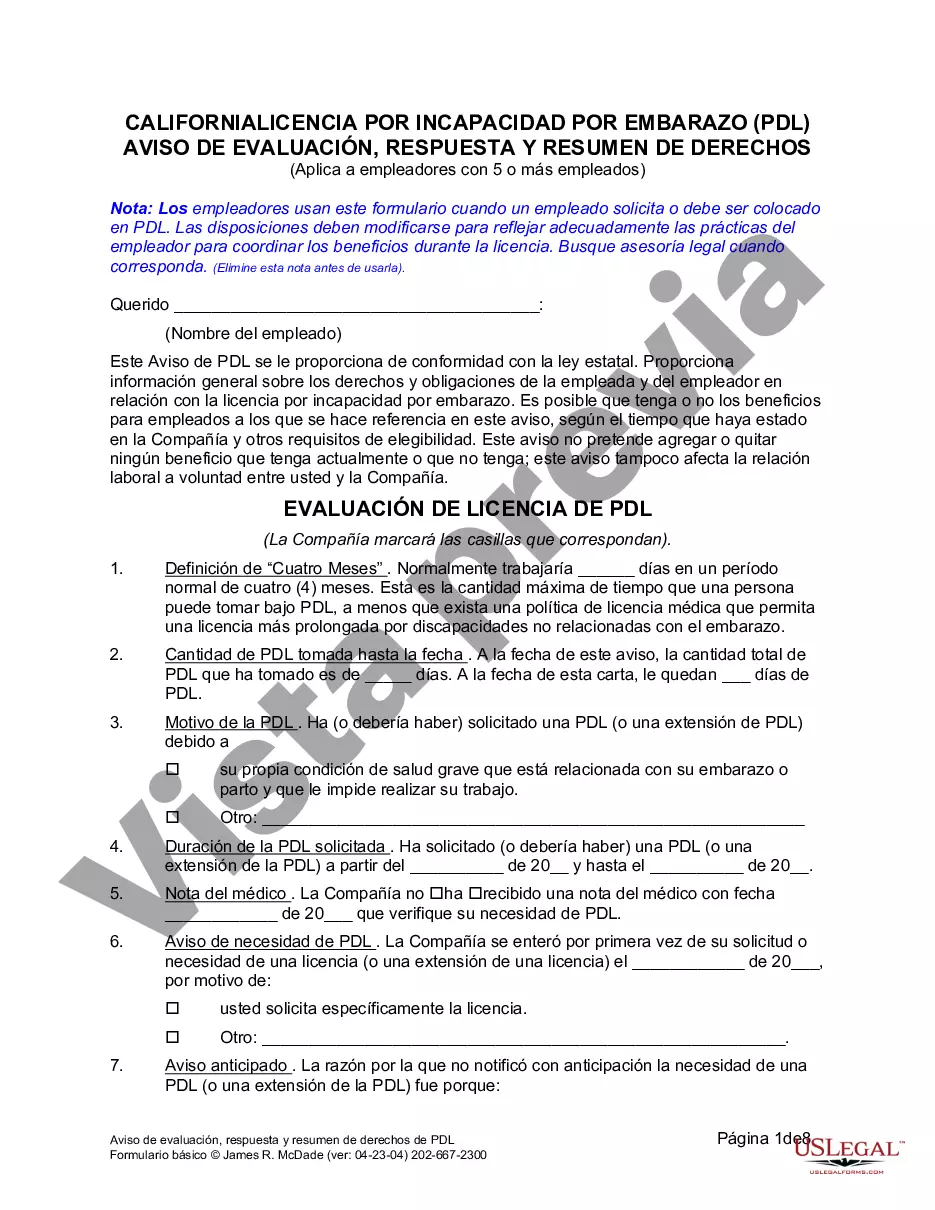

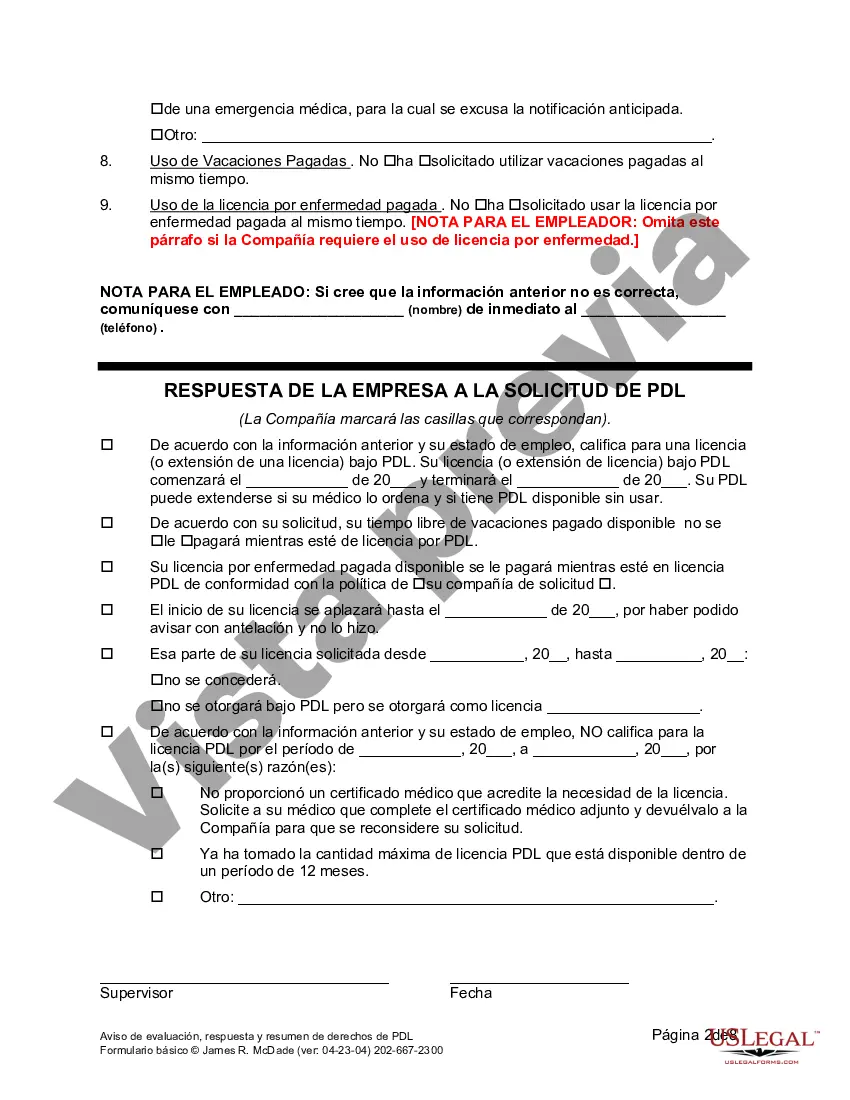

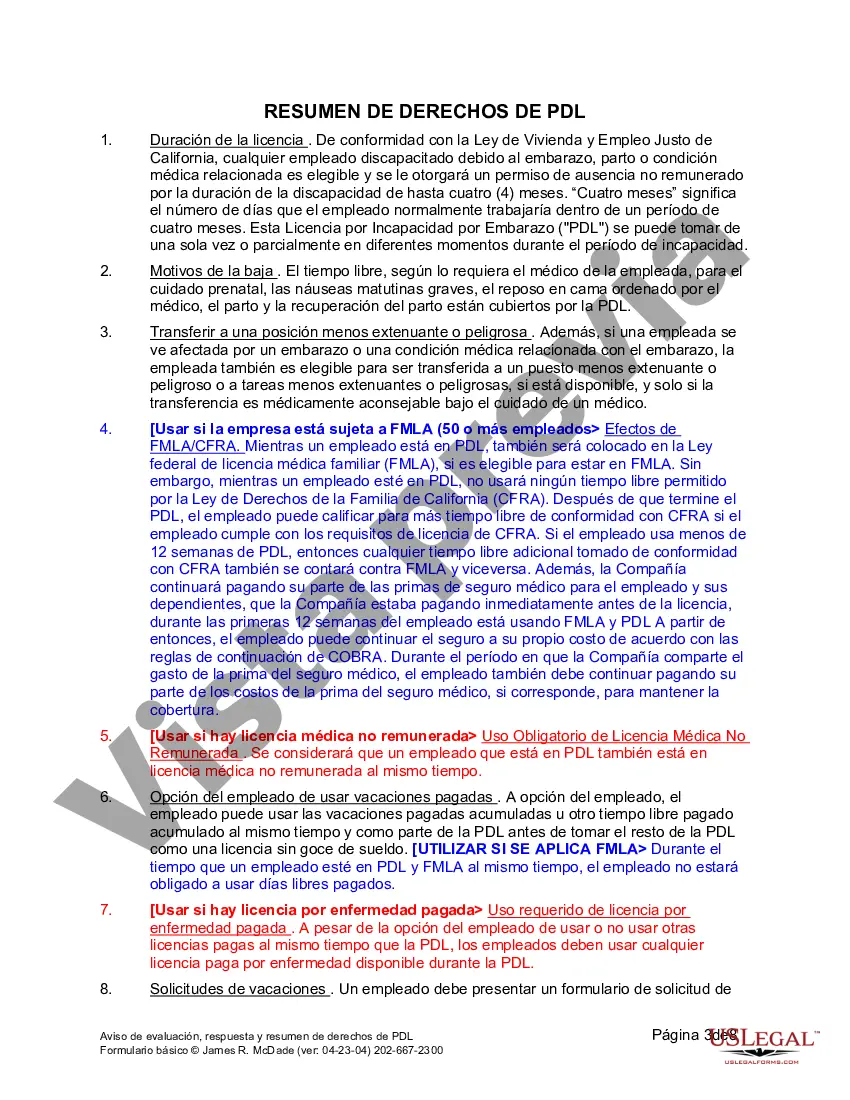

