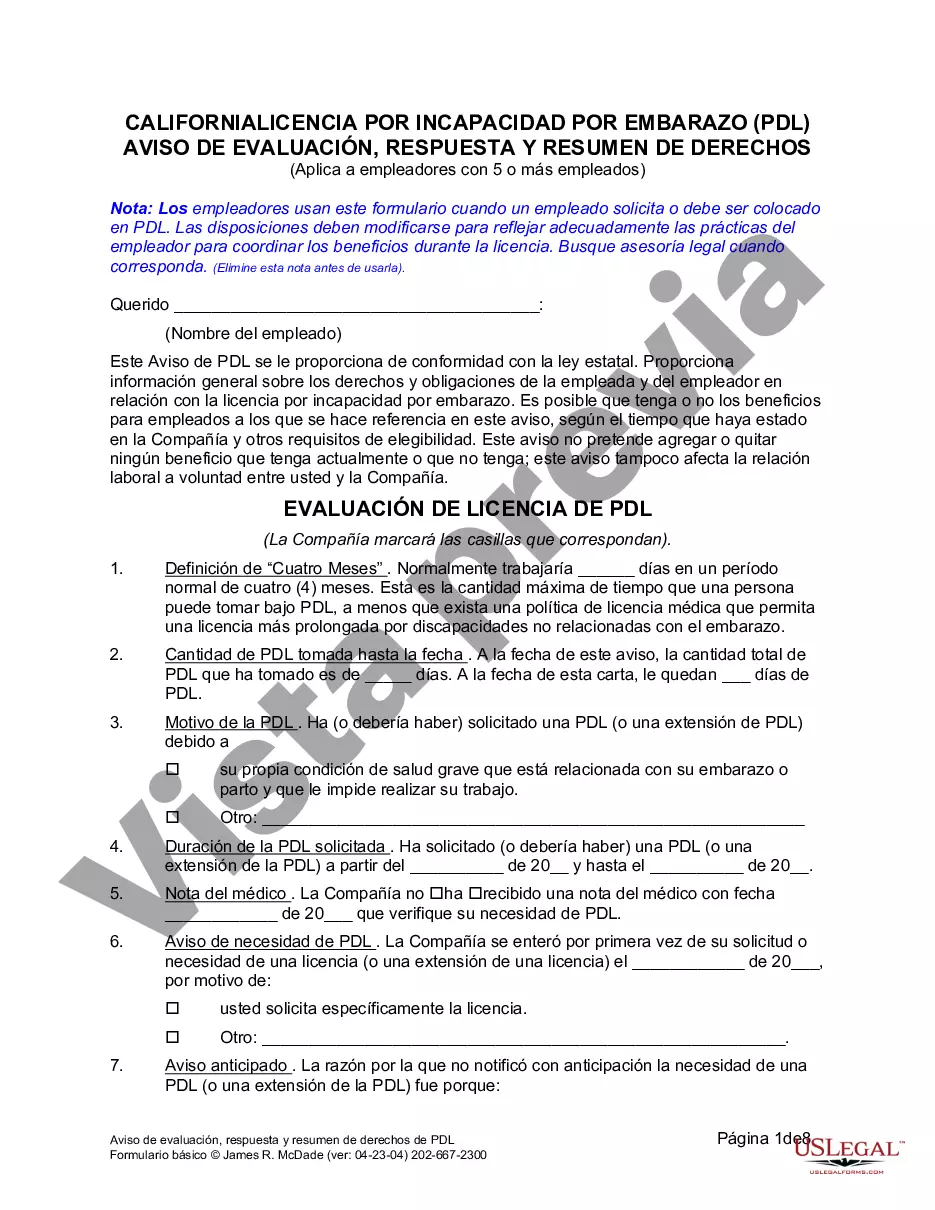

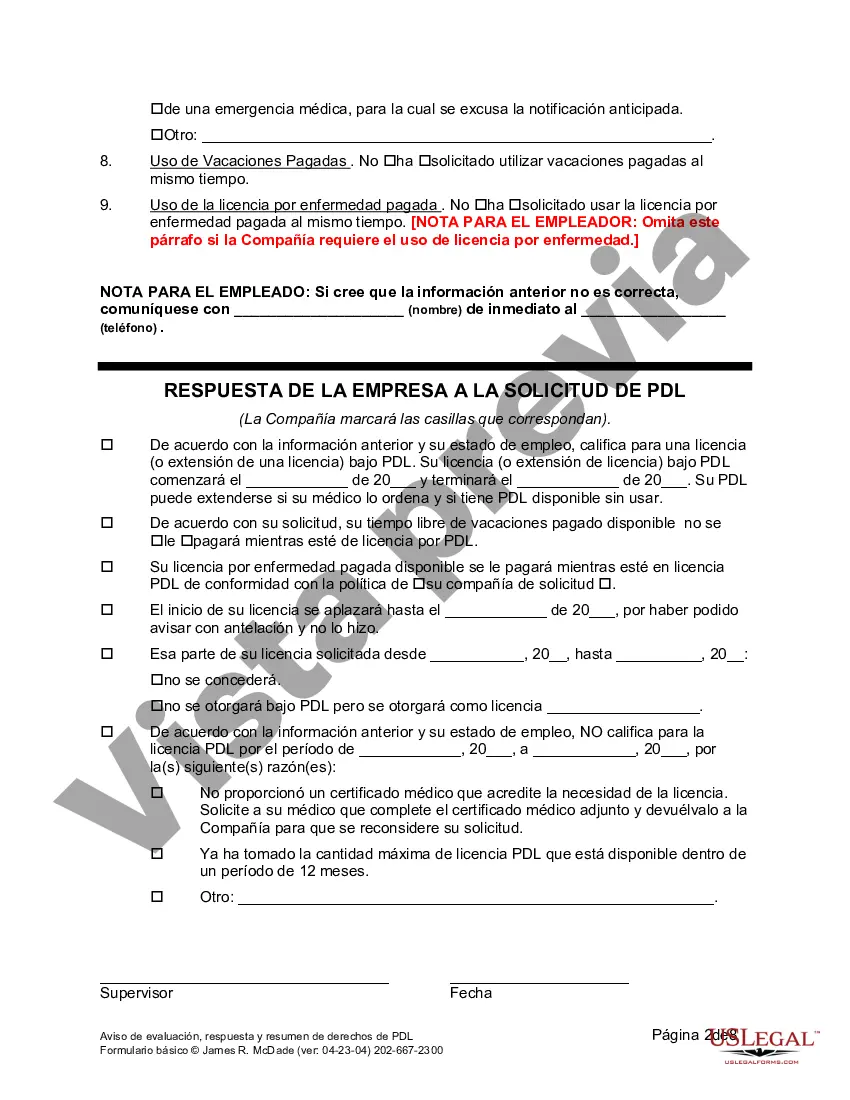

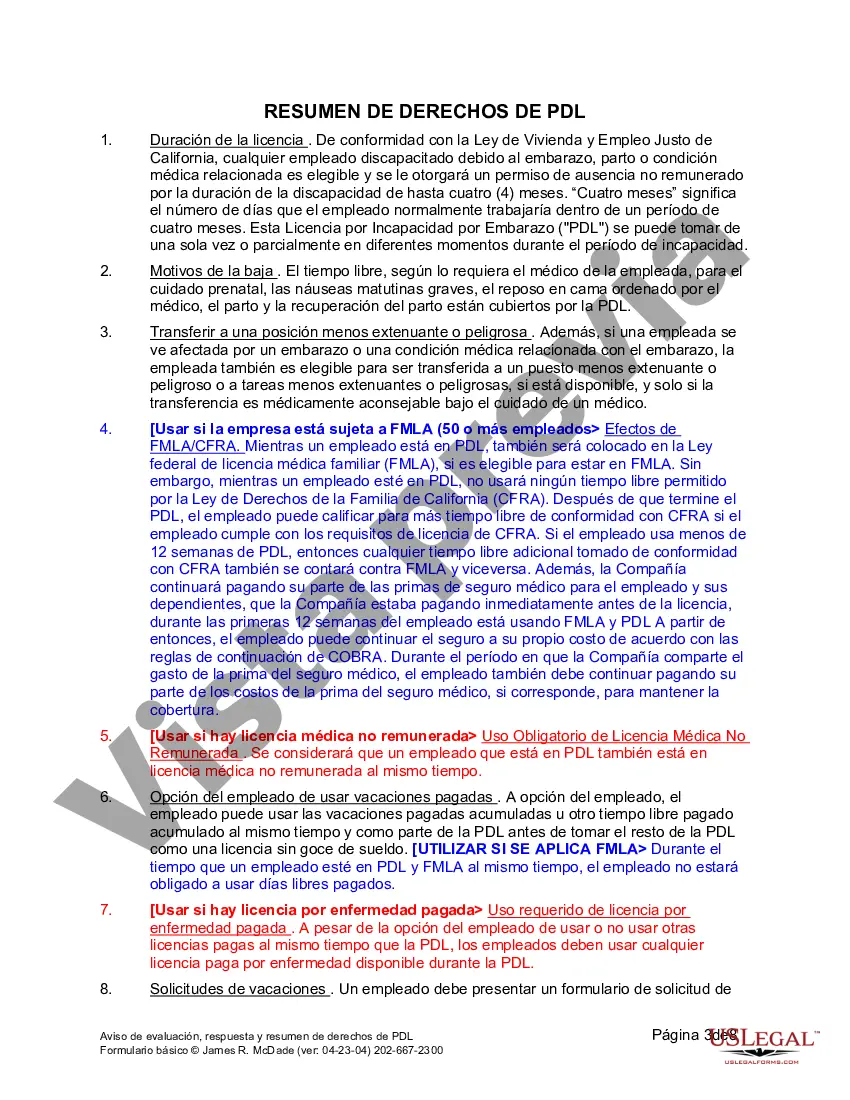

