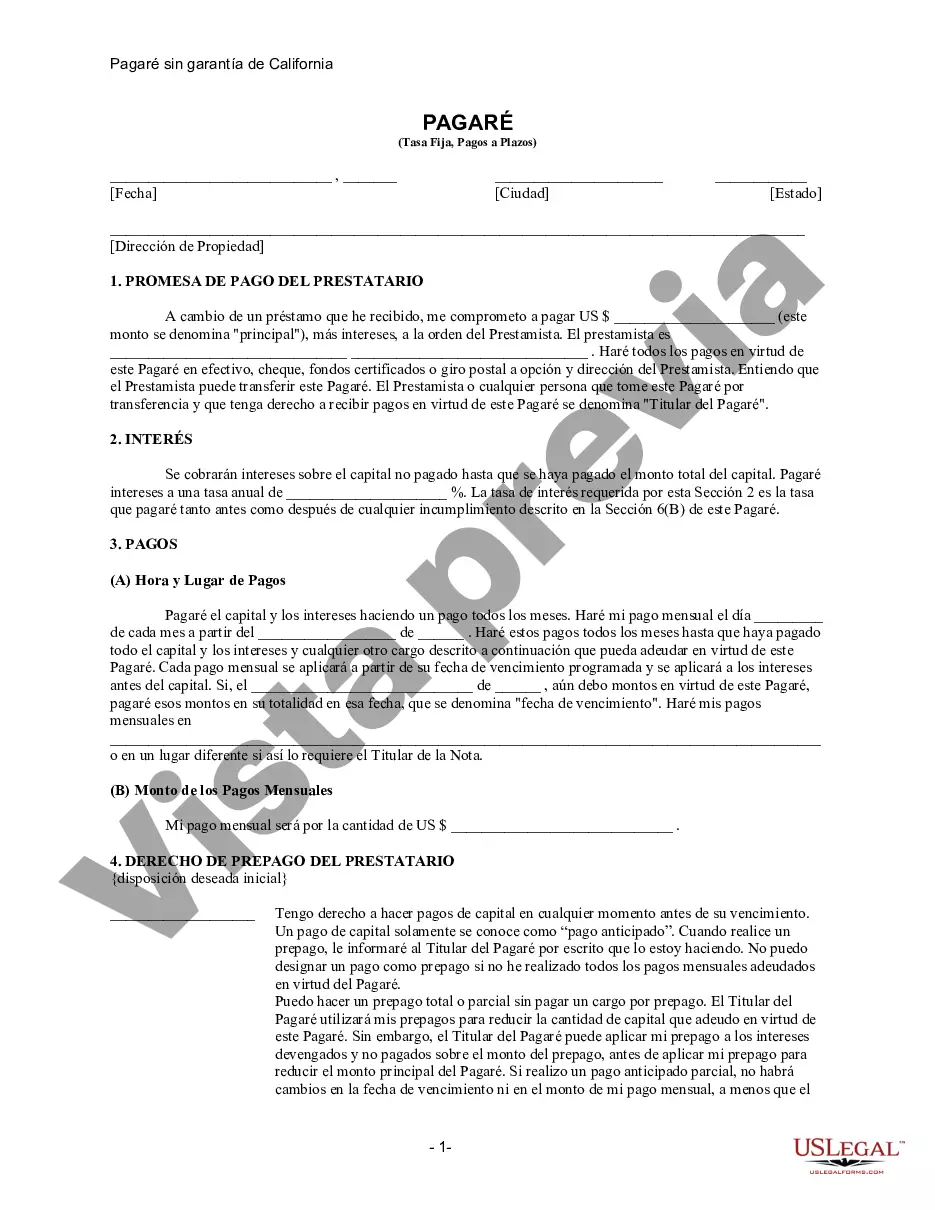

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

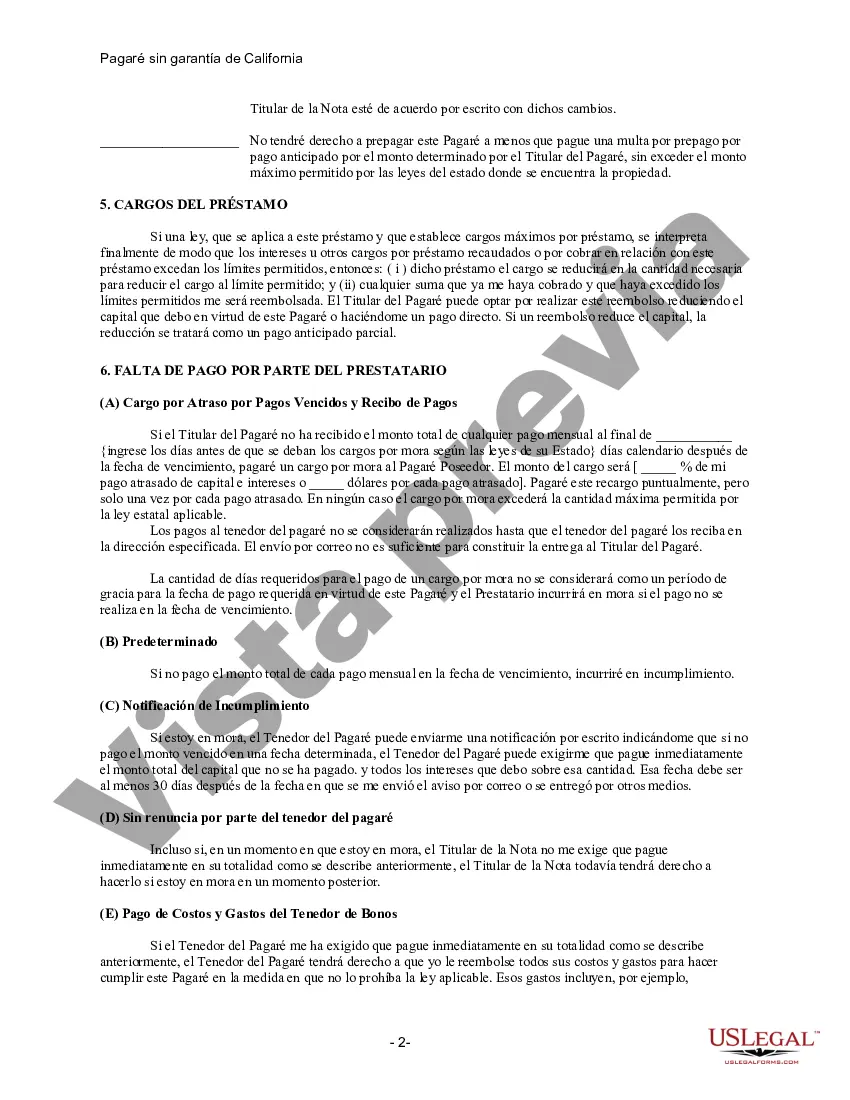

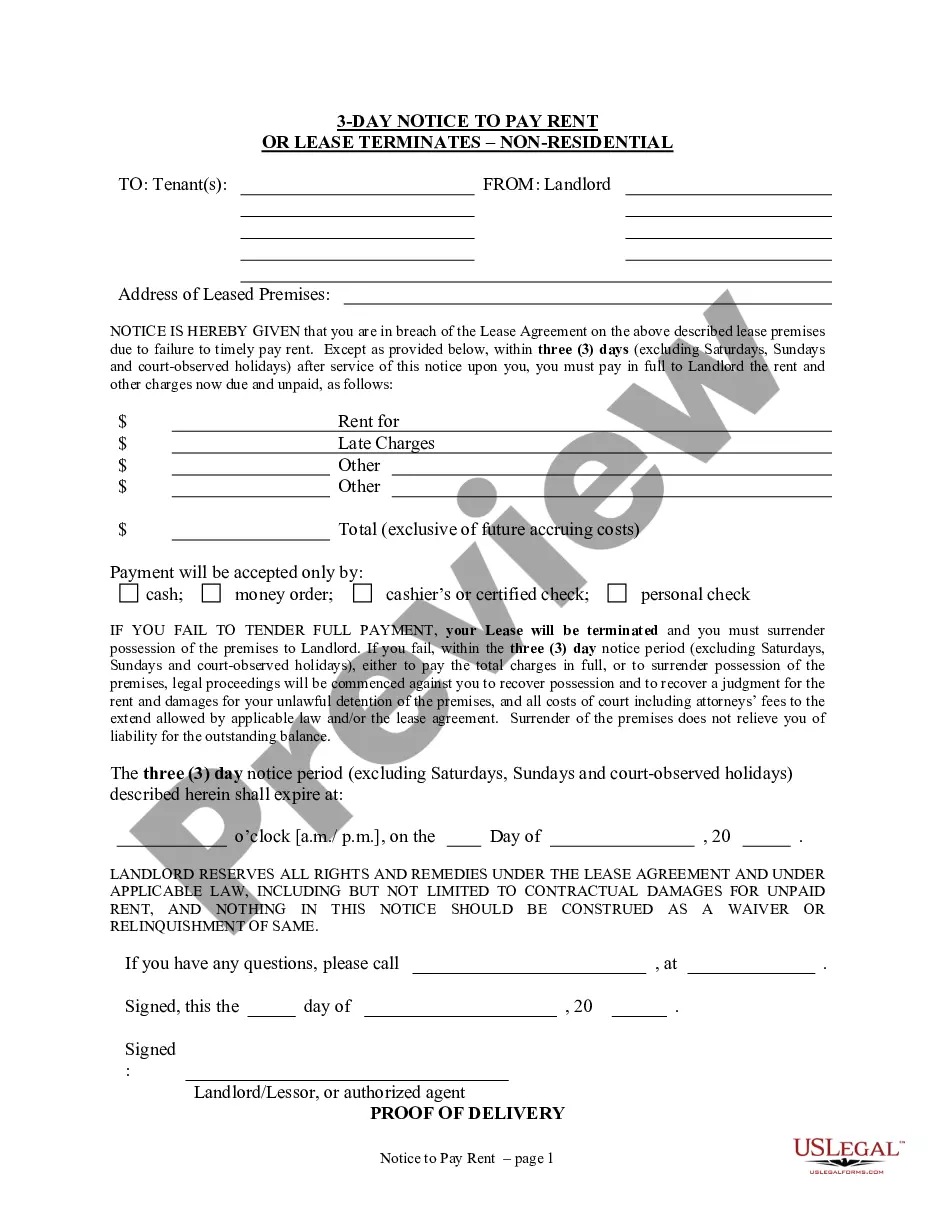

Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that serves as a written agreement between a borrower and a lender in the city of Temecula, California. This promissory note outlines the terms and conditions for a loan where repayment is made in fixed installment payments over a specified period. The purpose of this promissory note is to establish a clear understanding between the parties involved regarding the terms of repayment, interest rates, and any additional fees or charges. It provides a comprehensive framework for the borrower's obligation to repay the borrowed sum along with the lender's rights and remedies in case of default. The primary characteristic of the Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate is that it does not require any collateral or security to back the loan. This means that the borrower does not need to pledge any assets as collateral, making it an ideal option for individuals or businesses who may not possess sufficient assets to secure a loan. The promissory note identifies the borrower and lender, clearly stating their names, addresses, and contact information. It also specifies the loan amount disbursed to the borrower and the repayment schedule, including the number of installments, their frequency, and the due dates. The interest rate charged on the loan is also clearly mentioned along with the