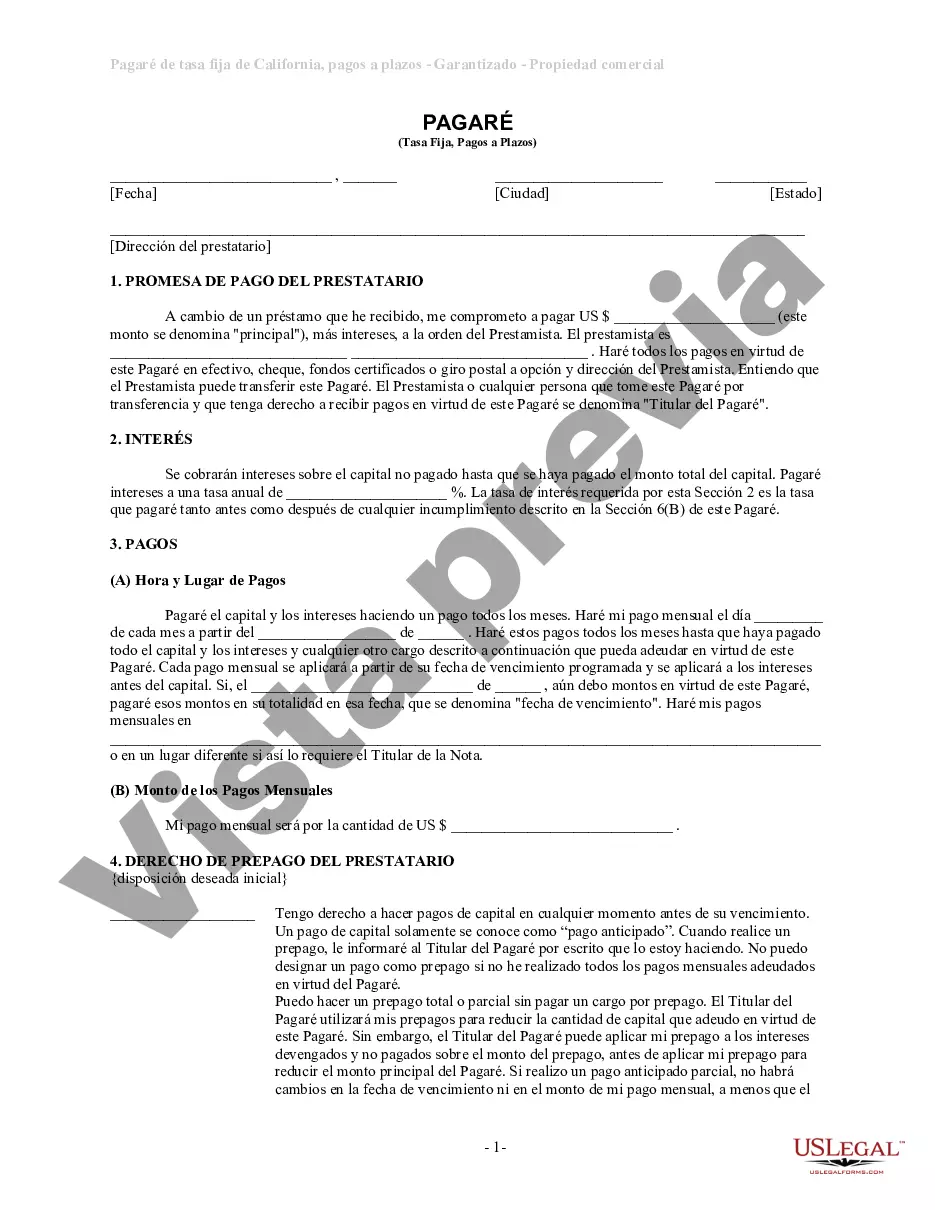

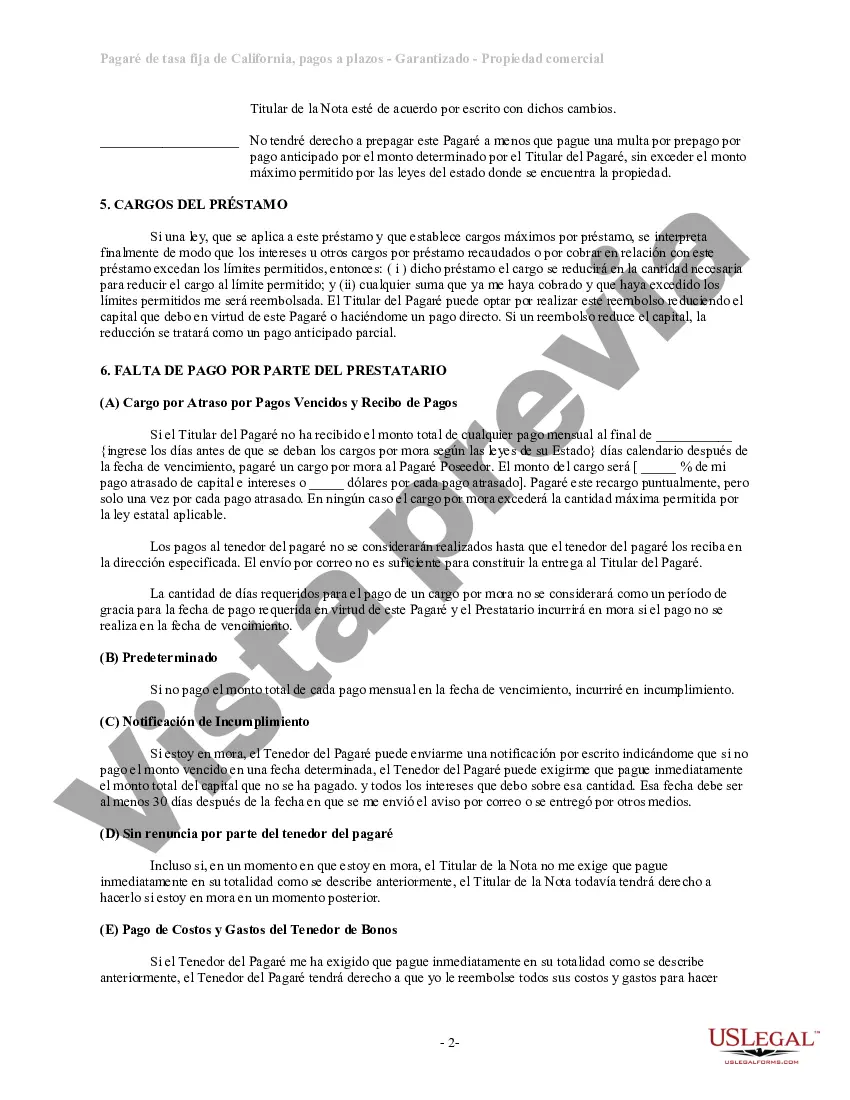

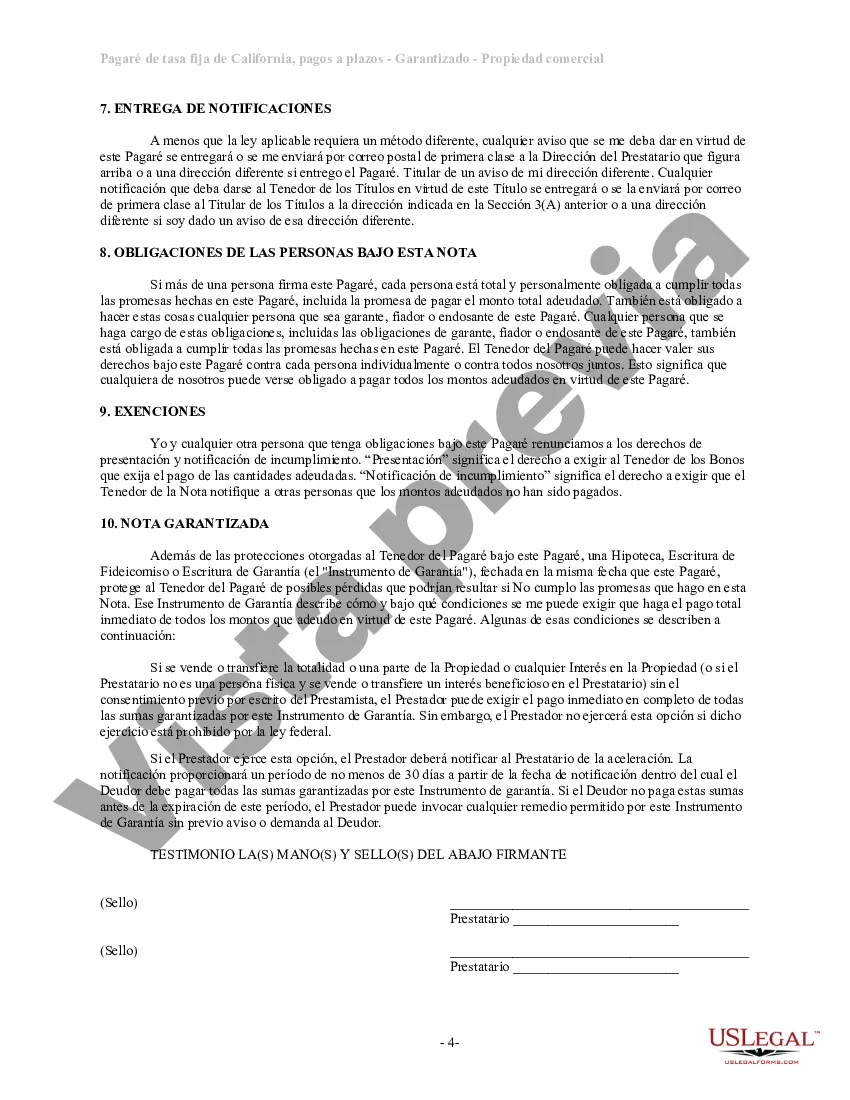

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

A Costa Mesa California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that establishes a loan agreement between a lender and a borrower, where the borrower must repay the loan amount in installments, based on a fixed interest rate. This type of promissory note is further secured by commercial real estate properties located in Costa Mesa, California. These promissory notes are commonly used in real estate transactions, especially for commercial properties where a substantial amount of money is involved. By securing the loan with commercial real estate, lenders have an added layer of security, as the property can be used as collateral in the event of default by the borrower. The Costa Mesa California Installments Fixed Rate Promissory Note may vary depending on the specific terms agreed upon by the parties involved. The variations can include different interest rates, repayment schedules, loan amounts, and the duration of the loan. It's essential for both parties to carefully review and negotiate the terms to protect their interests. In addition to the standard Costa Mesa California Installments Fixed Rate Promissory Note, there may be subcategories or specific types of promissory notes applicable to commercial real estate in Costa Mesa. These types can include: 1. Non-recourse promissory note: This type of note ensures that the lender's recourses are directly tied to the commercial property itself, and the borrower is not personally responsible for the loan repayment beyond the value of the property. 