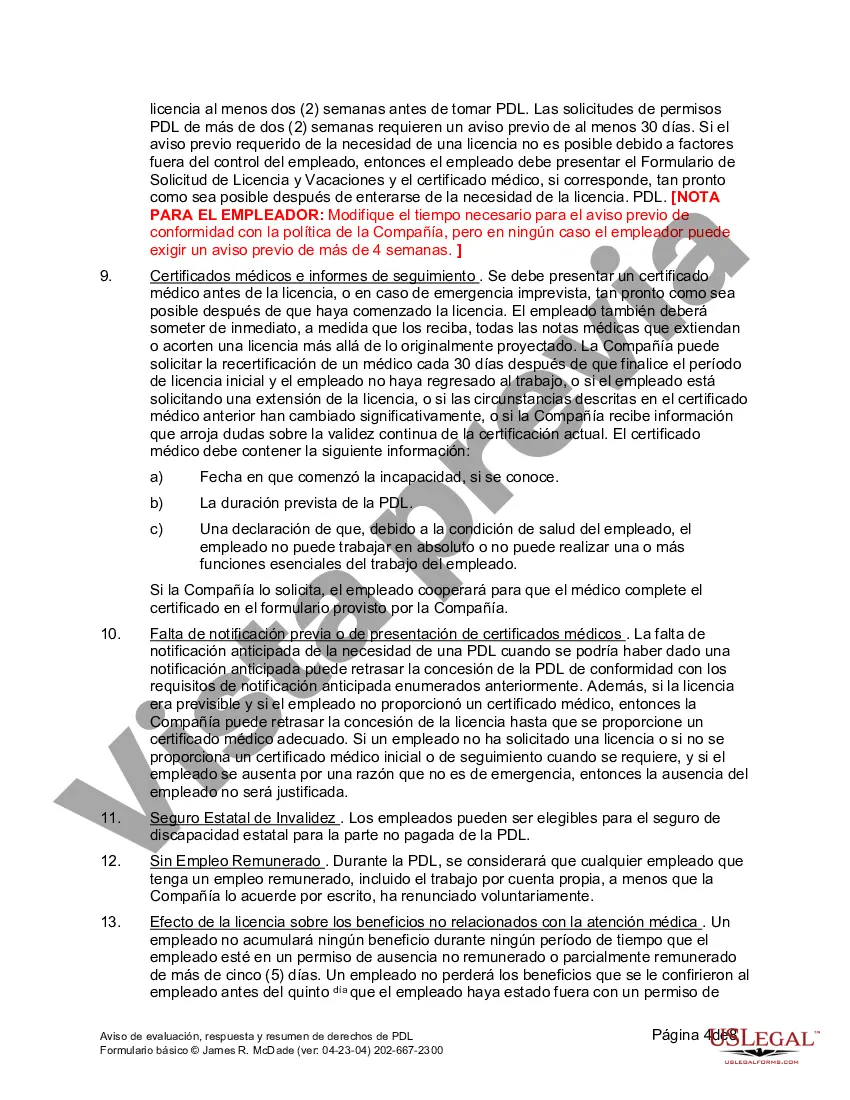

Employers use this form when an employee requests or should be placed on pregnancy disability leave. It provides general information about an employee’s and employer’s rights and obligations in relation to pregnancy disability leave.