method of calculation, typically as an annual percentage rate (APR). Different types of Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate may include variations in repayment terms, such as a balloon payment, where a large final payment is made at the end of the loan term. Other types may include provisions for late payment penalties or treatments for early repayment or prepayment. In conclusion, the Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate is an essential legal document used to formalize and document a loan agreement in Temecula, California. It outlines the terms and conditions of the loan, including repayment schedules, interest rates, and borrower's obligations. By understanding the details of this promissory note, borrowers and lenders can enter into a fair and transparent financial agreement.Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that serves as a written agreement between a borrower and a lender in the city of Temecula, California. This promissory note outlines the terms and conditions for a loan where repayment is made in fixed installment payments over a specified period. The purpose of this promissory note is to establish a clear understanding between the parties involved regarding the terms of repayment, interest rates, and any additional fees or charges. It provides a comprehensive framework for the borrower's obligation to repay the borrowed sum along with the lender's rights and remedies in case of default. The primary characteristic of the Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate is that it does not require any collateral or security to back the loan. This means that the borrower does not need to pledge any assets as collateral, making it an ideal option for individuals or businesses who may not possess sufficient assets to secure a loan. The promissory note identifies the borrower and lender, clearly stating their names, addresses, and contact information. It also specifies the loan amount disbursed to the borrower and the repayment schedule, including the number of installments, their frequency, and the due dates. The interest rate charged on the loan is also clearly mentioned along with the method of calculation, typically as an annual percentage rate (APR). Different types of Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate may include variations in repayment terms, such as a balloon payment, where a large final payment is made at the end of the loan term. Other types may include provisions for late payment penalties or treatments for early repayment or prepayment. In conclusion, the Temecula California Unsecured Installment Payment Promissory Note for Fixed Rate is an essential legal document used to formalize and document a loan agreement in Temecula, California. It outlines the terms and conditions of the loan, including repayment schedules, interest rates, and borrower's obligations. By understanding the details of this promissory note, borrowers and lenders can enter into a fair and transparent financial agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.