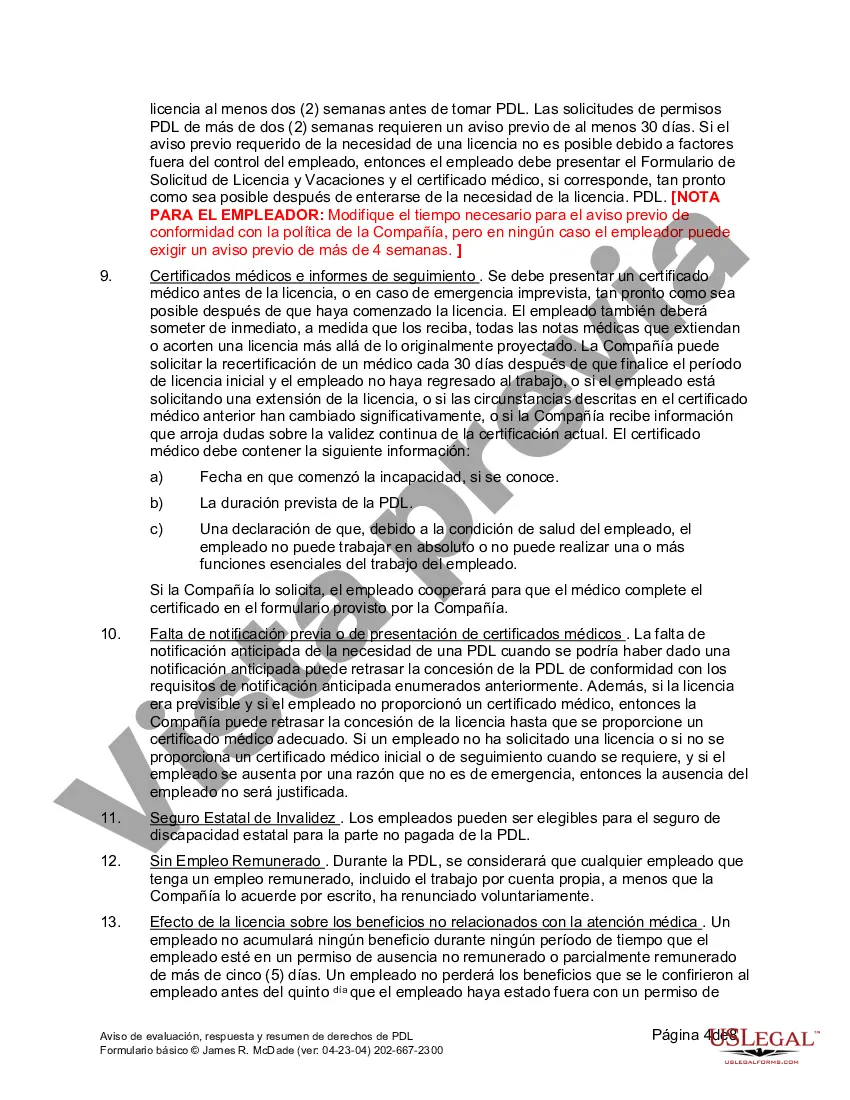

Employers use this form when an employee requests or should be placed on pregnancy disability leave. It provides general information about an employee’s and employer’s rights and obligations in relation to pregnancy disability leave.

