This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently seek to lessen or prevent legal complications when handling subtle legal or financial issues.

To achieve this, we pursue attorney solutions that are generally quite costly.

However, not all legal issues are similarly intricate; many can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you have misplaced the form, you can always re-download it from within the My documents tab.

- Our library enables you to take charge of your affairs without relying on an attorney's assistance.

- We offer access to legal form templates that are not always available to the public.

- Our templates are tailored to specific states and regions, making the search process significantly easier.

- Utilize US Legal Forms whenever you need to obtain and download the Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form effortlessly and securely.

Form popularity

FAQ

Yes, a handwritten promissory note can be legal, provided it includes all essential information such as the amount, repayment terms, and signatures. In the case of a Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure you clearly outline the secured asset. However, for larger amounts or complex agreements, using a templated format might offer more protection. Consider platforms like uslegalforms for comprehensive options and guidance.

An example of a promissory note could be a document where one individual borrows $10,000 from another with a term of five years to repay with monthly installments of $200. This note can be customized to reflect the terms of a Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Including elements such as interest rates and default clauses will enhance clarity and understanding. Always keep a copy for your records.

Filling out a promissory demand note involves stating the borrower's promise to repay a specific amount upon request. This note should include the names of both parties and the amount involved in the Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Clearly outline how the lender can demand repayment and ensure both parties sign the note to make it legally binding. This simplicity adds clarity to your financial agreement.

To fill out a promissory note, start with the date and the names of both the borrower and lender. Next, clearly state the amount borrowed and any interest rate associated with the Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Include detailed repayment terms, such as the schedule and method of payment. Be sure to sign the document, as a signature is necessary for legal validity.

The security for a promissory note is typically the collateral specified in the note. For a Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the real estate property serves as this security, ensuring that the lender has a claim to the property if the borrower defaults. This security reduces risk for lenders and helps facilitate smoother transactions. Uslegalforms can assist you in outlining these details clearly in your documentation.

Yes, promissory notes can indeed be backed by collateral, which offers additional security for the lender. In the case of a Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the real estate itself acts as this collateral. This arrangement increases the likelihood of receiving your investment back should any issues arise. Using uslegalforms can help you structure the note appropriately.

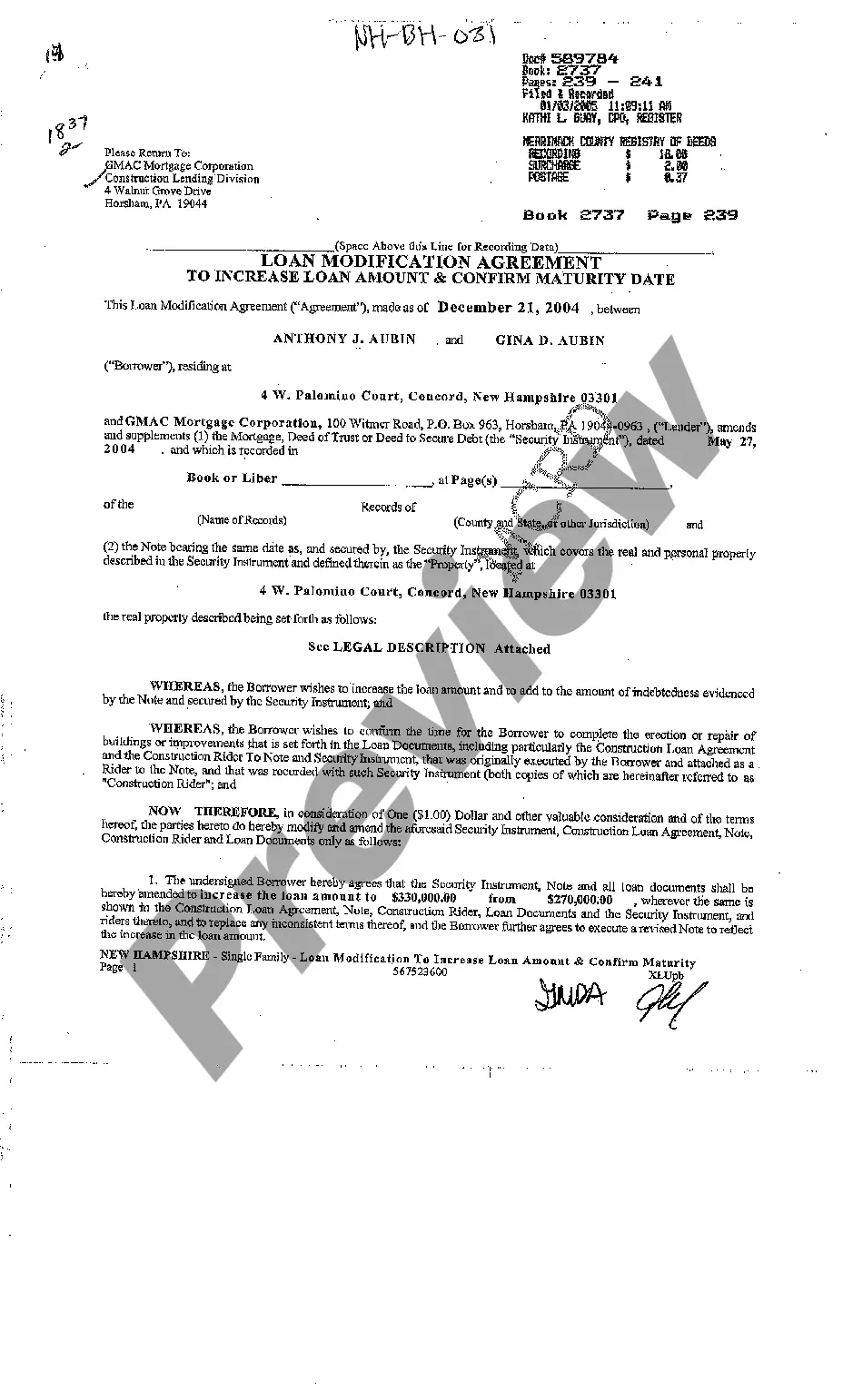

You typically file a promissory note at the county recorder's office where the property is located. In cases involving a Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this means connecting with the local Sunnyvale authority. Filing properly protects your legal rights and helps establish clarity in property ownership. You can find guidance on this process through platforms like uslegalforms.

Yes, a secured promissory note should be recorded to protect your investment. Recording it creates a public record, which establishes priority over other claims. In the context of Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this step is crucial to ensure your rights are secure. Additionally, using uslegalforms can help you navigate the recording process accurately.

Yes, promissory notes are enforceable in California as long as they meet specific legal requirements. Typically, these requirements include being in writing, signed by the borrower, and containing clear terms of repayment. A Sunnyvale California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is not only enforceable but provides an added layer of security for both lenders and borrowers, ensuring that substantial loans can be upheld in a court of law.

To obtain a promissory note for a mortgage, you can consult a lender or access online legal document providers. For a Sunshine California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, platforms like uslegalforms offer easy-to-use templates that guide you through the creation process. This allows you to customize the note to fit your specific needs and ensure compliance with California laws. Always review your note or consult a legal expert to ensure everything is in order.