San Jose California PDL Request Response and Notice, also known as Payday Lending (PDL) Request Response and Notice, is a legal process and document used in San Jose, California, related to payday loans. Payday loans are short-term, small-dollar loans with high interest rates primarily catered to individuals facing financial emergencies. In San Jose, PDL Request Response and Notice refers to the legal procedure followed by borrowers to request, receive a response, and be provided with a notice regarding their payday loan transaction. It is designed to ensure transparency and protect the rights of borrowers, promoting fair lending practices within the city. When a borrower requests a PDL, they must submit a written application that includes essential information like their personal details, income, employment history, and the loan amount requested. The lender then reviews the application and determines eligibility based on certain predetermined criteria, such as income stability, credit history, and local regulations. If the PDL request is approved, the lender is required to provide a response to the borrower within a specified timeframe, typically within a few business days. This response generally includes the loan agreement terms, the repayment schedule, associated fees, and any other relevant information related to the loan transaction. It ensures that the borrower is fully aware of the loan terms and conditions before proceeding. Moreover, the lender is obligated to provide a notice to the borrower, outlining their rights and responsibilities as per the San Jose payday lending regulations. This notice emphasizes key aspects, such as the borrower's right to cancel the loan within a certain period, the prohibition of harassment or unfair collection practices by the lender, and information on potential recourse options available in case of disputes or violations. Different types of San Jose California PDL Request Response and Notice may vary based on the specific requirements of different lending institutions or changes in local regulations. However, typically, the core elements of the request, response, and notice processes remain consistent, with variations primarily relating to the format and specific content tailored to each financial institution's policies. In summary, San Jose California PDL Request Response and Notice is an integral part of the payday loan process in San Jose, ensuring that borrowers receive complete information about the loan terms and conditions, their rights, and available options. It aims to safeguard the interests and well-being of borrowers, allowing them to make informed decisions regarding their financial obligations.San Jose California PDL Request Response and Notice, also known as Payday Lending (PDL) Request Response and Notice, is a legal process and document used in San Jose, California, related to payday loans. Payday loans are short-term, small-dollar loans with high interest rates primarily catered to individuals facing financial emergencies. In San Jose, PDL Request Response and Notice refers to the legal procedure followed by borrowers to request, receive a response, and be provided with a notice regarding their payday loan transaction. It is designed to ensure transparency and protect the rights of borrowers, promoting fair lending practices within the city. When a borrower requests a PDL, they must submit a written application that includes essential information like their personal details, income, employment history, and the loan amount requested. The lender then reviews the application and determines eligibility based on certain predetermined criteria, such as income stability, credit history, and local regulations. If the PDL request is approved, the lender is required to provide a response to the borrower within a specified timeframe, typically within a few business days. This response generally includes the loan agreement terms, the repayment schedule, associated fees, and any other relevant information related to the loan transaction. It ensures that the borrower is fully aware of the loan terms and conditions before proceeding. Moreover, the lender is obligated to provide a notice to the borrower, outlining their rights and responsibilities as per the San Jose payday lending regulations. This notice emphasizes key aspects, such as the borrower's right to cancel the loan within a certain period, the prohibition of harassment or unfair collection practices by the lender, and information on potential recourse options available in case of disputes or violations. Different types of San Jose California PDL Request Response and Notice may vary based on the specific requirements of different lending institutions or changes in local regulations. However, typically, the core elements of the request, response, and notice processes remain consistent, with variations primarily relating to the format and specific content tailored to each financial institution's policies. In summary, San Jose California PDL Request Response and Notice is an integral part of the payday loan process in San Jose, ensuring that borrowers receive complete information about the loan terms and conditions, their rights, and available options. It aims to safeguard the interests and well-being of borrowers, allowing them to make informed decisions regarding their financial obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.