Roseville California PDL Request Response and Notice refers to the process and documentation required for obtaining a Payday Deferred Deposit Lending (PDL) Request Response and Notice in the city of Roseville, California. PDS, also known as payday loans, are short-term loans provided by lenders to borrowers who need immediate cash to cover unexpected expenses. In Roseville, individuals must follow specific procedures and submit various forms in order to initiate and receive a PDL Request Response and Notice. The Roseville California PDL Request Response and Notice may include the following types: 1. Roseville PDL Request Form: This is the initial document that borrowers need to complete and submit to the relevant authority in Roseville to request a PDL. The form typically requires basic personal information such as name, address, contact details, employment information, banking information, and the requested loan amount. 2. Employment Verification: As part of the PDL application process, borrowers may need to provide employment verification documents. This can include recent pay stubs, employment contracts, or any other relevant proof of income to demonstrate their ability to repay the loan. 3. Identity Verification: Borrowers may be required to provide valid identification documents such as a driver's license, passport, or state-issued identification card for identity verification purposes. 4. Bank Statements: Lenders may ask borrowers to provide recent bank statements to verify their financial stability, track transaction history, and assess the borrower's ability to repay the loan. 5. Credit Check Authorization: In some cases, lenders may perform credit checks on borrowers to evaluate their creditworthiness. Borrowers might be required to provide written consent or sign an authorization form allowing the lender to conduct a credit check. 6. PDL Request Response and Notice: Once the PDL Request Form is submitted and all necessary documentation is provided, the borrower will receive the PDL Request Response and Notice. This notice typically outlines the terms and conditions of the loan, including the total amount borrowed, interest rates, repayment schedule, and any additional fees or charges. It is important to note that the specific requirements and forms for Roseville California PDL Request Response and Notice may vary slightly depending on the lender and the loan amount applied for. Borrowers are advised to carefully review all documents, terms, and conditions before proceeding with a PDL application.Roseville California PDL Request Response and Notice refers to the process and documentation required for obtaining a Payday Deferred Deposit Lending (PDL) Request Response and Notice in the city of Roseville, California. PDS, also known as payday loans, are short-term loans provided by lenders to borrowers who need immediate cash to cover unexpected expenses. In Roseville, individuals must follow specific procedures and submit various forms in order to initiate and receive a PDL Request Response and Notice. The Roseville California PDL Request Response and Notice may include the following types: 1. Roseville PDL Request Form: This is the initial document that borrowers need to complete and submit to the relevant authority in Roseville to request a PDL. The form typically requires basic personal information such as name, address, contact details, employment information, banking information, and the requested loan amount. 2. Employment Verification: As part of the PDL application process, borrowers may need to provide employment verification documents. This can include recent pay stubs, employment contracts, or any other relevant proof of income to demonstrate their ability to repay the loan. 3. Identity Verification: Borrowers may be required to provide valid identification documents such as a driver's license, passport, or state-issued identification card for identity verification purposes. 4. Bank Statements: Lenders may ask borrowers to provide recent bank statements to verify their financial stability, track transaction history, and assess the borrower's ability to repay the loan. 5. Credit Check Authorization: In some cases, lenders may perform credit checks on borrowers to evaluate their creditworthiness. Borrowers might be required to provide written consent or sign an authorization form allowing the lender to conduct a credit check. 6. PDL Request Response and Notice: Once the PDL Request Form is submitted and all necessary documentation is provided, the borrower will receive the PDL Request Response and Notice. This notice typically outlines the terms and conditions of the loan, including the total amount borrowed, interest rates, repayment schedule, and any additional fees or charges. It is important to note that the specific requirements and forms for Roseville California PDL Request Response and Notice may vary slightly depending on the lender and the loan amount applied for. Borrowers are advised to carefully review all documents, terms, and conditions before proceeding with a PDL application.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.