2. Balloon payment promissory note: A promissory note that requires the borrower to make regular installment payments for a specific period, followed by a lump sum payment (balloon payment) at the end of the loan term. 3. Adjustable-rate promissory note: Unlike a fixed rate promissory note, this type of note includes an interest rate that may change periodically based on the market rates, potentially affecting the borrower's repayment amount. It's vital for borrowers and lenders to engage legal professionals familiar with Costa Mesa, California, real estate laws when creating or entering into an Installments Fixed Rate Promissory Note. They can ensure compliance with relevant regulations, as well as protect the interests of both parties involved in the real estate transaction.A Costa Mesa California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that establishes a loan agreement between a lender and a borrower, where the borrower must repay the loan amount in installments, based on a fixed interest rate. This type of promissory note is further secured by commercial real estate properties located in Costa Mesa, California. These promissory notes are commonly used in real estate transactions, especially for commercial properties where a substantial amount of money is involved. By securing the loan with commercial real estate, lenders have an added layer of security, as the property can be used as collateral in the event of default by the borrower. The Costa Mesa California Installments Fixed Rate Promissory Note may vary depending on the specific terms agreed upon by the parties involved. The variations can include different interest rates, repayment schedules, loan amounts, and the duration of the loan. It's essential for both parties to carefully review and negotiate the terms to protect their interests. In addition to the standard Costa Mesa California Installments Fixed Rate Promissory Note, there may be subcategories or specific types of promissory notes applicable to commercial real estate in Costa Mesa. These types can include: 1. Non-recourse promissory note: This type of note ensures that the lender's recourses are directly tied to the commercial property itself, and the borrower is not personally responsible for the loan repayment beyond the value of the property. 2. Balloon payment promissory note: A promissory note that requires the borrower to make regular installment payments for a specific period, followed by a lump sum payment (balloon payment) at the end of the loan term. 3. Adjustable-rate promissory note: Unlike a fixed rate promissory note, this type of note includes an interest rate that may change periodically based on the market rates, potentially affecting the borrower's repayment amount. It's vital for borrowers and lenders to engage legal professionals familiar with Costa Mesa, California, real estate laws when creating or entering into an Installments Fixed Rate Promissory Note. They can ensure compliance with relevant regulations, as well as protect the interests of both parties involved in the real estate transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.