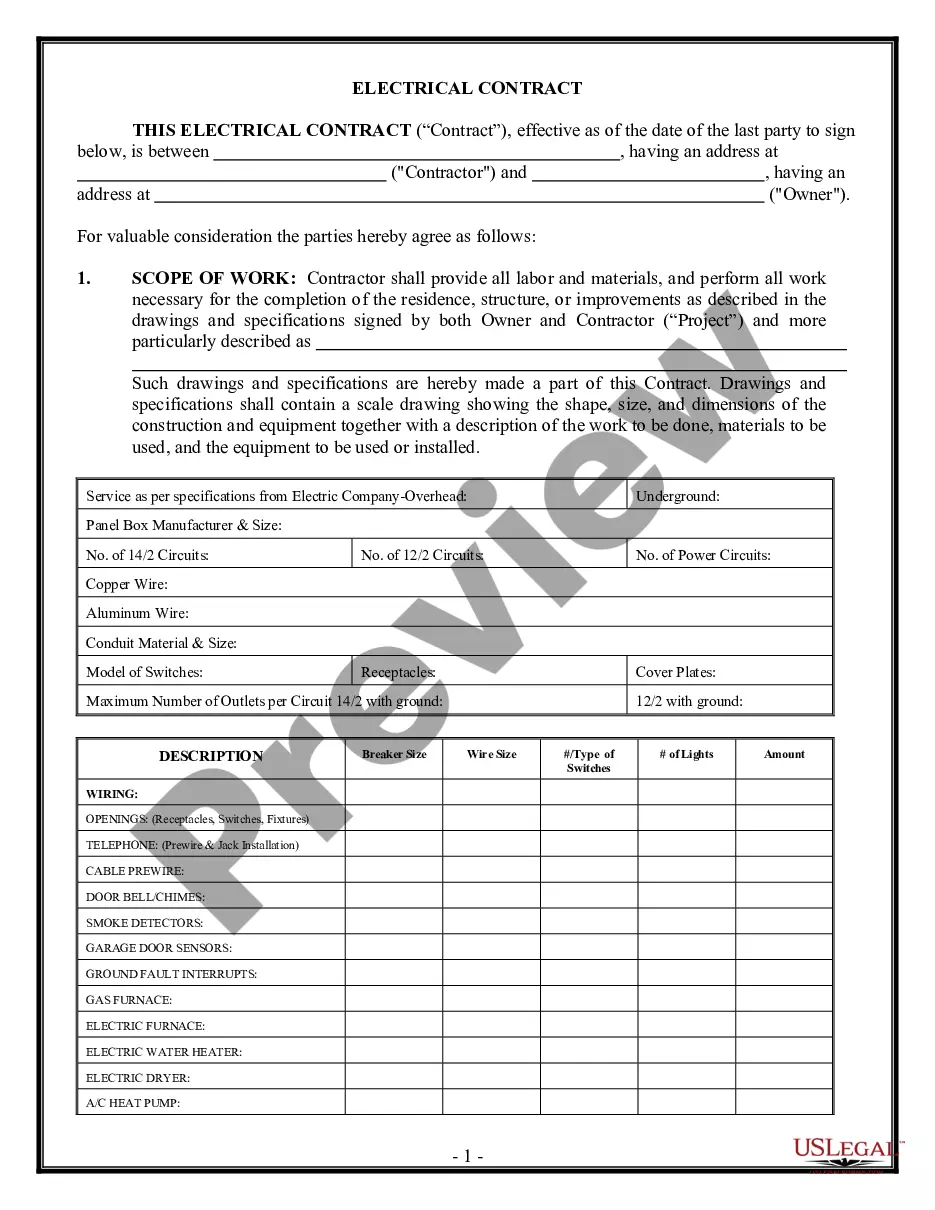

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.