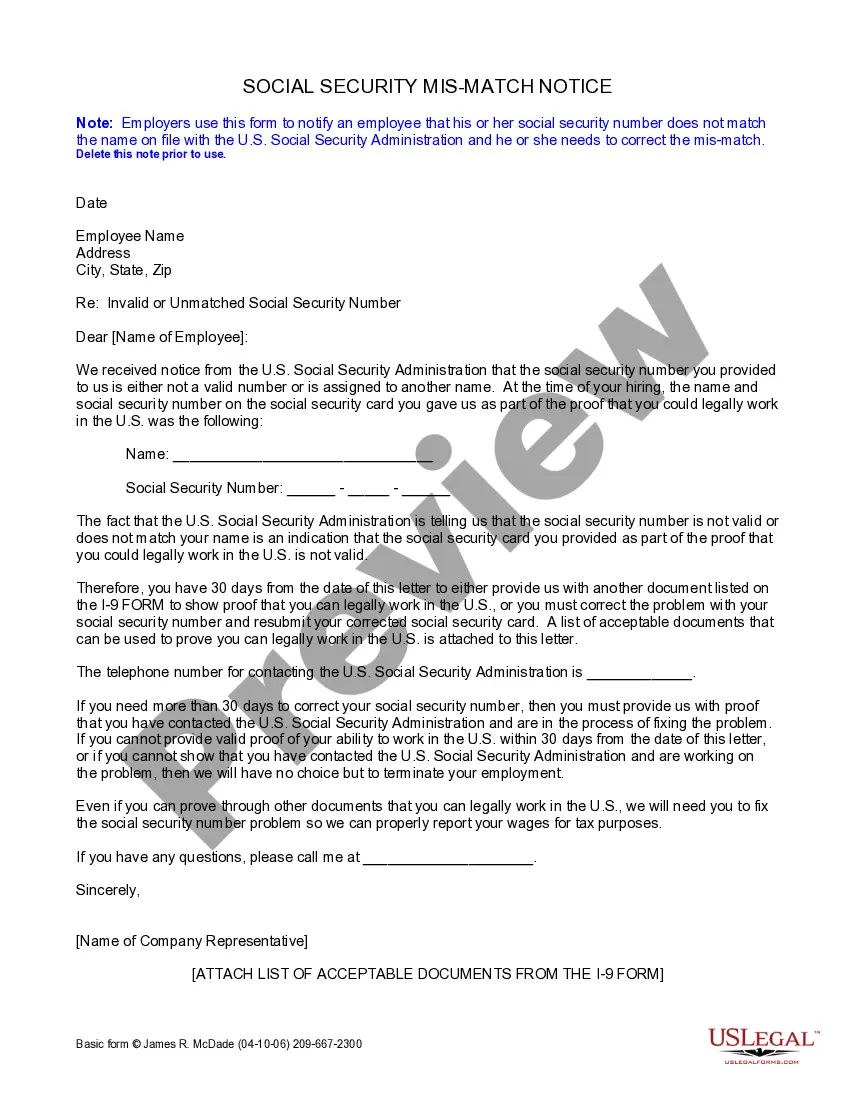

Employers use this form to notify an employee that his or her social security number does not match the name on file with the U.S. Social Security Administration and he or she needs to correct the mismatch.

Fontana California Social Security Mismatch Notice is a letter sent by the Social Security Administration (SSA) to employers in Fontana, California, informing them about potential discrepancies in employee records. This notice serves as a way for employers to ensure they have accurate employee information for tax and Social Security purposes. A Social Security mismatch occurs when the employee's reported name and Social Security Number (SSN) do not match the records held by the SSA. The SSA receives information from employers through annual wage reports, quarterly tax filings, and W-2 forms. If there is a mismatch detected, the agency sends out a Fontana California Social Security Mismatch Notice to employers, notifying them of the discrepancy. The notice aims to raise awareness about the potential errors in employee records and provides employers with guidance on resolving the mismatch. Employers may receive different types of Fontana California Social Security Mismatch Notices, including: 1. Notification of Mismatch: This type of notice simply informs the employer about the discrepancy found between the reported employee's name and SSN. It may include details such as the specific employee and the time frame of the mismatch. 2. Request for Employee Verification: In some cases, the SSA may request the employer to provide additional information or to ask their employee to verify their name and SSN. This helps in addressing any legitimate name changes or errors in the employer's records. 3. Corrections and Employers Responsibility: This type of notice advises employers on the steps they should take to resolve the mismatch. It emphasizes the need for accuracy in reporting and the importance of promptly updating employee records. 4. Consequences of Ignoring Mismatch: Employers may also receive a notice that highlights the potential consequences of ignoring or disregarding the Social Security mismatch. This notice may inform employers about the penalties and legal actions that can be imposed for non-compliance. To resolve a Fontana California Social Security Mismatch Notice, employers are usually asked to file a Form W-2C (Corrected Wage and Tax Statement) with the SSA, providing the correct employee information. Employers should communicate with the affected employee to rectify any errors and ensure accurate reporting in future filings. In summary, Fontana California Social Security Mismatch Notices are letters sent to employers to notify them of discrepancies between employee-reported names and SSNs. It highlights the importance of accurate reporting and provides guidance on resolving the mismatch. Employers should promptly address these notices to maintain compliance with Social Security regulations.